Vehicle Tax Exemption For Military Vehicle tax exemptions for military personnel Learn how to qualify for excise and regional transit authority RTA tax exemptions for non residents stationed in Washington and

Military Vehicle Tax Exemption Application Lease vehicles Vehicles leased by a qualified military service member and or spouse will receive a 100 state vehicle tax subsidy The N C Division of Motor Vehicles offers current and retired personnel of the U S Armed Forces convenient options for renewing vehicle registrations driver licenses as well as

Vehicle Tax Exemption For Military

Vehicle Tax Exemption For Military

http://sachet.org.pk/wp-content/uploads/2016/01/Exemption-236.jpg

Farm Tax Exempt Form Ky Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/5/503/5503386/large.png

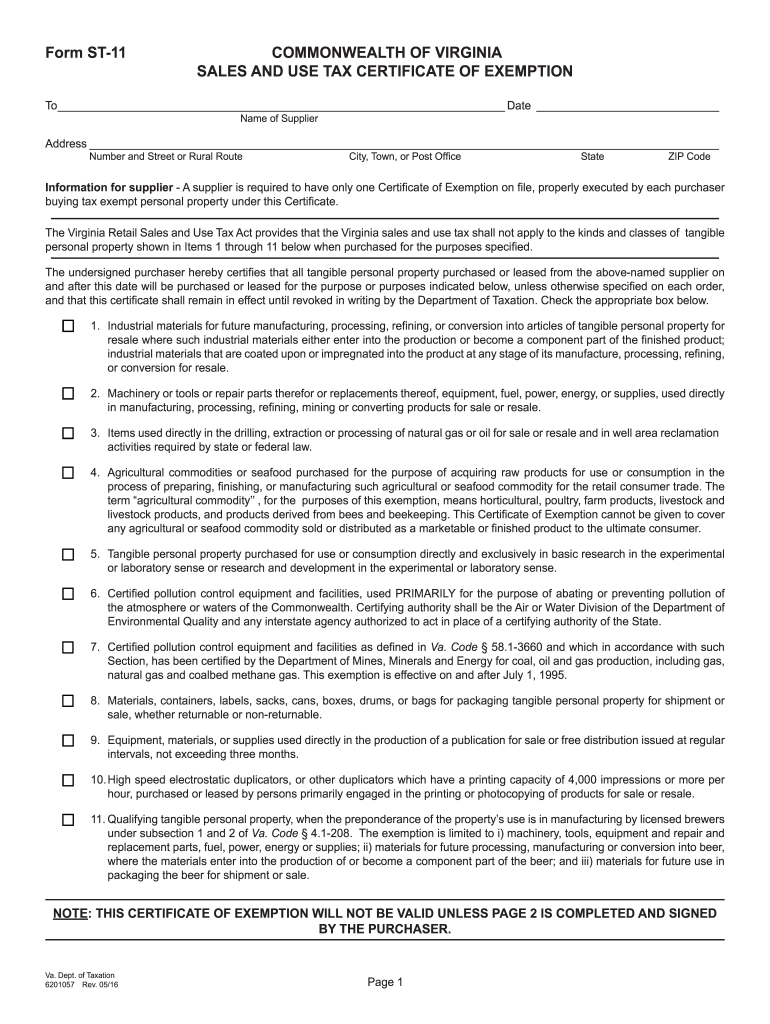

Commonwealth Of Virginia Sales And Use Tax Exemption Forms Fill Out

https://www.signnow.com/preview/443/65/443065685/large.png

Pursuant to Kansas statute 79 5107 e 1 not more than two motor vehicles may qualify for exemption from property taxation in Kansas if on the date of individual s application for Tax Exemption for Leased Vehicles As of tax year 2016 United States active duty military and or their spouse with out of state legal residency leasing a vehicle qualify for

