What Expenses Can I Deduct For Doordash If you have any questions about your own taxes and what business related expenses may be deductible please consult a tax professional Q How do I update my

Odds are good that as a dasher you re spending a lot on your car You can deduct costs like these using either the standard mileage rate or the actual expense method Gas Maintenance What expenses can I write off for DoorDash Dashers can write off fuel maintenance repairs parking and tolls insurance phone and service roadside

What Expenses Can I Deduct For Doordash

What Expenses Can I Deduct For Doordash

https://njmoneyhelp.com/wp-content/uploads/2014/12/tax-6-401kcalculator.org_-968x726.jpg

What Expenses Can You Deduct

https://media-exp1.licdn.com/dms/image/D4D12AQEysguo1ZrG9Q/article-cover_image-shrink_720_1280/0/1668097283422?e=2147483647&v=beta&t=N0yLW9sBK2U1GqNuXs2uchc77KuUiE89ALiMe8MV1GM

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

Working with DoorDash Tax deductions to know about As an independent contractor you re eligible for special deductions If you use a personal car for dashing you can choose one of two methods to claim a deduction You can use certain tax deductions and business expenses to lower your total tax liability Half of your self employment tax for example is tax deductible There

As a delivery driver you can deduct business expenses like mileage vehicle maintenance and more Learn which deductions you qualify for and how to claim them Dashers can lower their taxable income by deducting business expenses such as mileage parking tolls cell phone usage insulated courier bags inspections repairs health insurance and

Download What Expenses Can I Deduct For Doordash

More picture related to What Expenses Can I Deduct For Doordash

What Expenses Can I Deduct As A 1099 Contractor Lendio

https://www.lendio.com/wp-content/uploads/2022/04/What-Expenses-Can-I-Deduct-as-a-1099-Contractor-1.jpg

Can I Deduct Mortgages For 3 Houses On My Tax Returns

https://s.hdnux.com/photos/01/32/47/05/23753055/3/rawImage.jpg

Individual Tax Deductions

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/8654/images/dGtNNfyFRc2jd72ieCJV_Blog_graphics_10.png

DoorDash drivers can only write off expenses such as gasoline if they take actual expenses as a deduction The standard mileage reimbursement includes the cost of Employee food delivery drivers often spend their own money on the job so you might be able to deduct certain work related costs at tax time including Phone bills

A calculator to help you estimate how much more taxes you will owe or how much less refund based on your earnings and expenses from Doordash The most common DoorDash tax deduction is vehicle mileage Drivers can use any type of Doordash mileage tracker to track their business miles and claim the deduction You can

Can I Deduct Health Insurance Premiums HealthQuoteInfo

https://healthquoteinfo.com/wp-content/uploads/2018/10/Can-I-Deduct-Health-Insurance-Premiums.jpg

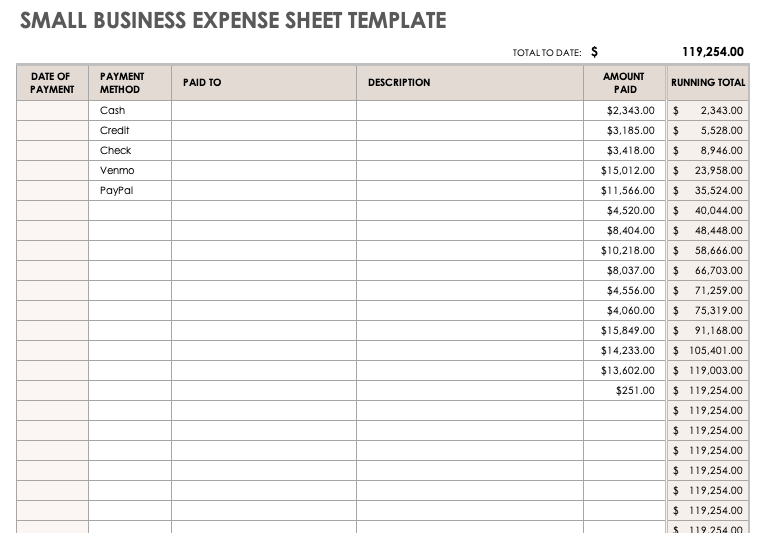

Small Business Printable Expense Report Template Printable Templates

https://www.smartsheet.com/sites/default/files/IC-Small-Business-Expense-Sheet-Template.png

https://help.doordash.com/dashers/s/article/Common...

If you have any questions about your own taxes and what business related expenses may be deductible please consult a tax professional Q How do I update my

https://www.keepertax.com/posts/doord…

Odds are good that as a dasher you re spending a lot on your car You can deduct costs like these using either the standard mileage rate or the actual expense method Gas Maintenance

Doordash Is Considered Self Employment Here s How To Do Taxes Stride

Can I Deduct Health Insurance Premiums HealthQuoteInfo

What Tax Can I Deduct For Medical Expenses Smith Rossi

What Car Expenses Can I Deduct For Business Driving YouTube

Can I Deduct Coaching As A Job Search Expense Official Site Dan Miller

Comprehensive List Of Business Expenses And Tax Deductions Annette

Comprehensive List Of Business Expenses And Tax Deductions Annette

What Can I Deduct As A Business Expense

Can I Deduct Expenses For Growing Food That I Donate Nj

Pin On Small Biz

What Expenses Can I Deduct For Doordash - You can use certain tax deductions and business expenses to lower your total tax liability Half of your self employment tax for example is tax deductible There