Vehicle Tax Exemption For Military Sc Be used on the highways sold to a resident of another state but who is located in South Carolina by reason of orders of the United States Armed Forces This exemption is allowed only if

Active duty military personnel stationed in South Carolina who are not SC residents are not required to pay the vehicle license tax portion of the annual vehicle registration South Carolina Taxes on Military Pay South Carolina taxes military pay received by South Carolina residents serving on active duty in the U S Armed Forces Military pay that is received

Vehicle Tax Exemption For Military Sc

Vehicle Tax Exemption For Military Sc

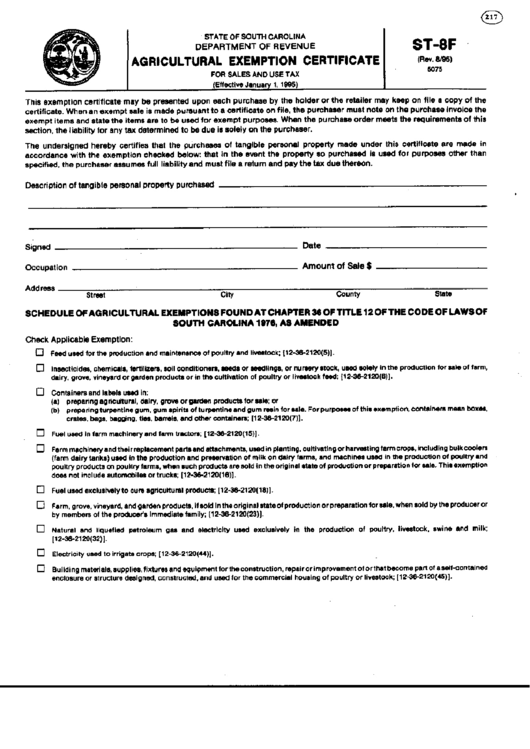

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-8f-agricultural-exemption-certificate-printable-pdf.png

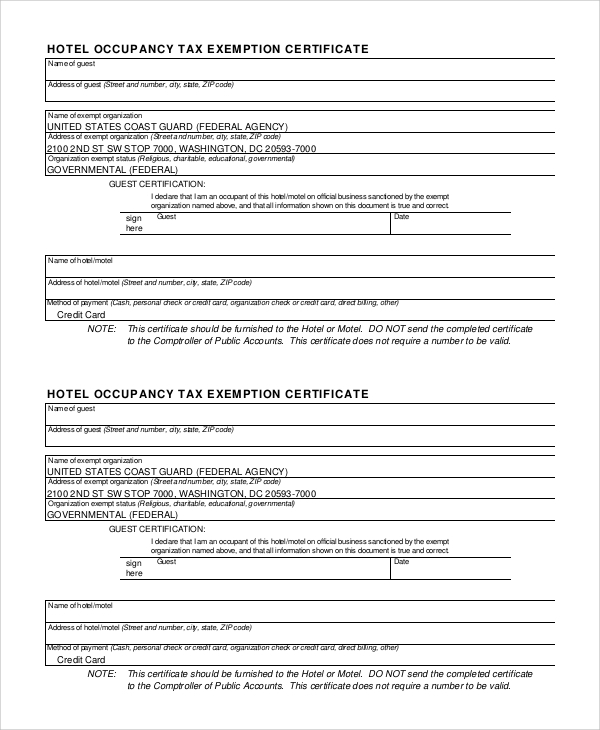

Us Government Tax Exempt Form For Hotels ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-9.png?w=979&ssl=1

Request Letter For Tax Exemption And Certificate SemiOffice Com

https://i0.wp.com/semioffice.com/wp-content/uploads/2021/08/Request-Letter-for-Tax-Exemption-and-Certificate.png?ssl=1

How do I apply for an active duty military exemption for my vehicle s If your home of record is not South Carolina you do not have to pay personal property taxes on your motor vehicles or For members of the military who are active duty claim their home of record in a state other than South Carolina and are currently stationed in South Carolina personal property exemption benefits are available for motor

