What Are Qualified Medical Expenses Paid Using Hsa Distributions You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons

The taxpayer can receive tax free distributions from an HSA to pay or be reimbursed for qualified medical expenses incurred after the taxpayer establishes the HSA Qualified medical Generally qualified medical expenses for HSA purposes are unreimbursed medical expenses that could otherwise be deducted on itemized deductions Schedule A Form 1040 However you

What Are Qualified Medical Expenses Paid Using Hsa Distributions

What Are Qualified Medical Expenses Paid Using Hsa Distributions

https://i.pinimg.com/736x/0b/7d/6a/0b7d6a419e534849db35671b64946b5f.jpg

Am I Eligible For A Health Savings Account SKP Advisors Accountants

https://skpadvisors.com/wp-content/uploads/2021/10/HSA_rsz.jpg

Your Quick Guide To Qualified Medical Expenses SavingsOak

https://savingsoak.com/wp-content/uploads/2021/06/blog5-cover.png

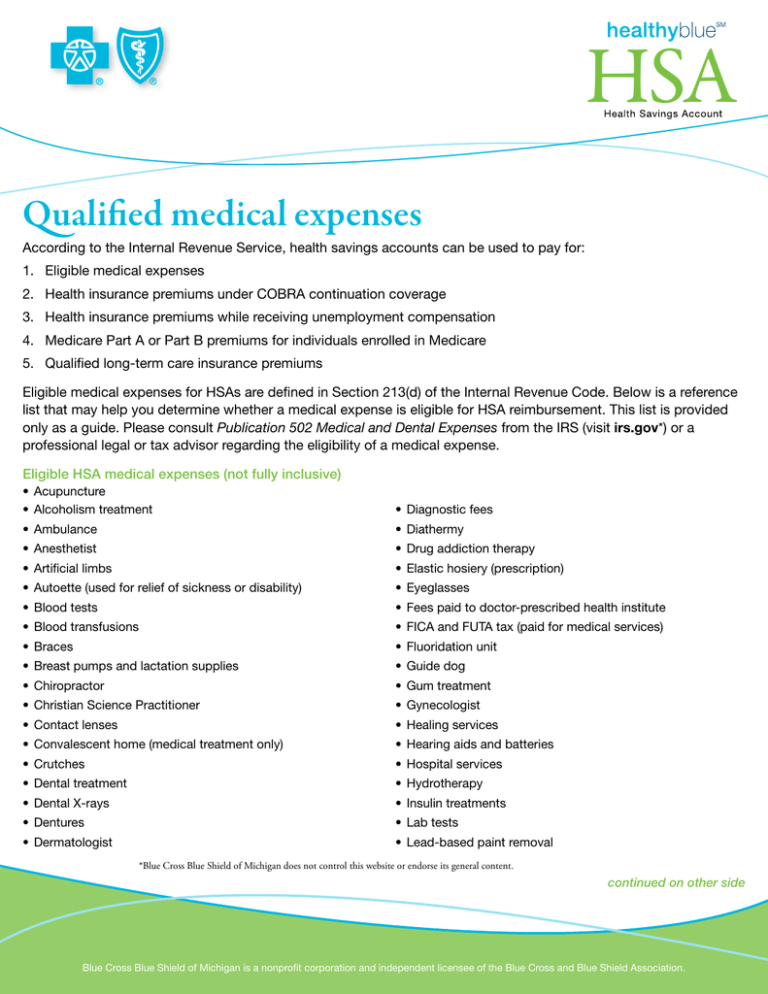

Individuals can withdraw money from their HSA to pay for eligible medical expenses also known as qualified medical expenses for the account holder their spouse or their dependents What medical expenses does my HSA cover To be considered a qualified medical expense QME the expense must be incurred after the HSA is established and must qualify for the medical and dental expense tax deduction

When it s time to use the money in your HSA it s important to understand the types of medical expenses that can be paid or reimbursed tax free 1 Distributions from an HSA are tax free1 You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings account HSA health care flexible spending account

