What Expenses Can I Claim On My Airbnb What expenses are allowed for Airbnb hosts You can reduce your tax bill as an Airbnb host by deducting many of these common tax deductible expenses water rates council tax gas electricity insurance costs of services

Depreciation cost segregation furnishings cleaning maintenance fees marketing home office deduction commissions and fees mortgage interest and insurance and other indirect expenses are just a few of the tax By claiming these deductions you can lower the amount of Airbnb income taxes you owe For hosts tax deductions can include a wide range of expenses related to renting out your property

What Expenses Can I Claim On My Airbnb

What Expenses Can I Claim On My Airbnb

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

AirBnB Taxes Everything You Need To Know For 2020 Tax Season

https://www.picnictax.com/wp-content/uploads/2020/01/alex-block-bb7YrenUr3o-unsplash-1377x2048-1.jpg

As a new host you can deduct various expenses to manage your rental effectively including a portion of utilities guest supplies like coffee property related costs Learn about 20 essential tax deductions for Airbnb hosts including mortgage interest repairs professional services and more Maximize your profits and reduce your tax

You can fully deduct related expenses including the phone purchase and monthly bills If you also use your phone for personal reasons you should only deduct the portion used for business Renting out your property on Airbnb can be lucrative but it also comes with its share of responsibilities especially when tax season rolls around To maximize your

Download What Expenses Can I Claim On My Airbnb

More picture related to What Expenses Can I Claim On My Airbnb

What Expenses Can I Claim For The Accountancy Partnership

https://www.theaccountancy.co.uk/wp-content/uploads/2014/02/manage-your-expenses-1110x511.jpg

Claiming Expenses On Rental Properties 2022 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/rental-income-tax.jpg

What Expenses Can I Claim With My Novated Lease Maxxia

https://sagov.maxxia.com.au/sites/sa_gov/files/styles/jumbotron_angle/public/MAX_SAGOV_Blog_Feature_WhatExpensesCarIClaim_1920x700_0.jpg?itok=OW-k6M_q

So claiming expenses is an easy way to recoup taxes owed All you need is to keep track of what you re allowed to claim and keep records for future reference In this blog post we will take a look at what expenses homeowners who let all or part of their UK property as an Airbnb can claim for tax purposes and what the tax implications are

What Expenses Can I Write Off for Airbnb As an Airbnb host you might be worried about the expenses associated with running a short term rental But the good news is that you You can claim tax deductions for all expenses which are incurred in deriving your rental income Typically where the entire property is rented out all of the costs involved in running the

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

What Travel Costs Can I Claim As A Business Expense When I Travel Full

https://images.squarespace-cdn.com/content/v1/5510bad9e4b0ce924f0445c5/1591045269227-VP84B76ENM22TGRFB25R/Can+I+claim+my+travel+expenses+as+business+expenses+when+I+travel+full+time+as+a+digital+nomad+or+full-time+RVer.+NuventureCPA.com

https://moneysavinganswers.com › persona…

What expenses are allowed for Airbnb hosts You can reduce your tax bill as an Airbnb host by deducting many of these common tax deductible expenses water rates council tax gas electricity insurance costs of services

https://andersonadvisors.com › blog › short …

Depreciation cost segregation furnishings cleaning maintenance fees marketing home office deduction commissions and fees mortgage interest and insurance and other indirect expenses are just a few of the tax