Vehicles leased by a qualified military service member and or spouse will receive a 100 state vehicle tax subsidy as a tax credit on the first 20 000 of assessed value To A vehicle leased by an active duty service member and or spouse is taxable however it may qualify for a personal property tax relief credit of 100 on the first 20 000 of

Download Vehicle Tax Exemption For Military

More picture related to Vehicle Tax Exemption For Military

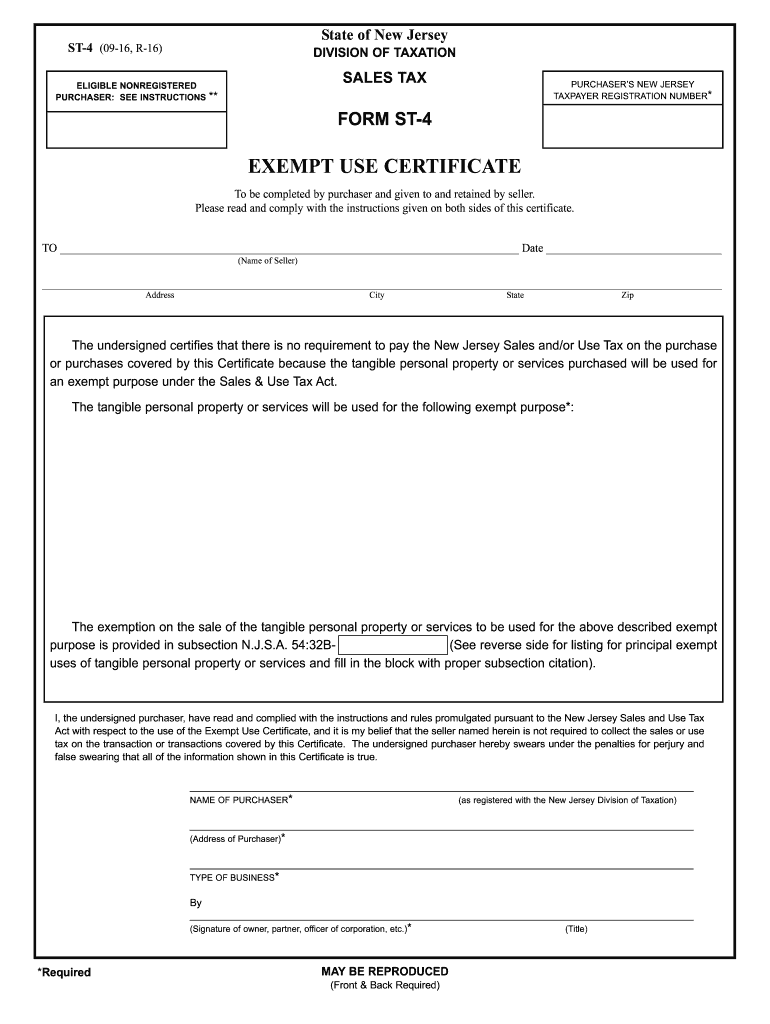

NJ ST 4 2016 2022 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/395/763/395763626/large.png