If a nonresident soldier purchases a car in South Carolina he she may avoid paying sales taxes maximum 300 by completing a Nonresident Military Tax Exemption Certificate These forms Are there any exemptions for active duty or retired military Military Exemption You may qualify for military exemption All military exemptions from property taxes are listed in Section B of the

Download Vehicle Tax Exemption For Military Sc

More picture related to Vehicle Tax Exemption For Military Sc

Farm Tax Exempt Form Ky Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/5/503/5503386/large.png

Letter Of Exemption Sample

https://i.pinimg.com/736x/d3/80/e1/d380e18a29ce6f6ca47a7d306f7a5706.jpg

Accepted Religious Exemption Letters

https://www.umsystem.edu/media/fa/procurement/2Missouri_Tax_Exemption_Letter.gif

Active Duty military may be exempted from all vehicle property taxes annually if the following criteria are met Must be Active Duty no reserves retired or ROTC Must present unexpired military ID Must have orders or a letter from The exemption covers motor vehicles including trucks campers motor homes boats and outboard motors personal recreational watercraft like wave runners and jet skis aircraft and

Download a Property Tax Exemption Application for Individuals PT 401 I at dor sc gov forms and include the completed form with your supporting documents APPLICATION MUST BE FILED EACH YEAR YOU ARE ON ACTIVE DUTY IN SOUTH CAROLINA AND WISH TO CLAIM EXEMPTION FROM PERSONAL PROPERTY TAXES

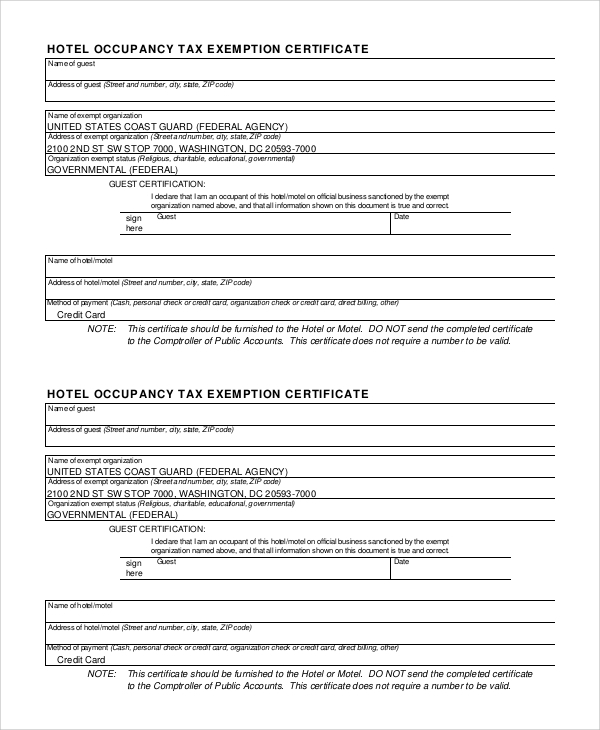

Tax Exempt Form Florida Hotel ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-35.jpg

Georgia Sales Tax Exemption Form St 5 ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-5-sales-and-use-tax-certificate-of-exemption-georgia-10.png

https://dor.sc.gov › forms-site › Forms

Be used on the highways sold to a resident of another state but who is located in South Carolina by reason of orders of the United States Armed Forces This exemption is allowed only if

https://home.army.mil › ... › vehicle-tax-exemption-forms

Active duty military personnel stationed in South Carolina who are not SC residents are not required to pay the vehicle license tax portion of the annual vehicle registration

