Washing Work Clothes Tax Allowance If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a fully uniformed pilot

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In the 2024 25 tax year the flat rate expense The HMRC uniform laundry allowance is a tax relief that allows you to deduct the cost of washing your work uniforms from your taxes If you have a specific uniform that clearly shows who you work for or your job role and you

Washing Work Clothes Tax Allowance

Washing Work Clothes Tax Allowance

https://www.dry-clean.pl/wp-content/uploads/2017/09/Ubrania-robocze.jpg

Correct Status Of So called Tax Free Salary Allowances Washing

https://i.ytimg.com/vi/rIGnc_dNBEM/maxresdefault.jpg

Washing Machine Laundry Clothing Cartoon Washing Machine Appliance

https://flyclipart.com/thumbs/washing-machine-laundry-clothing-cartoon-washing-machine-1679336.png

Just keep in mind that if your employer provides the facilities to wash your uniform at work but you decide not to use them then no tax claim can be made There are three broad rules which apply to claiming clothing as an HMRC are reminding those who have to use workwear or provide uniform which they take home that they may be eligible to get money towards work costs if these aren t covered by their employer such as washing

The good news is that there is some Tax Relief available on both equipment and clothing when these are needed for work and the employee is required to pay for them This works much the same way as for example a You could be entitled to a tax refund of 100s for up to five years of work expenses if you wear a uniform at work and have to wash fix or replace it yourself If it s a branded T shirt or a uniform specific to your industry you

Download Washing Work Clothes Tax Allowance

More picture related to Washing Work Clothes Tax Allowance

Step by step Guide On Washing Work Clothes Grab Green Home

http://grabgreenhome.com/cdn/shop/articles/Guide_to_Washing_Work_Clothes_1200x1200.png?v=1678908670

Clothes Rent Meals What Is Tax Deductible Humphries Associates

https://humphriespeople.co.nz/wp-content/uploads/2023/02/Ho3uaezKr7Adf5PAK7oa4-waldemar-brandt-Db4d6MRIXJc-unsplash-open.jpg

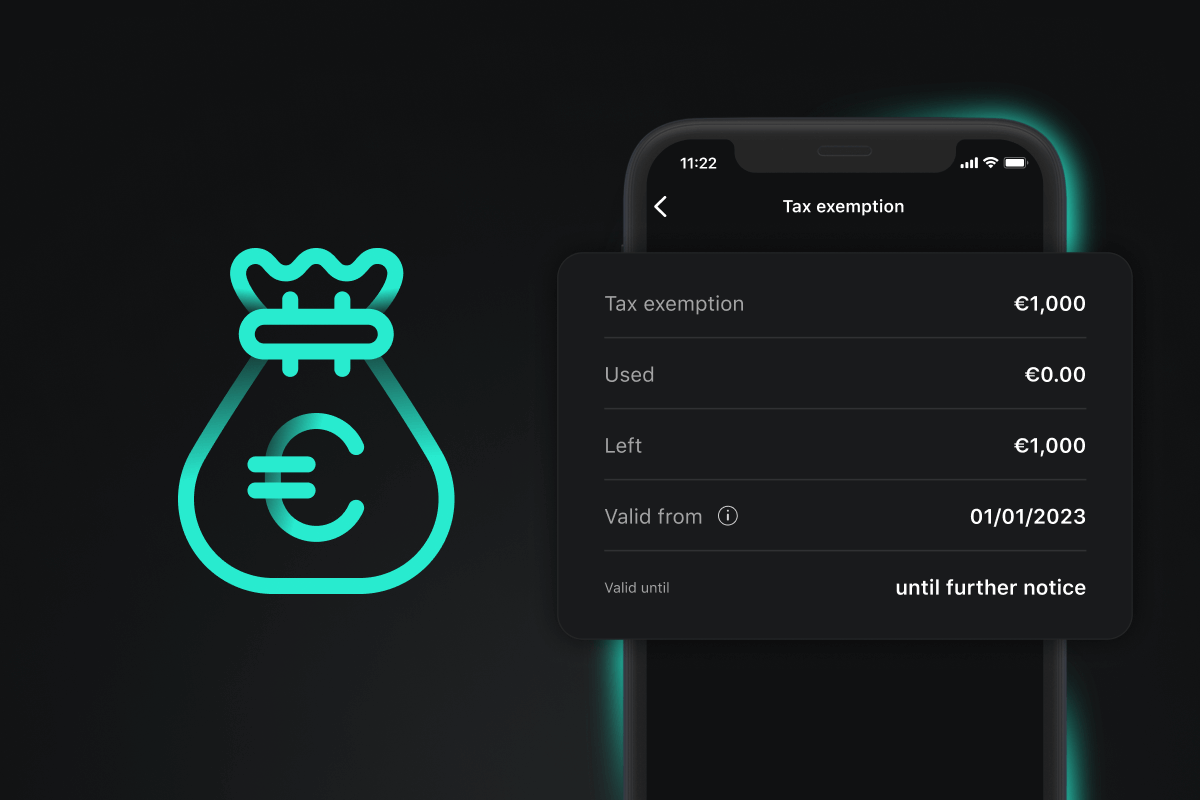

Tax Allowance For 2023 Increases

https://de.scalable.capital/images/kcbf79ije7q7/7gw2NUPVaC8b3JD25eC3ri/b49bbecb57168e32f1bb122d6659dd23/Asset_Blog_Tax_Allowance_Increase_600_EN.png

Do you need to wear a uniform for work You may be entitled to a tax rebate for the cost of cleaning and maintaining your workwear This workwear tax rebate specifically applies to employees who must wear branded uniforms The standard allowance for spending on uniform maintenance is 60 for 2011 12 so basic rate taxpayers would be able to claim 12 back 20 of 60 and higher rate payers 24 40 of 60 The 60 is a flat rate so you

The cost of the initial purchase of ordinary clothing cannot be claimed because a tax deduction is only available for employment expenses under the wholly exclusively and Learn how to claim tax relief for cleaning and replacing work clothing including eligibility criteria and claim methods

Clothes Rent Meals What Is Tax Deductible Hunter Withers

http://static1.squarespace.com/static/6376a4320f05ce50eec2ffc3/t/64139e146bf4c14849b1a147/1679007255950/unsplash-image-ojZ4wJNUM5w.jpg?format=1500w

Premium Photo The Woman Takes The Washed Clothes Out Of The Washing

https://img.freepik.com/premium-photo/woman-takes-washed-clothes-out-washing-machine_414132-329.jpg?w=2000

https://www.moneysavingexpert.com › recla…

If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a fully uniformed pilot

https://taxscouts.com › expenses › how-mu…

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In the 2024 25 tax year the flat rate expense

5 Easy Tax Deductions For A Higher Tax Return AUSTRALIA Part 1

Clothes Rent Meals What Is Tax Deductible Hunter Withers

How To Use A Washing Machine Cleanipedia ZA

How To Claim A Tax Deduction For Work Clothes Sapling

Can You Write Off Clothes Costumes For Work FreeCashFlow io 2024

Are Work Clothes Tax deductible For Self employed EMS

Are Work Clothes Tax deductible For Self employed EMS

Are Work Clothes Tax Deductible 2024 Limited Company Rules

Are Work Clothes Tax Deductible For Self Employed

Clothes Rent Meals What Is Tax Deductible Corbeau Accounting

Washing Work Clothes Tax Allowance - You could be entitled to a tax refund of 100s for up to five years of work expenses if you wear a uniform at work and have to wash fix or replace it yourself If it s a branded T shirt or a uniform specific to your industry you