Tds Tax Rebate Web You can claim your TDS refund by following the steps mentioned below Step 1 File your

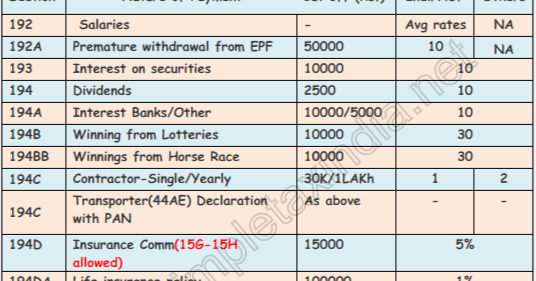

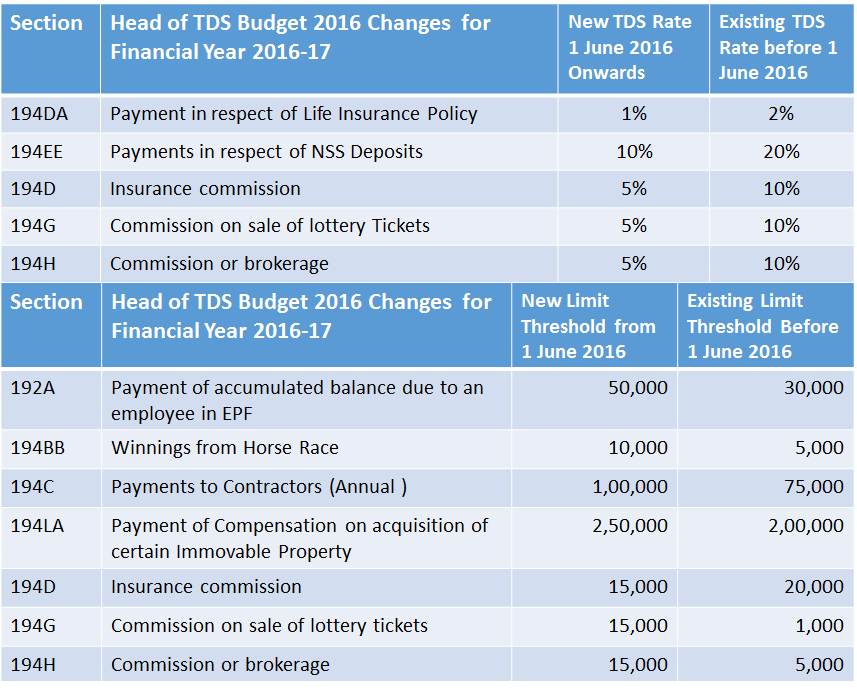

Web 29 mars 2017 nbsp 0183 32 TDS or Tax Deducted at Source is income tax reduced from the money paid at the time of making specified payments such as rent Web 16 ao 251 t 2019 nbsp 0183 32 If TDS tax deducted at source has been deducted on any income paid to you during the FY 2019 20 then remember to claim

Tds Tax Rebate

Tds Tax Rebate

https://3.bp.blogspot.com/-dNuhLRz1NTs/WOkAqGYWdWI/AAAAAAAAQgM/zF1fCIOPuOwG6IDLIXAnzh6r0kqdlm0ZwCLcB/w600-h315-p-k-no-nu/tds%2Brates%2Bchart%2Bfy%2B2017-18.png

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

https://1.bp.blogspot.com/-6tNn2hi5BU4/Xgq0_3mhp7I/AAAAAAAALX0/o1GLWnLdwv4U83jdi5vB-0Dok4eOztfawCNcBGAsYHQ/s1600/Picture%2Bfor%2BTax%2BSlab%2Bf.y.%2B2019-20.jpg

