Tax Return Home Office Allowance Verkko Last updated 29 Dec 2022 If you re self employed there are two ways through which you can claim your home as an expense Calculate your rent mortgage and bills then

Verkko 6 elok 2020 nbsp 0183 32 The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return With more people working from home than ever Verkko Someone working 23 3 hours a week or more will be able to claim 163 312 per year towards use of home as office If this amount does not fairly represent the value your business

Tax Return Home Office Allowance

Tax Return Home Office Allowance

https://blog.gerhard-vogt.de/wordpress/wp-content/uploads/2020/06/workstation-336369_1280-1024x682.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Personal Tax Return Why Should You Claim A Personal Tax Return

https://www.handt.ca/wp-content/uploads/2021/06/taxes-646512_1920.jpg

Verkko 26 kes 228 k 2021 nbsp 0183 32 Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct Verkko 25 tammik 2023 nbsp 0183 32 If you re self employed If you work from home rather than from a business premises you can either add work related expenses when you file your 2022 23 tax return or you may be able to claim by

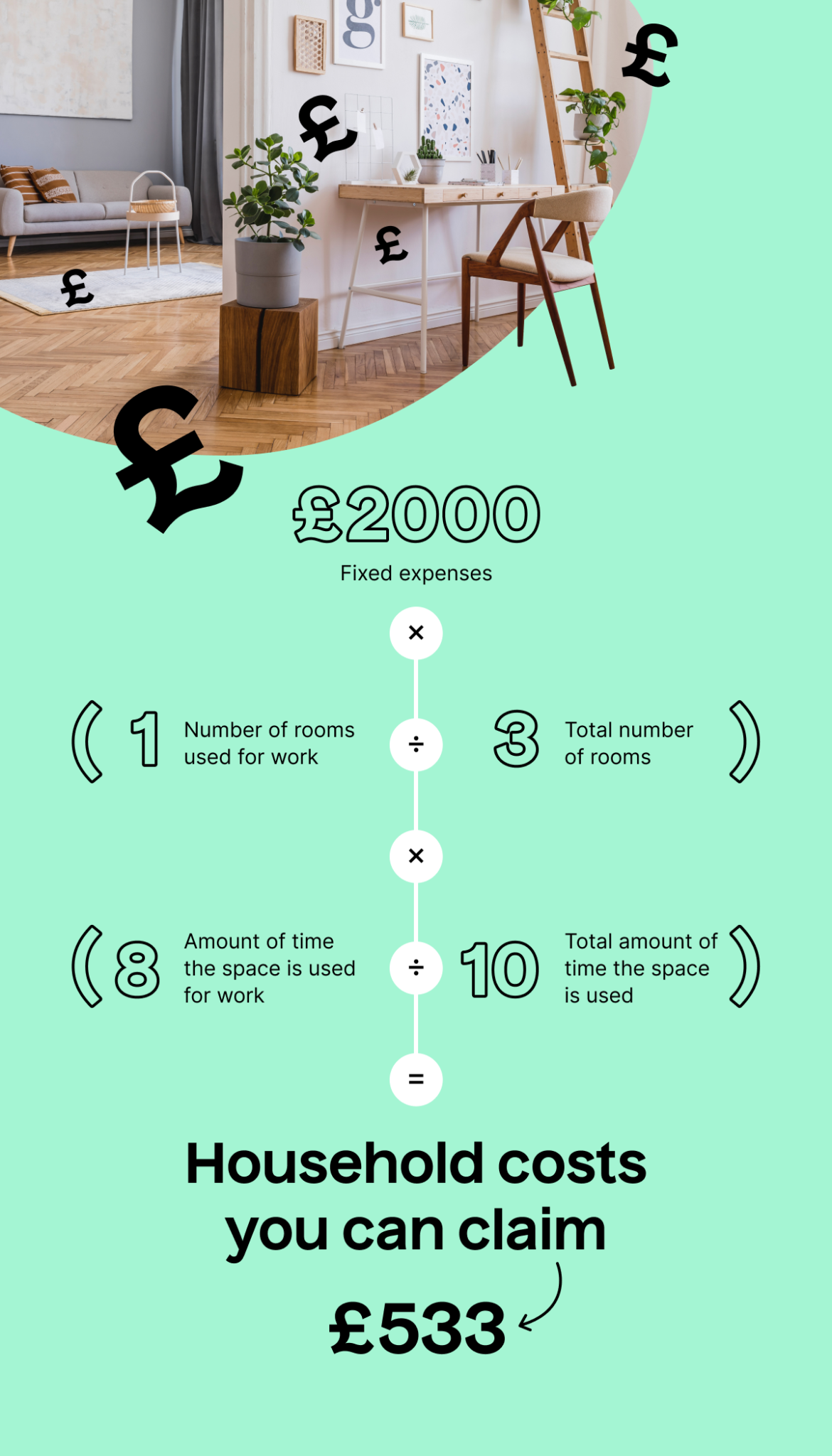

Verkko The Home Office Allowance is a flat rate that you can claim if you re self employed and use your home for work This is done through a system known as simplified expenses and the amount of Home Verkko 31 maalisk 2023 nbsp 0183 32 The easiest way to calculate your home office expenses is to use HMRC s published allowance for the additional costs of running your business from

Download Tax Return Home Office Allowance

More picture related to Tax Return Home Office Allowance

Your 2021 Tax Return And Home Office Expenses The Do s And Don ts NowHR

