Tax Return Claim Health Insurance Web Insurances that are tax deductible Insurance for health care and income protection e g health insurance liability accident disability or pension insurance Insurance for

Web You can claim part of the cost of private health insurance as a pension expense in your tax return according to the Citizens Relief Act B 252 rgerentlastungsgesetz which has Web 19 Aug 2019 nbsp 0183 32 What are medical expenses Krankheitskosten Expenditures incurred in connection with a disease can under certain conditions be deducted from your taxes as

Tax Return Claim Health Insurance

Tax Return Claim Health Insurance

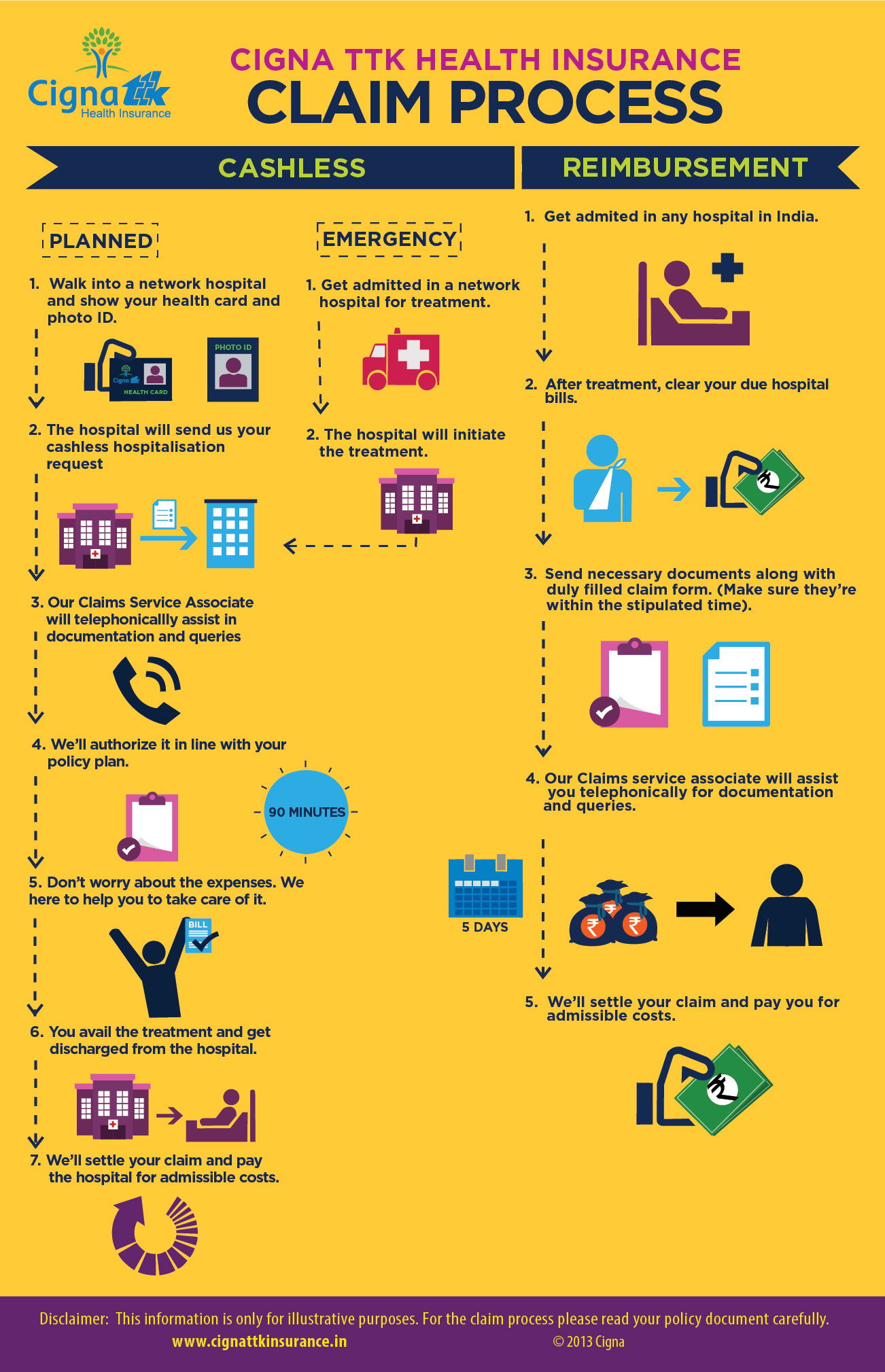

https://www.patriotsoftware.com/wp-content/uploads/2021/06/health-insurance-pre-tax-1.png

