Tuition Tax Credit Canada Carry Forward If you don t have enough employment income to make full use of your tuition tax credit you can carry the amount forward to

Carried forward amounts must be claimed in the first year that tax is payable Only the amounts required to reduce taxes to zero would be claimed and any remainder would The unused amount of a student s tuition tax credit may be carried forward to future years or be transferred to a spouse or common law partner or to a parent or

Tuition Tax Credit Canada Carry Forward

Tuition Tax Credit Canada Carry Forward

https://turbotax.intuit.ca/tips/images/work-with-the-people-that-motivate-and-inspire-you-picture-id539444770.jpg

What Is The Tuition Tax Credit In Canada

https://reviewlution.ca/wp-content/uploads/2022/09/reviewlution-guide2-10.png

Tuition Tax Credits In Alberta 2023 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/iStock-490357692-e1612819288782.jpg

This way you can carry forward as much as possible to use in a future year Fill out Schedule 11 to report your eligible tuition amount for 2023 and any unused tuition Taxes Income tax Personal income tax Claiming deductions credits and expenses Line 32300 Your tuition education and textbook amounts Eligible tuition fees Generally a

How to calculate and claim the non refundable tuition tax credit how to transfer unused current year tax credits to another designated individual or carry them Learn when how much and to whom you can transfer or carry forward tuition education and textbook amounts If you have eligible tuition fees and education and textbook

Download Tuition Tax Credit Canada Carry Forward

More picture related to Tuition Tax Credit Canada Carry Forward

What Happens To Unused Tuition Tax Credits Leftover Tuition Tax

https://www.liuandassociates.com/wp-content/uploads/2021/11/Unused-Tuition-Tax-Credit-Options.jpg

How To Claim Tuition Tax Credits In Canada

https://maplemoney.com/wp-content/uploads/tuition-tax-credits-pin.jpg

What Are Tuition Tax Credits Gallo LLP Chartered Professional

https://gallollp.ca/wp-content/uploads/2021/09/pexels-pixabay-261909-1024x731.jpg

The student cannot transfer any amount they carried forward in a previous year The maximum amount they are allowed to transfer is 5 000 less the amount they needed to 1 Carry forward unused tuition and education amounts from previous years If you have unused education tax credits you can carry them forward to help

Carrying forward your unused tuition tax credits means you can claim them in the following year so long as you file a tax return and include the amount of tax credits that you ll Now 15 of 6000 which is 900 will be subtracted from the amount of tax you owe to the Canada Revenue Agency for the 2022 tax year That brings your taxable income down

Tuition Tax Credit In Canada How It Works NerdWallet

https://www.nerdwallet.com/ca/wp-content/uploads/sites/2/2022/01/GettyImages-936987292-e1643665970419.jpg

Everything You Need To Know About The College Tuition Tax Credit

https://cdn.collegereaction.com/who_should_claim_the_tuition_credit.png

https://turbotax.intuit.ca/tips/understanding...

If you don t have enough employment income to make full use of your tuition tax credit you can carry the amount forward to

https://www.taxtips.ca/filing/students/tuition-transfer-carry-forward.htm

Carried forward amounts must be claimed in the first year that tax is payable Only the amounts required to reduce taxes to zero would be claimed and any remainder would

