What Deductions Can You Claim As A Nurse Verkko 13 kes 228 k 2023 nbsp 0183 32 Nurses and midwives guide to income allowances and claiming deductions for work related expenses Last updated 13 June 2023 Print or

Verkko If you ve ever wondered quot Are scrubs a tax write off for nurses quot or quot What tax deductions can a nurse take you ve come to the right place Read on for a list of the top tax Verkko Frequently Asked Questions Top 9 Nurse Tax Deductions Employed and contract nurses can take advantage of general deductions and tax credits like student loan

What Deductions Can You Claim As A Nurse

What Deductions Can You Claim As A Nurse

https://southernpb.com/wp-content/uploads/2021/06/How-To-Obtain-Small-Business-Tax-Deductions-1.png

COVID 19 What Deductions Can You Claim Back At Tax Brighte Blog

https://media.graphassets.com/ySm8jpnTbmVKZh8YdYqd

What Tax Deductions Can You Claim Without Receipts Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/IQpcd3jf5Wjwhbavj12bn/cceb5f092bc5456e1db7c26687444c02/BenchBlog_TaxTips_FindOutHowMuchYouOwetheIRS.png?h=800&q=70&w=800

Verkko 20 huhtik 2023 nbsp 0183 32 In this article we discuss all things tax tax returns tax deductions how to reduce your taxable income and the expenses nurses and midwives can claim as a tax deduction Keep reading to Verkko 20 huhtik 2023 nbsp 0183 32 Here s a list of 30 things nurses can claim as tax deductions Find out whether your AHPRA fee nursing uniforms are claimable or not here Healthcare Facilities

Verkko 28 jouluk 2022 nbsp 0183 32 One of the most common deductions available to nurses and health professionals is for work related expenses These deductions can include uniforms travel expenses professional Verkko 18 maalisk 2022 nbsp 0183 32 As a nurse you may deduct these expenses for nurses income tax deductions while filing your taxes How often do you visit your clients at home If you

Download What Deductions Can You Claim As A Nurse

More picture related to What Deductions Can You Claim As A Nurse

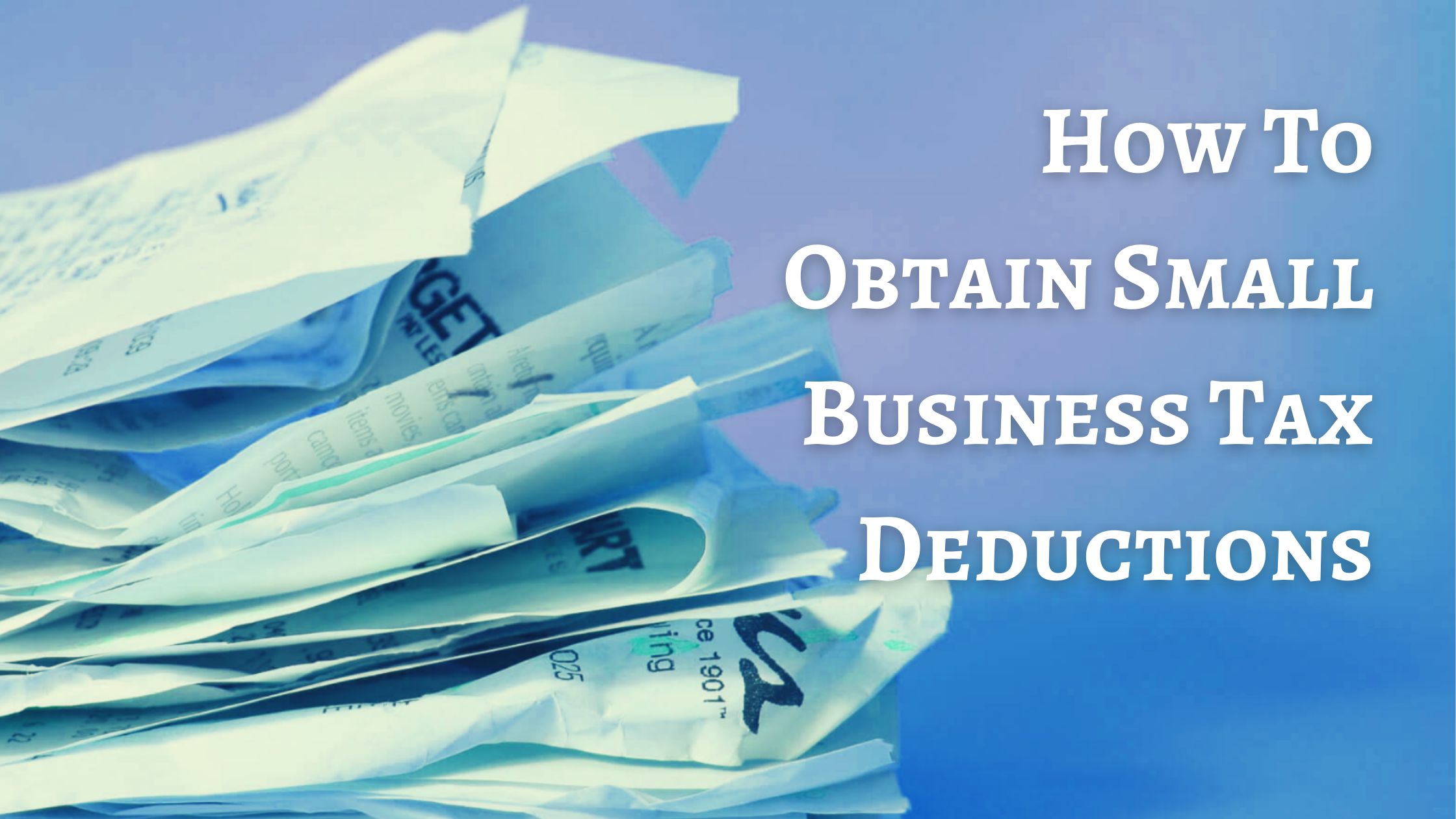

Top 10 Tax Deductions Synchrony Bank Synchrony Bank

https://www.synchronybank.com/images/hero-top-10-tax-deductions-you-should-know-about_1140x570.jpg