Download What Are Qualified Medical Expenses Paid Using Hsa Distributions

More picture related to What Are Qualified Medical Expenses Paid Using Hsa Distributions

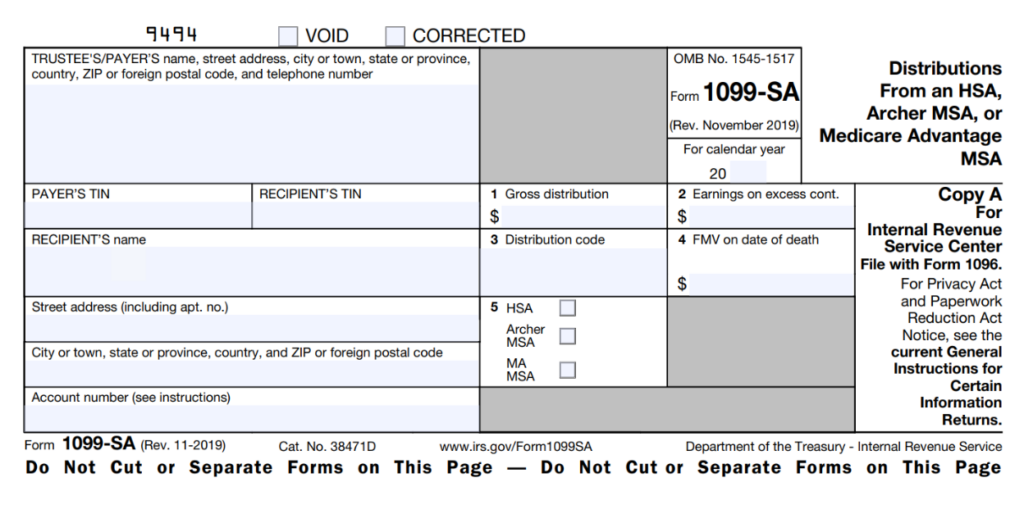

Need Your Health Savings Account Tax Form Asante News Site

https://news.asante.org/wp-content/uploads/2023/02/image2022-8-8_13-22-30-1024x505.png

