Vat Refund Rate In Spain Tax Free reclaim VAT from your purchases in Spain If you are not a resident of the European Union you ll be pleased to know you can claim a refund of the VAT Value Added Tax you

The standard VAT rate in Spain is 21 Spain will reimburse between 12 75 and 15 3 of the amount you spend during your trip on products subject to standard VAT rates The minimum Professionals and businesses who are not established in the Spanish VAT area but who are established in the EU may apply for the refund of amounts of VAT they have

Vat Refund Rate In Spain

Vat Refund Rate In Spain

https://api.tourismthailand.org/upload/live/content_article/1124-20937.jpeg

Europe Haul Updated VAT Refund Overview MUST WATCH Exact

https://i.ytimg.com/vi/5y-0xYC1JBY/maxresdefault.jpg

Value Added Tax VAT Refund

https://www.triptipedia.com/tip/img/bU3jmlExN.jpg

The standard VAT rate in Spain is 21 On average visitors can expect a refund of approximately 13 of the total purchace price although rates may vary What is the minimum spend for VAT In Spain VAT refunds can be processed as a credit card refund Spain s main VAT rate is 21 with other rates including 10 and 4 that can apply to certain transactions The Value added

Find out how to get a VAT refund in Spain step by step We explain all the requirements and what steps you should follow until you arrive at the airport The following information details the requirements needed to be eligible for a VAT refund in Spain These include claimable expense types the Spain VAT rates and deadlines as well as

Download Vat Refund Rate In Spain

More picture related to Vat Refund Rate In Spain

Vat Refund Calculator StormTallulah

https://www.rd.go.th/fileadmin/user_upload/kortor/images/Vat-Refund-Sheet1.jpg

Map Of Spain s Unemployment Rates By Municipality 2014 Mapas Mapa

https://i.pinimg.com/originals/4e/74/c3/4e74c38dca853c6742856835e4a67190.jpg

VAT Refund 101 What Is It And How To Claim Your VAT Refund It s All

https://selectitaly.com/blog/wp-content/uploads/2016/03/D_D_Italia-VAT-Refund-1024x677.jpg

Find out when you are entitled to a VAT refund on purchases made in Spain how to obtain it Find out when you are entitled to a VAT refund on purchases made in Spain how to obtain it Purchase invoices and the refund document ERD Consult the procedure for filling out invoices

How much is VAT in Spain There are 4 different Spanish VAT rates There is the regular VAT rate 21 the reduced VAT rate 10 the highly reduced VAT rate 4 and Spain s standard VAT rate is 21 and the refund rate can be 10 4 to 15 7 of the purchase amount It s worth mentioning that there is no minimum spending requirement for

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

UAE VAT Refund A Handy Guide For Businesses MBG

https://www.mbgcorp.com/ae/saseraf/2021/12/Blog-7-Image-how-to-get-vat-refund.jpg

https://www.spain.info/gcc/en/travel_ideas/tax-free

Tax Free reclaim VAT from your purchases in Spain If you are not a resident of the European Union you ll be pleased to know you can claim a refund of the VAT Value Added Tax you

https://glocalzone.com/vat-refund-calculator/spain

The standard VAT rate in Spain is 21 Spain will reimburse between 12 75 and 15 3 of the amount you spend during your trip on products subject to standard VAT rates The minimum

7 Practical Ways To Lower Your Refund Rate MemberMouse

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

How To Apply For The EU VAT Refund In France France Travel Tips

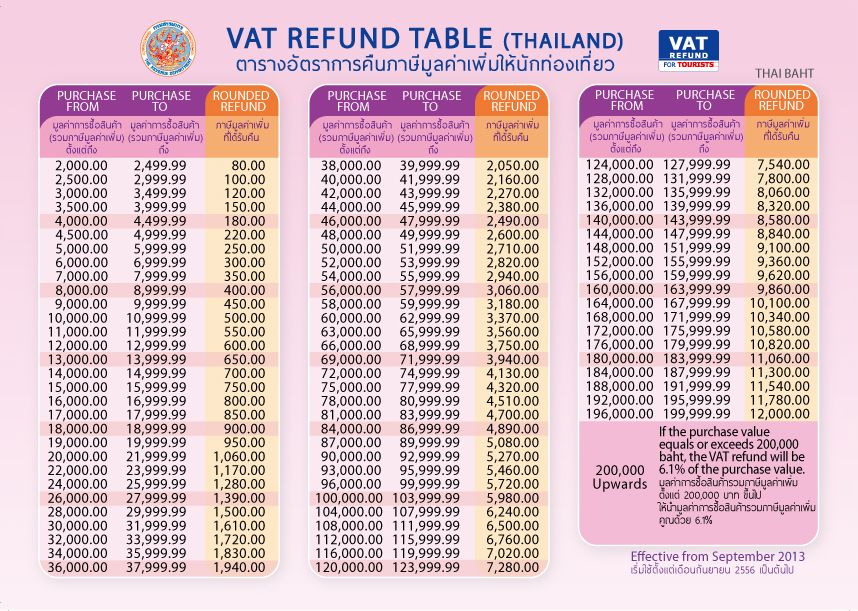

VAT Refund For Tourists Royal Thai Consulate General Vancouver

Full Details About The VAT Refund Available In The UAE

How To Get A VAT Refund IVA In Spain Express Digest

How To Get A VAT Refund IVA In Spain Express Digest

VAT Tax Refund Tax Refund

How To Claim VAT Refund An EU Guide

VAT Refund Belgian VAT Desk

Vat Refund Rate In Spain - The standard VAT rate in Spain is 21 On average visitors can expect a refund of approximately 13 of the total purchace price although rates may vary What is the minimum spend for VAT