What Expenses Can I Claim CIS EEBS

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

Can I Claim Medical Expenses On My Taxes TMD Accounting

Can You Deduct Unreimbursed Employee Expenses In 2022

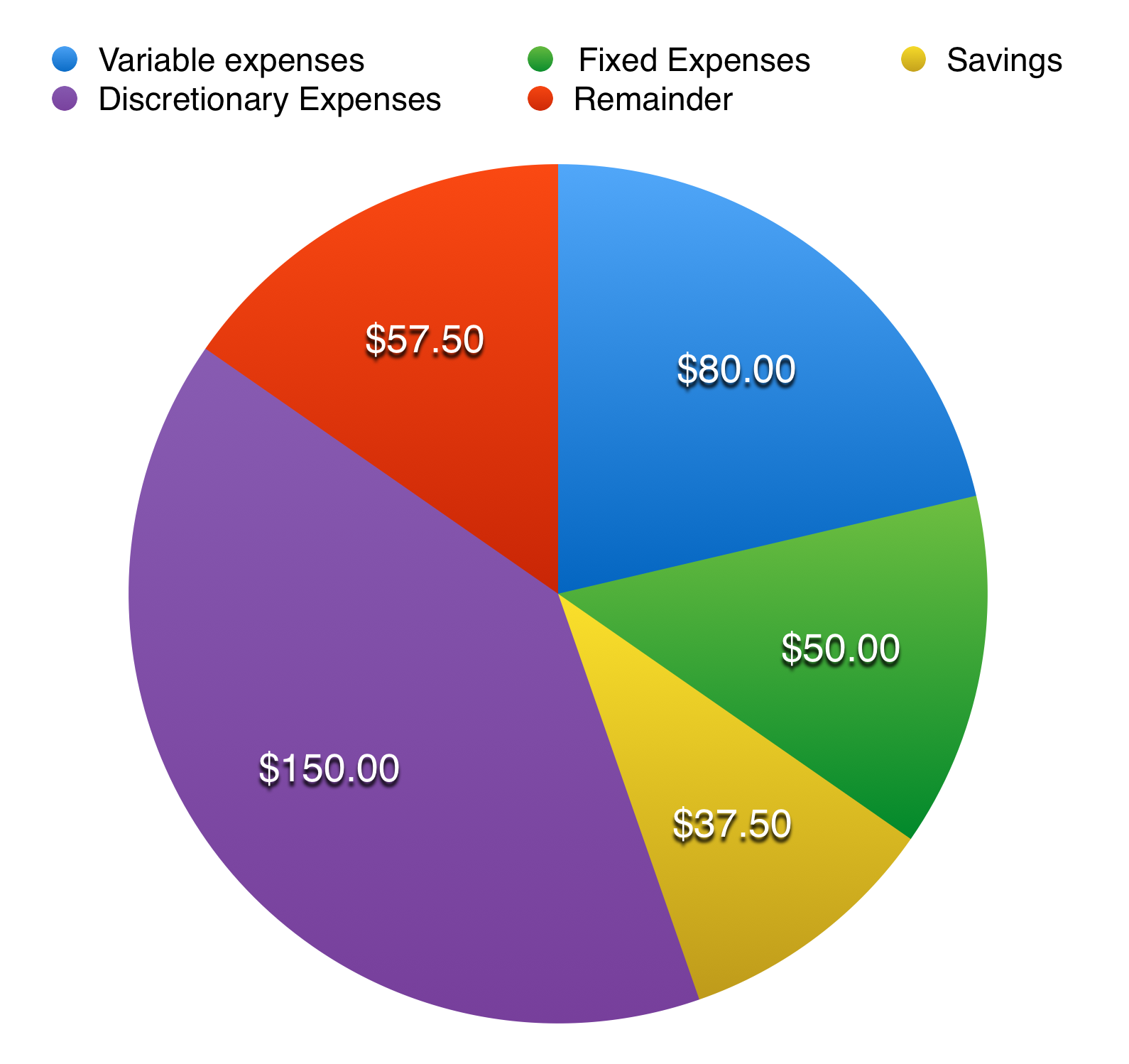

Budgeting Financial Literacy

What Expenses Can I Claim On My Buy To Let Properties

What Expenses Can I Claim On My Buy To Let Properties

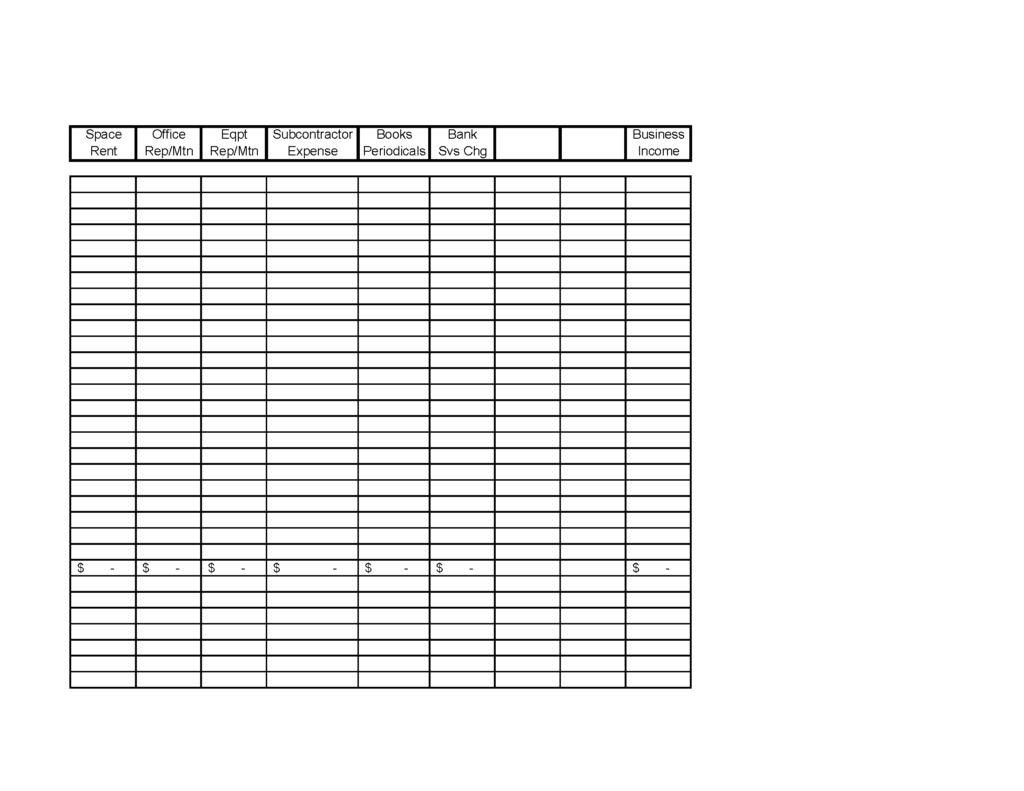

