Tesla Tax Credit California Income Limit Tesla orders for a Model 3 or Model Y placed on or before March 15 2022 and after January 12 2023 may qualify for the California EV rebate if all other program

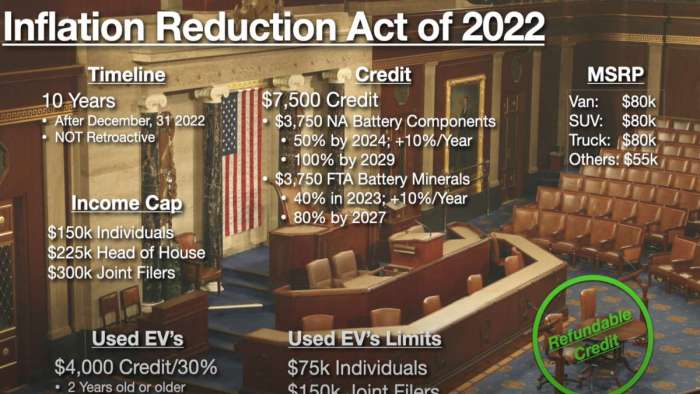

As part of the 2023 Inflation Reduction Act eligible businesses and tax exempt organizations can claim up to a 7 500 credit when purchasing new Tesla vehicles with a gross vehicle weight rating GVWR of up to 14 000 pounds If you buy a new eligible plug in electric vehicle or fuel cell vehicle in 2023 you may qualify for a clean vehicle tax credit of up to 7 500 To claim the credit the modified adjusted

Tesla Tax Credit California Income Limit

Tesla Tax Credit California Income Limit

https://i.ytimg.com/vi/sZZn7-_iolU/maxresdefault.jpg

Tesla s Genius Pricing Plan To Save You Thousands My Tech Methods

https://mytechmethods.com/wp-content/uploads/2021/09/tesla-tax-credit-2021-copy-2.jpg

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

It s limited to applicants who make less than three times the federal poverty level which at the time of writing figures out to 45 180 in annual income for a one person household Those in The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

