Tuition Tax Credit Canada 2023 To calculate the tuition tax credit for the 2023 tax year take the total eligible tuition amount and multiply it by 15 Your

If you paid 5 000 of eligible tuition fees in the 2023 tax year for example you would be entitled to a 750 tax credit The tuition tax October 27 2023 1 Min Read Updated for tax year 2023 Contents 1 Minute Read What is the Schedule 11 tax form How do I fill out the Schedule 11 tax form Do I have to claim

Tuition Tax Credit Canada 2023

Tuition Tax Credit Canada 2023

https://turbotax.intuit.ca/tips/images/work-with-the-people-that-motivate-and-inspire-you-picture-id539444770.jpg

Tuition Tax Credits In Alberta 2023 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/iStock-490357692-e1612819288782.jpg

What Is The Tuition Tax Credit In Canada

https://reviewlution.ca/wp-content/uploads/2022/09/reviewlution-guide2-10.png

All deductions credits and expenses Find a list of all deductions credits and expenses you may be able to claim on your income tax and benefit return Date modified 2024 01 It s quite straightforward The tuition tax credit is worth 15 of eligible tuition fees paid for the tax year 2022 Now comes the important distinction the tuition tax credit is exactly that it s a tax credit and it

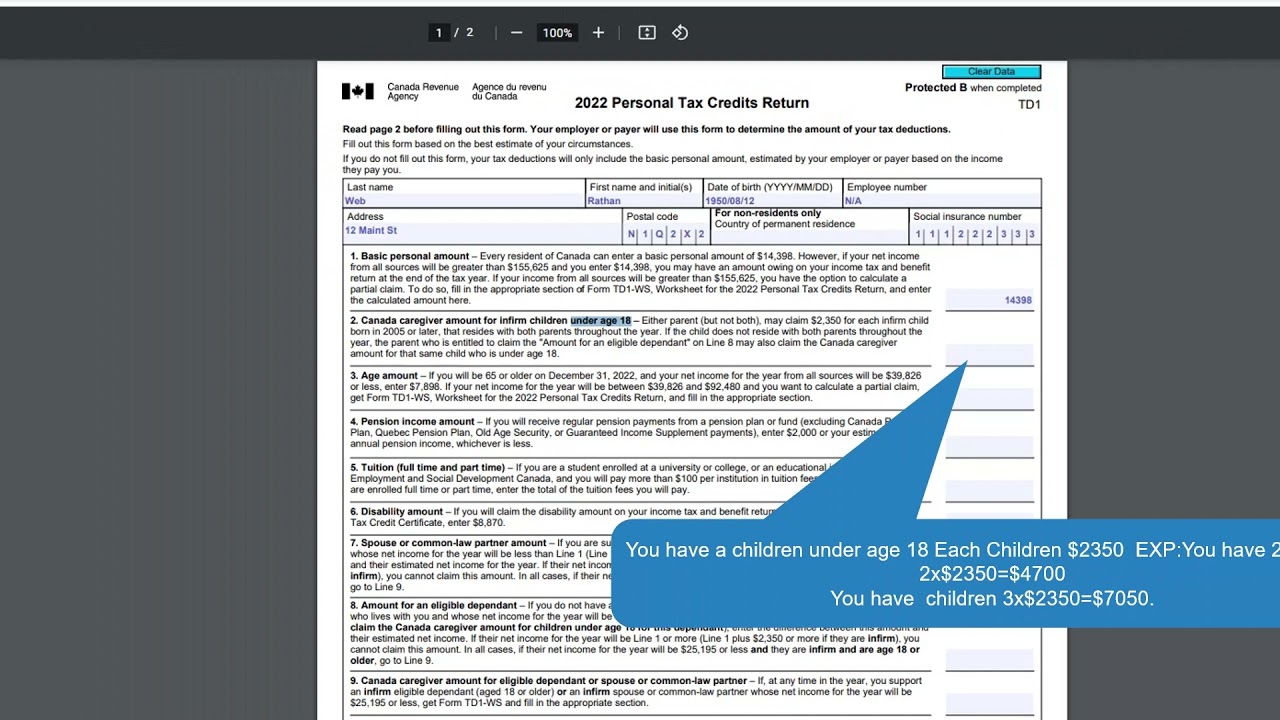

Starting in 2023 amounts from your RC210 slip are to be reported on Schedule 6 Canada Workers Benefit in order to calculate the amount to enter on line 41500 of your return If Persons under 18 years of age at the end of the year may also be eligible for an additional amount of up to 5 174 For more information about the DTC go to canada ca disability

Download Tuition Tax Credit Canada 2023

More picture related to Tuition Tax Credit Canada 2023

What Happens To Unused Tuition Tax Credits Leftover Tuition Tax

https://www.liuandassociates.com/wp-content/uploads/2021/11/Unused-Tuition-Tax-Credit-Options.jpg

How To Claim Tuition Tax Credits In Canada

https://maplemoney.com/wp-content/uploads/tuition-tax-credits-pin.jpg

What Are Tuition Tax Credits Gallo LLP Chartered Professional

https://gallollp.ca/wp-content/uploads/2021/09/pexels-pixabay-261909-1024x731.jpg

