Us Tax Credit For Child The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may receive up to

Learn how the Child Tax Credit works if you qualify how to claim it and what additional credits you may be able to claim If you are not eligible for the Child Tax Credit you The child must have an SSN to be a qualifying child eligible for the child tax credit CTC and or additional child tax credit ACTC To be a qualifying child for the CTC and or

Us Tax Credit For Child

Us Tax Credit For Child

https://i0.wp.com/zobuz.com/wp-content/uploads/2020/05/The-Child-Tax-Credit.jpg

Changes To The Child Tax Credit For 2014 Good Financial Cents

http://www.goodfinancialcents.com/wp-content/uploads/2014/04/IMG-Changes-to-the-child-tax-credit.png

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

https://taxprocpa.com/images/increased-child-tax-credit.jpg

File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit In addition the American There are seven qualifying tests to determine eligibility for the Child Tax Credit age relationship support dependent status citizenship length of residency and family income If you aren t able to claim the Child Tax Credit

Credits can help reduce your taxes or increase your refund The Earned Income Tax Credit EITC helps low to moderate income workers and families The Child Tax Credit helps The Child Tax Credit is a valuable tax benefit claimed by millions of American parents with the goal of offsetting the costs of raising a child The Child Tax Credit 2024 is worth up to 2 000 for each qualifying child for returns filed

Download Us Tax Credit For Child

More picture related to Us Tax Credit For Child

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

https://www.the-sun.com/wp-content/uploads/sites/6/2021/11/KB_COMP_child-tax-credit-ctc-2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