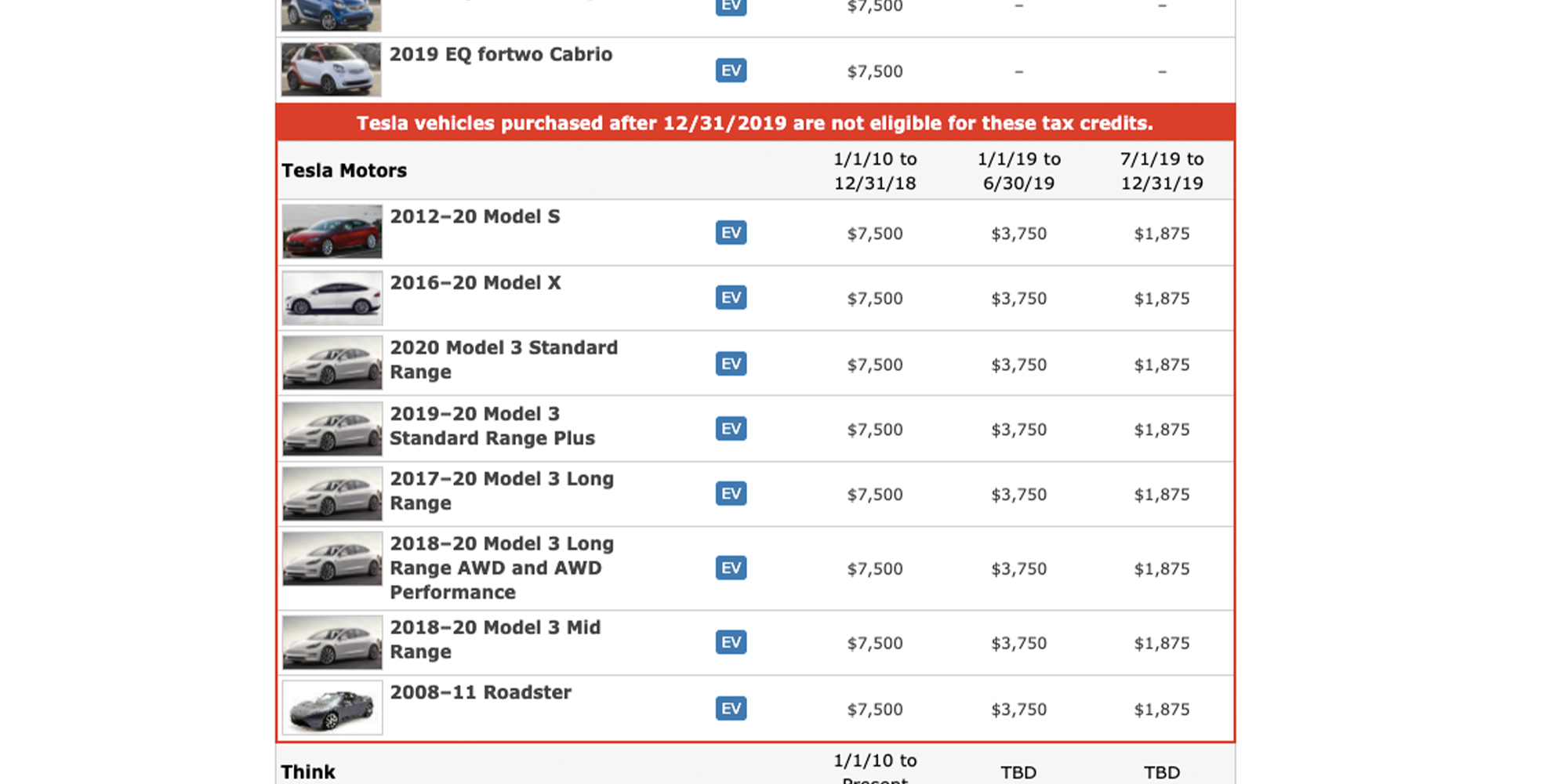

Eligible taxpayers who placed in service an eligible vehicle on or after January 1 2023 may claim the credit on their tax return based on the updated vehicle You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Download Tesla Tax Credit California Income Limit

More picture related to Tesla Tax Credit California Income Limit

Tesla Says All New Model 3s Now Qualify For Full 7 500 Tax Credit

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1c4DLg.img

Tesla Confirms Hitting Federal Tax Credit Threshold 7 500 Credit Cut

https://i1.wp.com/electrek.co/wp-content/uploads/sites/3/2018/02/screen-shot-2018-02-20-at-9-46-49-pm.jpg?w=2500&quality=82&strip=all&ssl=1

Congress Passes 1 2 Trillion Infrastructure Bill 12 500 EV Tax

https://electrek.co/wp-content/uploads/sites/3/2021/11/Tesla-Tax-Credits.jpg?resize=350

California will exclude people who make more than 150 000 a year from getting an electric vehicle rebate starting December 3 The state has spent more than 800 million of taxpayer money to Income limits Buyers will get zero credit if their modified adjusted gross income exceeds by even one dollar 150 000 for individuals or 300 000 for married couples said San Francisco CPA

If you buy a used EV you can still get up to 4 000 in credit Starting in 2024 you can use that tax credit as a down payment but if your vehicle does not The Tesla Model Y and Model 3 California s 1 and 2 best selling vehicles are once again eligible for California s 2 000 electric car rebate after steep price drops last month which bring

TESLA Tax Credit Explained And possibly Extended He Said She Said

https://teslauserguides.com/wp-content/uploads/6355404323_cf97f9c58e_b-768x512.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

https://www.findmyelectric.com/blog/california-ev...

Tesla orders for a Model 3 or Model Y placed on or before March 15 2022 and after January 12 2023 may qualify for the California EV rebate if all other program

https://www.tesla.com/support/incentives

As part of the 2023 Inflation Reduction Act eligible businesses and tax exempt organizations can claim up to a 7 500 credit when purchasing new Tesla vehicles with a gross vehicle weight rating GVWR of up to 14 000 pounds

Tax Payment Which States Have No Income Tax Marca

TESLA Tax Credit Explained And possibly Extended He Said She Said

Tesla s 7 500 Tax Credit Goes Poof But Buyers May Benefit WIRED

Calfresh Income Guidelines 2022 INCOMRAE

EV Tax Credits Are Coming Back How Tesla Benefits Torque News

The Tesla Tax Credit Explained That Tesla Channel

The Tesla Tax Credit Explained That Tesla Channel

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

Tesla Model 3 Tax Credit Explained Real Example YouTube

How Tesla Wins With No More Tax Credit Top 10 Advantages YouTube

Tesla Tax Credit California Income Limit - Tesla models like the Model Y and all Model 3 versions were eligible for the full 7 500 EV credit through the 2023 tax year However not all Tesla models are