Tuition Tax Credit Canada Calculator

Tuition Tax Credit In Canada How It Works NerdWallet

Tuition Tax Credit Canada Calculator

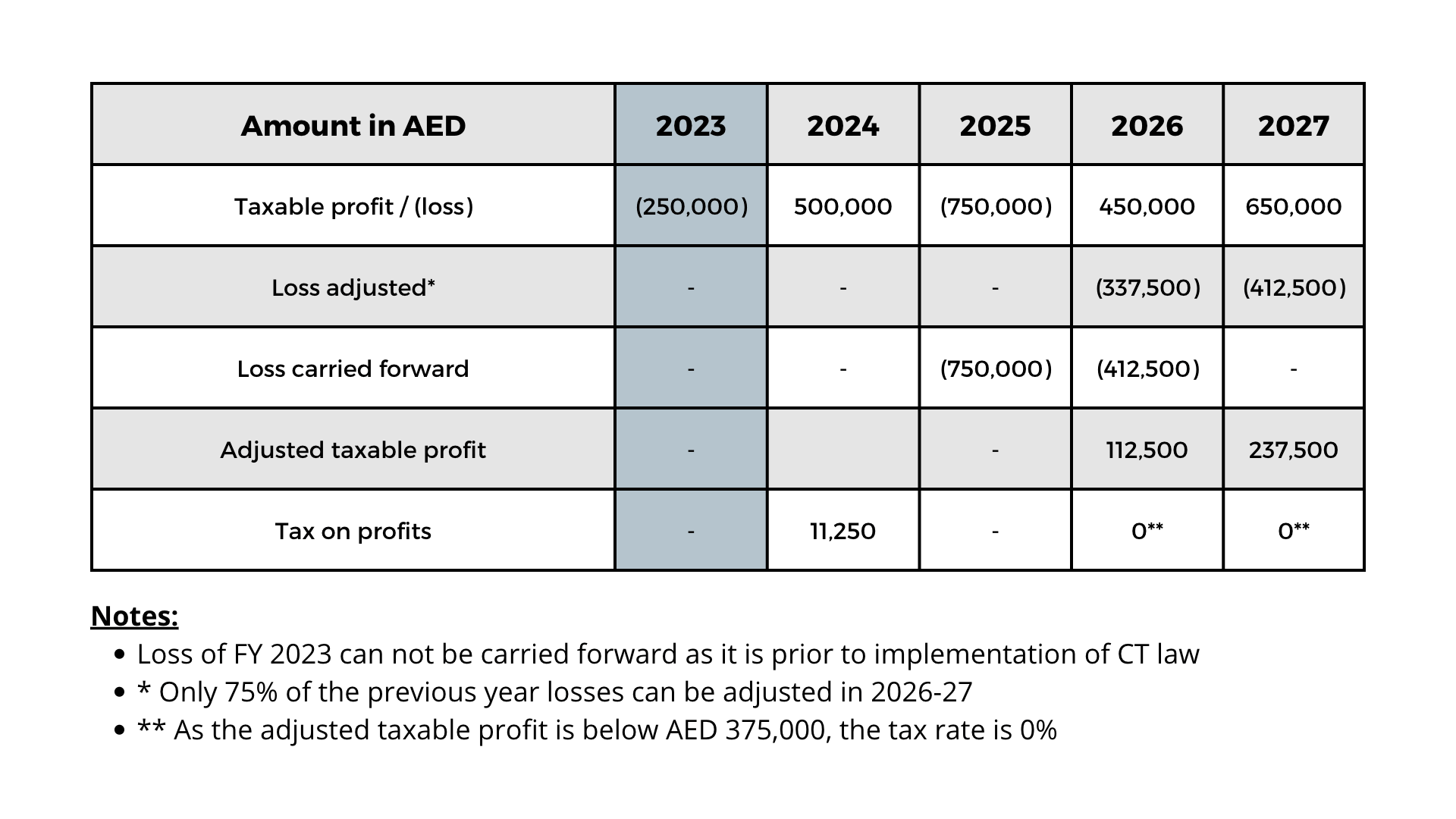

Corporate Tax Loss Carry Forward What When And How Much

What Is The Tuition Tax Credit In Canada And How Does It Work

With The Participation Of Canada The Canadian Film Of Video Production

With The Participation Of Canada The Canadian Film Of Video Production

What Happens To Unused Tuition Tax Credits Leftover Tuition Tax

To Set Off

The Canadian Film Or Production Tax Credit And Quebecor Fund Tech

Tuition Tax Credit Canada Carry Forward - There is generally a 5 000 limit you can transfer of the tuition credits from the current year To transfer you must sign and complete form T2202 and Schedule 11 You are