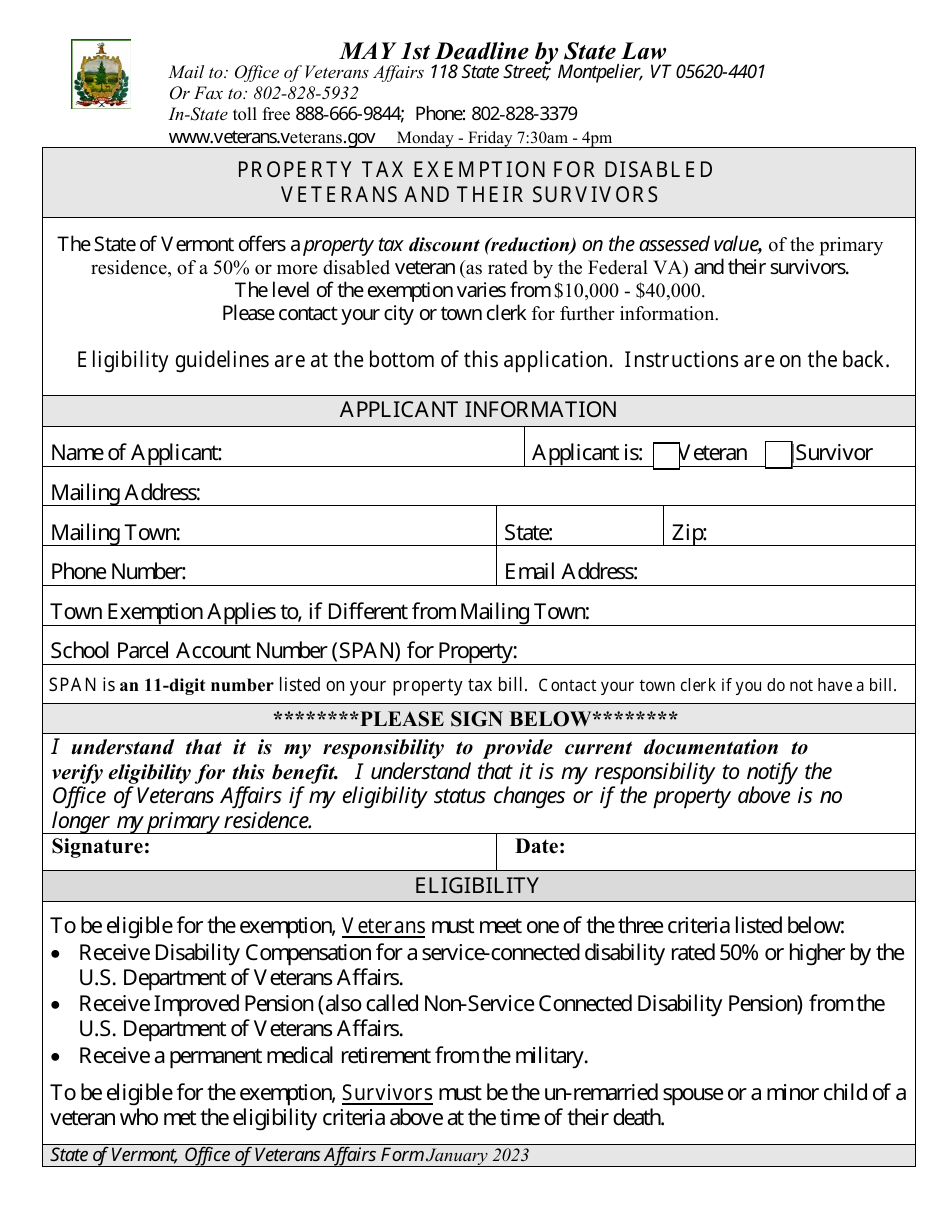

Vermont Property Tax Exemption You may be eligible for a property tax credit on your property taxes if your property qualifies as a homestead and you meet the eligibility requirements The maximum credit is