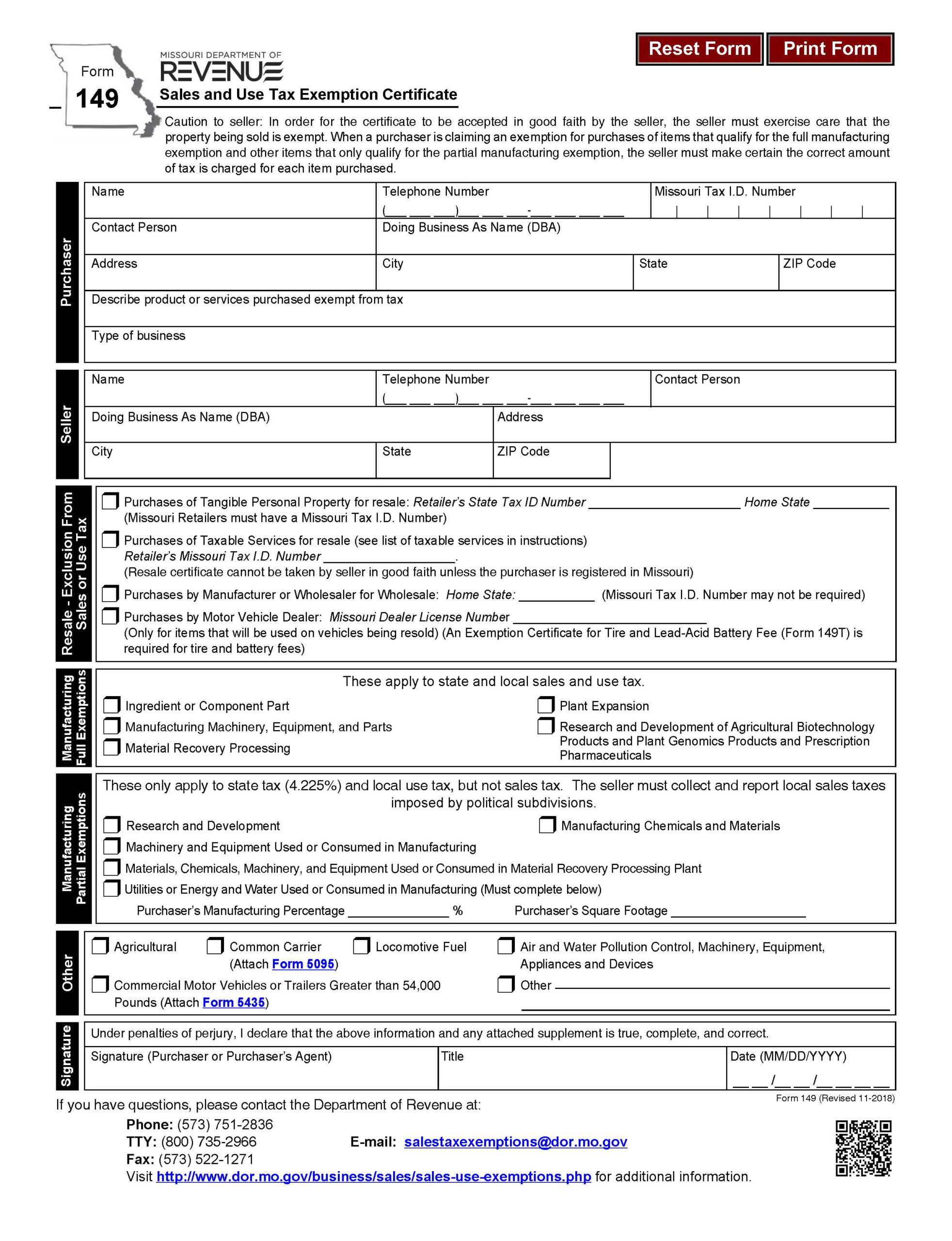

Missouri Sales Tax Exemption Certificate Updated On July 2021

Tax Exempt Form Florida Hotel ExemptForm

FL DMV Vehicle Registration Exemption PDF Military Discharge