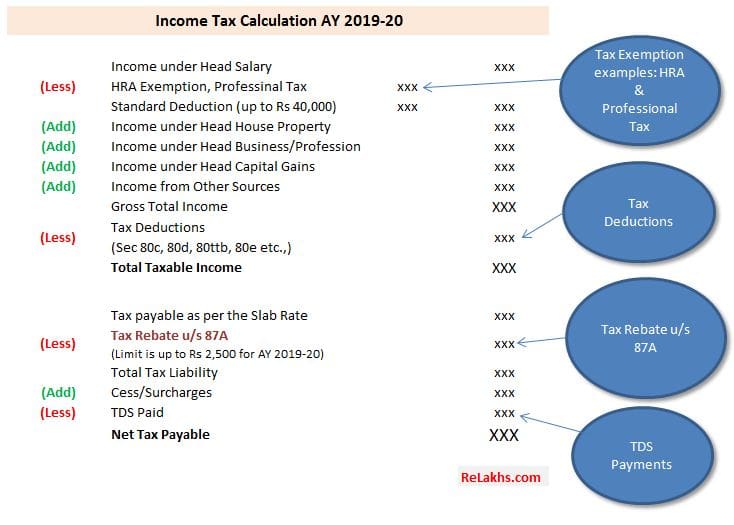

Web Tax Rebate and Relief Tax Rebate You can receive a tax credit of up to Rs 12 500 if Web 12 mars 2019 nbsp 0183 32 Standard Deduction of up to Rs 40 000 for FY 218 19 from your Salary Income Tax Benefit relief on Home Loan for payment of Interest is allowed as a deduction under Section 24 of the Income Tax

Web Bonus Commissions Gratuity Annuity payments etc Who can deduct TDS under Web 4 avr 2023 nbsp 0183 32 Updated on May 8th 2022 10 22 24 PM 14 min read CONTENTS Show Section 192 of the Income Tax Act 1961 deals with tax deducted at source TDS on salary Your employer will deduct TDS