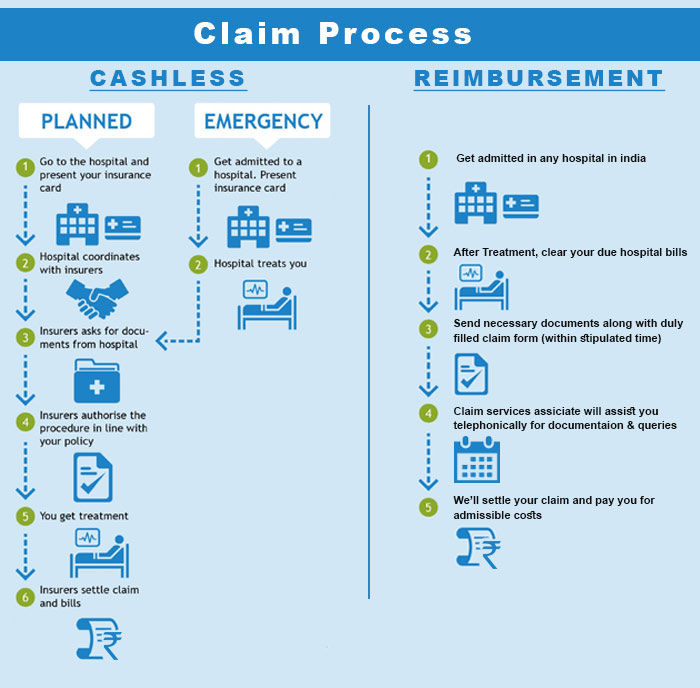

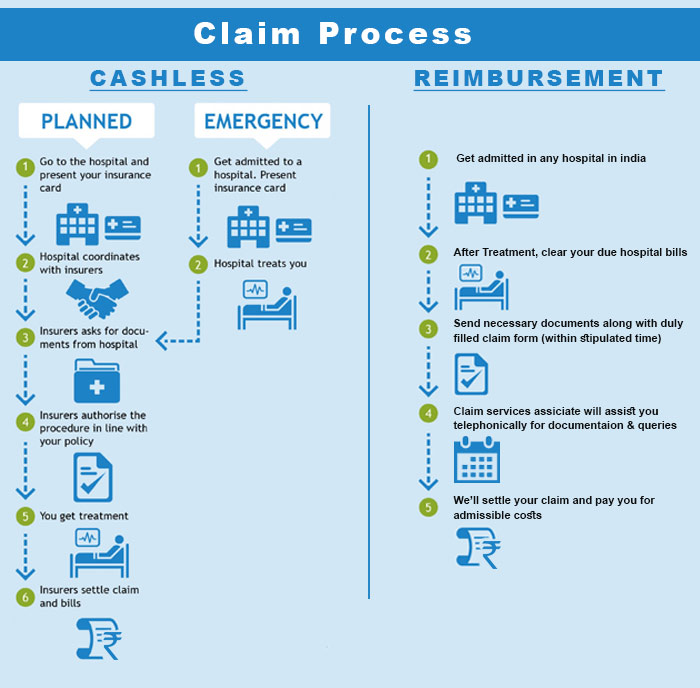

Health Insurance Claim Process And Required Documents PolicyX Com

https://cdn.policyx.com/images/articles/cashless-and-reimbursement-claim-process.jpg

