Tax Return Child Care Benefit Verkko Overview Pay the tax charge Opt out of Child Benefit payments Restart your Child Benefit payments If your circumstances change Pay the tax charge To pay the tax charge you

Verkko 31 jouluk 2022 nbsp 0183 32 Taxes Income tax Personal income tax Line 11700 Universal child care benefit UCCB Note Line 11700 was line 117 before tax year 2019 You must report the UCCB lump sum payment that you received in 2022 for prior tax years Verkko What is happening to child benefit Under current rules all parents and guardians receive child benefit of 163 20 30 a week for the first child and 163 13 40 for each child after that This amounts to 163 1 752 a year for families with two children

Tax Return Child Care Benefit

Tax Return Child Care Benefit

https://wowa.ca/static/img/opengraph/canada-child-benefit.png

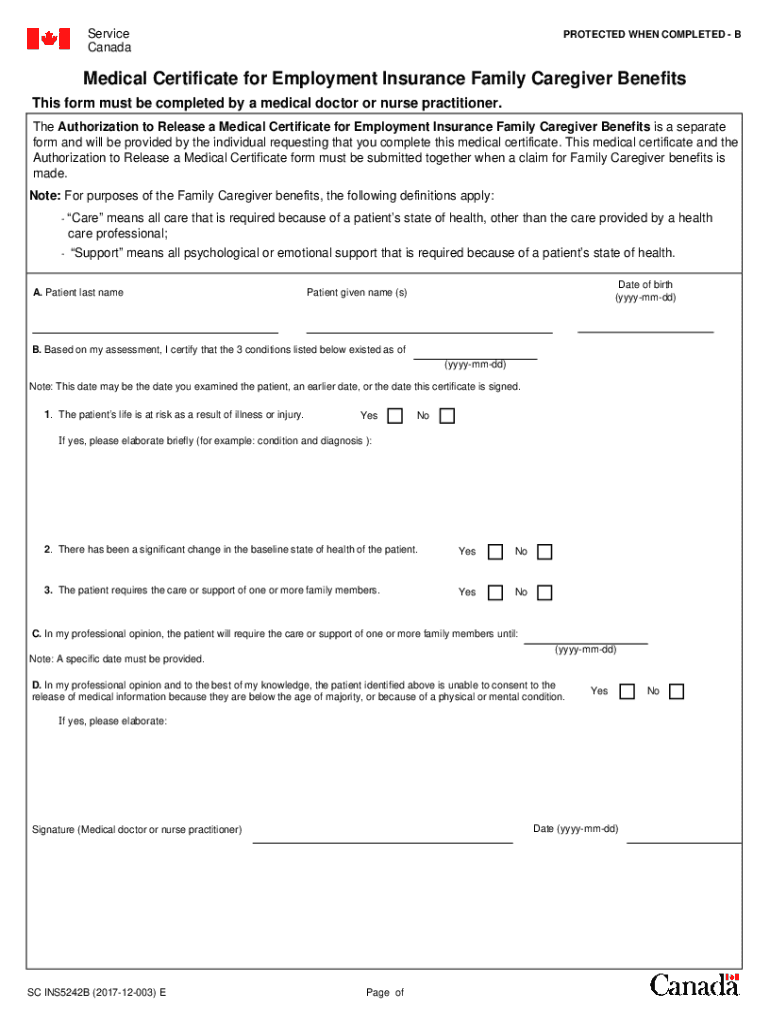

Family Caregiver Benefits Form Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/433/22/433022843/large.png