Download Tds Tax Rebate

More picture related to Tds Tax Rebate

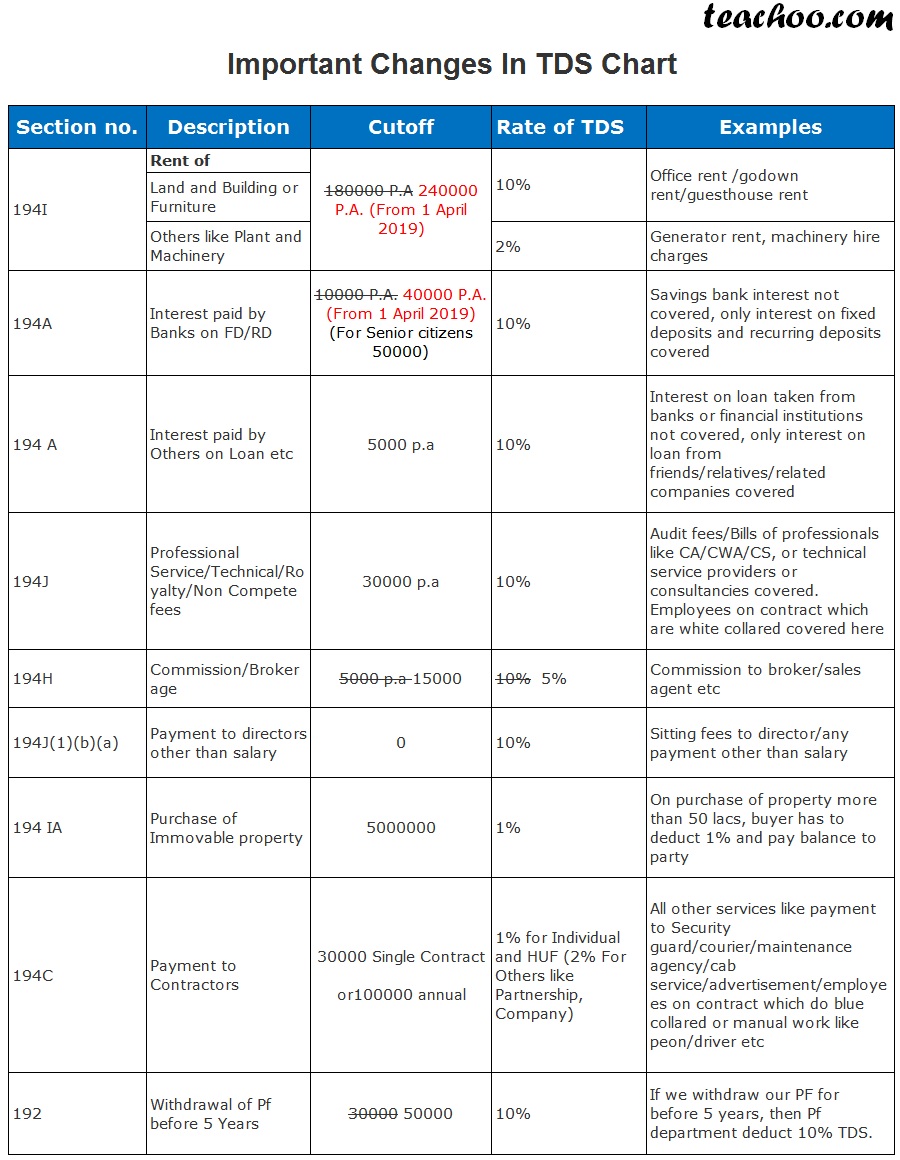

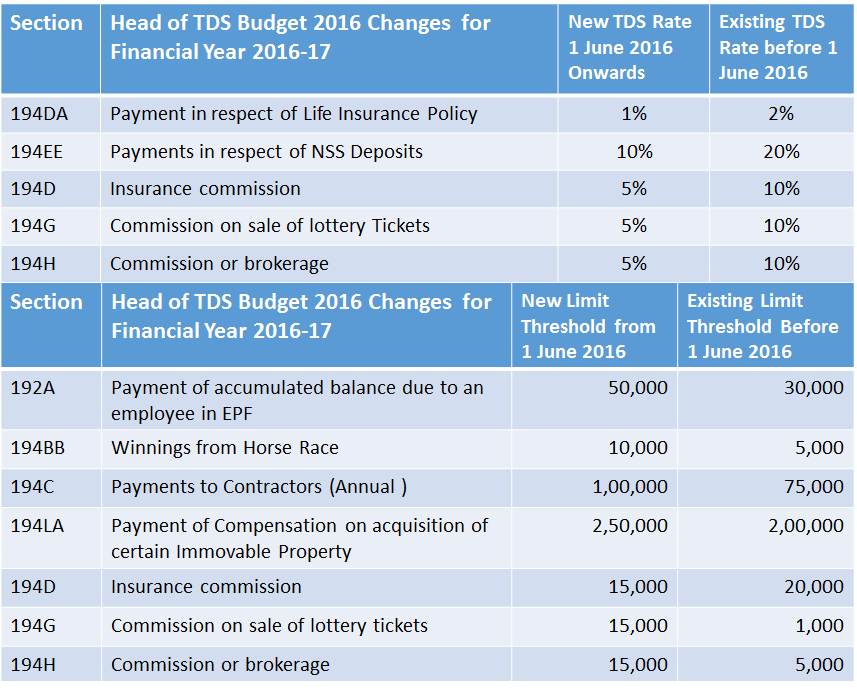

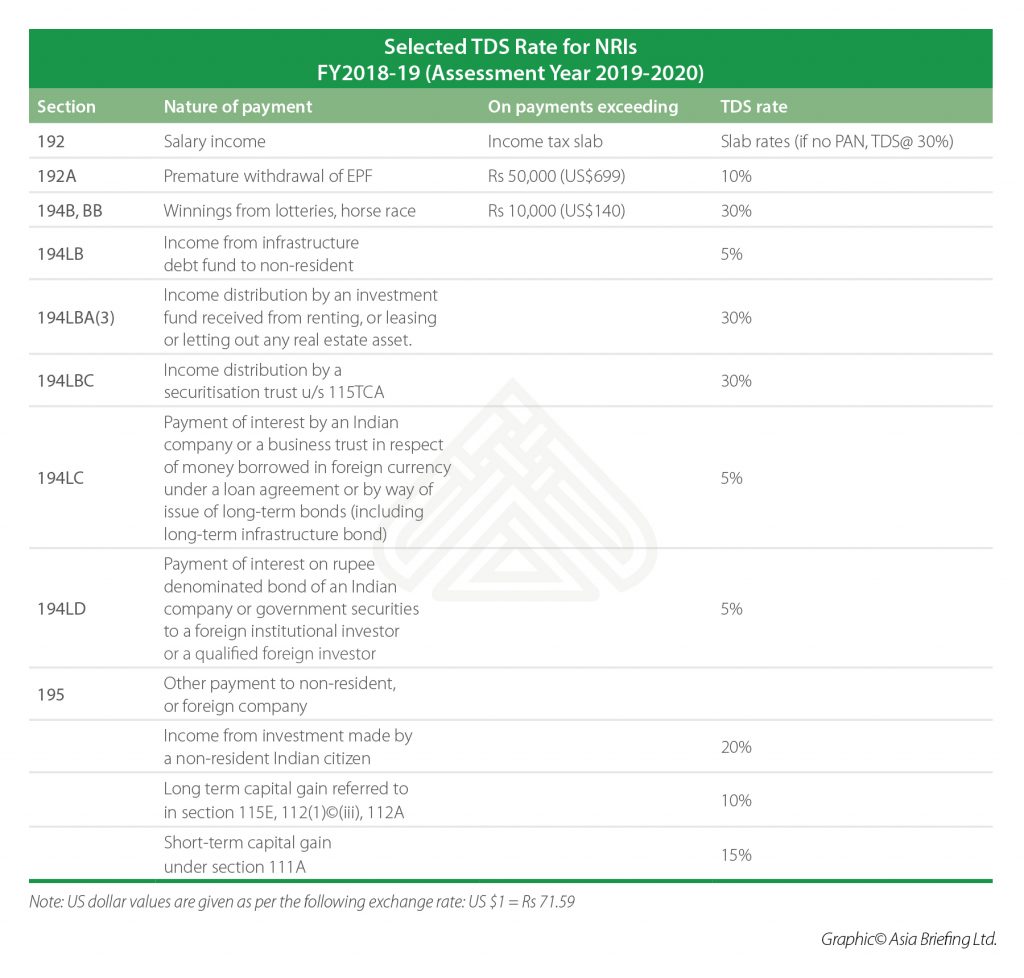

TDS RATE CHART FY 2018 19 AY 2019 20 TDS DEPOSIT RETURN DUE DATES

https://2.bp.blogspot.com/-JHSpeXCnJ9k/WspJCng8sRI/AAAAAAAAEZA/ziYKFvaInc8znX0qpUTAMMKDrHMZfJWkgCLcBGAs/s1600/tds%2Brates%2Bchart%2Bfy%2B2018-19%2Bay%2B2019-20%2B%25281%2529.png

TDS Tax Deducted At Source Yadnya Investment Academy

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2019/08/TDS-rates.png?fit=900%2C617&ssl=1

Income Tax Rates For Fy 2019 2020 Pdf Carfare me 2019 2020

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/5cf27152-f979-4e2b-833d-e8f9f702343b/important-section-tds-chart.jpg

Web 28 juil 2018 nbsp 0183 32 What amount is to be considered for TDS on Salary 4 Is it possible to Web Download Challan Credit for tax payments a Challan Status b View Your Tax Credit i

Web 2 mai 2023 nbsp 0183 32 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the said Web What is TDS Refund TDS refund is about getting a part of the paid TDS tax back into

WELCOME TO CA GROUPS Revised And Latest TDS Tax Deducted At Source

https://4.bp.blogspot.com/-la6KKxgOViw/VumIdtuHJcI/AAAAAAAABuw/QPEUjojdSpEnpUWd2k4D1Ys6pSzULKweg/s1600/Revised%2Band%2BLatest%2BTDS%2BTax%2BDeducted%2Bat%2BSource%2BRate%2BChart%2Bfor%2BFY%2B2016-17%2BAY%2B2017-18.png