Nysc Exemption Letter How To Apply And Collect Nysc Exemption Letter

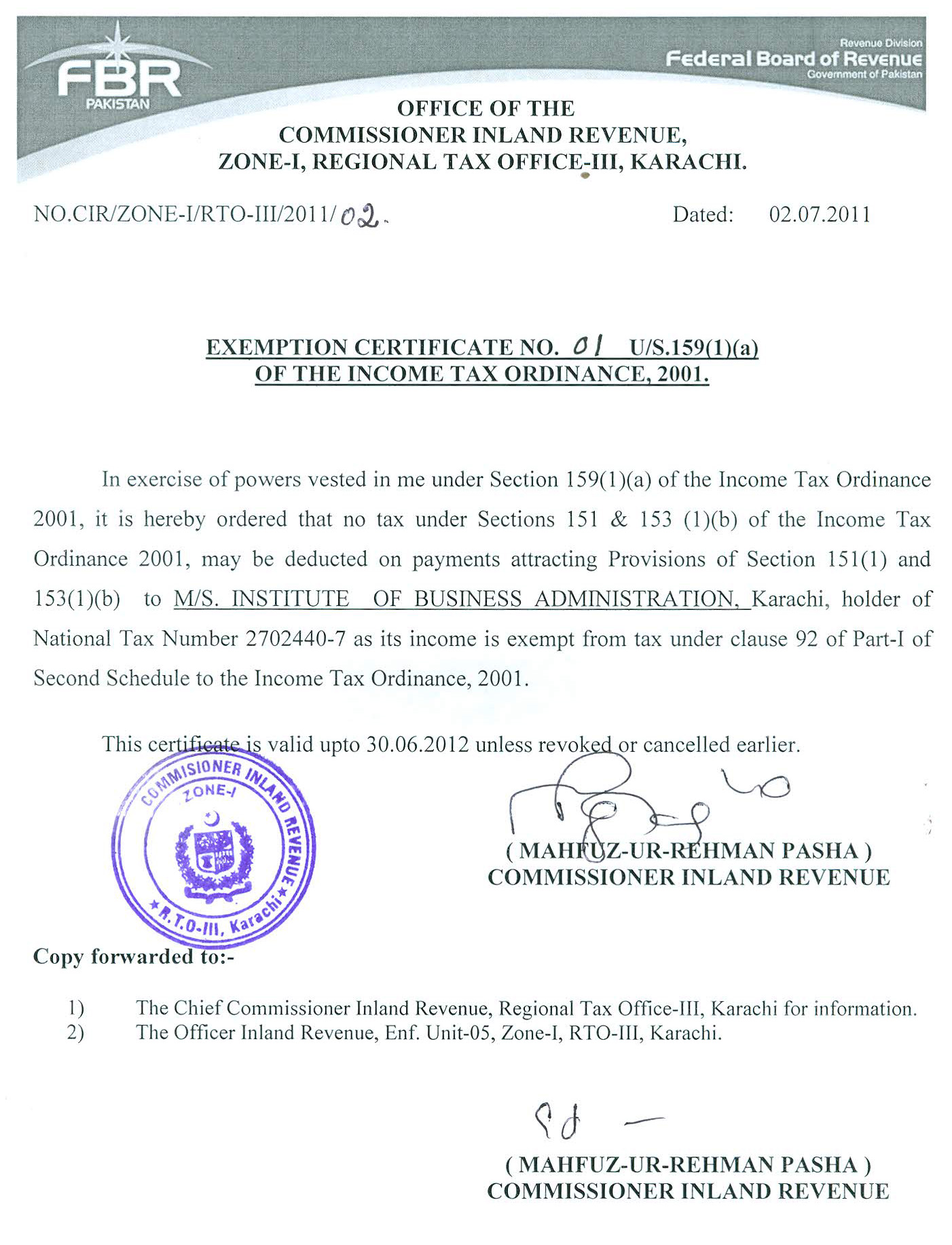

Exemption Certificate Format TUTORE ORG Master Of Documents

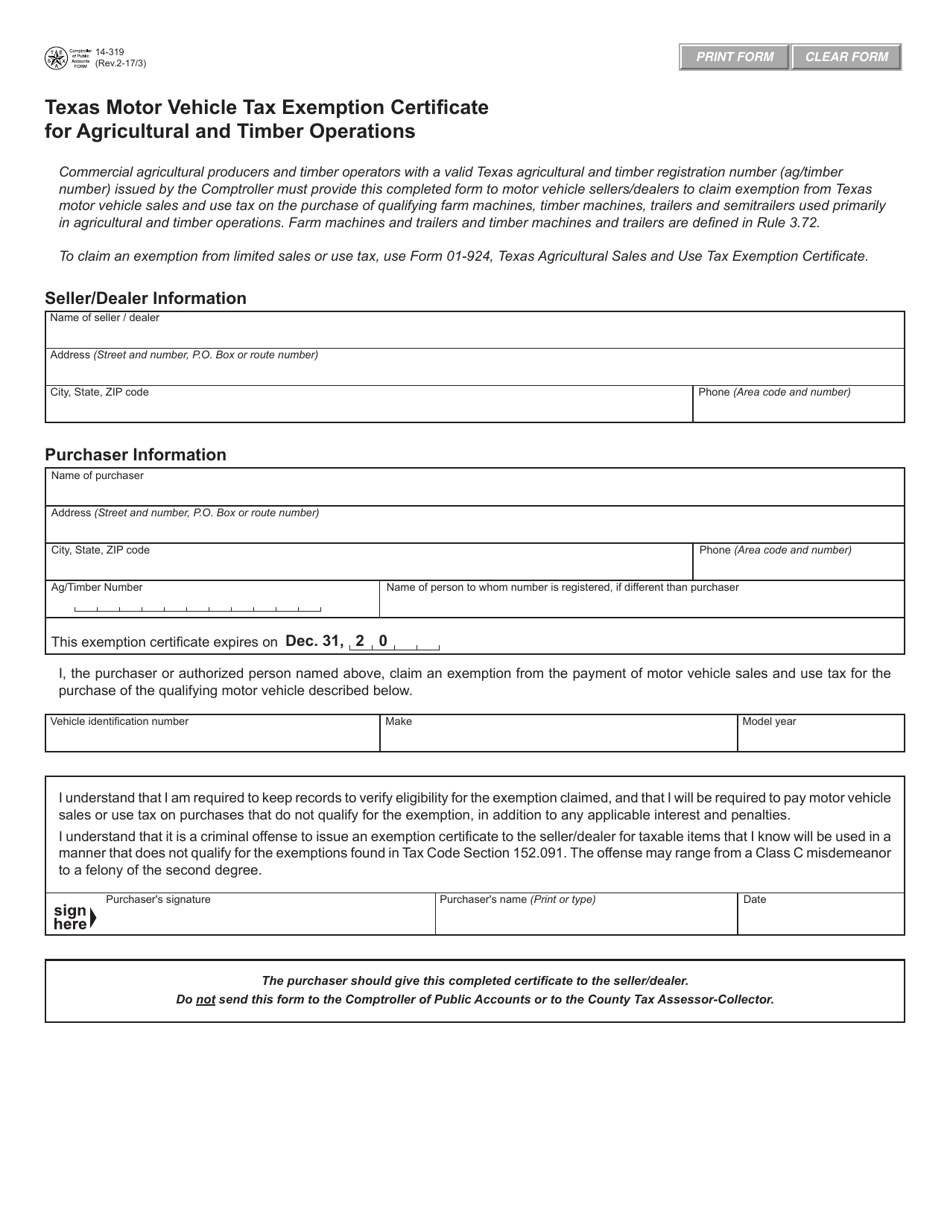

