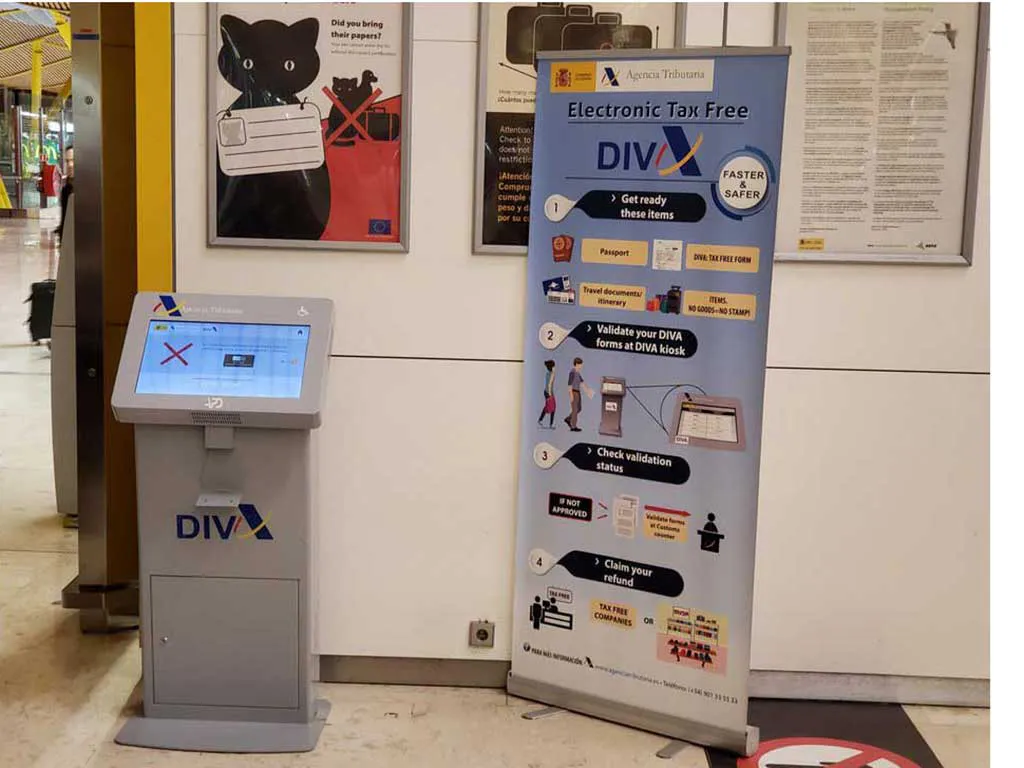

Vat Refund Spain Diva VAT refunds for travellers purchases DIVA Did you know that if you live in a non EU country and you make purchases in Spain EU you can recover the VAT paid on them

The electronic VAT refund procedure DIVA makes the validating process quicker and easier You just have to ask the shops offering this service to provide you with the DIVA DIVA digital stamp for companies The DIVA system is the only valid system in Spain for the refund of VAT to travelers This voluntary application period aims to give shops time to

Vat Refund Spain Diva

Vat Refund Spain Diva

https://expressdigest.com/wp-content/uploads/2022/09/image-1670.jpg

Full Details About The VAT Refund Available In The UAE

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2022/03/28/16484854422575.jpg

UAE FTA Has Amended Rule To VAT Refund Application On Newly Built

https://acuteconsultants.com/wp-content/uploads/2021/04/UAE-new-house-vat-refund-1340px-1024x690.jpg

In Spain the entire VAT refund process for travellers is digital through using he DIVA system When shopping ask the vendor for the electronic tax free form called the All foreigners or Spanish citizens not residing in Spain or in a European Union country who are travelling to a third country are entitled to a Value Added Tax VAT refund on their

Tax Agency VAT refund process VAT refund procedure and operation of DIVA terminals PDF 681 48 kB Find out about the VAT refund when you travel to Spain Clear up In the XIII edition the Spanish Tax Agency has been awarded with the prize for innovation in management for its DIVA system for VAT refunding to travellers DIVA

Download Vat Refund Spain Diva

More picture related to Vat Refund Spain Diva

Step By Step Guide How Tourists From Great Britain Claim Refunds For

https://www.visit-andalucia.com/article_images/howuktouristscanclaimrefundsonivataxfreeshoppinginandalucia/diva-station2.webp

VAT Returns Refund The Netherlands First VAT All VAT Services At

https://1vat.com/wp-content/uploads/2020/04/VAT-Returns-Refund_1vat_NL_1.png

Contact Us DIVA By Tasnim Porna

https://divabytasnimporna.com/wp-content/uploads/2021/06/Diva-Official-logo.png

Request a DER DIVA You must request an electronic tax free refund document DER DIVA at the time of your purchase in the shop in which you are making Find out when you are entitled to a VAT refund on purchases made in Spain how to obtain it