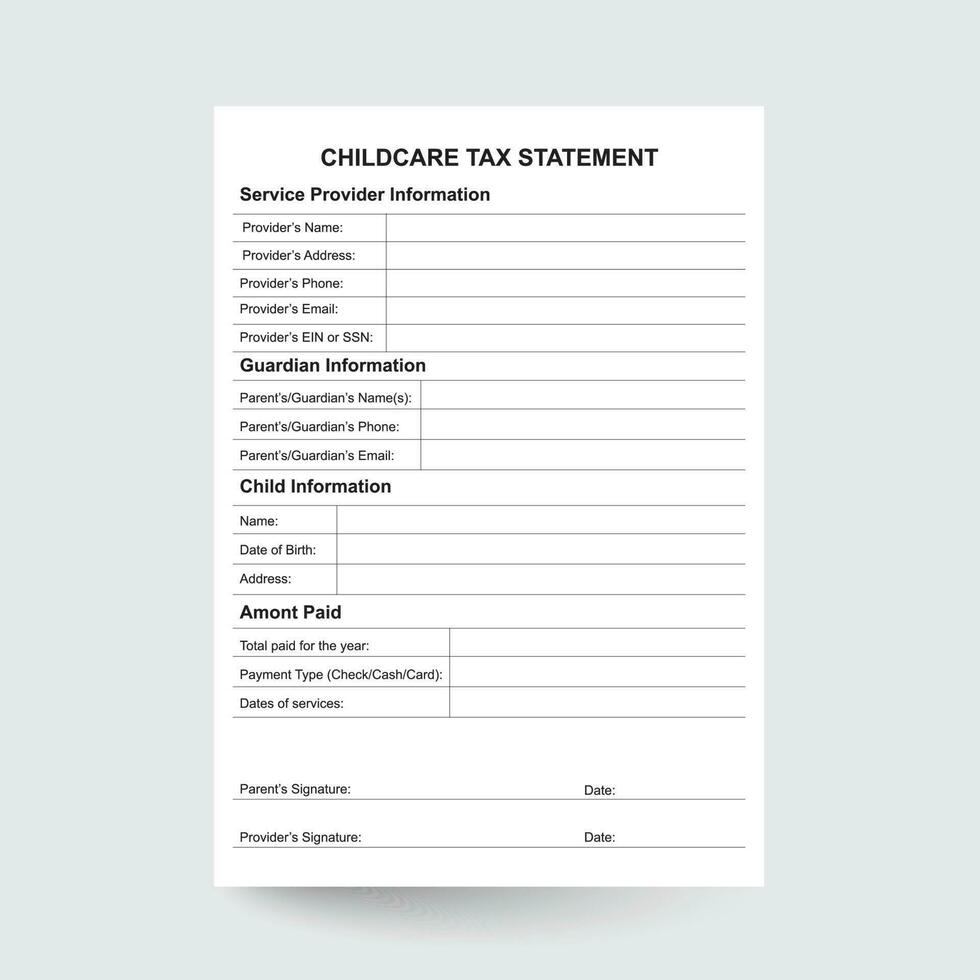

Child Care Receipt Daycare Payment Form Daycare Tax Form Printable

https://static.vecteezy.com/system/resources/previews/023/627/673/non_2x/child-care-receipt-daycare-payment-form-daycare-tax-form-printable-daycare-tuition-receipt-receipt-template-daycare-balance-due-child-care-form-child-care-receipt-free-vector.jpg