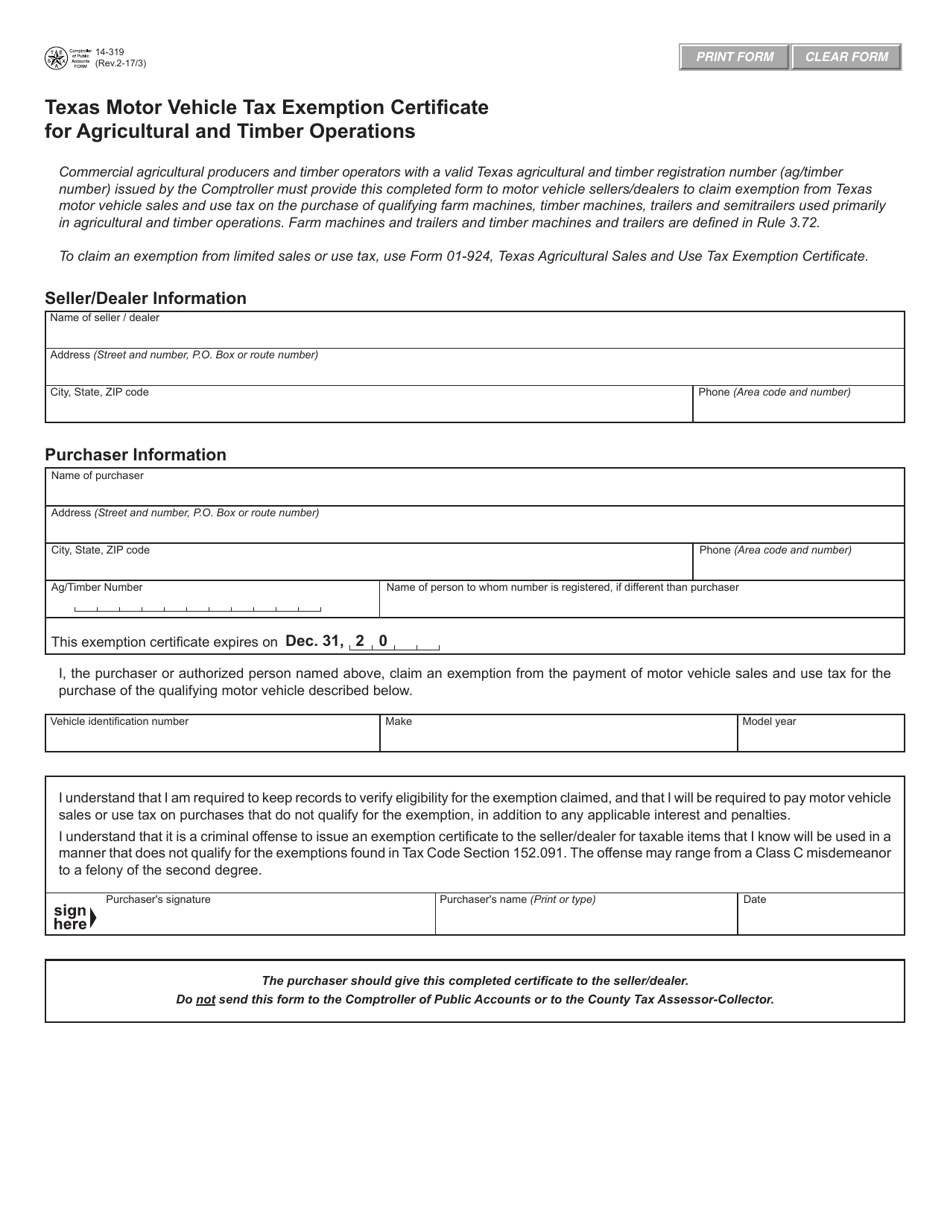

Form 14 319 Fill Out Sign Online And Download Fillable PDF Texas

Form 14 319 Fill Out Sign Online And Download Fillable PDF Texas

