Tax Relief Redundancy Ireland You may receive a lump sum payment on redundancy or retirement If you do it may be exempt from tax or may qualify for some relief from tax For further

You may receive a lump sum payment on redundancy or retirement from your employer A lump sum payment on termination of employment may be exempt from tax Statutory redundancy is calculated on the basis of 2 weeks pay per year of service plus one additional week subject to a maximum weekly pay figure of 600 As statutory

Tax Relief Redundancy Ireland

Tax Relief Redundancy Ireland

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

Redundancy Notice Sample Template Word PDF

https://www.wonder.legal/Les_thumbnails/redundancy-notice.png

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Ex gratia payments from employers Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption The maximum weekly amount used to calculate redundancy pay is 600 a week or 31 200 a year even if your pay is more per week You can use this redundancy

The three types of tax reliefs are 1 Basic Exemption 2 Increased Basic Exemption and 3 Standard Capital Superannuation Benefit SCSB relief There is a lifetime cap Statutory redundancy payments are exempt from tax Tax relief There is some tax relief for salary or wages in lieu of notice on redundancy or retirement and

Download Tax Relief Redundancy Ireland

More picture related to Tax Relief Redundancy Ireland

Redundancy Entitlements In Ireland What You Need To Know Terry Gorry

https://businessandlegal.ie/wp-content/uploads/how-to-dismiss-an-employee-1.jpg

An Employee s Guide To Redundancy Neate Pugh

https://www.neateandpugh.com/wp-content/uploads/2022/03/redundancy-individual.png

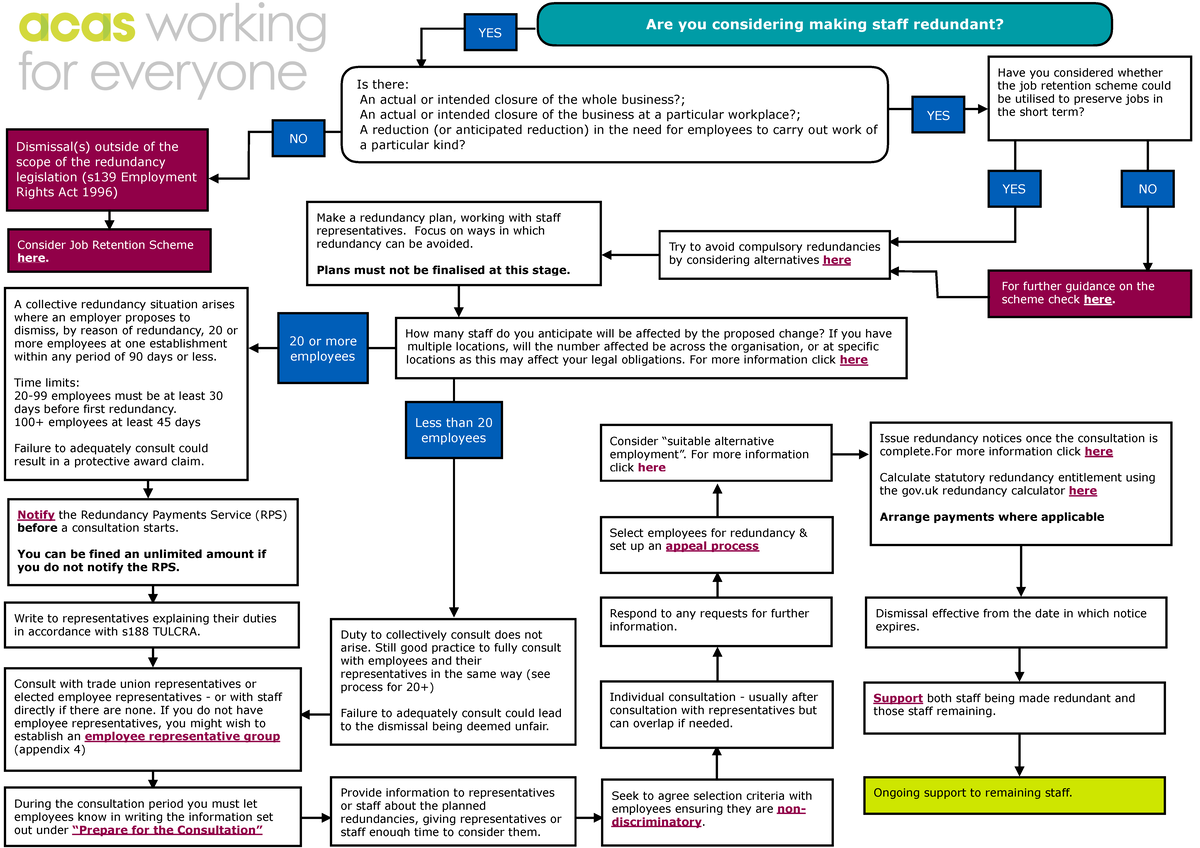

Redundancy Process Map Issue Redundancy Notices Once The Consultation

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0d121356ad02c0b8d7bdec1958ee7510/thumb_1200_848.png

Additional ex gratia payments received as part of your redundancy package over and above your statutory redundancy payments may be taxable subject to certain reliefs That s a relief Redundancy is now a reality for many people in Ireland particularly since the economic downturn which started in 2008 The Redundancy Payments Act 1967 2007

Your redundancy lump sum is calculated according a certain formula based on your years of service in an employment This worksheet is to help you work it out for yourself As before the statutory redundancy payment is tax free However tax may be payable on any additional ex gratia payment subject to certain reliefs Options It is

Redundancy Pay

https://s3.studylib.net/store/data/006919277_1-71a8e0a1b460839d4dc41bde5835aba0-768x994.png

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

https://www.revenue.ie/.../redundancy-lump-sum-payments.aspx

You may receive a lump sum payment on redundancy or retirement If you do it may be exempt from tax or may qualify for some relief from tax For further

https://www.revenue.ie/en/personal-tax-credits...

You may receive a lump sum payment on redundancy or retirement from your employer A lump sum payment on termination of employment may be exempt from tax

What Is The SEIS Tax Relief Scheme Exporaise

Redundancy Pay

Redundancy Ireland In 2014 Employment Law YouTube

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

Redundancy Law In Ireland And Calculating Redundancy With The

Redundancy Process Explained Step By Step Guide For Employers

Redundancy Process Explained Step By Step Guide For Employers

Redundancy

Redundancy Options Where From Here Aspire Wealth Management

Med 2 Form Tax Relief On Dental Expenses

Tax Relief Redundancy Ireland - When you are made redundant you become entitled to claim tax back on a number of tax exemption options Basically whichever of the following are higher Basic Exemption