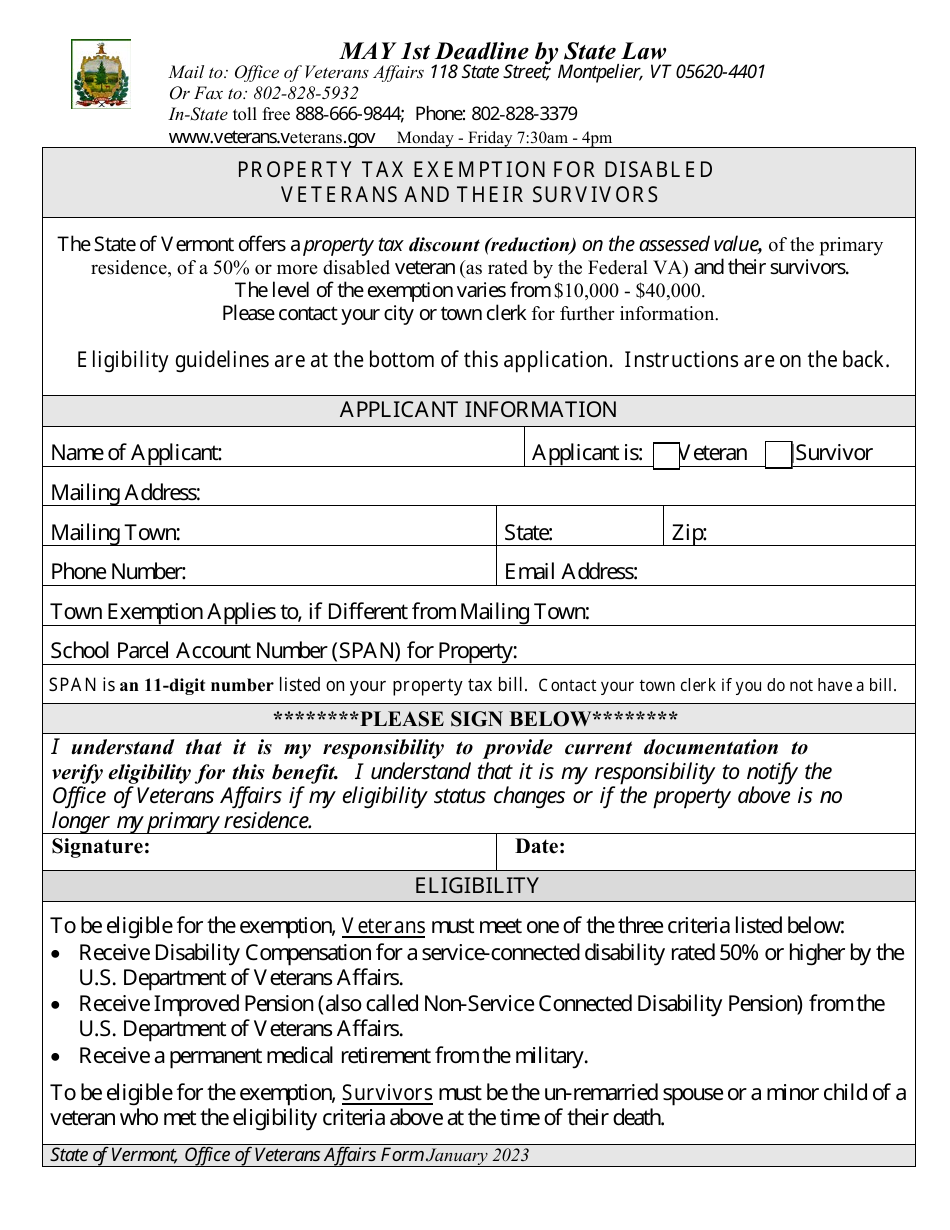

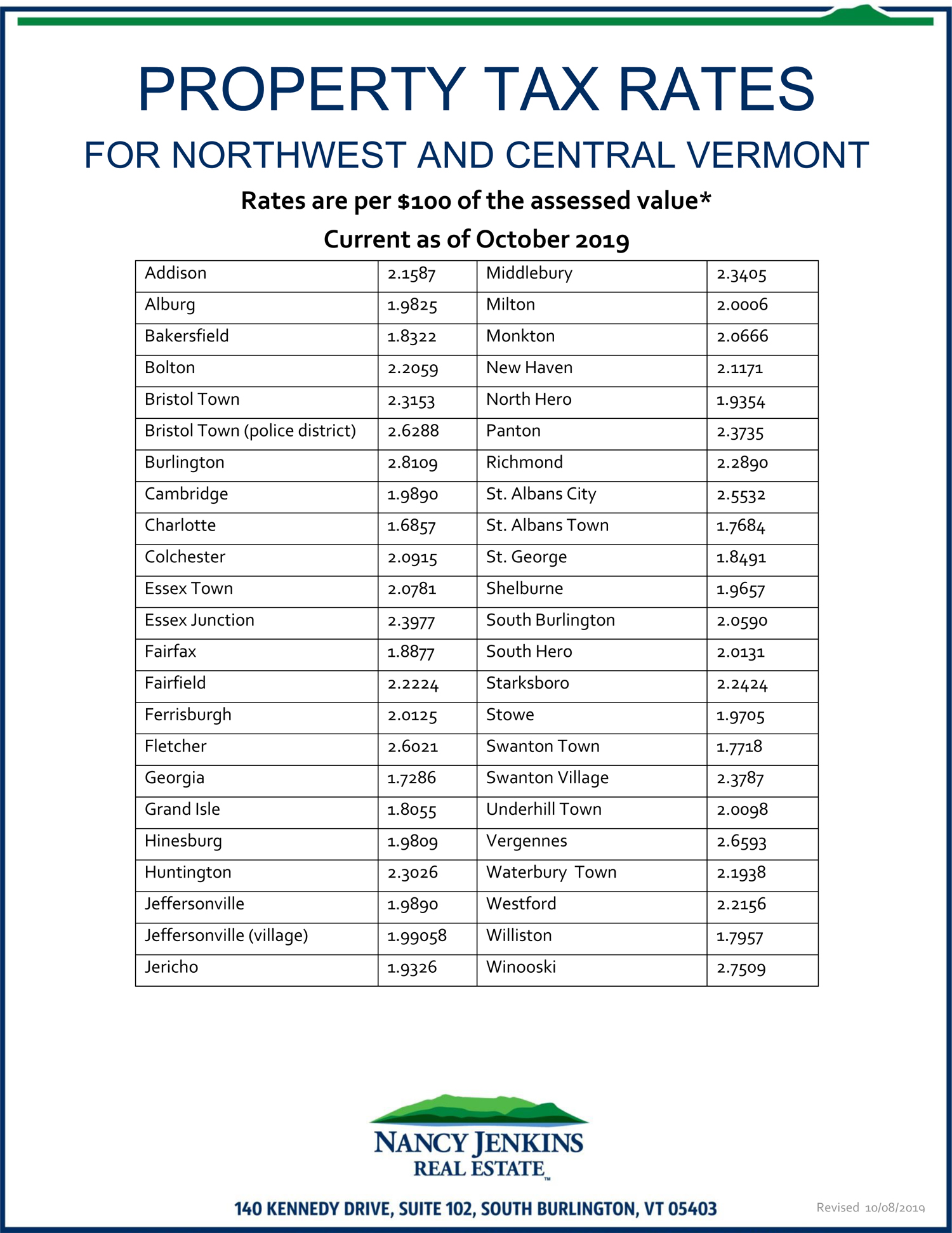

Disabled veterans who own their homes may be eligible for a property tax exemption that reduces the assessed value of their home Learn how to apply for the exemption The property tax credit assists Vermont residents to pay property tax and is based on a percentage of household income Homeowners eligible for a credit are those

