Tuition Fee Rebate In Income Tax Web 14 avr 2017 nbsp 0183 32 Tax deduction on tuition fees Exemption for Childrens education and Hostel Expenditure The following exemption is provided to a salaried taxpayer in India

Web 27 janv 2023 nbsp 0183 32 It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can

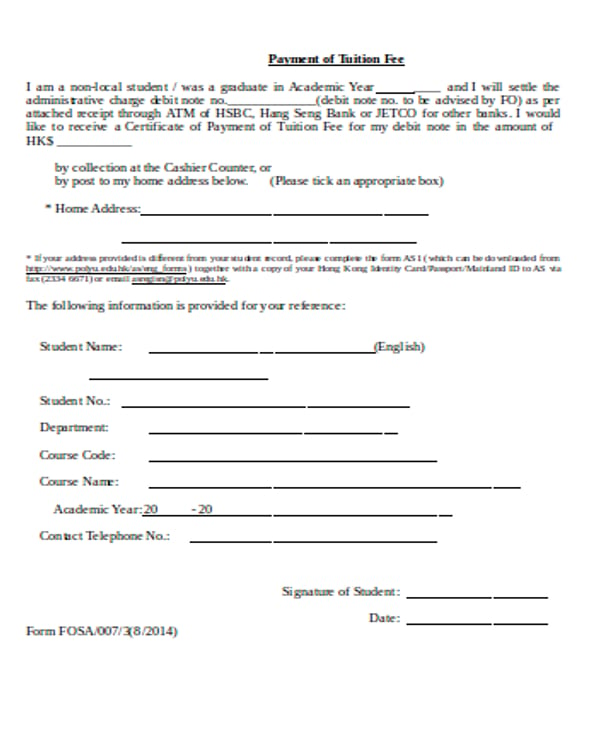

Tuition Fee Rebate In Income Tax

Tuition Fee Rebate In Income Tax

https://i.pinimg.com/originals/b5/8d/91/b58d9127751a3ec09910dd46c3257e99.jpg

Province Of Manitoba Tuition Fee Income Tax Rebate

http://www.gov.mb.ca/asset_library/en/tuition/header-tuition-fee.jpg

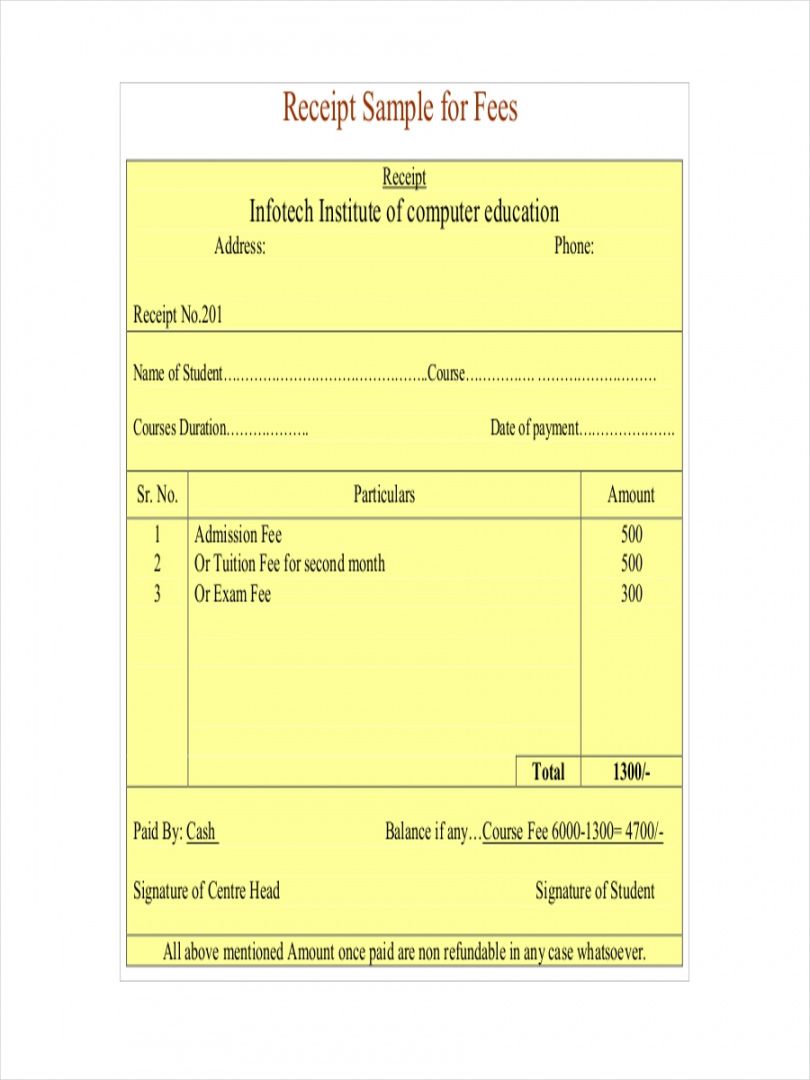

Editable 5 Tuition Receipt Templates Pdf Free Premium Templates

https://i.pinimg.com/originals/bf/12/39/bf1239938e99faa94fedc6d2c10fc3f6.jpg

Web 1 d 233 c 2022 nbsp 0183 32 Written by a TurboTax Expert Reviewed by a TurboTax CPA The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to Web 13 mai 2022 nbsp 0183 32 The maximum amount you could claim for the tuition and fees adjustment to income was 4 000 per year The deduction was further limited by income ranges

Web 14 juil 2022 nbsp 0183 32 Tuition fees paid by parents for their kid s education come with tax benefits The amount paid as tuition fees qualifies for tax benefit under section 80C up to a Web 10 sept 2018 nbsp 0183 32 The deduction for tuition fees is covered under Section 80C of the Income Tax Act and is subject to an overall ceiling limit prescribed under this section i e Rs

Download Tuition Fee Rebate In Income Tax

More picture related to Tuition Fee Rebate In Income Tax

Tuition Fee Receipt School Forms

https://discountschoolforms.com/wp-content/uploads/2015/04/Tuition-Fee-Receipt_E-116.png

27 Receipt Formats In Word

