Tax Rebate For Health Expenses Web 9 mars 2023 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40

Web 24 avr 2023 nbsp 0183 32 If you had a lot of unreimbursed out of pocket health care costs this year you ll be glad to learn that many of those expenses may qualify for a deduction on your 2022 income tax return How to claim Web 12 f 233 vr 2023 nbsp 0183 32 Fortunately if you have medical bills that aren t fully covered by your insurance you may be able to take a deduction for those to reduce your tax bill We ll take you through which medical expenses are tax

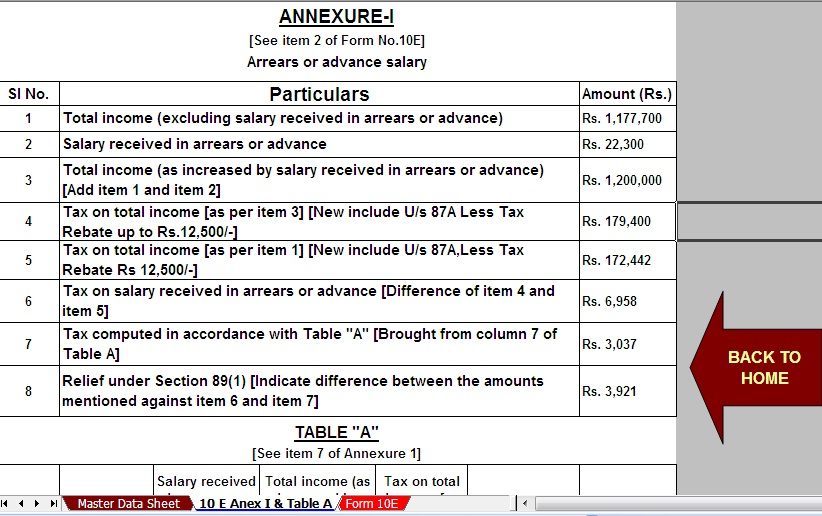

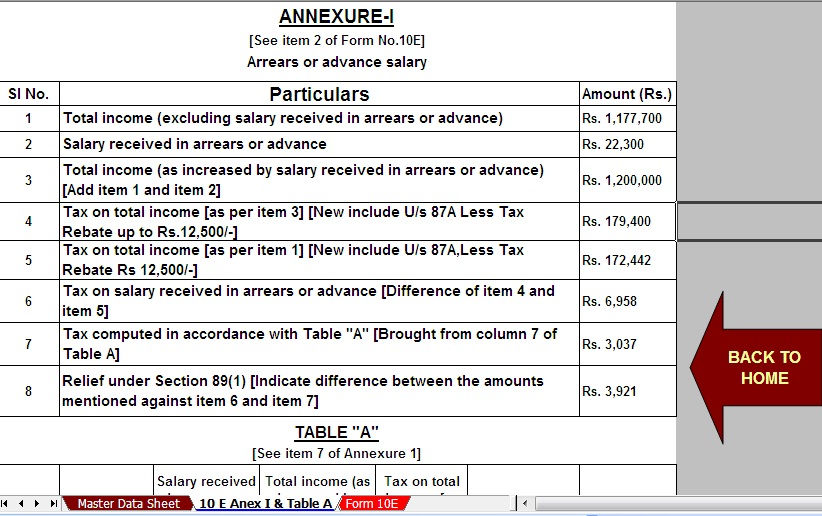

Tax Rebate For Health Expenses

Tax Rebate For Health Expenses

https://www.carrebate.net/wp-content/uploads/2022/06/revised-tax-rebate-under-sec-87a-after-budget-2019-with-automated.jpg

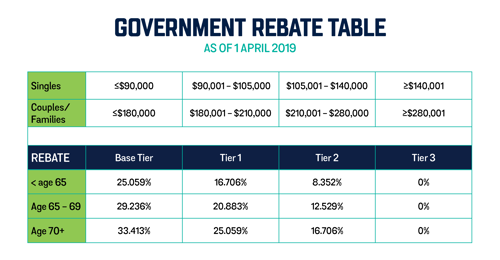

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

Get Your Money Back On Eye Care Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2018/05/ITR-EyeCare-Expenses-Infographic-.png

Web 3 mars 2022 nbsp 0183 32 Eligible Employers that are entitled to claim the refundable tax credits are businesses and tax exempt organizations that 1 have fewer than 500 employees and Web 12 janv 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For example if your

Web 10 mars 2023 nbsp 0183 32 Short term health insurance premiums are paid out of pocket using pre tax dollars so if you take the itemized deduction and your total annual medical expenses are greater than 7 5 of your AGI Web 18 mai 2021 nbsp 0183 32 IR 2021 115 May 18 2021 The Internal Revenue Service today provided guidance on tax breaks under the American Rescue Plan Act of 2021 for continuation

Download Tax Rebate For Health Expenses

More picture related to Tax Rebate For Health Expenses

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

ISelect What You Need To Know Tax Rebates On Health Insurance And

https://www.iselect.com.au/content/uploads/2017/06/Rebates-Table.jpg

What Is Australian Government Rebate On Private Health Insurance

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Article-35-PrivateHealthInsuranceTax_v2_3.png

Web 20 mars 2023 nbsp 0183 32 If you re able to claim your health insurance as a medical expense deduction you can only deduct medical expenses if you itemize your deductions and Web 8 juin 2023 nbsp 0183 32 Que vous soyez parent ou proche d un enfant handicap 233 ou vous m 234 me handicap 233 les contrats de rente survie et d 233 pargne handicap vous permettent

