Tourist Tax Return Canada Navigating the landscape of sales tax and potential refunds in Canada presents a unique challenge for international visitors Unlike countries with centralized

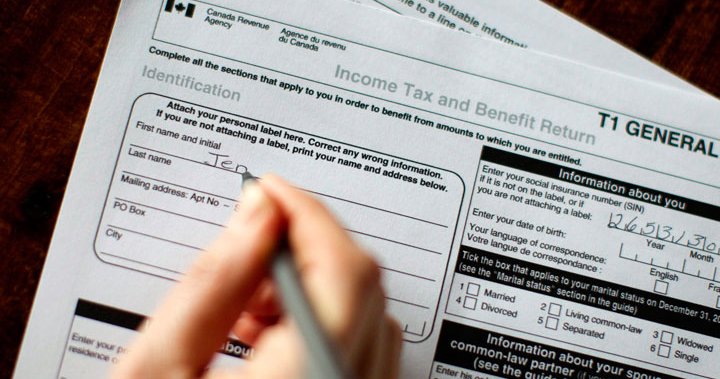

File your taxes manually using a paper return Send your completed return by mail to your tax centre Usually 8 or more weeks to process Get the right income tax package for you Find where to mail your return As a non resident of Canada you pay tax on income you receive from sources in Canada The type of tax you pay and the requirement to file an income tax return depend on the

Tourist Tax Return Canada

Tourist Tax Return Canada

https://turbotax.intuit.ca/tips/images/turbotax-canada-tax-checklist.png

PSAC Strike Refund Delay May Be Consequence Of Filing Taxes After

https://globalnews.ca/wp-content/uploads/2015/04/canada-tax-return.jpg?quality=85&strip=all&w=720&h=379&crop=1

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

TaxTips ca The GST HST visitor rebate program was eliminated in 2007 but is still available in a few cases Foreign convention and tour incentive program FCTIP Taxation for Canadians travelling living or working outside Canada Canadians who live or work abroad or who travel a lot may still have to pay Canadian and provincial or

The taxation is pretty simple you would have to prepare and file your income tax return and submit it to the competent authority the Canada Revenue Agency It is important to note that income taxes The tourist part offers a GST HST refund to non residents on eligible tourist packages see ETA 252 1 The tourist package must cost at least 200 and make

Download Tourist Tax Return Canada

More picture related to Tourist Tax Return Canada

Top 6 Tax Tips For Filing A Canadian Tax Return

https://workingholidayincanada.com/wp-content/uploads/2017/03/tax.png

What Is Line 15000 Tax Return formerly Line 150 In Canada

https://thefinancekey.com/wp-content/uploads/2022/02/what-is-line-15000-on-tax-return-canada.jpg

As An American Living In Canada Do I Need To File Tax Returns In Both

https://help.truenorthaccounting.com/hubfs/image-png-Sep-29-2020-07-50-36-75-PM.png

Under the Canada Revenue Agency s commercial goods and artistic works exported by a non resident subsection 252 1 and 252 2 clause you could be entitled to a Use this form to claim a refund of goods and services tax harmonized sales tax GST HST if you are an individual and a non resident of Canada and the total of your eligible

The Canadian government abolished the GST refund formally called the Visitor Rebate Program for individual travelers earlier this month as part of 2007 Step 1 Complete the Tourism Levy Return Video How to complete the Tourism Levy Return Instruction guide Completing the Tourism Levy Return Online Log in to your

Business Income Tax Filing In Canada Tax Accountant Abdullah CPA

https://abdullahcpa.ca/wp-content/uploads/2023/06/Corporate-Tax-Return-Canada.png

How To Read And Understand A Tax Return C2P Central

https://c2pcentral.com/wp-content/uploads/2023/09/HolisticPlanning_How-to-read-and-understand-a-tax-return.jpg

https://www.migrationexpert.com.au/blog/canadian...

Navigating the landscape of sales tax and potential refunds in Canada presents a unique challenge for international visitors Unlike countries with centralized

https://www.canada.ca/en/revenue-age…

File your taxes manually using a paper return Send your completed return by mail to your tax centre Usually 8 or more weeks to process Get the right income tax package for you Find where to mail your return

What Is Line 15000 Tax Return formerly Line 150 In Canada

Business Income Tax Filing In Canada Tax Accountant Abdullah CPA

Tax Return Deadline Extension

Tax Return Employment Self Employment Dividend Rental Property

Contact AAA Tax Service

Democratic Plan Would Close Tax Break On Exchange traded Funds

Democratic Plan Would Close Tax Break On Exchange traded Funds

When Should I File My UK Self Assessment Tax Return For 2022 23 Gold

File Canada Search And Rescue jpg Wikipedia

Make The Most Of Your 2021 Tax Return Cascade Community Credit Union

Tourist Tax Return Canada - TaxTips ca The GST HST visitor rebate program was eliminated in 2007 but is still available in a few cases Foreign convention and tour incentive program FCTIP