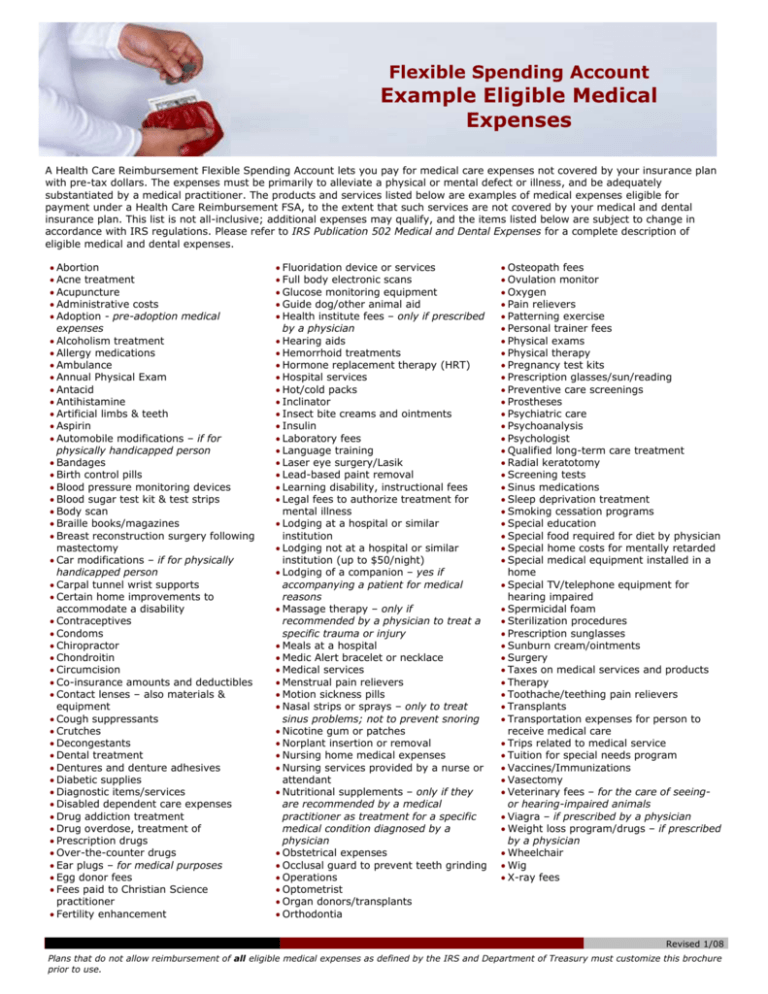

Flexible Spending Account Example Eligible Medical Expenses

https://s3.studylib.net/store/data/007783568_2-ce6693b5ed4cb9d25441e26bfd42732d-768x994.png

HSA Qualified Medical Expenses

https://s2.studylib.net/store/data/012820623_1-1132dc89d22ae76677bae033049228ca-768x994.png

This article details how qualified medical expenses function for an HSA Covers both tax benefits and who when and what are considered qualified But section 213 does something else it sets out the expenses to be eligible to be paid or reimbursed under an HSA FSA Archer MSA or HRA You can benefit from those plans even if you don t

Ed Zurndorfer discusses the tax savings when HSA distributions are made to pay medical expenses including which expenses are qualified IRS reporting requirements and IRS Publication 502 has a detailed list of what medical expenses you can pay with HSA funds in order for the distribution to be considered qualified They include prescription

5 Things To Know About Health Savings Accounts ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

Health Savings Account Qualified Medical Expenses MTB Management

https://mtbmanagement.zendesk.com/hc/article_attachments/5386049021332/Capture2.JPG

https://www.irs.gov/publications/p969

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons

https://apps.irs.gov/app/vita/content/17s/37_09_005.jsp?level=advanced

The taxpayer can receive tax free distributions from an HSA to pay or be reimbursed for qualified medical expenses incurred after the taxpayer establishes the HSA Qualified medical