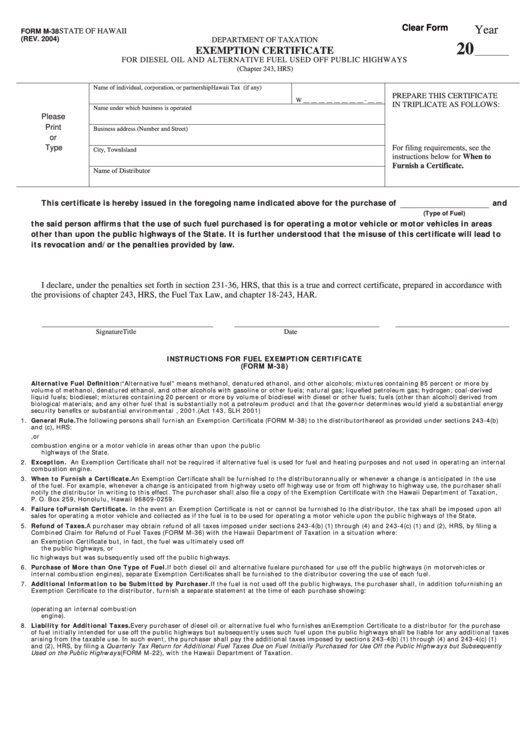

Fillable Form M 38 Exemption Certificate Template State Of Hawaii

https://data.formsbank.com/pdf_docs_html/227/2271/227100/page_1_thumb_big.png

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Military and Veteran Tax Benefits Resident Service Members If you are a resident service member stationed out of State and buy a car outside of New Jersey Vehicles leased by a qualified military service member and or spouse will receive a 100 state vehicle tax subsidy as a tax credit on the first 20 000 of assessed value

To qualify for the motor vehicle sales tax exemption a veteran typically needs to have a service connected disability This means that the disability was a Active duty non resident military personnel may be exempt from personal property taxes in North Carolina To apply please submit your Leave Earnings Statement LES for the

FL DMV Vehicle Registration Exemption PDF Military Discharge

https://imgv2-1-f.scribdassets.com/img/document/43495187/original/c4e71e0940/1631367703?v=1

Taxact Online Fillable Tax Forms Printable Forms Free Online

https://www.signnow.com/preview/100/313/100313563/large.png

https://dol.wa.gov/.../vehicle-tax-exemptions-military-personnel

Vehicle tax exemptions for military personnel Learn how to qualify for excise and regional transit authority RTA tax exemptions for non residents stationed in Washington and

https://www.fairfaxcounty.gov/taxes/vehicles/military-exemption

Military Vehicle Tax Exemption Application Lease vehicles Vehicles leased by a qualified military service member and or spouse will receive a 100 state vehicle tax subsidy