https://www.nowhr.co.za/wp-content/uploads/2021/09/Nowicki-Website-Images-8.jpg

Everything You Need To Know About Claiming Home Office Expenses On Your

https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2022/02/vw0210expenses.jpg

Office Desk With Hutch And Right Return Desk Home Design Ideas

https://www.anguloconsulting.com/wp-content/uploads/2017/06/office-desk-with-hutch-and-right-return.jpg

Verkko 12 lokak 2022 nbsp 0183 32 Tax reliefs and allowances for businesses employers and the self employed Find out about tax reliefs and allowances available from HMRC if you run Verkko 15 kes 228 k 2023 nbsp 0183 32 This means the majority of employees who claimed home working tax relief in 2020 21 and 2021 22 will no longer qualify as only limited circumstances will

Verkko 13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000 Verkko 22 elok 2023 nbsp 0183 32 Where do I state the Home Office allowance in my tax return The good thing is you don t need to apply or register in order to make use of the

9 Important Tax Allowances For Freelancers Accountable

https://www.accountable.de/wp-content/uploads/2023/10/Bildschirmfoto-2023-11-02-um-10.36.58.png

Ketentuan Tax Allowance Direvisi Proses Pengajuan Lebih Sederhana

https://www.mucglobal.com/storage/files/1596532664_IncomeTax.png

https://taxscouts.com/the-tax-basics/home-office-allowance

Verkko Last updated 29 Dec 2022 If you re self employed there are two ways through which you can claim your home as an expense Calculate your rent mortgage and bills then

https://www.irs.gov/newsroom/heres-what-taxpayers-need-to-know-about...

Verkko 6 elok 2020 nbsp 0183 32 The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return With more people working from home than ever