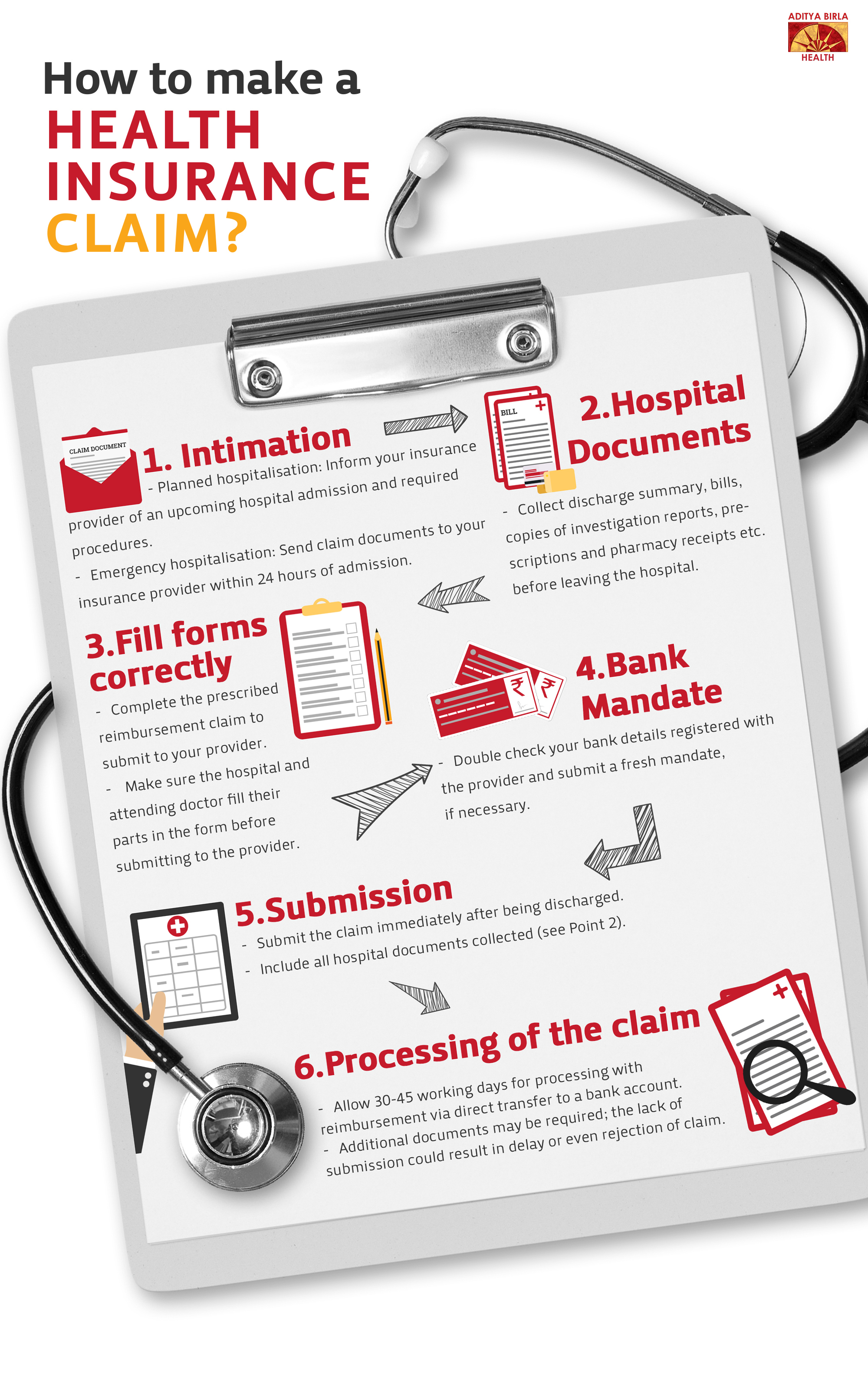

6 Simple Steps To Filing An Insurance Claim

https://www.adityabirlacapital.com/healthinsurance/active-together/wp-content/uploads/2017/09/Final-How-to-make-a-Health-Insurance-V1-1.jpg

Web 25 Okt 2022 nbsp 0183 32 Retirement provisions Contributions to statutory and private retirement insurance funds occupational pension provisions Riester and R 252 rup pension plans Insurance Contributions to health insurance Web Insurance costs When filing your tax return you can declare both your and your employer s share of social security contributions this includes your health insurance