California Sales Tax Exemption Certificate Video Bokep Ngentot

FL DMV Vehicle Registration Exemption PDF Military Discharge

California Ag Tax Exemption Form Fill Out Sign Online DocHub

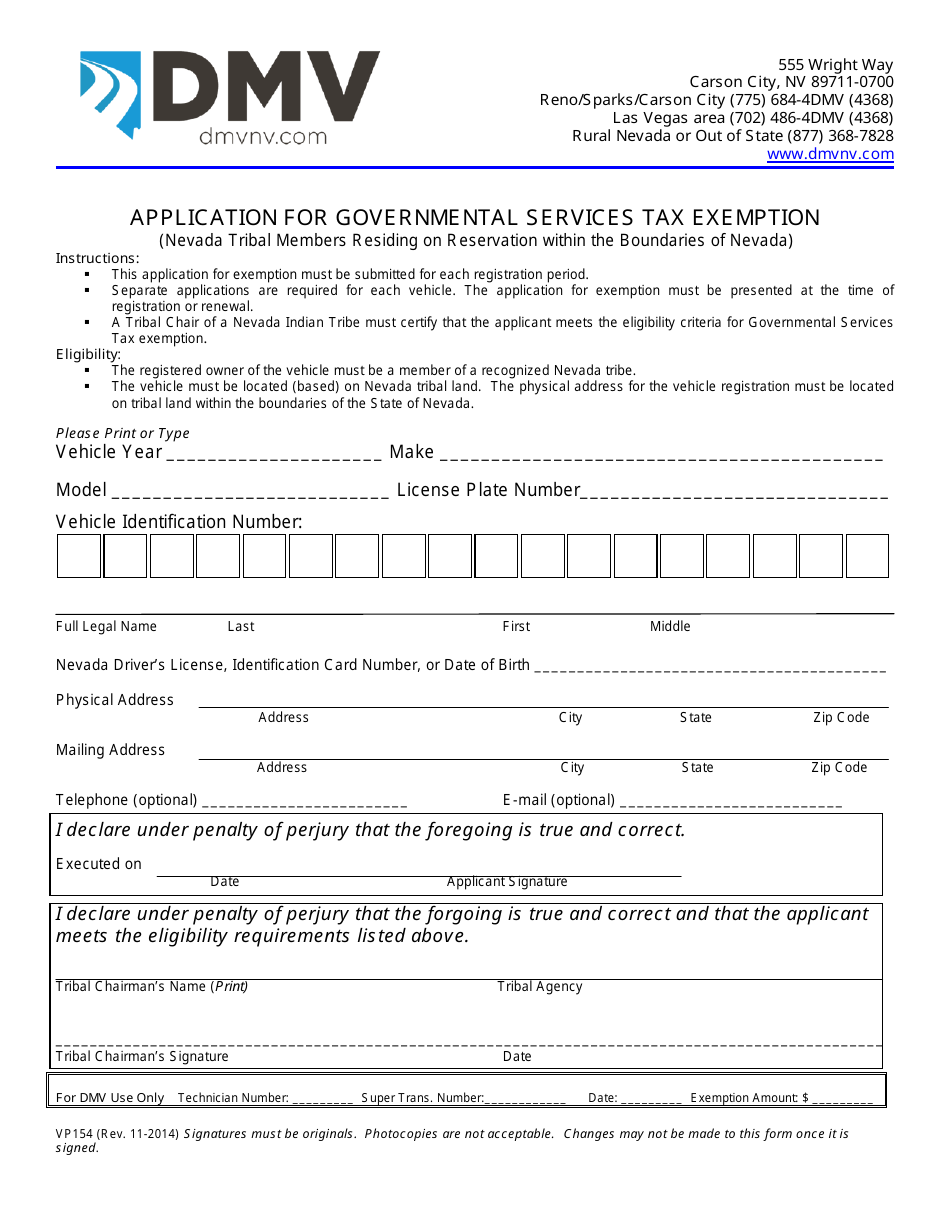

Form VP154 Fill Out Sign Online And Download Fillable PDF Nevada

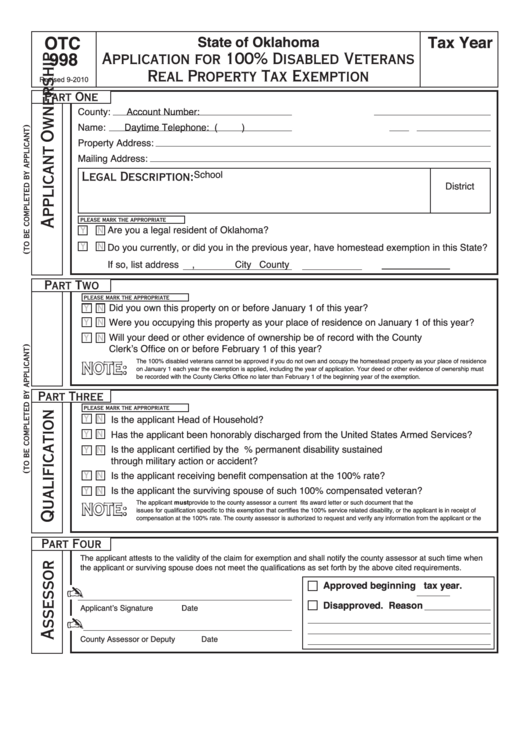

Kentucky Property Tax Exemption For Disabled Veterans PRORFETY

Florida Military Exemption Tax Form Fill Out And Sign Printable PDF