Let s say you paid 6 000 in tuition fees during the 2023 tax year 15 of 6 000 is 900 so you would be entitled to a tax credit worth 900 But because it is a Here s what you need to know when you file your 2023 taxes Remember to claim your federal tuition tax credit The federal tuition tax credit is one of the top tax credits for post secondary students Even if

Printing problems Calculate Reset Tax TaxTips ca 2024 and 2023 Canadian income tax and RRSP savings calculator excellent tax planning tool calculates taxes shows Every taxpayer gets a tax credit for the basic personal amount so any person can earn taxable income of 15 000 in 2023 without paying any federal tax and can earn

Tuition Tax Credit In Canada How It Works NerdWallet

https://www.nerdwallet.com/ca/wp-content/uploads/sites/2/2022/01/GettyImages-936987292-e1643665970419.jpg

Everything You Need To Know About The College Tuition Tax Credit

https://cdn.collegereaction.com/who_should_claim_the_tuition_credit.png

https://turbotax.intuit.ca/tips/understandi…

To calculate the tuition tax credit for the 2023 tax year take the total eligible tuition amount and multiply it by 15 Your

https://www.nerdwallet.com/ca/person…

If you paid 5 000 of eligible tuition fees in the 2023 tax year for example you would be entitled to a 750 tax credit The tuition tax

Tuition Tax Credit In Canada 2023 What Is It How Does It Work In

Tuition Tax Credit In Canada How It Works NerdWallet

Tuition Pain This Tax Credit Can Help Ideal Tax LLC Ideal Tax Solution

What About College Tuition Tax Breaks For Dual Credits College

With The Participation Of Canada The Canadian Film Of Video Production

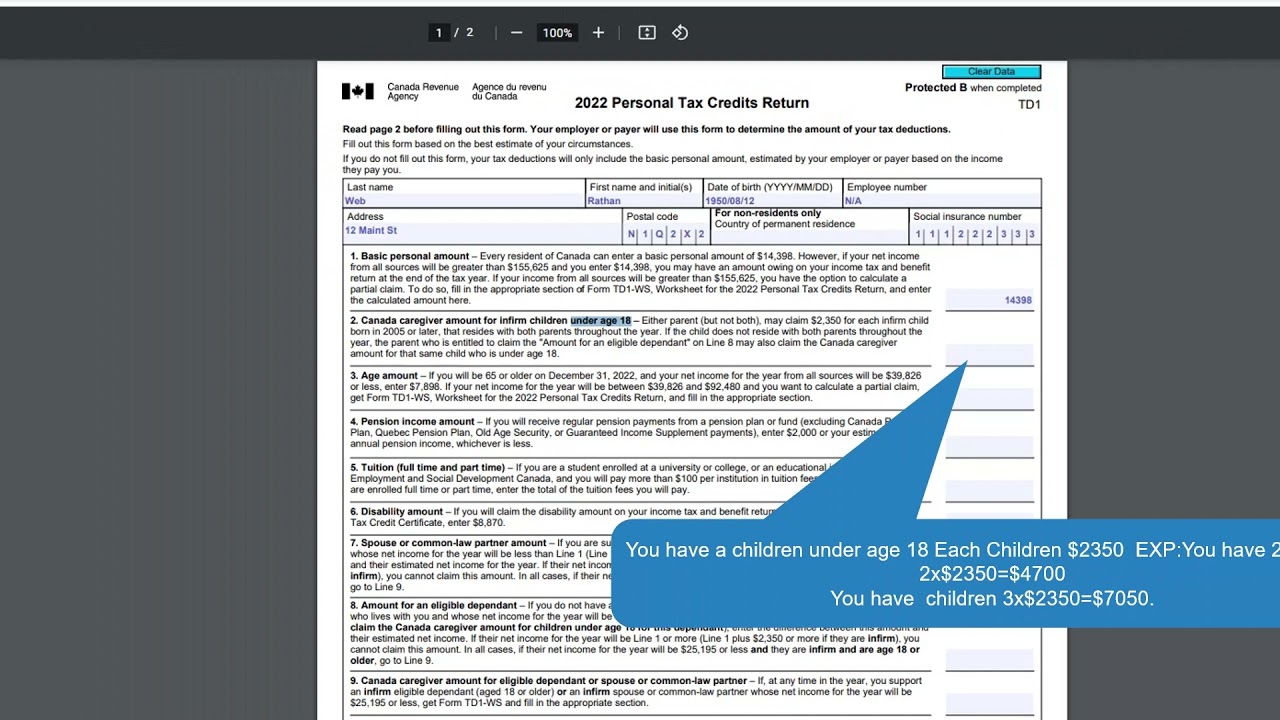

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

Tuition Tax Credit Canada Calculator

Canada Credits Logo LogoDix

Tuition Tax Credit Canada Calculator

Tuition Tax Credit Canada 2023 - All deductions credits and expenses Find a list of all deductions credits and expenses you may be able to claim on your income tax and benefit return Date modified 2024 01