Vermont Property Tax Exemption

Vermont Property Tax Exemption

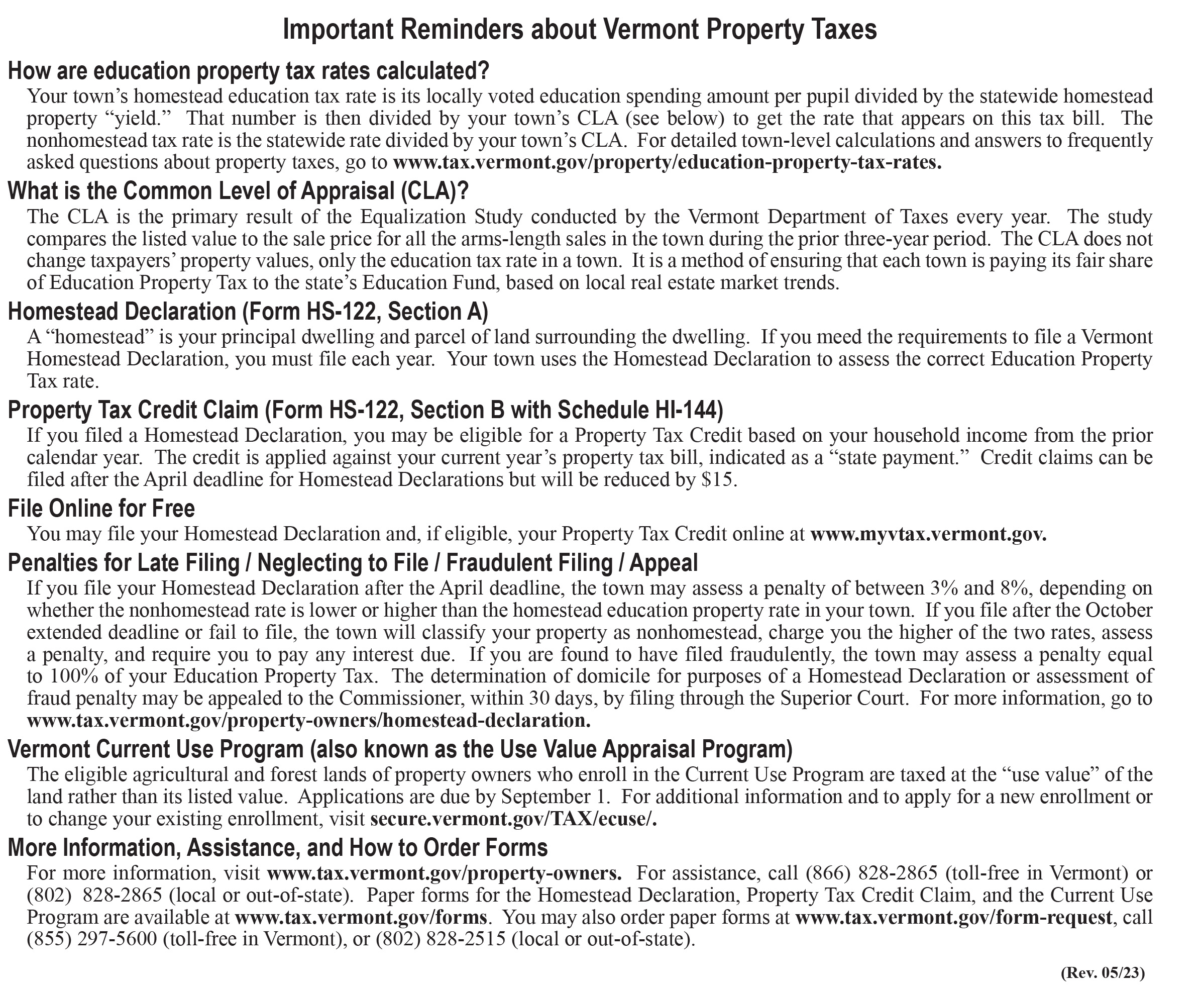

https://nancyjenkins.com/wp-content/uploads/2019/11/Property_Tax_Rates_2019-20-2.jpg

Vermont Property Tax Exemption For Disabled Veterans And Their

https://data.templateroller.com/pdf_docs_html/2576/25767/2576723/property-tax-exemption-for-disabled-veterans-and-their-survivors-vermont_print_big.png

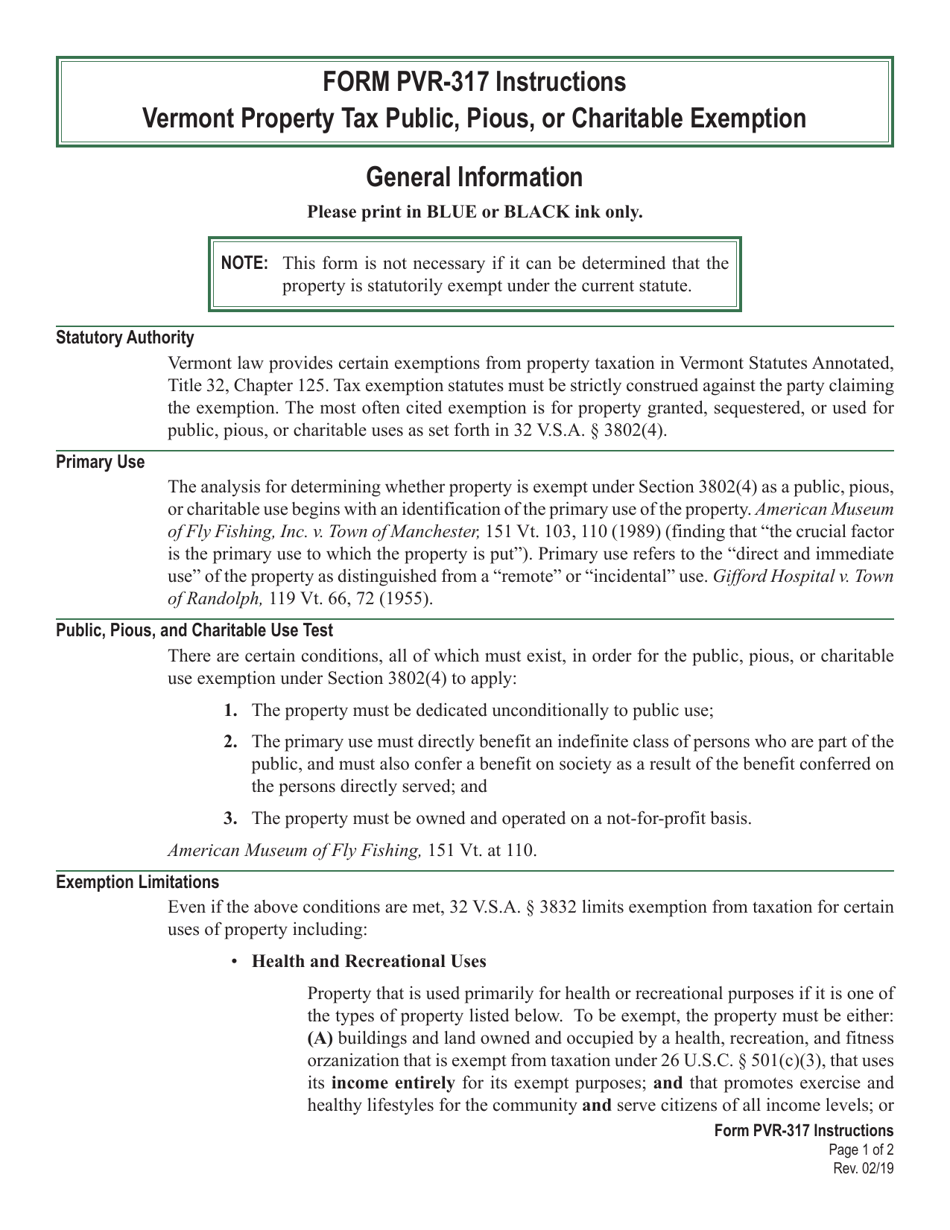

VT Form PVR 317 Download Printable PDF Or Fill Online Vermont Property

https://data.templateroller.com/pdf_docs_html/1908/19080/1908065/vt-form-pvr-317-vermont-property-tax-public-pious-or-charitable-exemption-vermont_print_big.png

In Vermont if you own your home and cannot pay your property taxes because your income is low there may be something you can do A city or town can Do you own your home If you meet certain income and residency requirements the State of Vermont can help pay your property taxes You could be eligible for up to 8 000 of Property Tax Credit File

Use myVTax the department s online portal to e file Form HS 122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI 144 Household Income with the MONTPELIER Vt WCAX Tax relief is on the way for Vermont homeowners under a new bill passed by lawmakers and signed by Gov Phil Scott this

