Term Insurance Tax Benefit Under Section 80d The annual premium for your term plan should not exceed 10 of the sum assured If the annual premium exceeds 10 of the sum assured tax benefits will be applied proportionately For example if

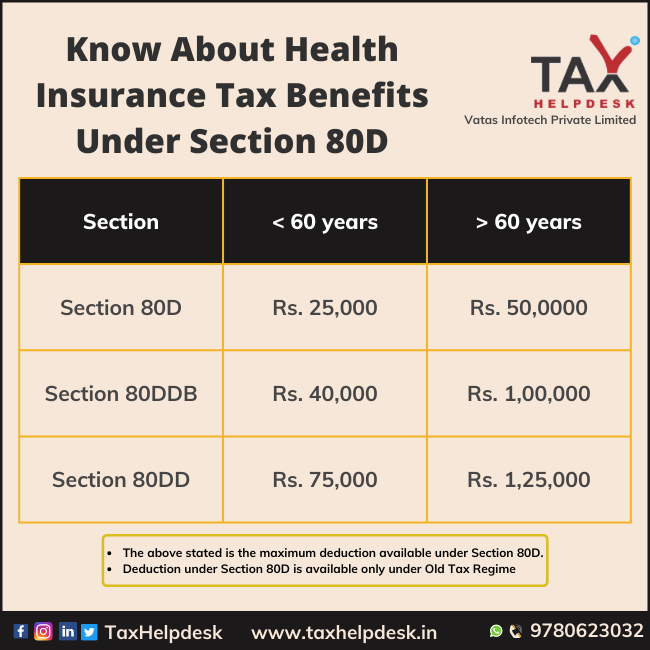

Term Insurance Tax Benefit under Section 80D Section 80D of The Income Tax Act 1961 offers deductions on health insurance premiums You can claim up to 25 000 on Section 80D mainly allows tax deductions on the premiums paid for health insurance However it also provides term insurance tax benefits though in an indirect manner You can avail term insurance

Term Insurance Tax Benefit Under Section 80d

Term Insurance Tax Benefit Under Section 80d

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

https://i.ytimg.com/vi/rLNZXvzHDFs/maxresdefault.jpg

Unlock The Term Insurance Tax Benefit Under Section 80C 80D Loan Papa

https://i0.wp.com/loanpapa.in/wp-content/uploads/2023/07/Term-Insurance-Tax-Benefit.png?w=840&ssl=1

Term Insurance Tax Benefit under Section 80C Tax deductions up to 1 5 Lakh on your premium amount in a financial year If the policy is purchased before 31 March 2012 and Term Insurance Tax Benefit under Section 80D Section 80D ensures a deduction of up to 25 000 on premiums paid for term plans with a critical illness cover Traditionally the Section is reserved only for health

The Indian Government allows tax deductions on term insurance premiums under sections 80C and 80D It reduces your taxable income and saves you some tax Term insurance falls under Section 80C The premiums paid to purchase this policy can be claimed as a tax deduction up to Rs 1 5 Lakh under Section 80C

Download Term Insurance Tax Benefit Under Section 80d

More picture related to Term Insurance Tax Benefit Under Section 80d

Section 80D Income Tax Act Dialabank Best Offers

https://www.dialabank.com/wp-content/uploads/2019/11/Section-80D.jpg

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Can Spouses Split Health Insurance Premium To Claim Tax Benefit Under

https://mbgpr.com/755b0327/https/4d6f0b/img.etimg.com/thumb/width-1200,height-900,imgsize-413031,resizemode-75,msid-69535472/wealth/tax/can-spouses-split-health-insurance-premium-to-claim-tax-benefit-under-section-80d.jpg

Term Insurance Tax Benefit Under Section 80D In accordance with Section 80D of the Income Tax Act you have the opportunity to claim deductions for health insurance premiums To sum it up section 80C offers deductions up to Rs 1 5 Lakhs year Section 80D offers deductions up to Rs 75 000 and in case of senior citizens the maximum benefit can

Conditions for term insurance benefit 80D include Deductions under Section 80D can be availed for an amount that doesn t exceed Rs 25 000 If you have taken an insurance Section 80D includes a deduction of Rs 5 000 for any payments made towards preventive health check ups This deduction will be within the overall limit of Rs

Section 80D Deduction In Respect Of Health Or Medical Insurance

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/Section-80D.jpg

https://www.etmoney.com › learn › insuran…

The annual premium for your term plan should not exceed 10 of the sum assured If the annual premium exceeds 10 of the sum assured tax benefits will be applied proportionately For example if

https://www.iciciprulife.com › term-insurance › term...

Term Insurance Tax Benefit under Section 80D Section 80D of The Income Tax Act 1961 offers deductions on health insurance premiums You can claim up to 25 000 on

How To Save Tax On Health Insurance Premiums Under Section 80D GQ India

Section 80D Deduction In Respect Of Health Or Medical Insurance

Medical Insurance Premium Receipt 2019 20 PDF Deductible Insurance

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

80D Tax Deduction Under Section 80D On Medical Insurance

Tax Saving On Health Insurance Section 80D Detailed Guide For FY

Section 80D Deduction Avail Health Insurance Tax Benefit Under

Term Insurance Tax Benefit Under Section 80d - Term Insurance Tax Benefit under Section 80C Tax deductions up to 1 5 Lakh on your premium amount in a financial year If the policy is purchased before 31 March 2012 and