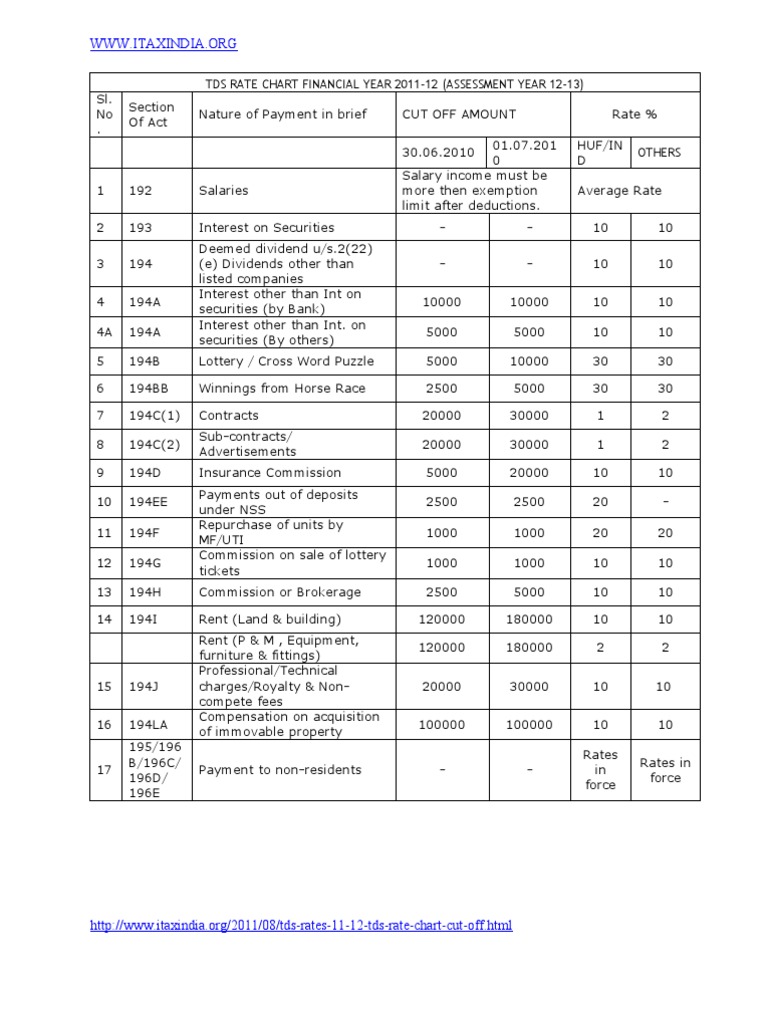

Tds Rate Chart Fy 11 12 Tax Refund Taxes

https://imgv2-2-f.scribdassets.com/img/document/63904218/original/fa93a594d4/1568562691?v=1

https://www.bankbazaar.com/tax/how-claim-tds-refund.html

Web You can claim your TDS refund by following the steps mentioned below Step 1 File your

https://cleartax.in/s/tds

Web 29 mars 2017 nbsp 0183 32 TDS or Tax Deducted at Source is income tax reduced from the money paid at the time of making specified payments such as rent