https://images.template.net/wp-content/uploads/2017/05/Tuition-Fee-Receipt.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web 3 oct 2021 nbsp 0183 32 In case you take education loan for full time education in India you can claim deduction for interest for such loan under Section 80E as well as for tuition fee paid Web August 25 2023 West Nile Virus Bulletin 2 August 15 2023 Province Issues High Wind Effect Warning for South Shores of Lake Manitoba and Lake Winnipeg August 4 2023

Web 17 f 233 vr 2017 nbsp 0183 32 When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax benefit under Web Tuition fee deduction in income tax is a provision for parents to claim tax deductions on education fees paid by them for educating their wards A maximum of 1 5 lakhs can be

Fillable Online Drake Drake Tuition Rebate Form Fax Email Print PdfFiller

https://www.pdffiller.com/preview/16/197/16197361/large.png

Student Tuition Fee Report Sample Templates Tuition Receipt Template

https://i.pinimg.com/originals/28/c7/55/28c7555496a304c022b0d7473f0eeea6.jpg

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 Tax deduction on tuition fees Exemption for Childrens education and Hostel Expenditure The following exemption is provided to a salaried taxpayer in India

https://www.irs.gov/credits-deductions/individuals/education-credits...

Web 27 janv 2023 nbsp 0183 32 It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40

Tuition Fee Receipt Template EmetOnlineBlog

Fillable Online Drake Drake Tuition Rebate Form Fax Email Print PdfFiller

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Fees Receipt Format 8 Fee School Tuition For Income Tax Seminar Free

Tax Rebate For Individual Deductions For Individuals reliefs

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Tuition Fee Rebate In Income Tax - Web 13 mai 2022 nbsp 0183 32 The maximum amount you could claim for the tuition and fees adjustment to income was 4 000 per year The deduction was further limited by income ranges