What Can I Claim On Tax As A Sole Trader Support Worker Community support workers and direct carers guide to income allowances and deductions for work related expenses Last updated 2 June 2024 Print or

Sole trader claim the deductions in your individual tax return in the Business and professional items schedule using myTax or a registered tax agent You would then claim those expenses as a business deduction as they are cost incurred in operating of your business There is no set list of what you can claim as

What Can I Claim On Tax As A Sole Trader Support Worker

What Can I Claim On Tax As A Sole Trader Support Worker

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

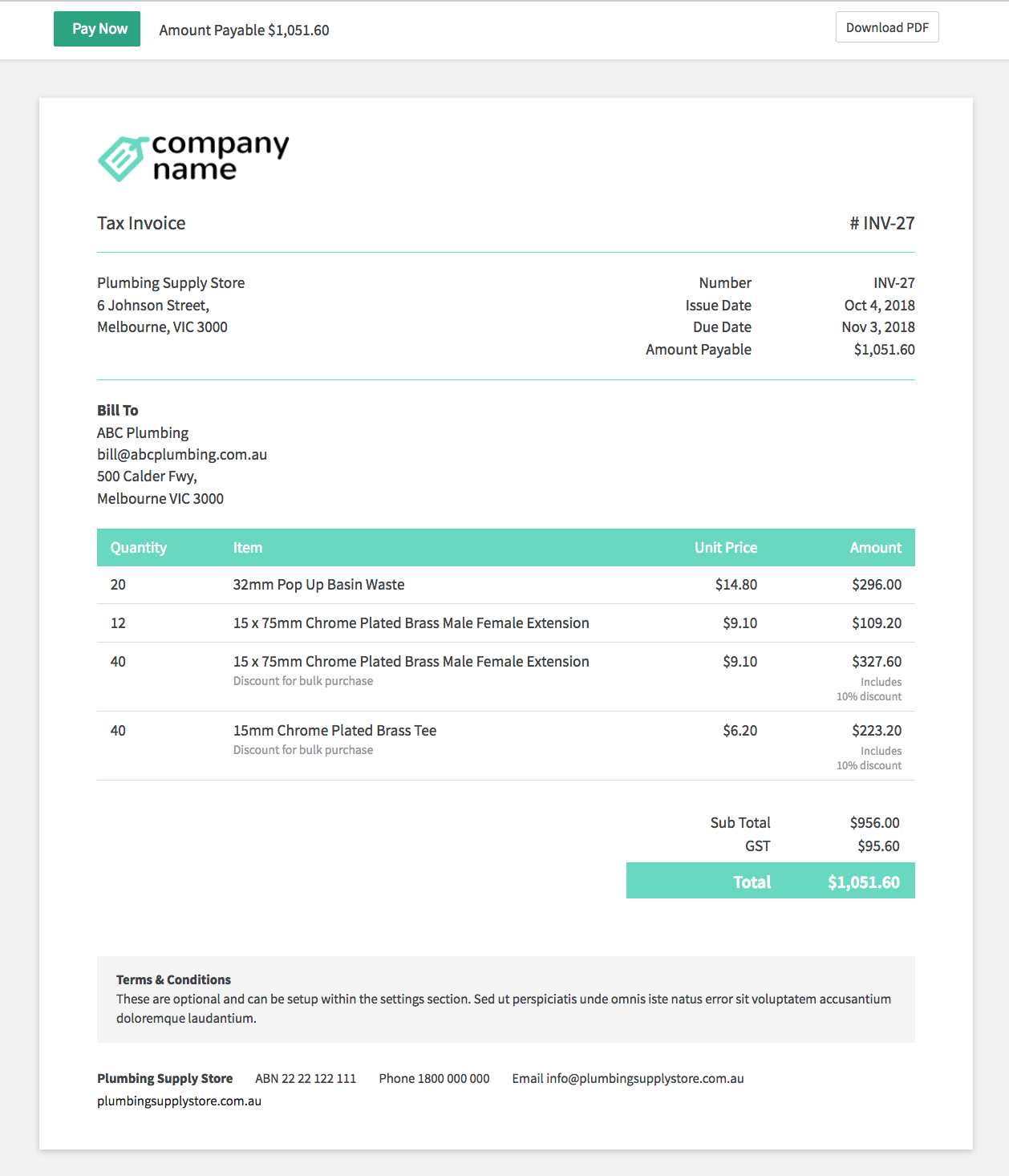

Sole Trader Support Worker NDIS Invoice Template Sample My Foundations

https://www.myfoundations.com.au/wp-content/uploads/2020/08/invoice-3739354_1920.jpg