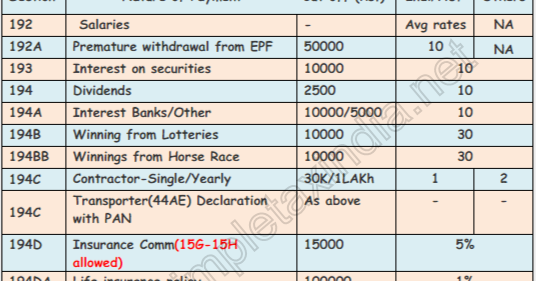

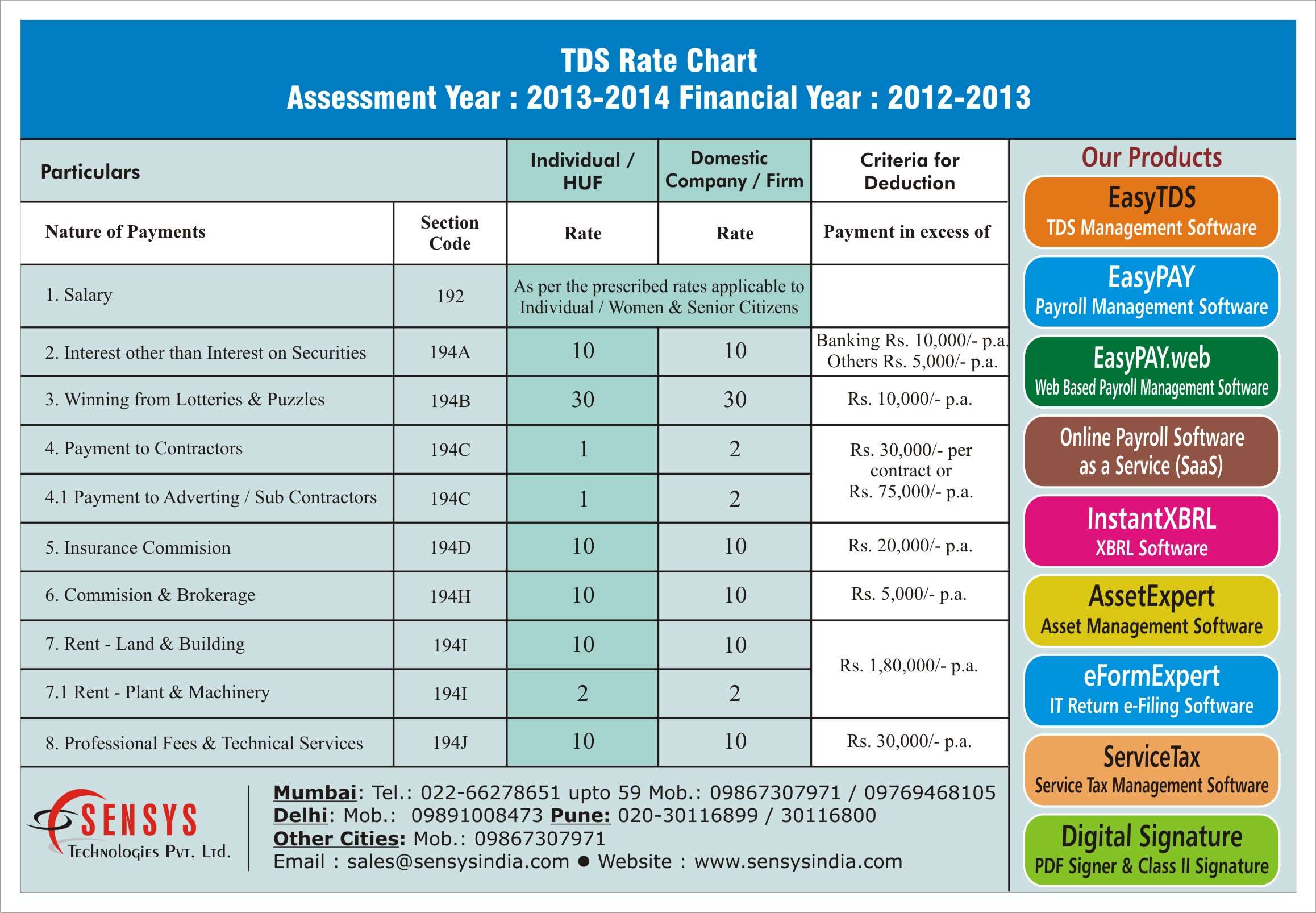

TDS Rate Chart Sensys Blog

WELCOME TO CA GROUPS Revised And Latest TDS Tax Deducted At Source

Latest TDS Rates FY 2019 20 Revised TDS Rate Chart AY 2020 21

Tax Refund Tax Refund Tds

Out Of This World Tax Deducted At Source Appears In The Balance Sheet

Understanding Form 16 Form 16A Form 26AS Tax Filing