Web Is private health insurance tax deductible If you ve recently switched to private health insurance or plan to you may be wondering whether you can deduct the costs from Web You can deduct insurance contributions from your tax return as part of your special expenses These include Statutory health insurance Statutory pension insurance

Download Tax Return Claim Health Insurance

More picture related to Tax Return Claim Health Insurance

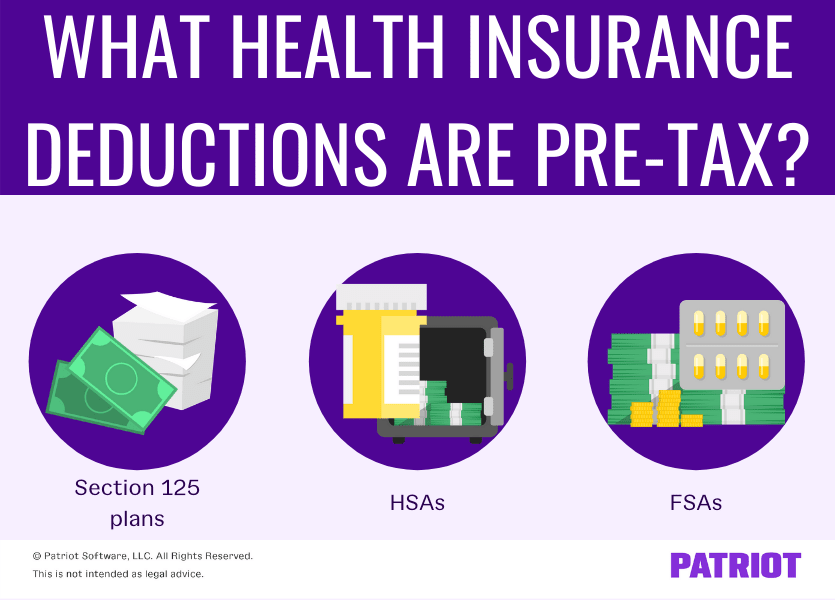

How To Claim Under Multiple Health Insurance Policies ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2019/11/How-to-claim-from-multiple-health-insurance-policies.jpg

Health Insurance Tax Claim Law Document Count Form Of Healthcare

https://thumbs.dreamstime.com/b/health-insurance-tax-claim-law-document-count-form-healthcare-vector-illustration-229657664.jpg

How To File An Insurance Claim And What To Expect

https://www.internationalstudentinsurance.com/blog/wp-content/uploads/2017/08/Insurance-Claims_EN.png

Web 20 M 228 rz 2023 nbsp 0183 32 Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an Web 10 M 228 rz 2023 nbsp 0183 32 You can only deduct the out of pocket portion of your employer sponsored health insurance premium if you take the itemized deduction on your tax return And even then the premiums can

Web Health insurance both statutory health insurance and private health insurance for primary healthcare are 100 deductible Long term care insurance contributions 100 deductible Unemployment insurance Web Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s

Health Insurance Claim Process Claim Assistance PolicyX YouTube

https://i.ytimg.com/vi/arPkU8pi714/maxresdefault.jpg

Health Insurance Claim Process Visual ly

https://i.visual.ly/images/health-insurance-claim-process_53d24d3c33809.JPG

https://germantaxes.de/deducting-insurance-from-tax

Web Insurances that are tax deductible Insurance for health care and income protection e g health insurance liability accident disability or pension insurance Insurance for

https://www.ottonova.de/en/expat-guide/private-health-insurance-tax-ret…

Web You can claim part of the cost of private health insurance as a pension expense in your tax return according to the Citizens Relief Act B 252 rgerentlastungsgesetz which has

