Volume Rebate Gst If you receive or provide a rebate you may need to adjust the amount of GST you ve claimed or paid or treat the rebate as a separate sale depending on the

How GST applies to rebates Understand what a rebate is and the way you apply GST to rebates Making an adjustment because of a rebate Information for purchasers and You may receive a volume rebate from your supplier for making purchases above a certain amount The rebate is equivalent to a discount given for past purchases When your supplier

Volume Rebate Gst

Volume Rebate Gst

https://jennaleelaw.com/wp-content/uploads/2021/10/thumb.jpg

GST HST New Residential Rental Property Rebate Jenna Lee Law

https://jennaleelaw.com/korean/wp-content/uploads/2021/10/KakaoTalk_Photo_2021-10-29-16-20-21-002.jpeg

Volume Rebate Incentives Explained

https://blog.e-bate.io/hubfs/5.png

To prepare GST registered businesses for the second rate change when the GST rate is increased from 8 to 9 with effect from 1 Jan 2024 we have published the e Tax Guide Volume Rebates For GST purposes volume rebates are considered to be a reduction of original purchase price and are treated in the same manner as refunds from vendors GST

Pplier rewards those buying in bulk by providing a reduced price for each good or group of goods Volume discounts allow businesses to purchase additional inventory at reduced cost and The vendor accepting the coupon from a customer is entitled to be reimbursed by the manufacturer or another third party When this type of coupon is used for a taxable purchase the GST or HST is applied to the full price of the item and

Download Volume Rebate Gst

More picture related to Volume Rebate Gst

Volume Incentive Rebate Management And Examples Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/625f1a4d5fb42e0f632eaad6_incentive-example-1.png

Volume Incentive Rebate Management And Examples Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/625f1a5b24cb3f200b74efe5_incentive-example-2.png

Peter Shuai Airfreight Solution Provider LinkedIn

https://media.licdn.com/dms/image/D4E03AQEbyB64Vj-nQQ/profile-displayphoto-shrink_800_800/0/1683342607226?e=2147483647&v=beta&t=KfT9C-Bz5h5qdz01mAqYjLDsJjOEsF2ZL0sr6EsMckg

This memorandum in the VALUE OF SUPPLY sub series explains for purposes of the Goods and Services Tax GST the value of rebates offered by suppliers in order to calculate the GST It has been clarified vide Para C of CBI C circular No 92 11 2019 GST dated 7 3 2019 that discounts offered by suppliers to customers including staggered discount under Buy more save more scheme and post supply

Volume rebates a warning Many distributors of goods allow their customers rebates based on volumes A common practice is for the supplier to invoice the goods and the Discover the different types of post sale discounts and incentives offered in trade practices along with their implications and treatment for GST Learn how to differentiate

The Volume Rebate Luggage Organizer Red Crumpler Touch Of Modern

https://cdn-s3.touchofmodern.com/products/000/071/204/1746aee02d428c664c49661f6727712b_large.jpg?1392245361

FRS 115 Revenue From Contracts With Customers Common Questions And

https://wc1.prod3.arlocdn.net/p/afc1dbe3bc1a4e3cb2edeba05d1feb06/d/JVq6Y1EejrOgdKwaHXozM7xy6jCSiFc53PASFLVE4FjvZp3W/22.png

https://www.ato.gov.au/.../gst-and-rebates/how-gst-applies-to-rebates

If you receive or provide a rebate you may need to adjust the amount of GST you ve claimed or paid or treat the rebate as a separate sale depending on the

https://www.ato.gov.au/.../gst-and-rebates

How GST applies to rebates Understand what a rebate is and the way you apply GST to rebates Making an adjustment because of a rebate Information for purchasers and

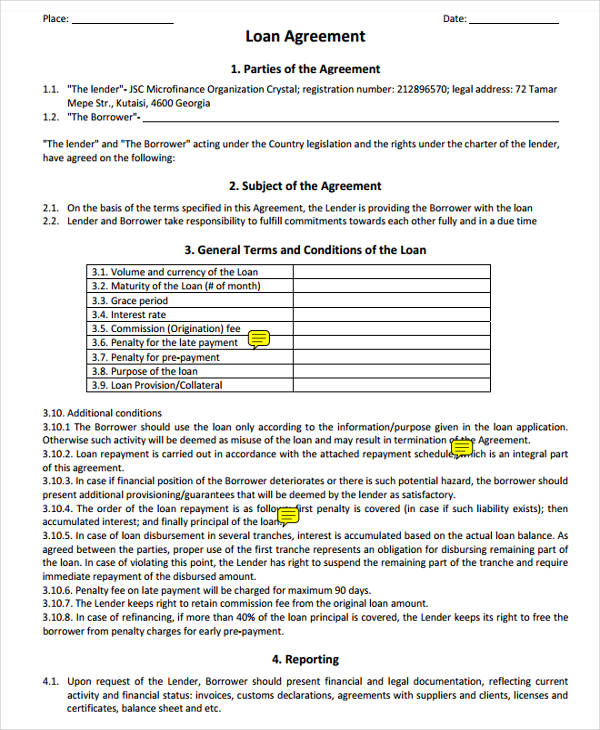

Volume Rebate Agreement Template

The Volume Rebate Luggage Organizer Red Crumpler Touch Of Modern

INUKA Business Guide WE VALUE ENCOURAGE EMPOWER THE LIVES WE TOUCH

Watershed Wise Unit Volume Rebate Table 2018 2019 San Antonio River

Volume Incentive Rebate Management And Examples Enable

Volume Incentive Rebate Management And Examples Enable

Volume Incentive Rebate Management And Examples Enable

Volume Rebate Agreement Template Creative Template Inspiration

Volume Rebate Agreement Template

New Housing GST HST Rebate

Volume Rebate Gst - If you offer volume discounts you may be able to adjust the GST and QST payable by the customer This will depend on when the discount is granted If the discount is granted at the