Don t Miss These Common Tax Deductions For Your New Business

https://www.wattleaccountants.com.au/wp-content/uploads/2022/08/pexels-karolina-grabowska-5900135-scaled.jpg

Working From Home What Deductions Can You Claim DGL Accountants

https://www.dglaccountants.com.au/wp-content/uploads/Work-from-home.jpg

Verkko 3 toukok 2023 nbsp 0183 32 There are no longer deductions available for you as an employee If you work as a contract nurse such as a traveling nurse home health care etc you Verkko 29 maalisk 2022 nbsp 0183 32 Itemize Versus Standard Deduction Once you know which deductions you re eligible for it s important to know the difference between an itemized and a standard deduction because you need to

Verkko 22 kes 228 k 2022 nbsp 0183 32 There are standard deductions that you can claim regardless of what area of nursing you work in Most nurses will be familiar with the standard Verkko Tax Deductions for Nurses amp Midwives For nurses tax deductions are a great way to improve your tax refund But keep your receipts to ensure you don t miss out As a

Working From Home What Deductions Can You Claim Business Edge Advisors

https://www.edgea.com.au/wp-content/uploads/2018/12/home_office_1543918882-1024x681.jpeg

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

https://www.ato.gov.au/Individuals/Income-deductions-offsets-and...

Verkko 13 kes 228 k 2023 nbsp 0183 32 Nurses and midwives guide to income allowances and claiming deductions for work related expenses Last updated 13 June 2023 Print or

https://www.everlance.com/blog/tax-deductions-nurses

Verkko If you ve ever wondered quot Are scrubs a tax write off for nurses quot or quot What tax deductions can a nurse take you ve come to the right place Read on for a list of the top tax

Free LLC Tax Calculator How To File LLC Taxes Embroker

Working From Home What Deductions Can You Claim Business Edge Advisors

What Deductions Can You Claim

10 Things New Business Owners Must Know Rate exchange

Expired Tax Breaks Deductible Unreimbursed Employee Expenses

Small Business Expenses Tax Deductions 2023 QuickBooks

Small Business Expenses Tax Deductions 2023 QuickBooks

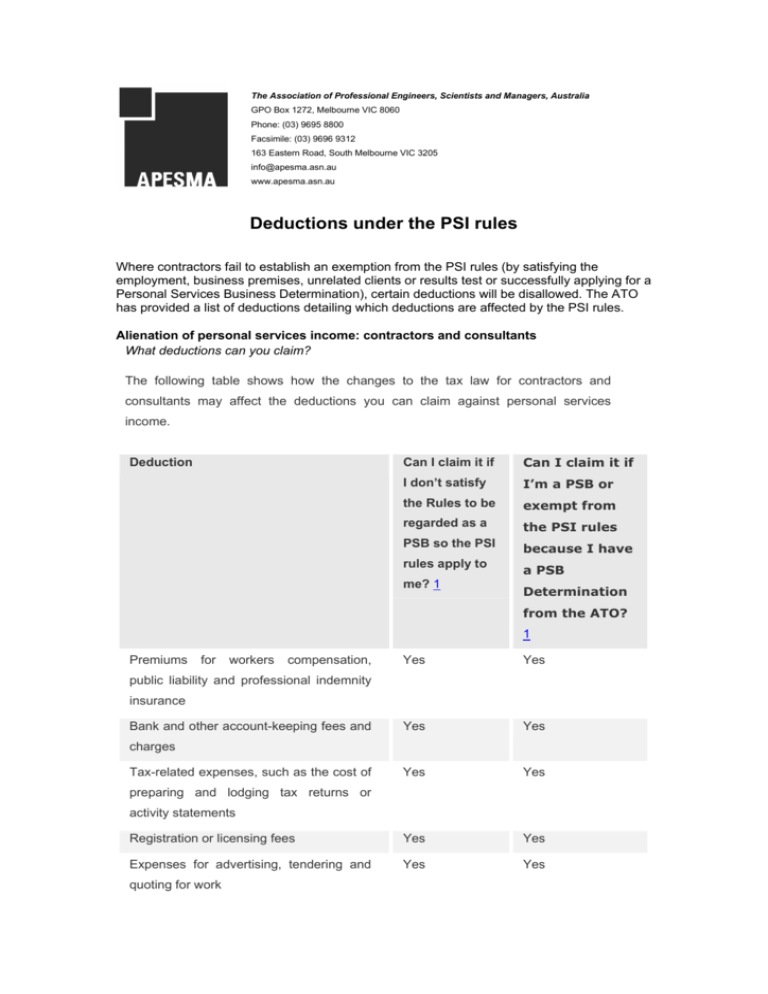

Deductions Under The PSI Rules

Alimony Advice News Features Tips Kiplinger

What Deductions Can You Claim On Your Website Abacus Professional

What Deductions Can You Claim As A Nurse - Verkko 18 maalisk 2022 nbsp 0183 32 As a nurse you may deduct these expenses for nurses income tax deductions while filing your taxes How often do you visit your clients at home If you