Download Vermont Property Tax Exemption

More picture related to Vermont Property Tax Exemption

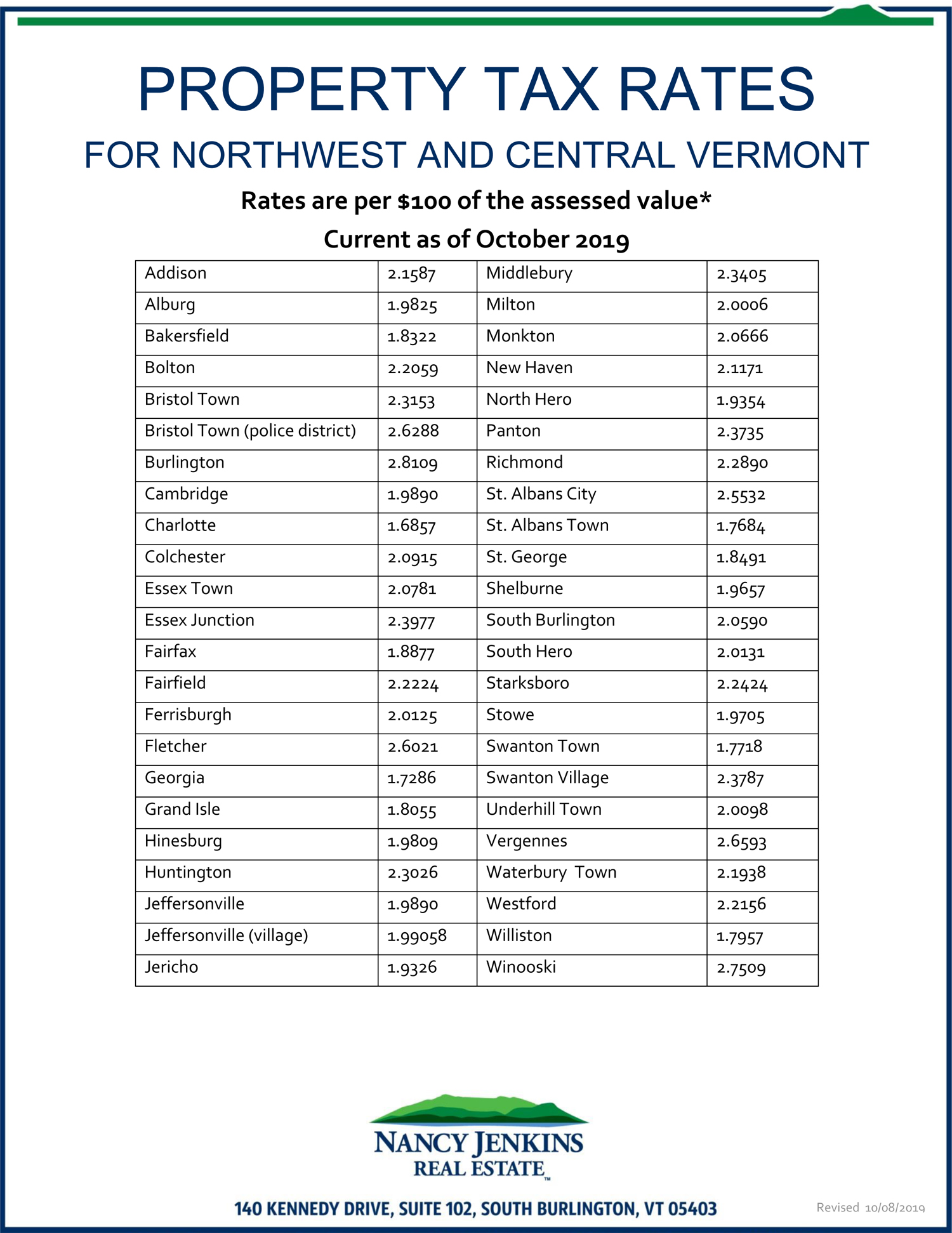

Half Of Vermont s Towns Will See Increased Property Tax Rates

http://mountaintimes.info/wp-content/uploads/2018/07/Property-TAx-CHART.jpg

How To Get A Vermont Certificate Of Exemption 2023 Guide

https://startingyourbusiness.com/wp-content/uploads/2019/09/Fillable-Vermont-Sales-Tax-Exemption-Certificate-Form-S-3.png