Florida Military Exemption Tax Form Fill Out And Sign Printable PDF

2023 Tax Exemption Form Pennsylvania ExemptForm

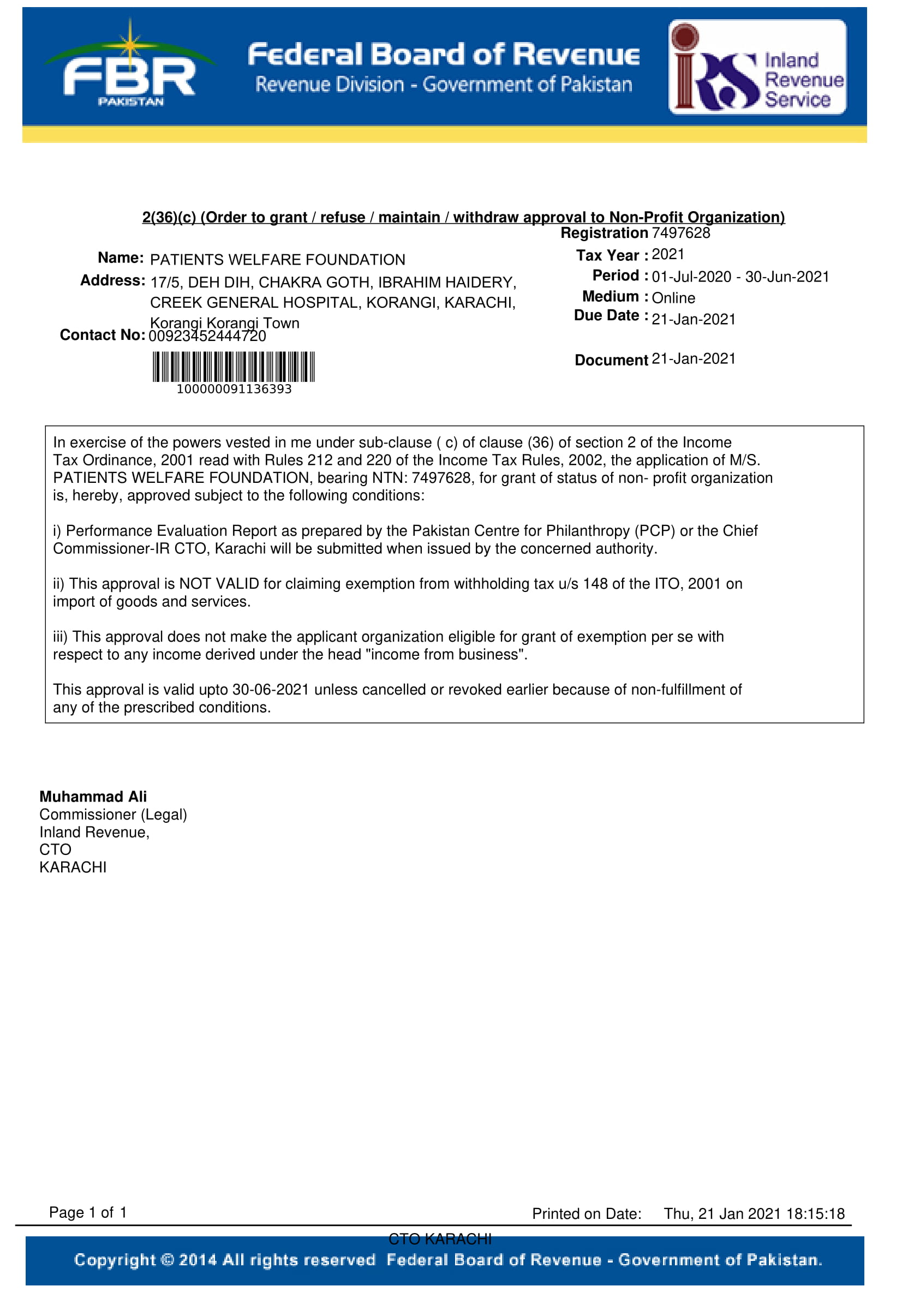

Tax Exemption Certificate PWF Pakistan

Exemption Certificate Format TUTORE ORG Master Of Documents

Vehicle Tax Exemption For Military - A vehicle leased by an active duty service member and or spouse is taxable however it may qualify for a personal property tax relief credit of 100 on the first 20 000 of