Tax Return On Rent Paid Ontario If you paid rent in Ontario and had a lower income you may be able to claim a tax credit Learn more in this article and get your maximum tax refund

Claim rent on taxes on Ontario with Ontario Trillium Benefit If you are a renter in the province of Ontario your monthly rent If you are a resident of Ontario Manitoba or Quebec or are self employed you may be able to claim rent paid on your tax return At Accountor CPA our tax

Tax Return On Rent Paid Ontario

Tax Return On Rent Paid Ontario

https://brokerininsurance.com/wp-content/uploads/2022/04/Untitled-design-5.jpg

Claim Tax Back On Rent Paid For Your Child Oliver Niland Co

https://www.taxreturnhelp.ie/wp-content/uploads/2020/06/shutterstock_1024269241.jpg

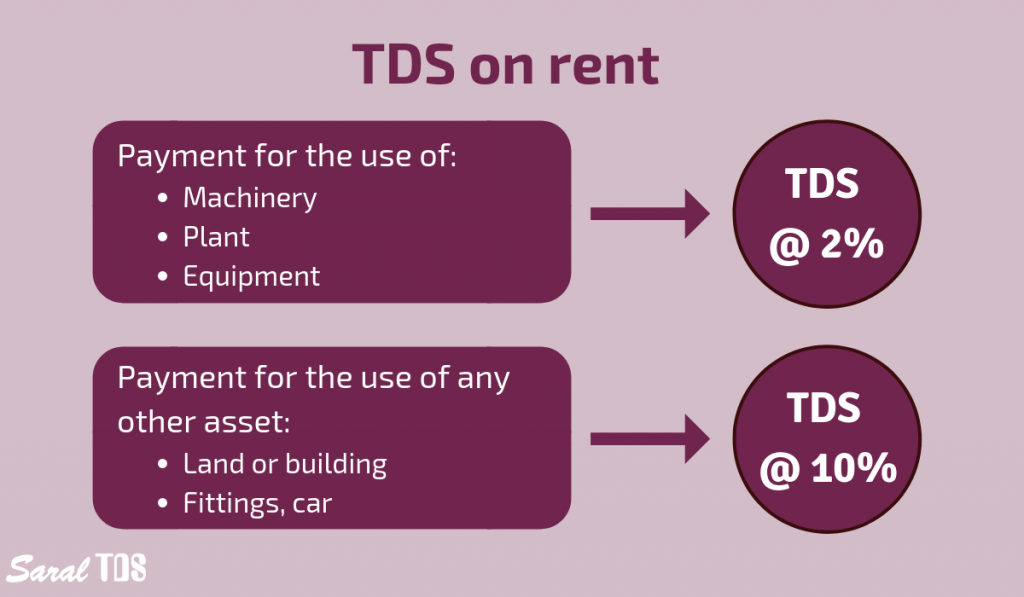

RCM On Rent Under GST Rcm On Rent Paid Under Gst Reverse Charge

https://i.ytimg.com/vi/Yo2ajdytSuA/maxresdefault.jpg

If you live in Manitoba or Ontario you can claim a credit for rent paid To claim the Manitoba Education Property Tax Credit Rent Paid Under the Provincial tab If you re eligible for one of the following benefits or credits then you will be able to claim the rent you paid during 2023 on your return Clergy Residence Deduction Home

Claiming rent on a tax return in Ontario A tenant who lives in Ontario may qualify for the Ontario Trillium Benefit OTB This refundable tax credit provides financial support for low to moderate This guide will help you determine your gross rental income the expenses you can deduct and your net rental income or loss for the year It will also help you fill in Form T776

Download Tax Return On Rent Paid Ontario

More picture related to Tax Return On Rent Paid Ontario

Rent Paid By Gst Registered Person For Commercial Use Of Residential

https://www.caindelhiindia.com/blog/wp-content/uploads/2022/07/Rent-paid-by-gst-registered-person-for-commercial-use-of-residential-premises-will-attract-RCM-768x455.jpg

Tributes Are Paid To An Ontario Woman Whose Body Was Found In BC She

https://www.narcity.com/media-library/jacqueline-mcdermott.jpg?id=31888201&width=1245&height=700&quality=85&coordinates=0%2C0%2C6%2C0

GST Payment Dates 2022 GST HST Credit Guide Filing Taxes

https://filingtaxes.ca/wp-content/uploads/2021/10/GST-Payment-Dates-20202.png

To claim rent on your taxes in Ontario you need to fill out Form T776 Statement of Real Estate Rentals This form allows you to report your rental income You must rent out the property at fair market value and have proof of rentals expenses and important financial transactions If you have any unpaid rentals