Working From Home Allowance Calculator When Invoicing Your Limited

9 Important Tax Allowances For Freelancers Accountable

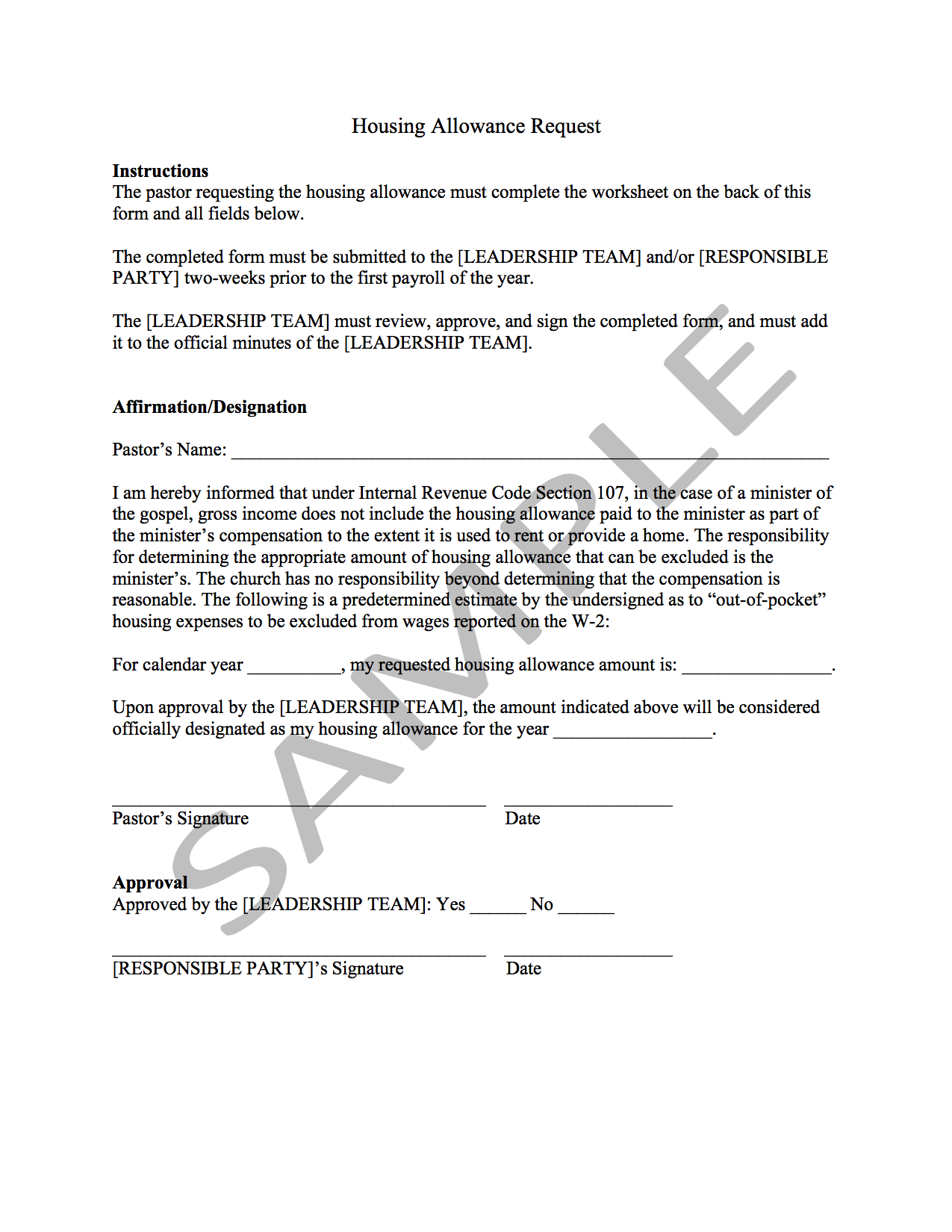

Housing Allowance Request Form Brokepastor

WFH Tax Relief Vs Home Office Allowance What s The Difference TaxScouts

The Home Office Allowance How To Claim If You Work From Home TaxScouts

Your 2021 Tax Return And Home Office Expenses The Do s And Don ts NowHR

Your 2021 Tax Return And Home Office Expenses The Do s And Don ts NowHR

WHAT ARE THE ALLOWANCES AND INCOMES NOT INCLUDED IN THE VIETNAM

Capital Allowances Capital Works Rental Property Nanak Accountants

WFH Tax Relief Vs Home Office Allowance What s The Difference TaxScouts

Tax Return Home Office Allowance - Verkko 31 maalisk 2023 nbsp 0183 32 The easiest way to calculate your home office expenses is to use HMRC s published allowance for the additional costs of running your business from