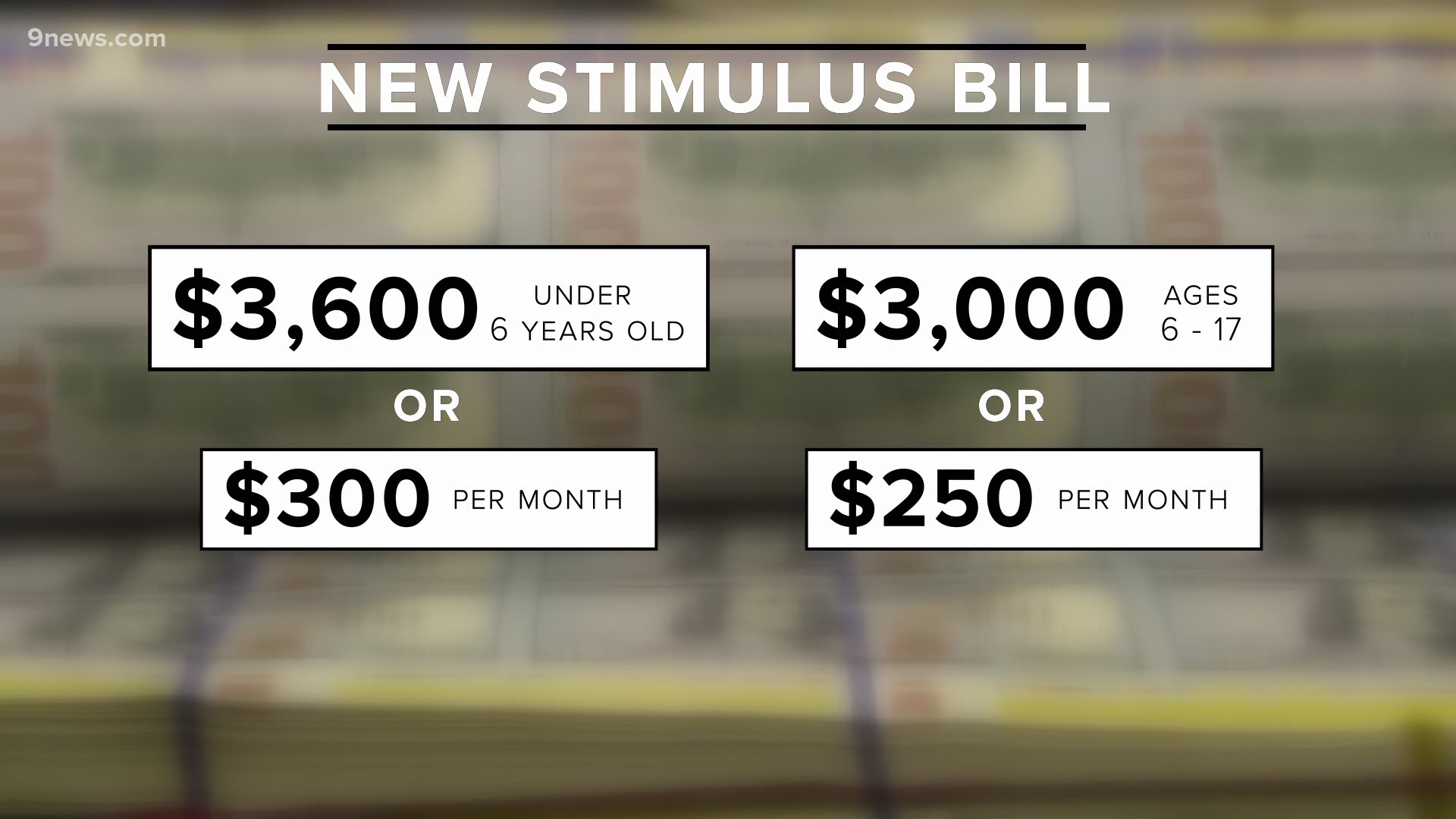

New Child Tax Credit Explained When Will Monthly Payments Start

https://media.9news.com/assets/KUSA/images/6401c0ff-2eae-43ab-87f9-5318969aa0f5/6401c0ff-2eae-43ab-87f9-5318969aa0f5_1920x1080.jpg

New Child Tax Credit Opens The Door For Old Scams

https://adamlevin.com/wp-content/uploads/2021/05/child-tax-credit-scam-scaled.jpg

Taxpayers can claim a child tax credit CTC of up to 2 000 for each child under age 17 who is a citizen The credit is reduced by 5 percent of adjusted gross income over 200 000 for single parents 400 000 for married couples What is the child tax credit The child tax credit is a nonrefundable credit that allows taxpayers to claim a tax credit of up to 2 000 per qualifying child which reduces their tax liability What do

You will need to file a Form 1040 U S Individual Income Tax Return to claim the CTC ACTC and ODC by entering your children and other dependents under the Dependents What Is the Child Tax Credit The Child Tax Credit is a tax benefit granted to American taxpayers with children under the age of 17 as of the end of the year For the 2023 tax year the tax return

Georgia Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4200&ssl=1

2021 Child Tax Credit Advances Payment Schedule Atlanta CPA

https://www.wilsonlewis.com/wp-content/uploads/2021/06/Child-Tax-Credit.jpg

https://www.usatoday.com › story › news › how...

The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may receive up to

https://www.usa.gov › child-tax-credit

Learn how the Child Tax Credit works if you qualify how to claim it and what additional credits you may be able to claim If you are not eligible for the Child Tax Credit you

Child Tax Credit 88 Of Children Covered By Monthly Payments Starting

Georgia Tax Credits For Workers And Families

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

What Is Child Tax Credit CTC Expat US Tax

Earned Income Tax Credit For Households With One Child 2023 Center

2022 Education Tax Credits Are You Eligible

2022 Education Tax Credits Are You Eligible

What You Need To Know About The 2021 Child Tax Credit Pittman Legal

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Child Tax Credit Payments Begin July 15 Marshfield Medical Center

Us Tax Credit For Child - There are seven qualifying tests to determine eligibility for the Child Tax Credit age relationship support dependent status citizenship length of residency and family income If you aren t able to claim the Child Tax Credit