What Energy Star Appliances Are Tax Deductible You can t claim Energy Star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return But many state and local

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary While you can t claim your standard energy efficient appliances like a dishwasher or a dryer you can most likely get a federal tax credit for any renewable energy systems that

What Energy Star Appliances Are Tax Deductible

What Energy Star Appliances Are Tax Deductible

https://www.solarreviews.com/content/images/blog/post/focus_images/1092_shutterstock_701043430.jpg

Are Appliances Tax Deductible

https://taxsaversonline.com/wp-content/uploads/2022/07/Are-Appliances-Tax-Deductible-2-1024x683.jpg

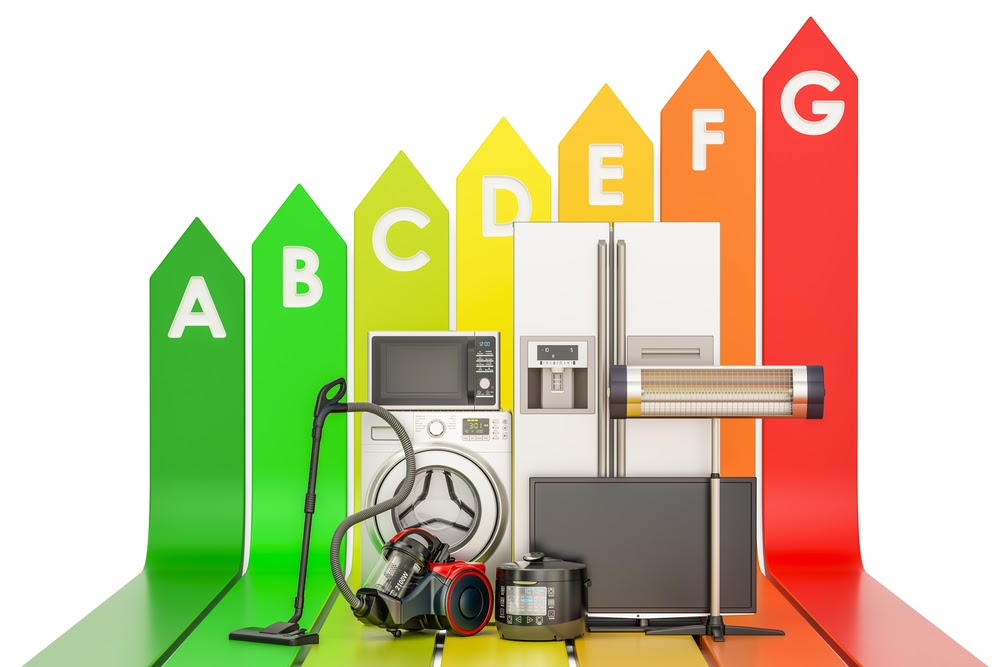

How Appliances Affect Your Household s Electricity Consumption

https://startsmarter.co.uk/wp-content/uploads/2022/06/households-electricity-consumption.jpg

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements Tax Credit Definitions Information updated 2 16 2023 Please note not all ENERGY STAR certified products qualify for a tax credit ENERGY STAR certifies

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement

Download What Energy Star Appliances Are Tax Deductible

More picture related to What Energy Star Appliances Are Tax Deductible

What Are The Tax Implications When Expanding Overseas

https://advancedproaccountant.com.au/content/images/2021/06/40454-70.jpg

Guide To Rental Property Appliance Depreciation FortuneBuilders

https://www.fortunebuilders.com/wp-content/uploads/2020/02/are-appliances-tax-deductible-768x512.jpg

5 Reasons You Should Unplug All Your Appliances When Heading Out A

https://www.shipleyenergy.com/wp-content/uploads/2021/01/iStock-525416877.jpg

IR 2024 113 April 17 2024 WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal Equipment type Tax Credit Available for 2022 Tax Year Home Clean Electricity Products Solar electricity Fuel Cells Wind Turbine Battery Storage Heating Cooling and Water

Federal Tax Credits For Energy Efficiency Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and Yes all ENERGY STAR certified solar hot water heaters are eligible for the tax credit Discover more home improvement tax credits and energy efficient appliance rebates

What Are The Best Energy Efficient Appliances For A New Home

https://nlhomestampa.com/wp-content/uploads/2020/08/energy-efficient-appliances.jpeg

Where To Donate Used Appliances Top 7 Places Cabin Lane

https://cabinlane.com/wp-content/uploads/2021/07/where-to-donate-used-appliances-768x512.jpg

https://ttlc.intuit.com/turbotax-support/en-us/...

You can t claim Energy Star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return But many state and local

https://www.energystar.gov/products/ask-the...

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary

How To Donate Appliances

What Are The Best Energy Efficient Appliances For A New Home

Pin On Appliances

How To Donate Appliances

How To Make A House More Energy Efficient In 2022

Which Charitable Contributions Are Tax Deductible Infographic

Which Charitable Contributions Are Tax Deductible Infographic

Are Appliances Tax Deductible

TakeCharge VA Efficient Products Program Appliances

TakeCharge VA Efficient Products Program Appliances

What Energy Star Appliances Are Tax Deductible - Specifically when someone owns a washer and dryer rental business they must pay self employment taxes if their net earnings exceed 400 This tax is calculated as 15 3 of