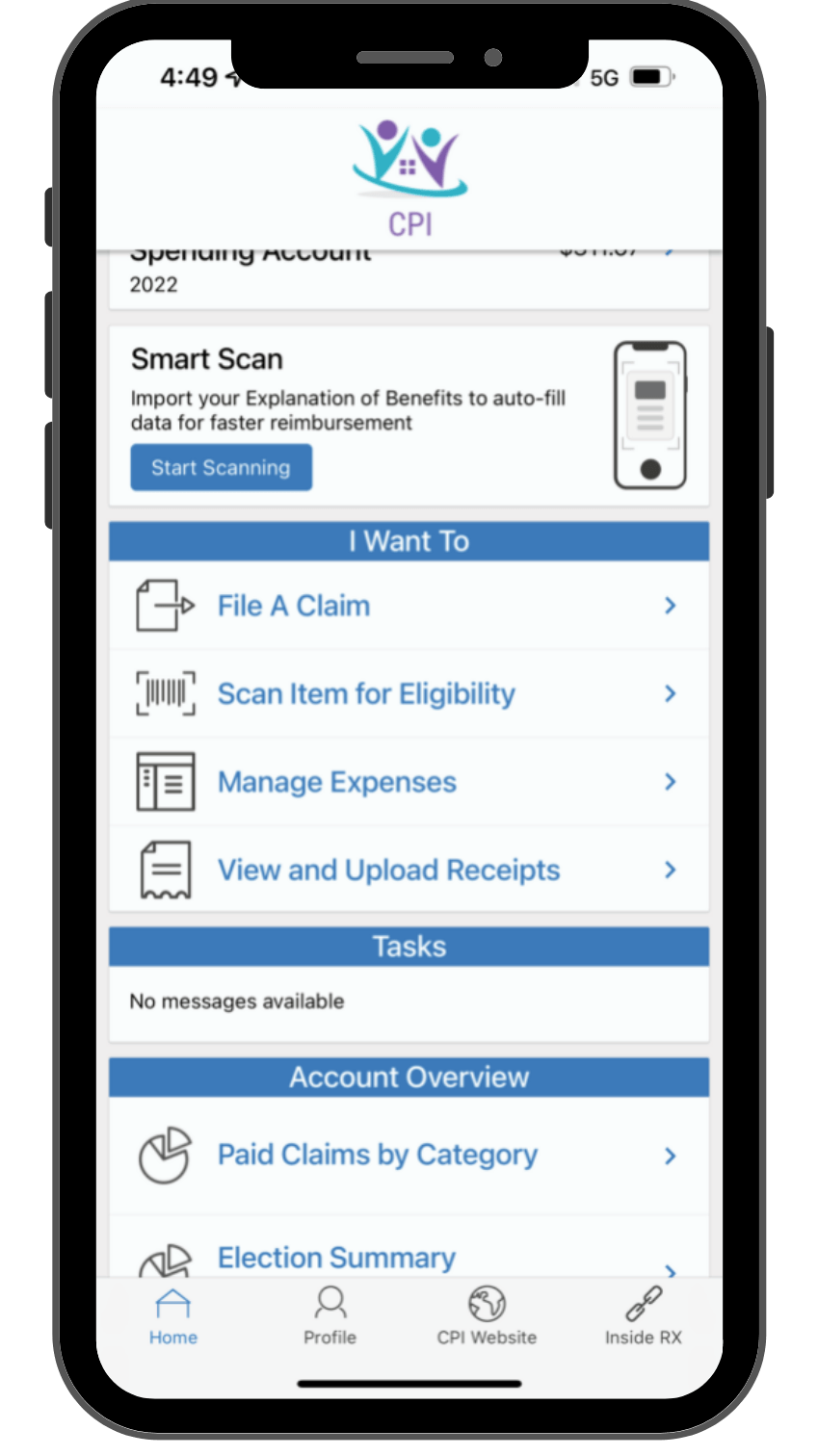

Health Savings Account Administration HSA Benefits Administration

5 Things To Know About Health Savings Accounts ThinkHealth

Qualified Vs Non Qualified Roth IRA Distributions

ERC Credit FAQ 63 Does The Amount Of Qualified Health Plan Expenses

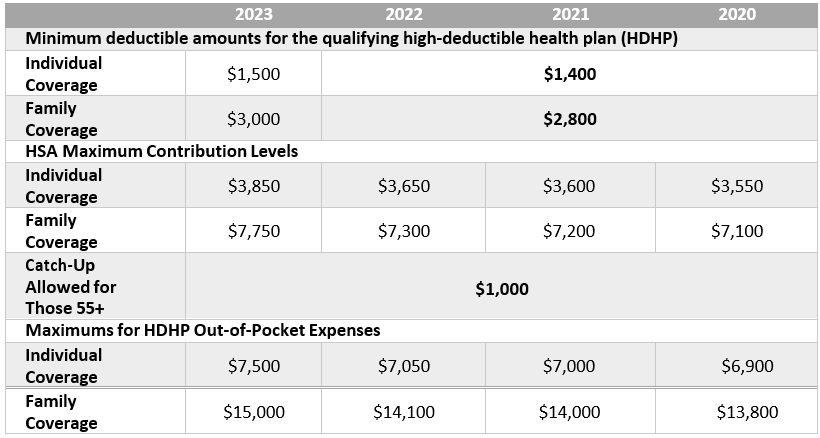

Update 2023 IRS Inflation Adjustments Are Here

Selecting The Correct IRS Form 1099 R Box 7 Distribution Codes Ascensus

Selecting The Correct IRS Form 1099 R Box 7 Distribution Codes Ascensus

Why Should You Consider A Health Savings Account HSA For Long term

Ready To Use Your 529 Plan Coldstream

Can I Use My HSA Money To Pay For My Health Insurance Premiums Sapling

What Are Qualified Medical Expenses Paid Using Hsa Distributions - When it s time to use the money in your HSA it s important to understand the types of medical expenses that can be paid or reimbursed tax free 1 Distributions from an HSA are tax free1