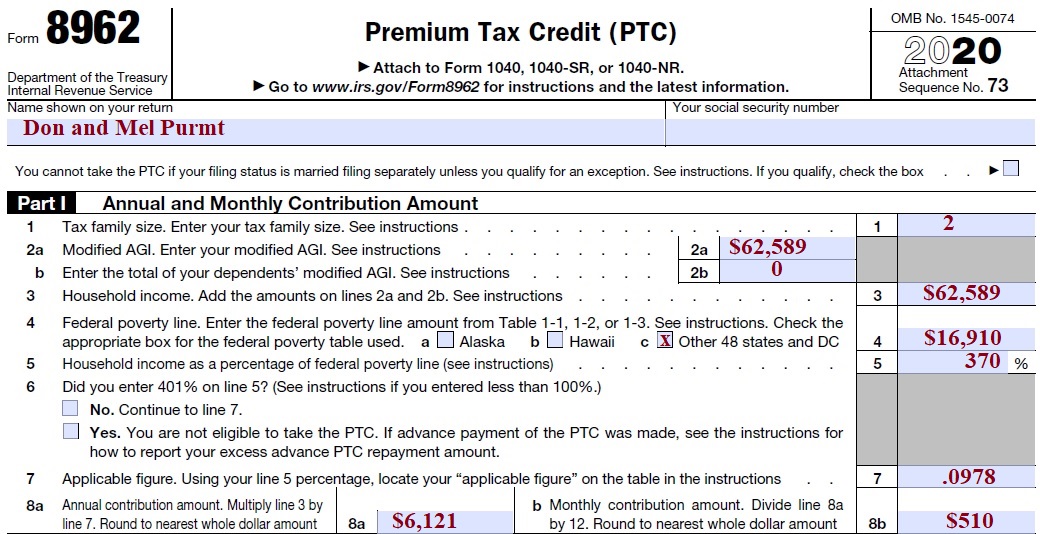

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Health Insurance Claim Process Claim Assistance PolicyX YouTube