Understanding Form 16 Form 16A Form 26AS Tax Filing

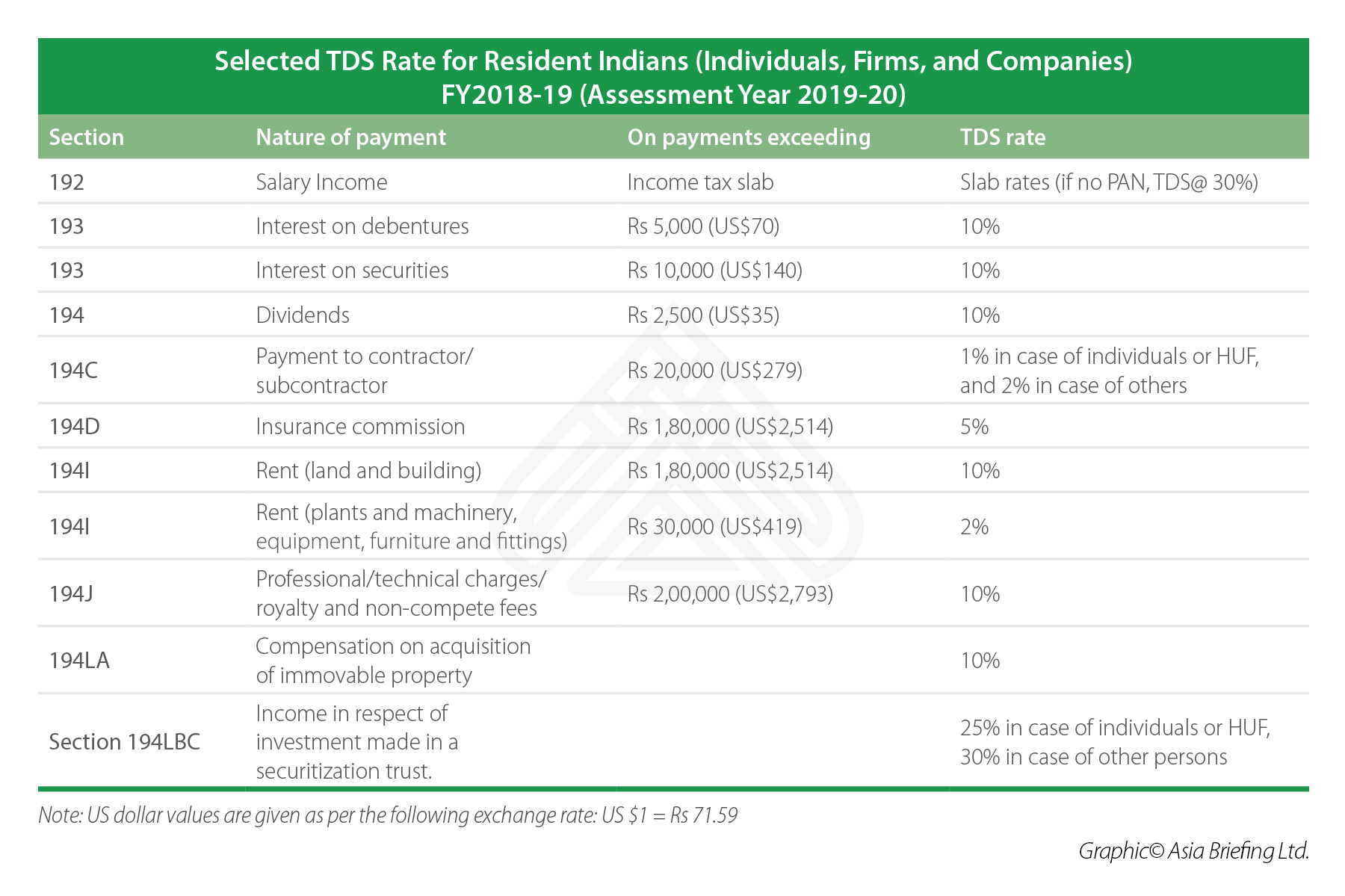

Direct Taxes In India Explained India Briefing News

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Direct Taxes In India Explained India Briefing News

Tds Tax Rebate - Web Tax Rebate and Relief Tax Rebate You can receive a tax credit of up to Rs 12 500 if