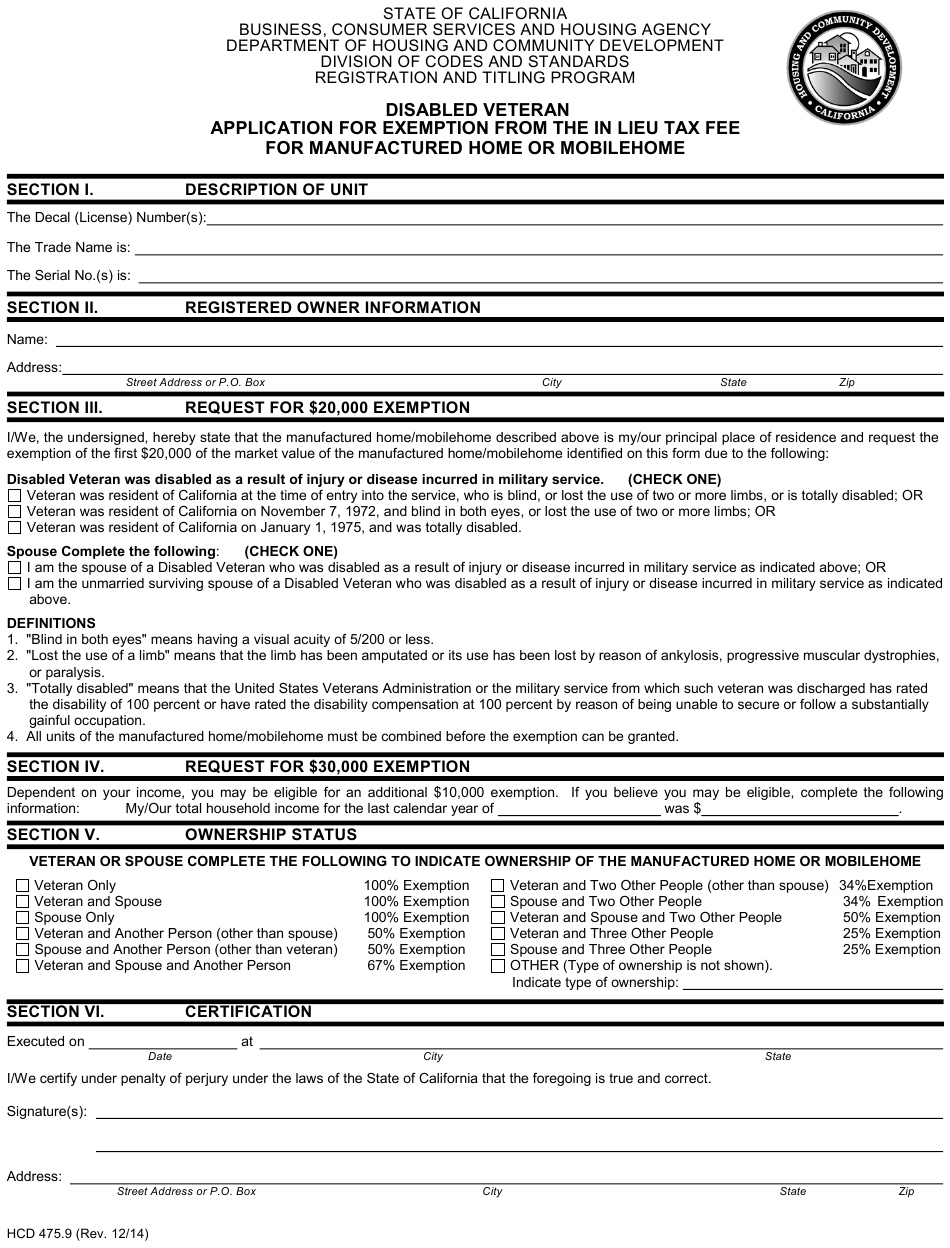

Disability Car Tax Exemption Form ExemptForm

2017 PAFPI Certificate of TAX Exemption Certificate Of

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

Vehicle Tax Exemption For Military Sc - If a nonresident soldier purchases a car in South Carolina he she may avoid paying sales taxes maximum 300 by completing a Nonresident Military Tax Exemption Certificate These forms