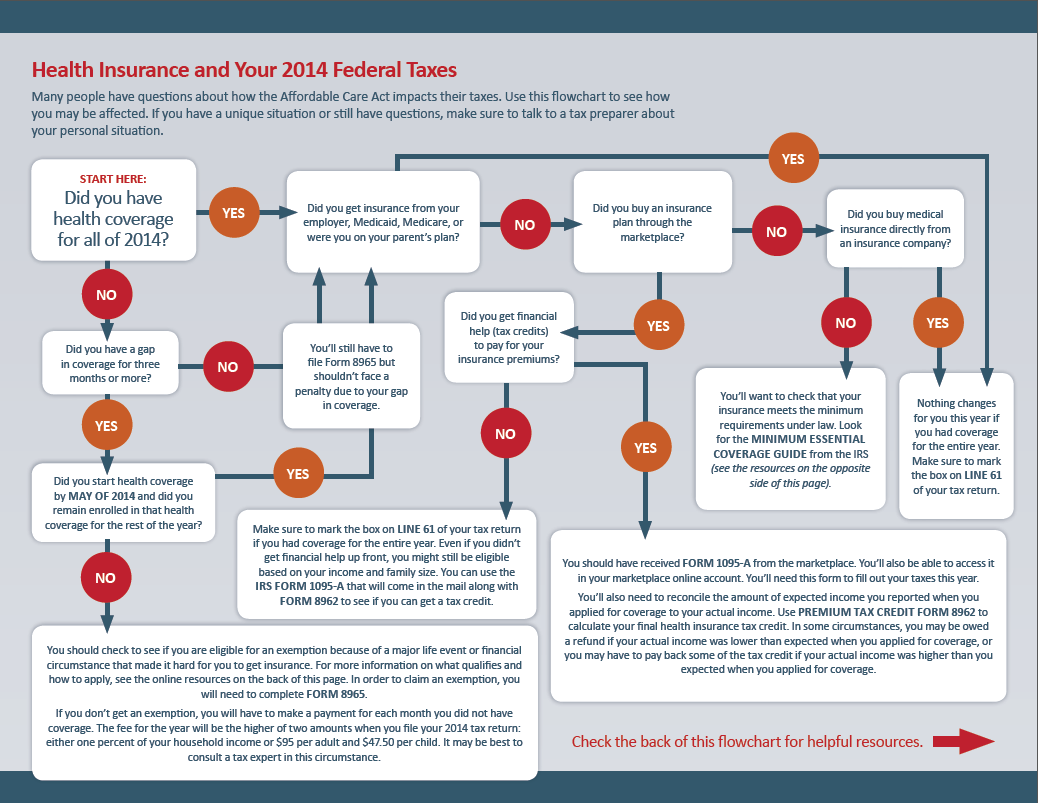

How To Report Health Insurance To IRS Under Obamacare

Questions About Tax Time And Health Insurance Georgians For A

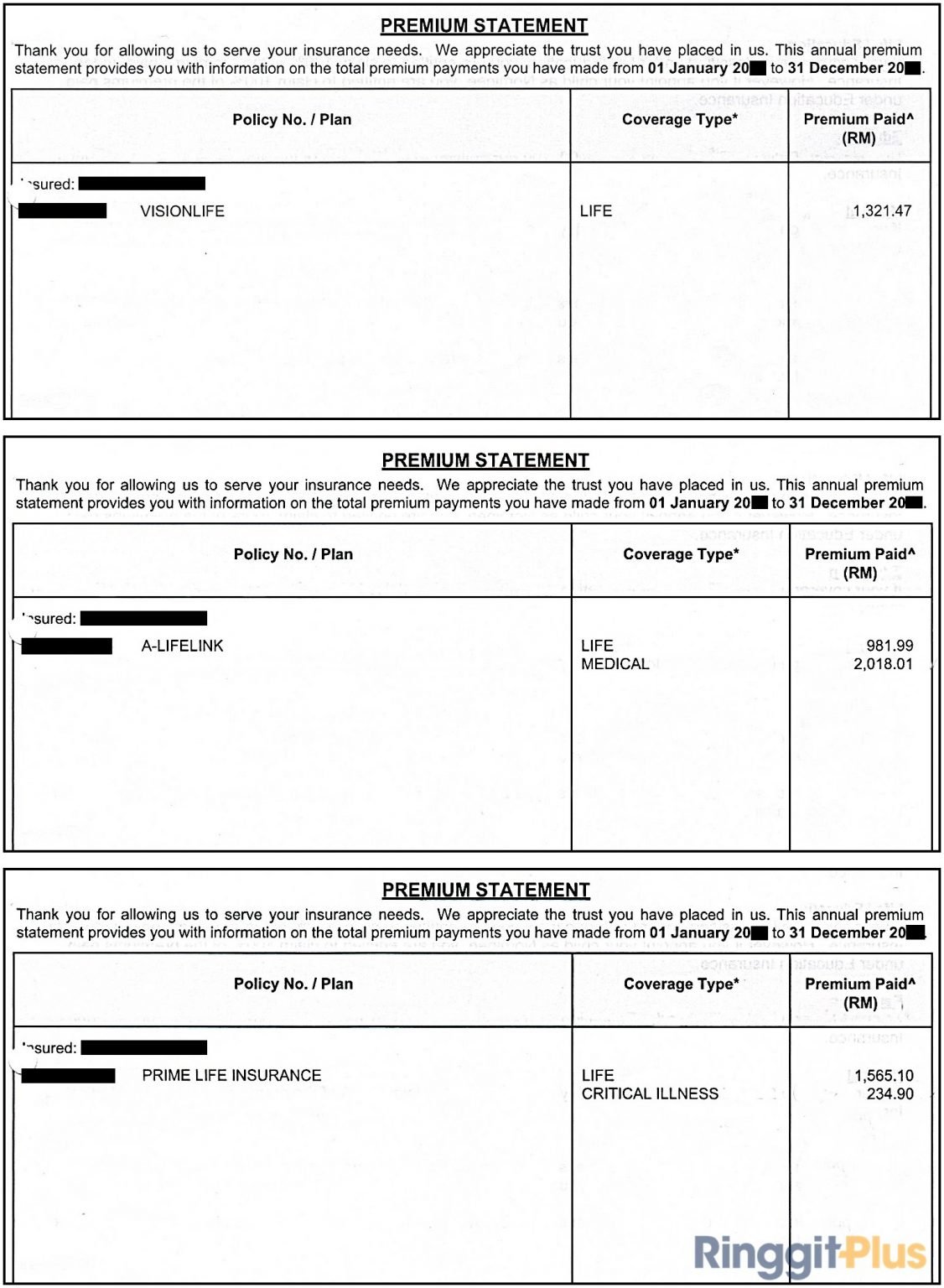

How To Claim Income Tax Reliefs For Your Insurance Premiums

Tax Benefits Of Health Insurance

Tax Benefits Of Health Insurance