Claiming Rent on Taxes in Ontario If you live in Ontario you can avail of the tax credit through the Ontario Energy and Property Tax Credit OEPTC a part of the Ontario Trillium Benefit OTB The tax credit is calculated You will need to complete Form T776 Statement of Real Estate Rentals when filing your personal income tax return Your taxable rental income is your gross

Commercial Rent Tax October 2022 Issue

https://assets.foleon.com/eu-west-2/screenshots-1d5fh4/219453/q0868fOY4YUlkEsG8p_fb.png

Key Note On Applicability Of GST 18 On Rent CA Rajput Jain

https://carajput.com/blog/wp-content/uploads/2022/07/GST-on-rent-applicablity-.jpg

https://turbotax.intuit.ca › tips

If you paid rent in Ontario and had a lower income you may be able to claim a tax credit Learn more in this article and get your maximum tax refund

https://turbotax.intuit.ca › tips

Claim rent on taxes on Ontario with Ontario Trillium Benefit If you are a renter in the province of Ontario your monthly rent

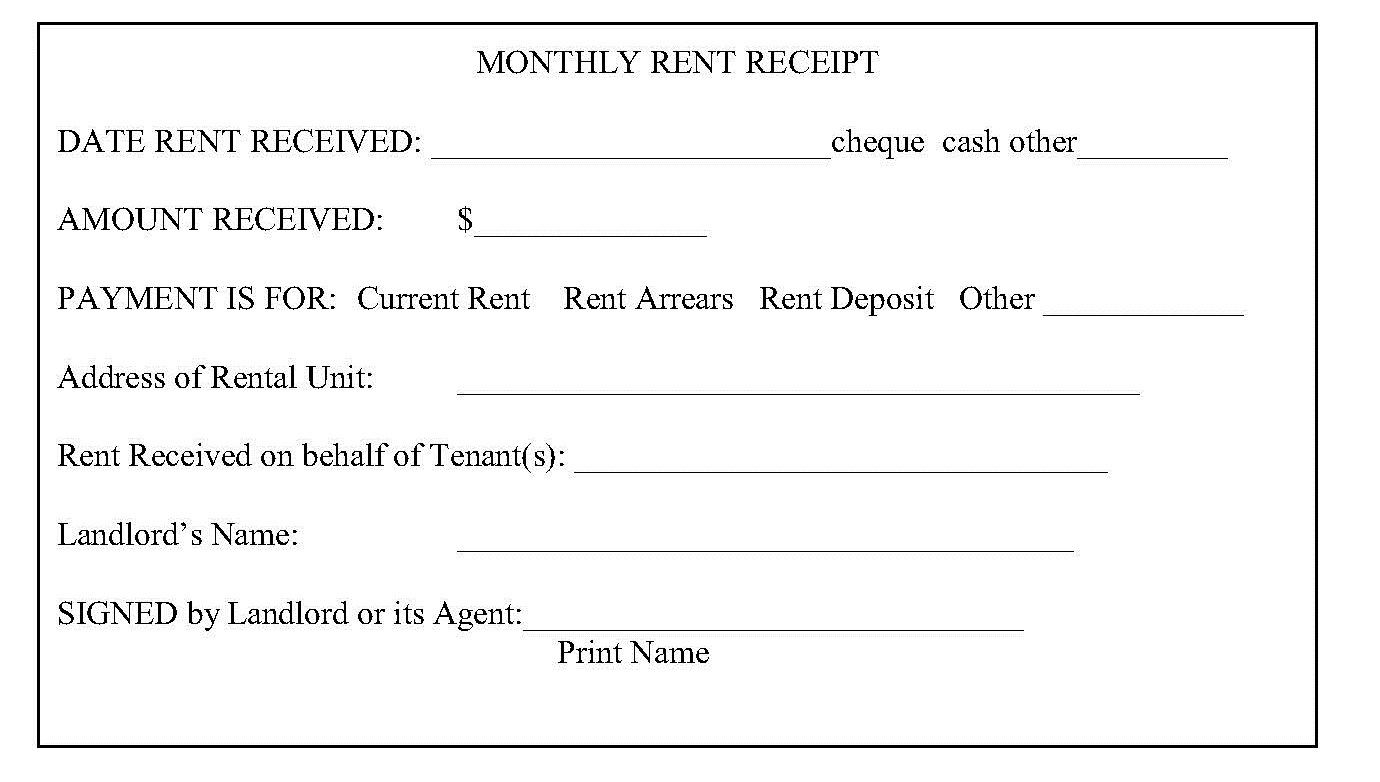

Rental Payment Receipt

Commercial Rent Tax October 2022 Issue

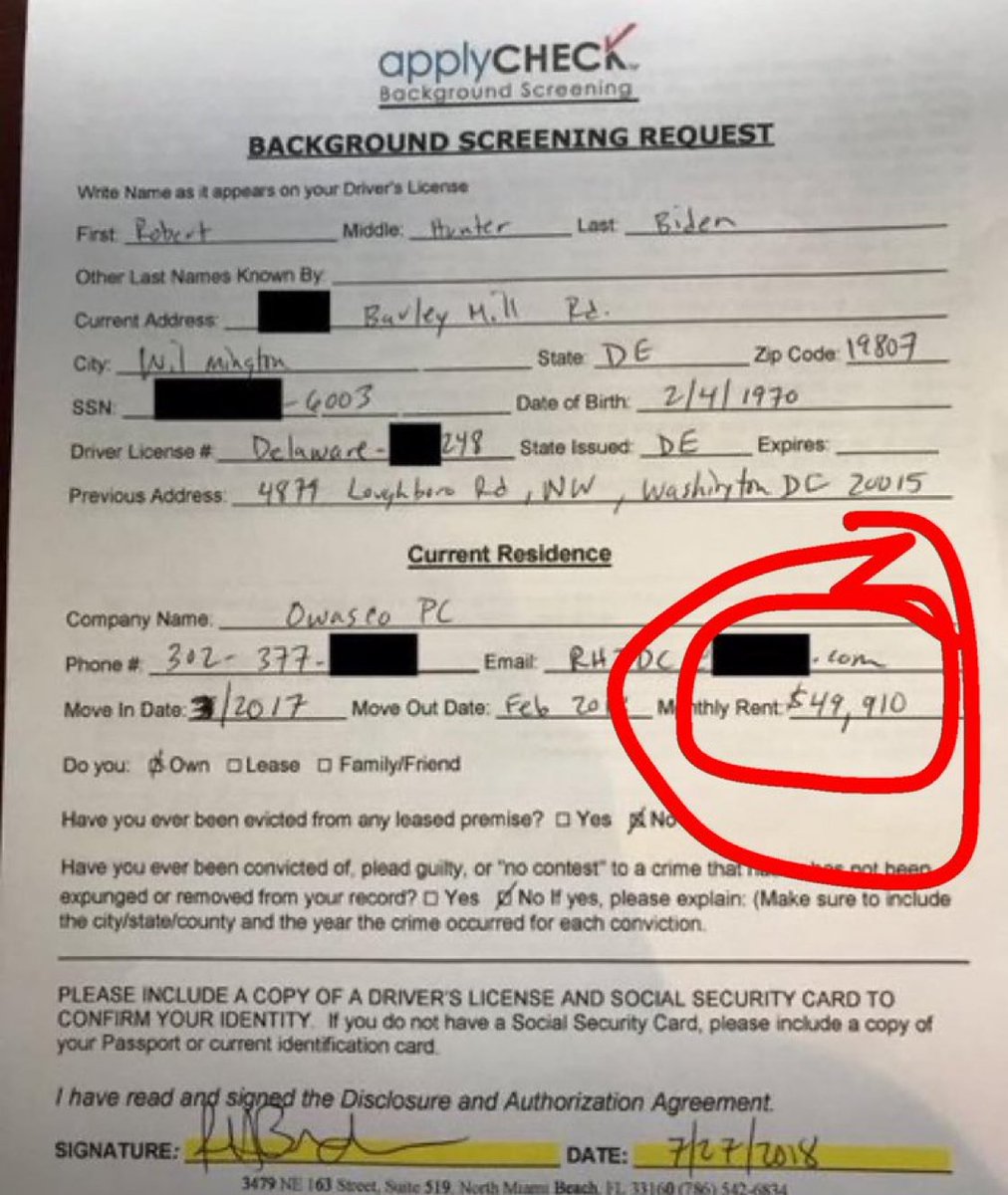

Trimble On Twitter RT WendellHusebo Hunter Biden Claimed In 2018 He

GST ON RENT COMMERCIAL AND RESIDENTIAL PROPERTY Consult CA Online

TDS On Rent Detailed Explanation On Section 194I

80GG Tax Benefit For Rent Paid

80GG Tax Benefit For Rent Paid

Auckland Average Rental Prices Reach New High But Central City

Ontario Trillium Benefit 2021 Do You Qualify

Free Fillable Rent Receipt Template

Tax Return On Rent Paid Ontario - This guide will help you determine your gross rental income the expenses you can deduct and your net rental income or loss for the year It will also help you fill in Form T776