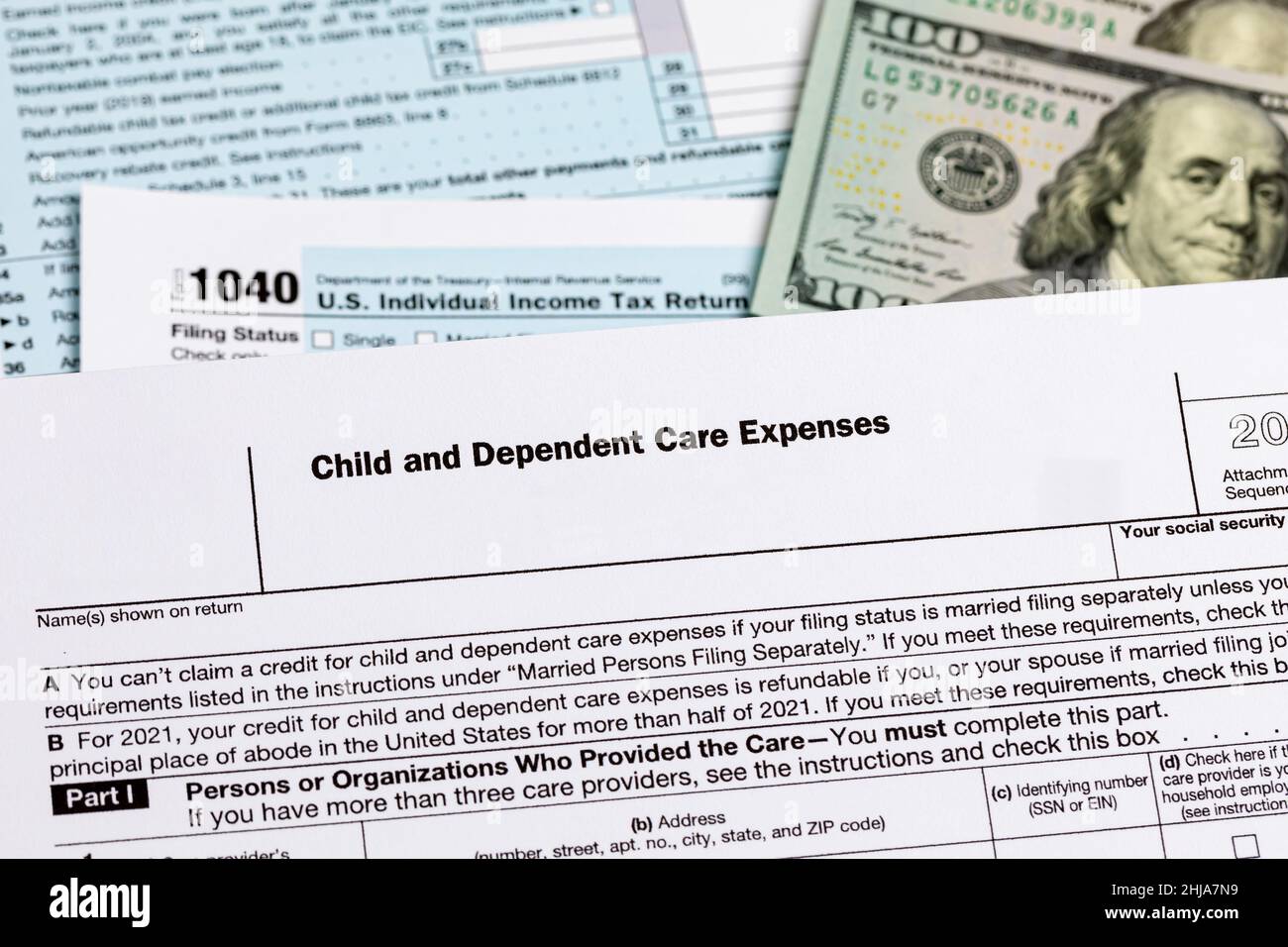

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum Verkko 15 kes 228 k 2023 nbsp 0183 32 You re receiving a tax benefit because under the plan you re not paying taxes on the money set aside to pay for the dependent care expenses You must complete and attach Form 2441 Child and Dependent Care Expenses to

Verkko 19 lokak 2023 nbsp 0183 32 Benefits of the tax credit Care you can claim Limits on who can provide care Click to expand Key Takeaways If you paid someone to care for a child age 12 or younger at the end of the year whom you claim as a dependent on your tax return you may qualify for the Child and Dependent Care Credit Verkko 2 helmik 2023 nbsp 0183 32 Your federal income tax may be reduced by claiming the Credit for Child and Dependent Care expenses on your tax return Who is eligible to claim the credit You may be eligible to claim the child and dependent care credit if

Download Tax Return Child Care Benefit

More picture related to Tax Return Child Care Benefit

Child And Dependent Care Credit LO 7 3 Calculate Chegg

https://media.cheggcdn.com/media/c7a/c7a7e54f-d046-435c-826a-3945e90aad03/php4ulBhq

![]()

How Does Paying Or Receiving Child Support Affect My Tax Return LJ

https://cdn.shortpixel.ai/client/q_glossy,ret_img,w_730,h_395/https://ljlawlv.com/wp-content/uploads/2020/01/leon-dewiwje-ldDmTgf89gU-unsplash-730x395.jpg

Childcare Receipts For Parents Taxes Daycare Receipts For Parents Taxes

https://i.etsystatic.com/27501955/r/il/df84d7/3597285216/il_1080xN.3597285216_4adk.jpg

Verkko 11 kes 228 k 2021 nbsp 0183 32 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school Verkko 27 marrask 2023 nbsp 0183 32 The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children People with kids under the age of 17 may be

Verkko It is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age The CCB may include the child disability benefit and any related provincial and territorial programs Sections Who can apply Verkko Definitions Canada child benefit Eligibility criteria Situations in which you should apply When you should apply If you share custody of a child How to apply Automated Benefits Application You need a social insurance number After you apply If the CRA reviews your information If you have a spouse or common law partner

2019 2023 Form Canada CF2900 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/471/882/471882521/large.png

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0188.gif?itok=6FfQuMuW

https://www.gov.uk/child-benefit-tax-charge/pay-the-charge

Verkko Overview Pay the tax charge Opt out of Child Benefit payments Restart your Child Benefit payments If your circumstances change Pay the tax charge To pay the tax charge you

https://www.canada.ca/en/revenue-agency/services/tax/individuals/...

Verkko 31 jouluk 2022 nbsp 0183 32 Taxes Income tax Personal income tax Line 11700 Universal child care benefit UCCB Note Line 11700 was line 117 before tax year 2019 You must report the UCCB lump sum payment that you received in 2022 for prior tax years

Child And Dependent Care Tax Credit Form Tax Credit Deduction And Tax

2019 2023 Form Canada CF2900 Fill Online Printable Fillable Blank

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

How Much Is Child Benefit 2023 Leia Aqui How Much Is Child Benefit In

Check The Status Of Your Application For The Affordable Child Care

The Right Help With Tax Returns Pension And Child Benefit Breaking

The Right Help With Tax Returns Pension And Child Benefit Breaking

Fillable Online Humanservices Gov Child Care Benefit For Fax Email

Child Care Expense Stock Illustrations 62 Child Care Expense Stock

Child Care Benefit Best Insurance Buy Insurance Online Travel Insurance

Tax Return Child Care Benefit - Verkko 2 helmik 2023 nbsp 0183 32 Your federal income tax may be reduced by claiming the Credit for Child and Dependent Care expenses on your tax return Who is eligible to claim the credit You may be eligible to claim the child and dependent care credit if