Self Employed Expenses Spreadsheet Regarding Schedule C Expenses

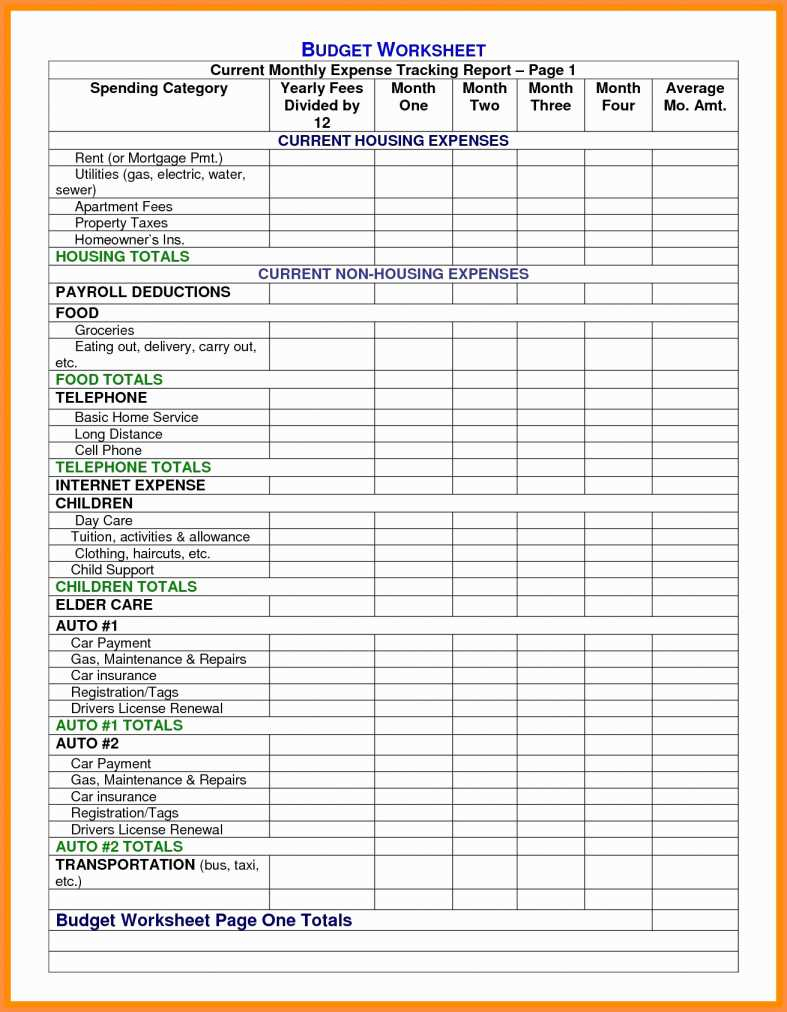

Printable Tax Preparation Checklist Excel

Image Result For Hair Salon Expenses Printable Business Tax

What Expenses Can I Claim On My Airbnb - You can claim legal fees directly relating to the operation of your rental property fees for resolving tax issues fees for the preparation of tax forms for your business and fees for unlawful