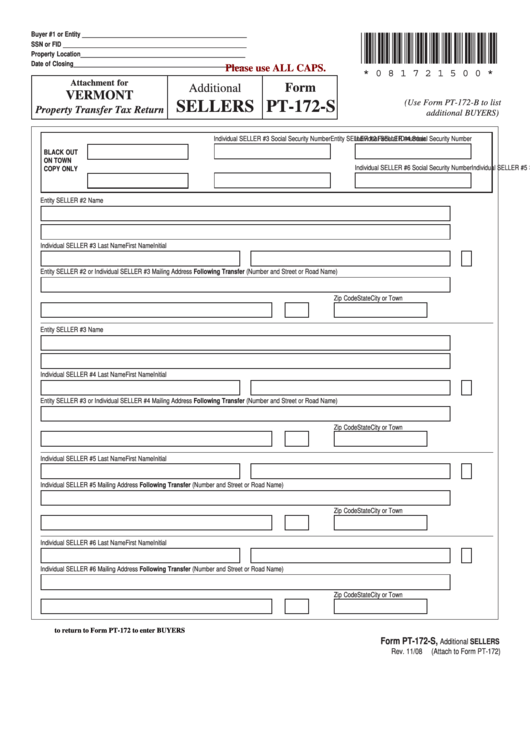

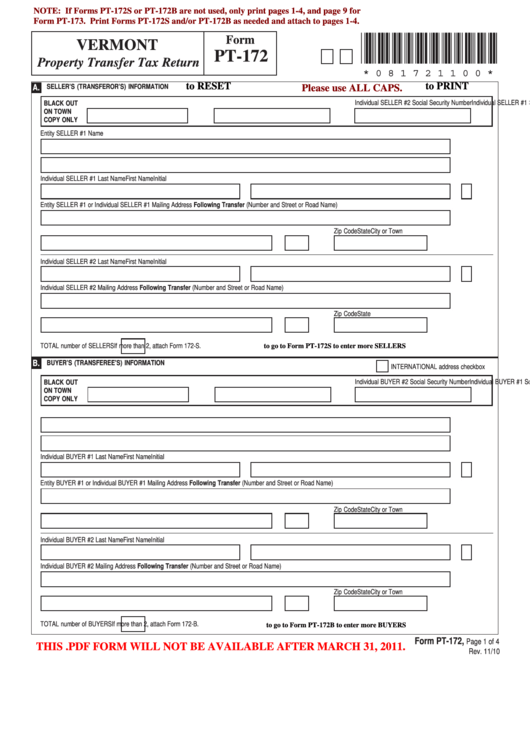

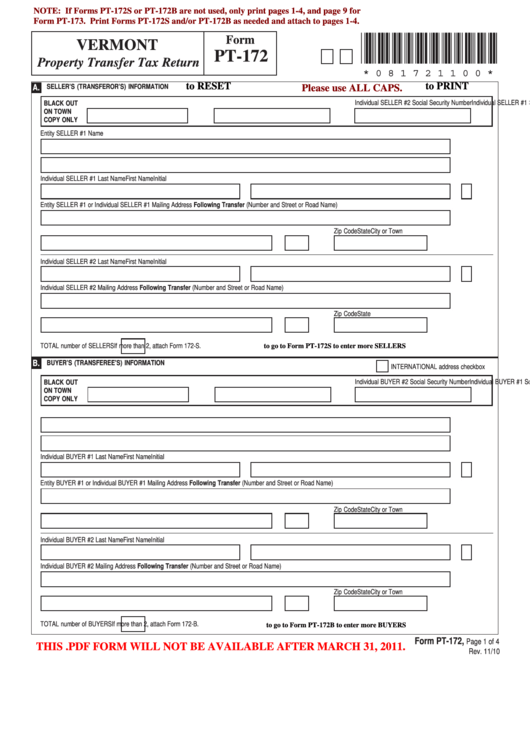

Fillable Form Pt 172 S Property Transfer Tax Return Vermont

https://data.formsbank.com/pdf_docs_html/172/1720/172074/page_1_thumb_big.png

Property tax The following property shall be exempt from taxation 1 Real and personal estate owned by this State except as otherwise provided real and personal estate Does Vermont have a Property Tax Reduction for Veterans Yes for some disabled veterans and families The following are eligible for the exemption Veterans receiving

Section 2 Total property value as determined by local assessing officials If you are entitled to a partial tax exemption of any kind this deduction will appear here See Notes on Exemptions below Homestead and Vermont offers a property tax credit of up to 8 000 to eligible homeowners Homeowners must meet all of the following requirements to qualify for the credit in 2023

Fillable Form Pt 172 Property Transfer Tax Return Vermont Printable

https://data.formsbank.com/pdf_docs_html/174/1744/174464/page_1_thumb_big.png

Understanding Your Property Tax Bill Department Of Taxes

https://tax.vermont.gov/sites/tax/files/inline-images/VTBillBacker-2023.jpg

https://tax.vermont.gov/property/property-tax-credit

You may be eligible for a property tax credit on your property taxes if your property qualifies as a homestead and you meet the eligibility requirements The maximum credit is

https://tax.vermont.gov/individuals/seniors-and-retirees

Disabled veterans who own their homes may be eligible for a property tax exemption that reduces the assessed value of their home Learn how to apply for the exemption