How To Complete Your Tax Return As A Sole Trader A Step By Step Guide

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/6273a312d44c223c7e14d513_R7OgsNjH4lig39o8XRd69U_UntN9gZN64X-layY-5kLM2h2EPqAwUKrQJEo8MT3dbnndQsaPLQpYTnmGyqa5KWJrD2D4WY1WXbi4F0gEgQKqYDPSynhakOIXRElrzkwPB9N7AN1zMGktXtHqKg.png

Personal Support Workers can claim tax deductions for the cost of purchasing and using a laptop or mobile phone to communicate with clients If you claim more than 50 you If you re set up as a sole trader you can claim deductions in the Business and professional items section of your individual tax return You can either do this yourself by lodging

Sole trader tax deductions What can business owners claim Getting tax deductions as a sole trader is one of the benefits of being self employed A tax Trump made a series of misleading claims on topics ranging from Jan 6 to terrorism to taxes at the first 2024 presidential debate while Biden flubbed some facts

Download What Can I Claim On Tax As A Sole Trader Support Worker

More picture related to What Can I Claim On Tax As A Sole Trader Support Worker

11 STEPS TO SETTING UP AS A SOLE TRADER SELF EMPLOYED Post 7 Of 10

https://i.pinimg.com/originals/9c/f8/4c/9cf84c237adfa1389e95d8971b978fa9.jpg

Automate Sole Trader Taxes With AI At Taxly ai

https://taxly.ai/wp-content/uploads/2023/12/Group-24.png

How To Complete Your Tax Return As A Sole Trader A Step By Step Guide

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/6273a365444f1a80c1a7a40e_RRz7aEc0EzA2_9ESzOBP3D1EQ6XLzxOJ-q3AaGpYLCFk9foDdfkf2ZXAmwhC5ou09uV_VSzc-xJoQ7JNCOMbs2Jrior3YZCir03TE8VamsFrTDxefYo4-gG2S8ayzrYw4FtGR-bnM-VKim7Ntw.png

You can claim tax back on some of the costs of running your business what HMRC calls allowable expenses These appear as costs in your business accounts Donald Trump and President Biden are set to take the debate stage at 9 p m Thursday for the first time in 2024

A checklist guide to Support Worker Tax Deductions See what you can claim for disability support work as either a Sole Trader or Employee To claim any of these sole trader tax deductions evidence is key You ll need to keep your receipts bank statements financial records and contracts Your

Paying Yourself And Managing Taxes As A Sole Trader More Than Accountants

https://www.morethanaccountants.co.uk/wp-content/uploads/2023/12/Paying-Yourself-and-Managing-Taxes-as-a-Sole-Trader.png

How To Complete Your Tax Return As A Sole Trader A Step By Step Guide

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/6273a38491505ed34870ec3d_xetQv6k7a8OsVfMe7dGDkxF-6xB_t0UtLd-aDCPkpt5_JQdc0bvR9hrmTEAufe3rv_Zw9tYEprFSlQiDk4dhP4yQ5ow8QHiYGtd4FtKy5tHHYc-h2MuqdczqOOHWzQ_E-5H3Kp4_lEL8gpxcqw.png

https://www.ato.gov.au/individuals-and-families/...

Community support workers and direct carers guide to income allowances and deductions for work related expenses Last updated 2 June 2024 Print or

https://www.ato.gov.au/businesses-and...

Sole trader claim the deductions in your individual tax return in the Business and professional items schedule using myTax or a registered tax agent