How to validate my tax free forms issued in Spain Spain has one of the easiest processes to validate tax free forms You just need to scan your form barcode at Fernando Matesanz of Spanish VAT Services explains the VAT refund system for travellers in Spain and why a harmonised refund scheme for non EU

VAT Refund Belgian VAT Desk

https://www.vatdesk.be/wp-content/uploads/2021/04/VAT-refund-1.png

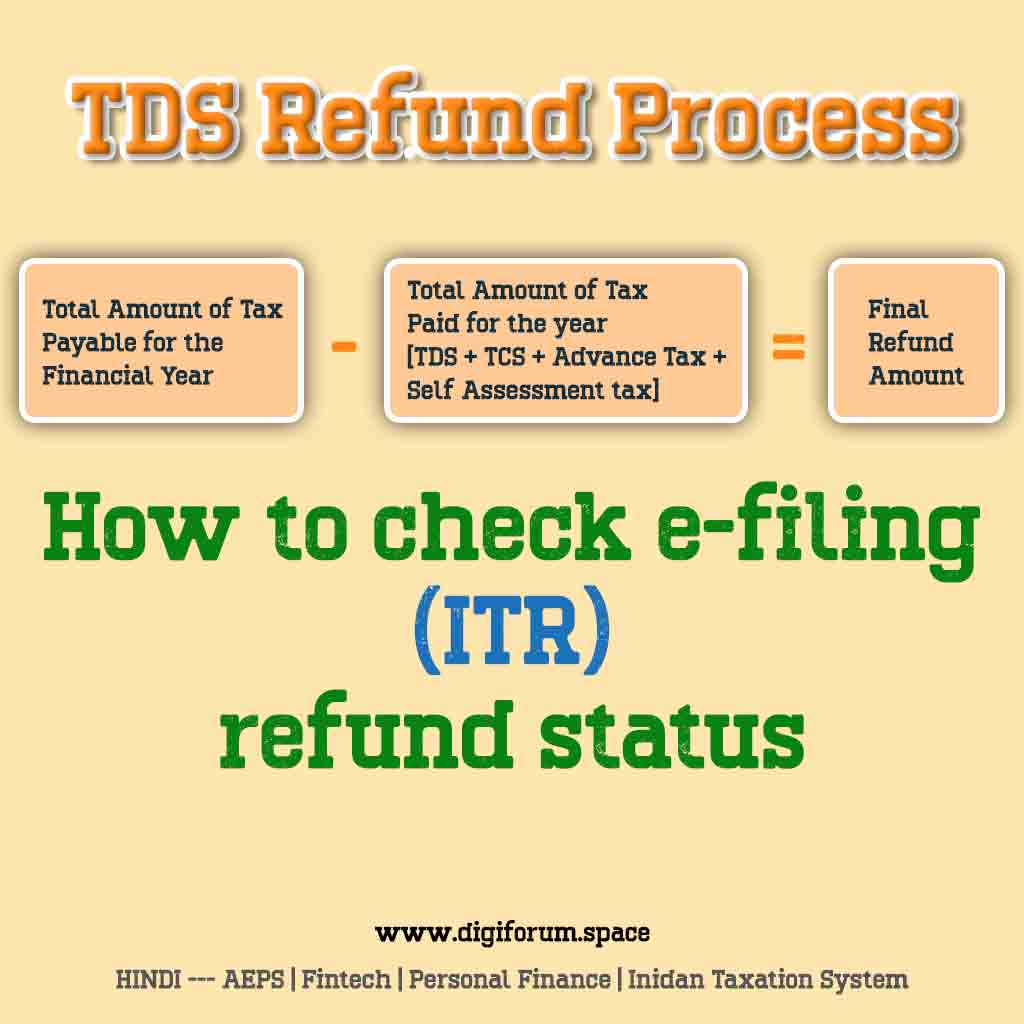

TDS Refund Process Digiforum Space

https://digiforum.space/wp-content/uploads/2022/08/TDS-Refund-Process.jpg

https://sede.agenciatributaria.gob.es/Sede/en_gb/...

VAT refunds for travellers purchases DIVA Did you know that if you live in a non EU country and you make purchases in Spain EU you can recover the VAT paid on them

https://www.spain.info/gcc/en/travel_ideas/tax-free

The electronic VAT refund procedure DIVA makes the validating process quicker and easier You just have to ask the shops offering this service to provide you with the DIVA

Changes In VAT Refund Rates DKV Euro Service Benelux

VAT Refund Belgian VAT Desk

VAT REFUND KO THE MALL

Cart Diva Be Natural

On Twitter Who Asked For A Refund

Refund PNG Transparent Background Images Pngteam

Refund PNG Transparent Background Images Pngteam

The Spanish Tax Agency s DIVA System For VAT Refunds To Travellers

Tax Free Shopping VAT Tax Refund Spain Planet

Refund Policy Legal Salaah

Vat Refund Spain Diva - Tax free stamping points in Spain Find the ports and airports in Spain where you will find the DIVA stamping points and validation posts to process the VAT refund on your