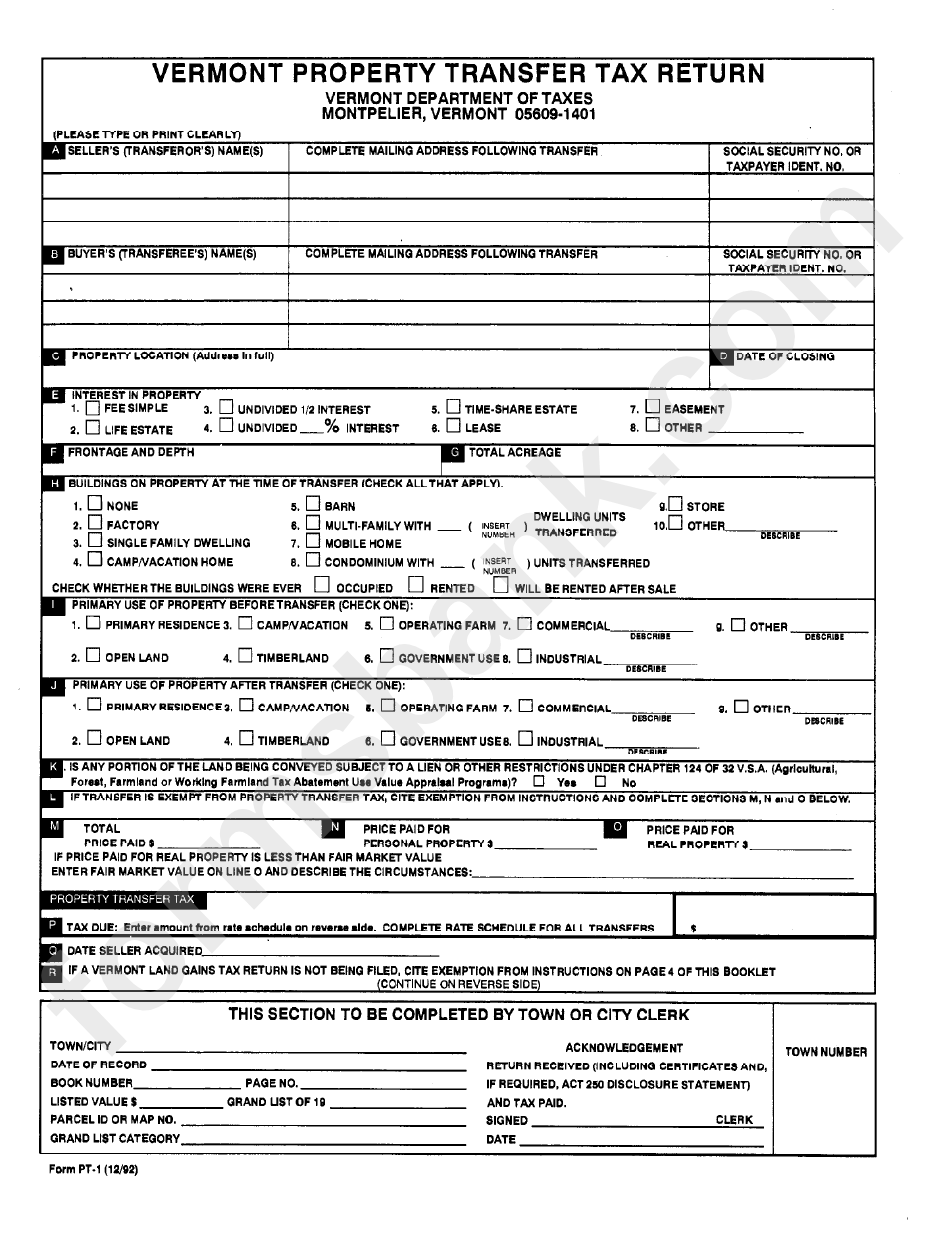

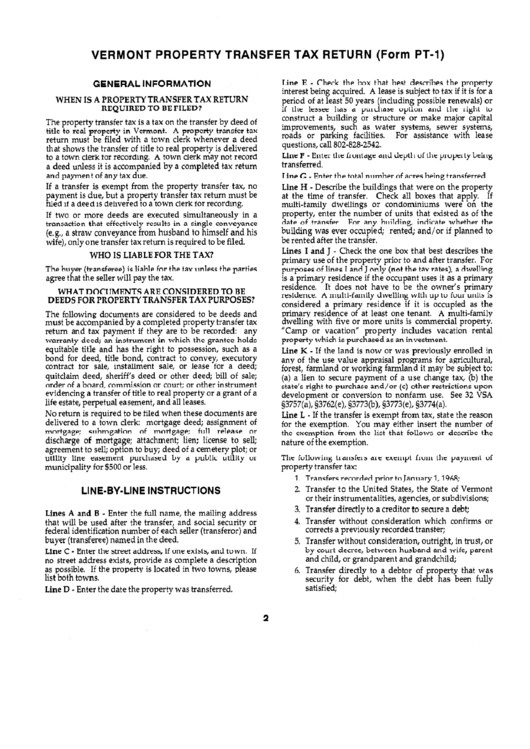

Form Pt 1 Vermont Property Transfer Tax Return Department Of Taxes

Fillable Form Pt 172 Property Transfer Tax Return Vermont Printable

Vermont Property Transfer Tax Return Fill Out Sign Online DocHub

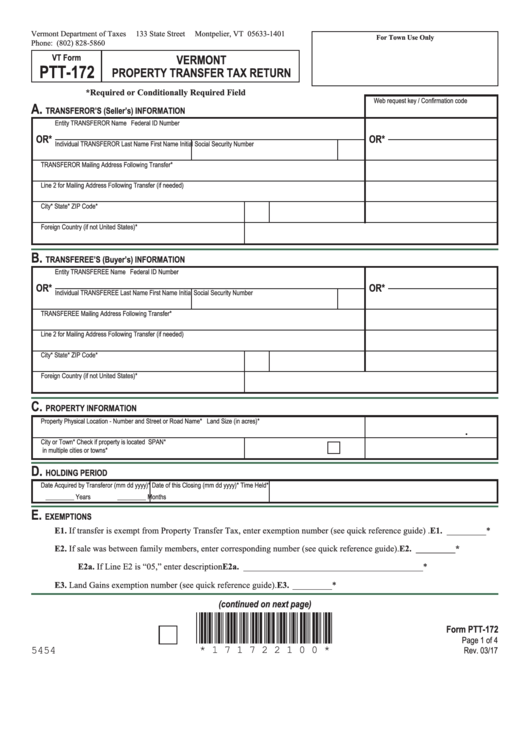

Fillable Form Ptt 172 Vermont Property Transfer Tax Return 2017