Web 27 sept 2012 nbsp 0183 32 If you had an individual insurance policy in 2011 and you claimed the standard deduction on your taxes like most taxpayers instead of itemizing you will not Web Eligible Employers can claim the Employee Retention Credit equal to 50 percent of up to 10 000 in qualified wages including qualified health plan expenses on wages paid

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

https://www.revenue.ie/.../health-and-age/health-expenses/index.aspx

Web 9 mars 2023 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40

https://turbotax.intuit.com/tax-tips/health-care…

Web 24 avr 2023 nbsp 0183 32 If you had a lot of unreimbursed out of pocket health care costs this year you ll be glad to learn that many of those expenses may qualify for a deduction on your 2022 income tax return How to claim

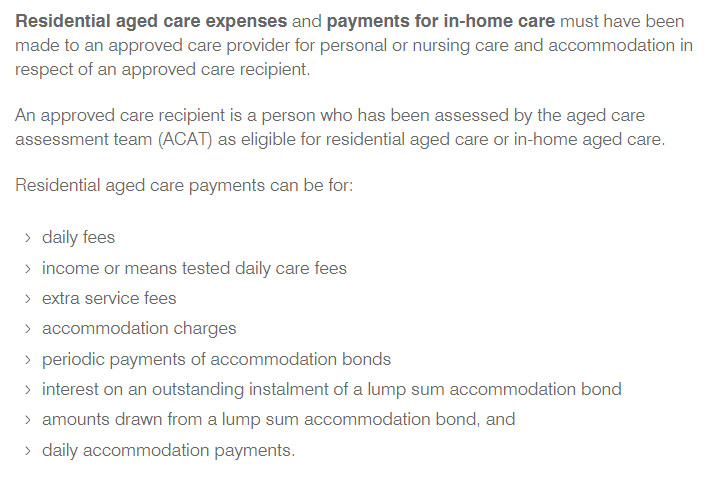

Claiming The Medical Offset Tax Rebate

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Medical Expense Receipt How To Create A Medical Expense Receipt

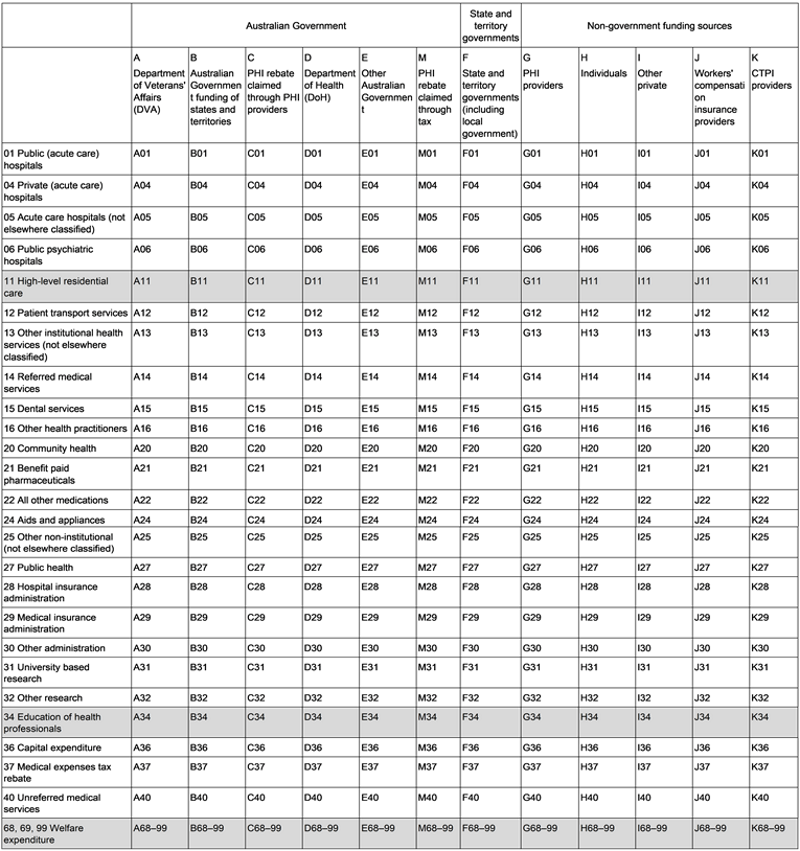

Health Expenditure Australia 2019 20 Compilation Of Health Expenditure

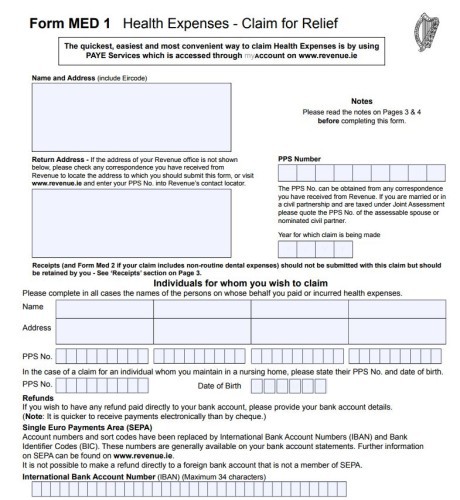

Why Do So Few Irish People Claim Back Their Medical Expenses

Deferred Tax And Temporary Differences The Footnotes Analyst

Deferred Tax And Temporary Differences The Footnotes Analyst

10 Sample Expense Report Forms Sample Templates

Tax Exemption Malaysia 2019

FREE 13 Sample Expense Report Forms In PDF Excel Word

Tax Rebate For Health Expenses - Web 22 ao 251 t 2023 nbsp 0183 32 So if your AGI is 50 000 and your total medical expenses are 5 000 you can deduct 2 500 the amount which exceeds 7 5 of 50 000 What qualifies as a