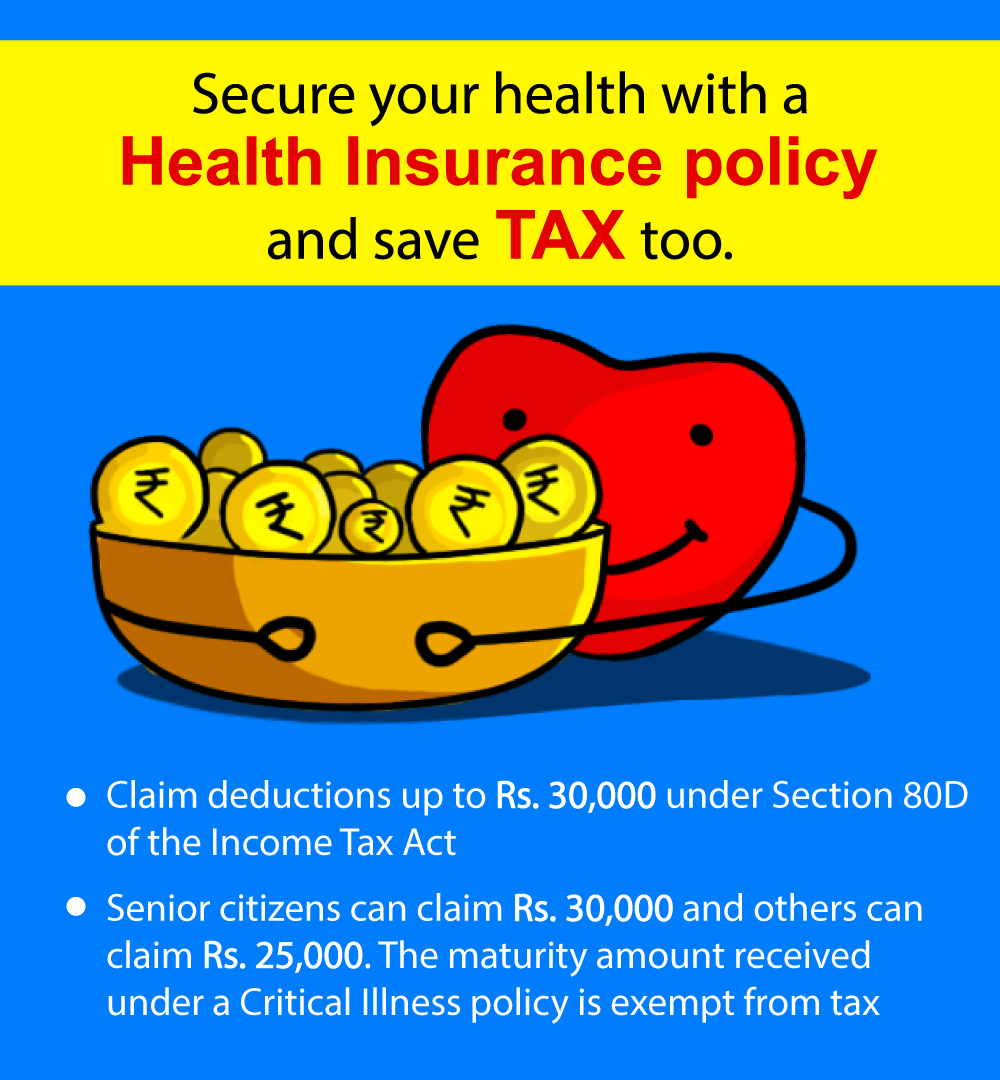

Tax Statements Navy Health

Are Health Insurance Premiums Tax Deductions In Canada

Few Claim Health Insurance Tax Credit

Tax Return Claim Health Insurance - Web Is private health insurance tax deductible If you ve recently switched to private health insurance or plan to you may be wondering whether you can deduct the costs from