Vermont Property Records Search Owners Title Tax And Deeds InfoTracer

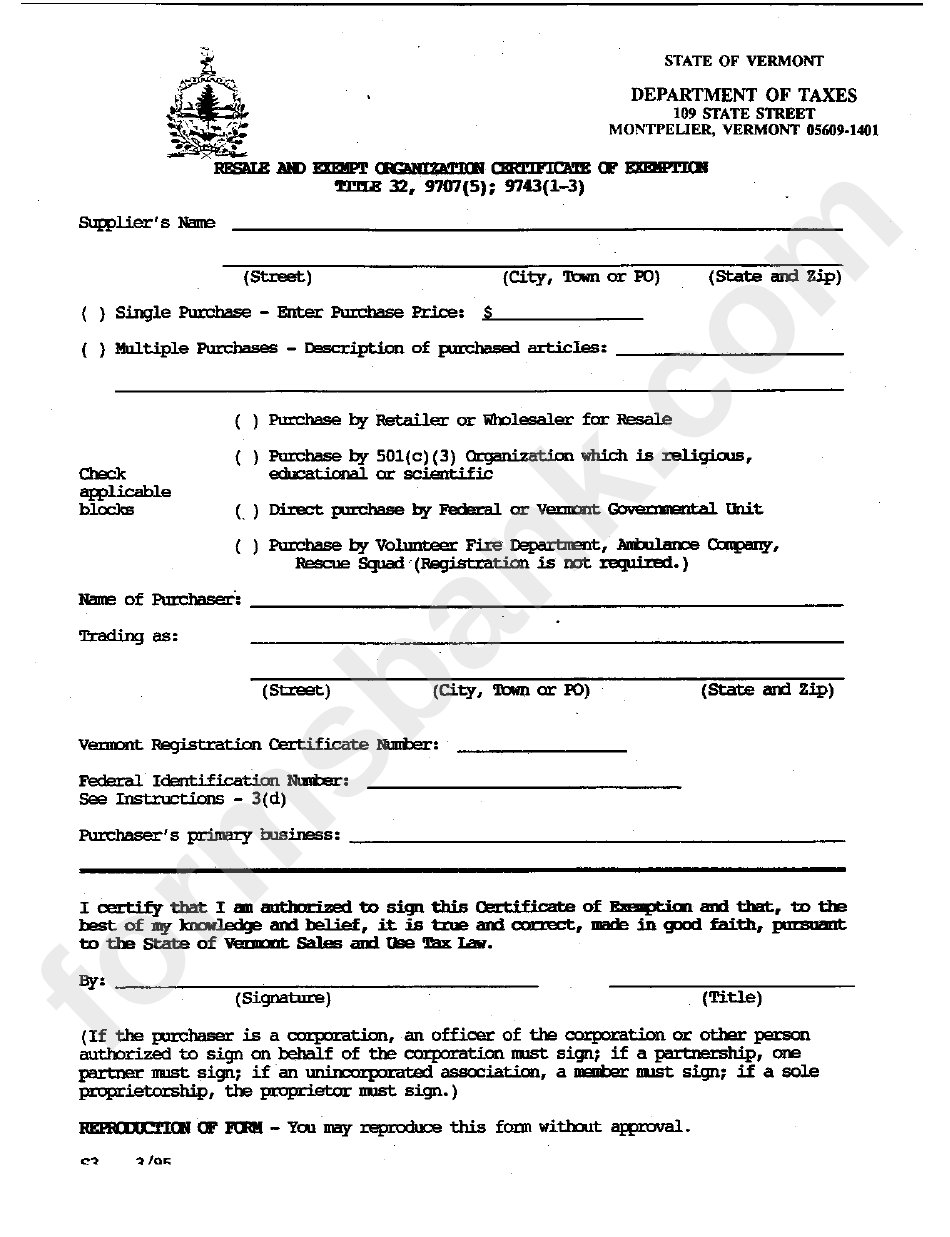

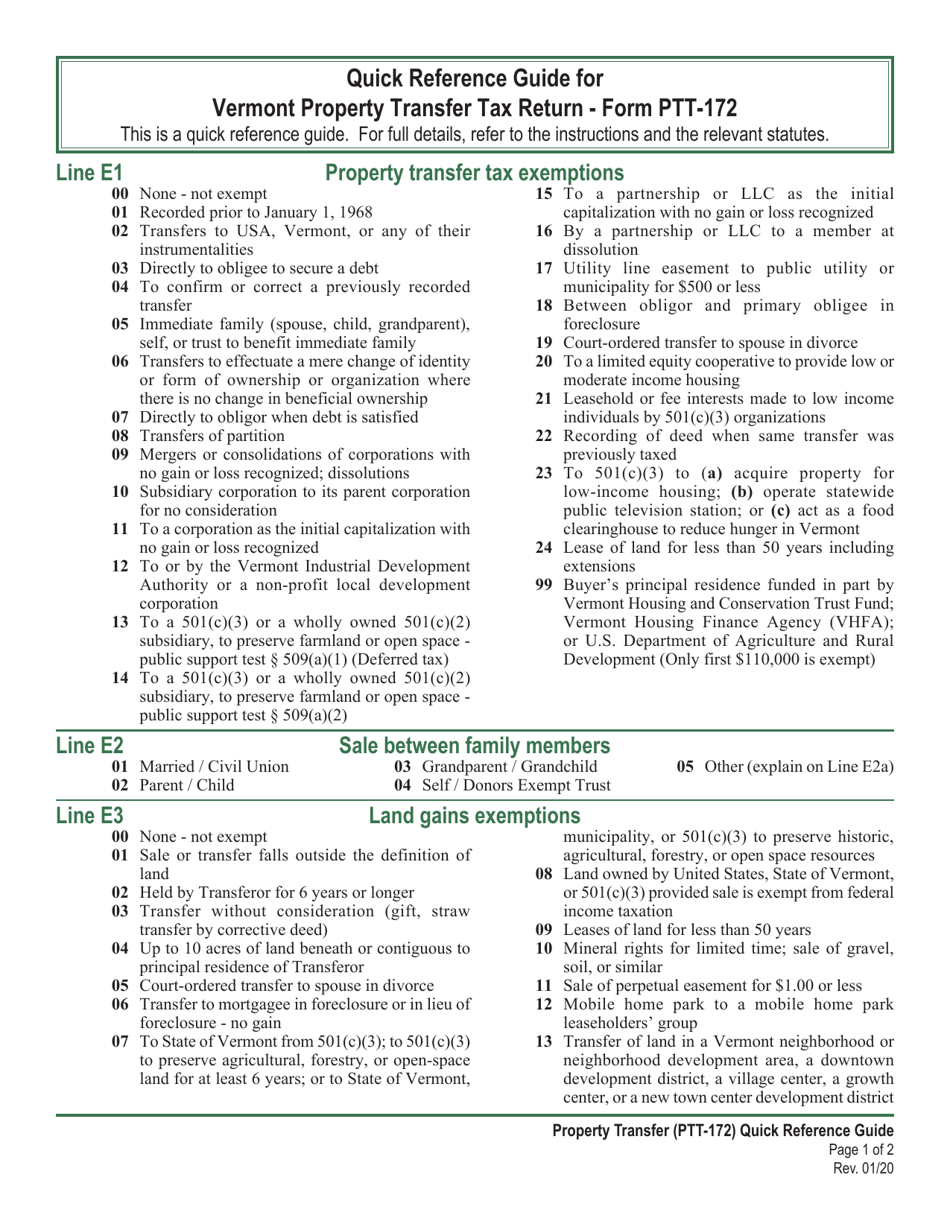

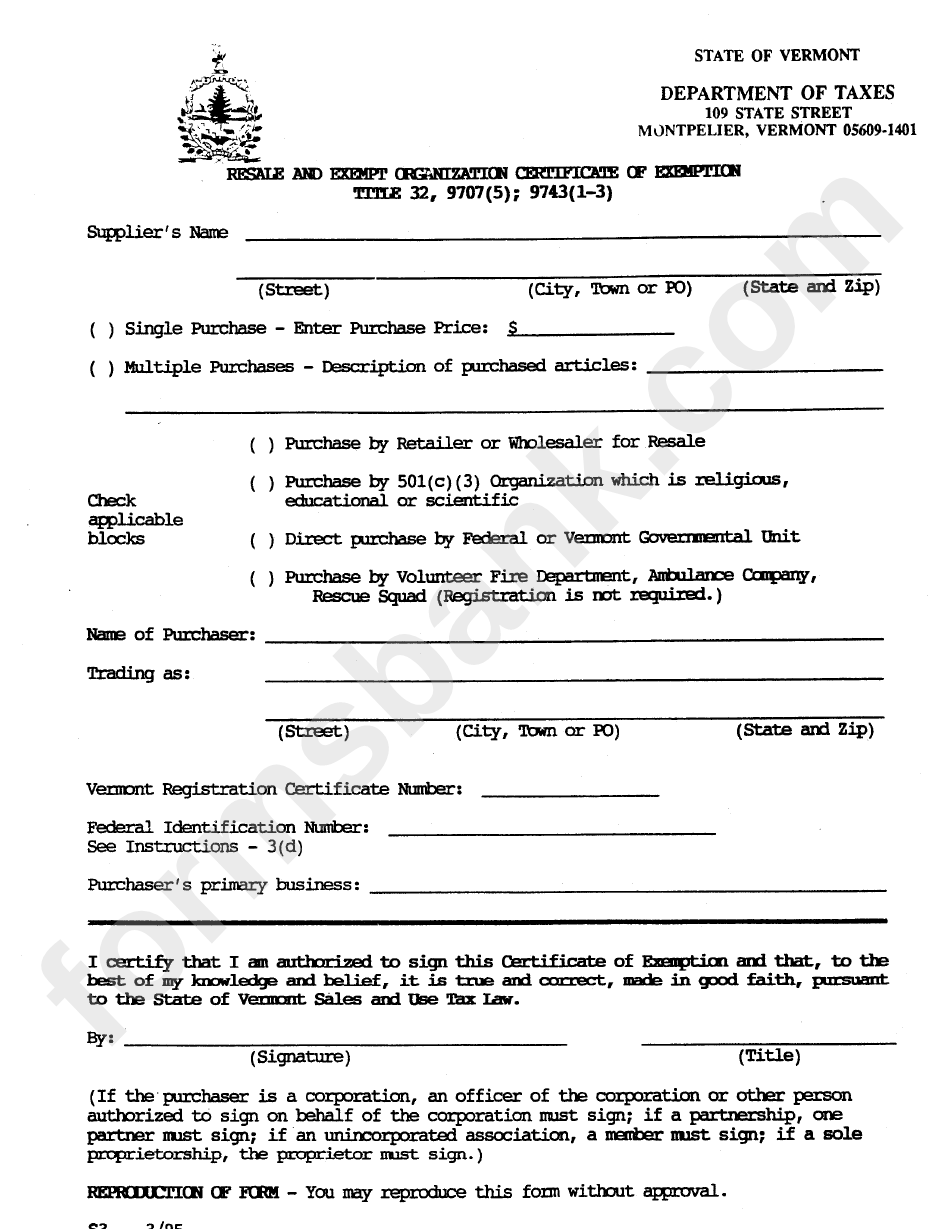

Resale And Exempt Organization Certificate Of Exemption Vermont

Resale And Exempt Organization Certificate Of Exemption Vermont

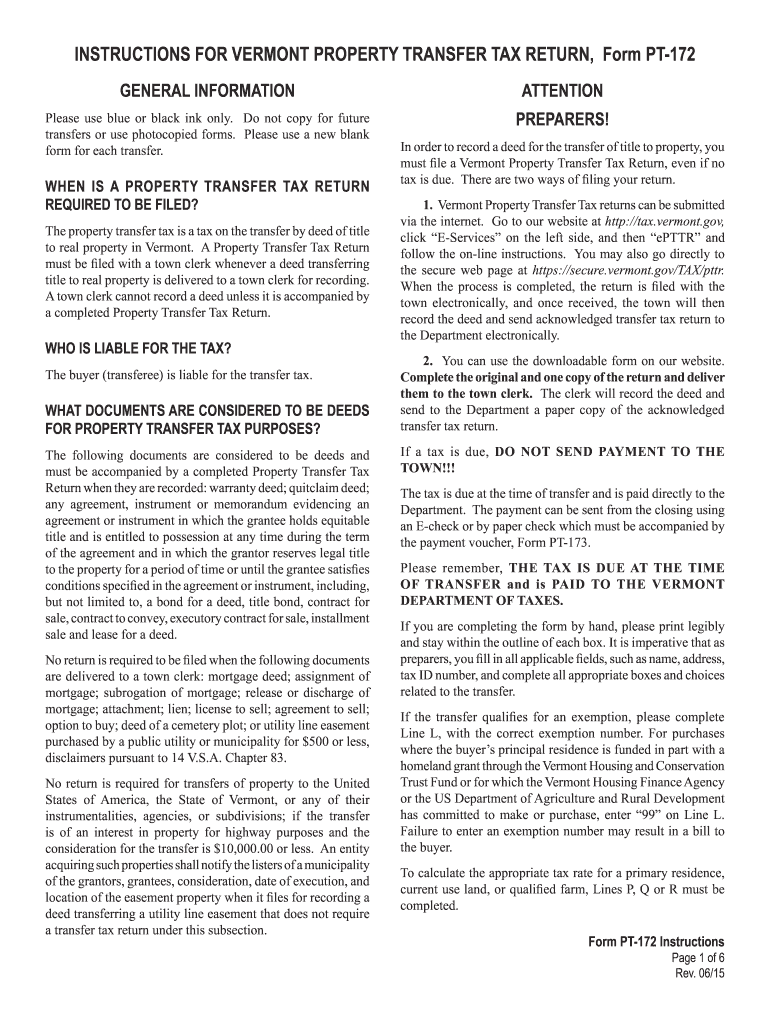

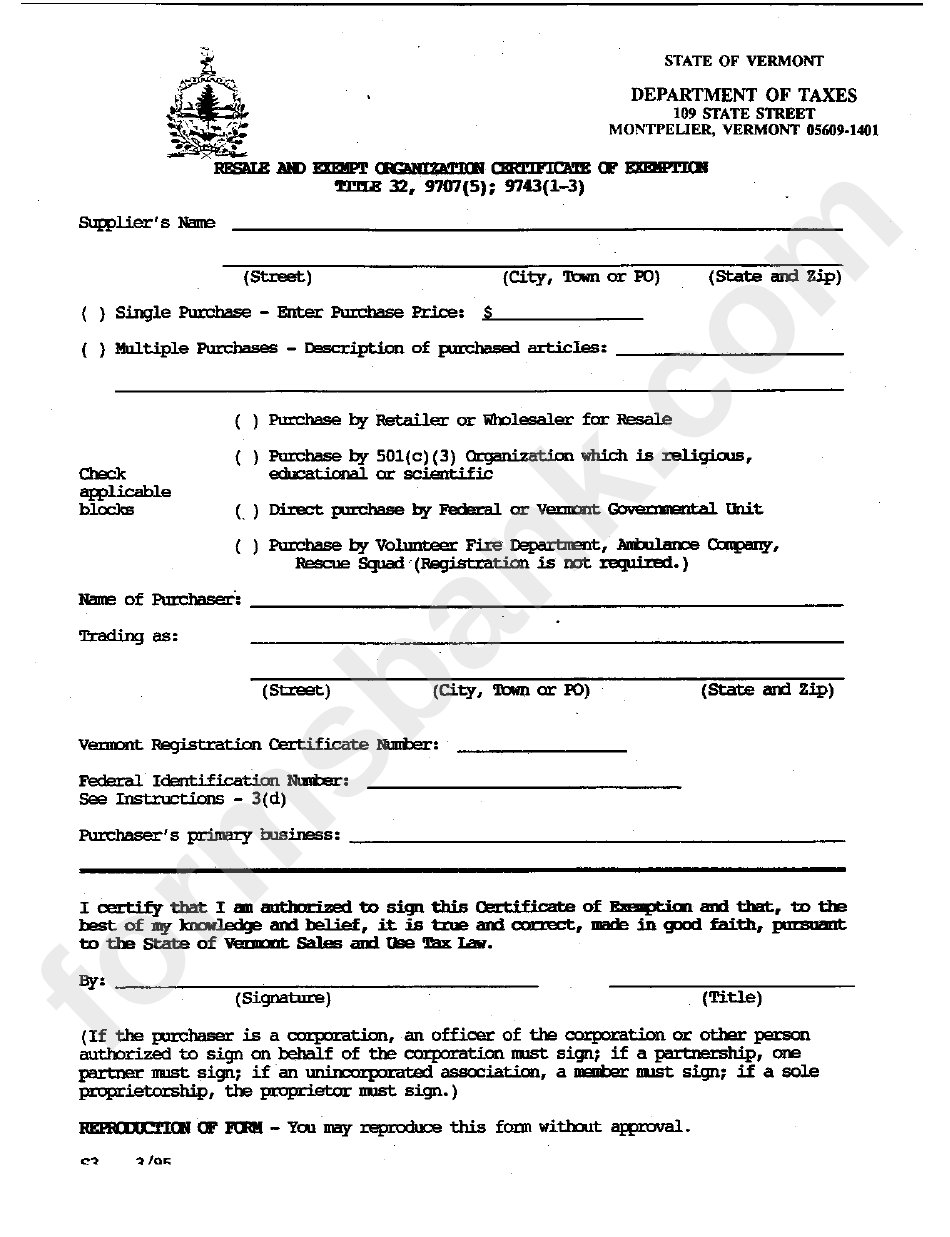

Download Instructions For VT Form PTT 172 Vermont Property Transfer Tax

Resale And Exempt Organization Certificate Of Exemption Form Vermont

Vermont Property Transfer Tax Return Form Pt 1 Printable Pdf Download

Vermont Property Tax Exemption - Do you own your home If you meet certain income and residency requirements the State of Vermont can help pay your property taxes You could be eligible for up to 8 000 of Property Tax Credit File