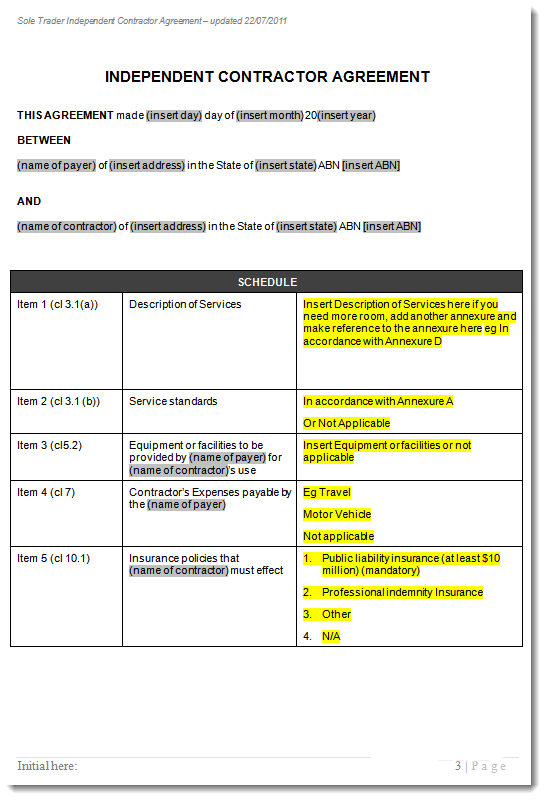

Sole Trader Invoice Template Free Printable Templates

Paying Yourself And Managing Taxes As A Sole Trader More Than Accountants

Free Invoice Template Uk Use Online Or Download Excel Word Sole

Sole Trader Invoice Template Invoice Complete Riset

Self Assessment Tax Return 6 Tips For Sole Traders Penfold

Australian Sole Trader Invoicing Simple Invoices For Sample Tax Invoice

Australian Sole Trader Invoicing Simple Invoices For Sample Tax Invoice

How Do You Write Off Fuel On Your Taxes Leia Aqui Is It Better To

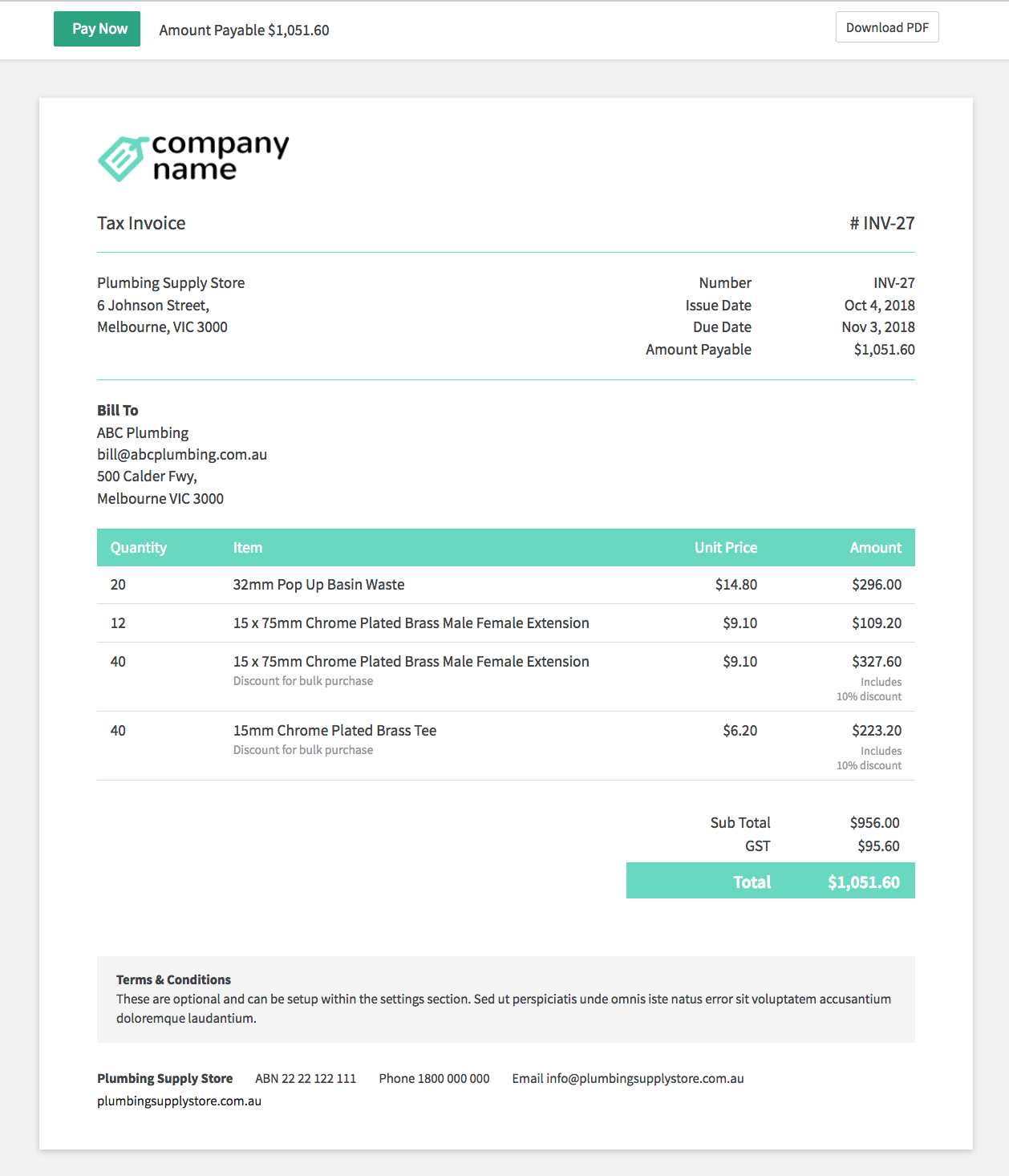

Sole Proprietorship Contract Template

Invoice Template For Sole Proprietor

What Can I Claim On Tax As A Sole Trader Support Worker - If you re set up as a sole trader you can claim deductions in the Business and professional items section of your individual tax return You can either do this yourself by lodging