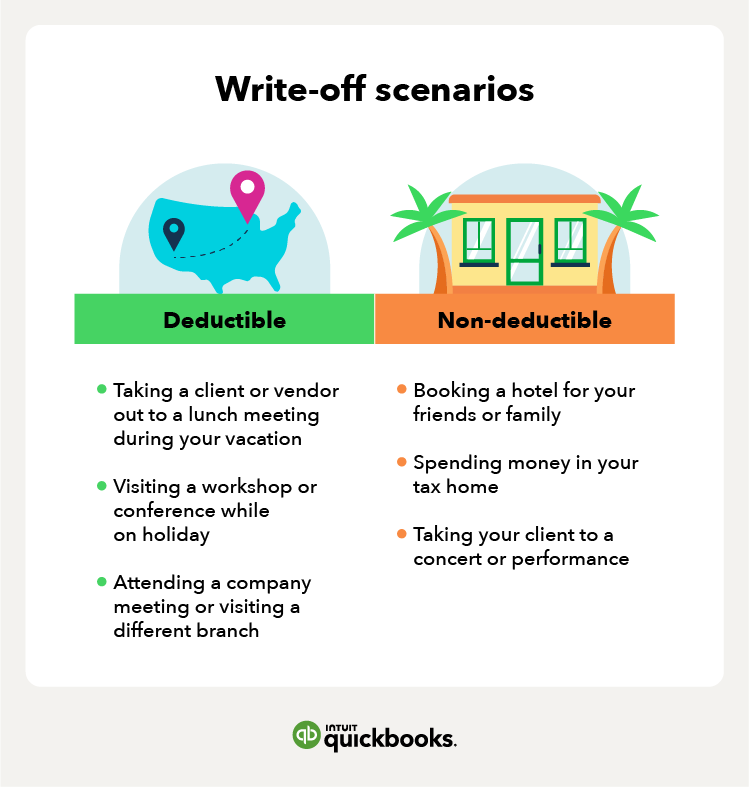

What Expenses Can I Write Off For Airbnb Whether you re a new or seasoned rental property host there s a lot to be gained from meeting with fellow property hosts or rental owners to learn from their work experiences This counts as a business meal so you can write off the cost of the meal

There are a lot of tax deductible Airbnb expenses Why does it matter Well you can offset your Airbnb income with those tax deductions The plus side is that you re likely paying for those expenses already So claiming Depreciation cost segregation furnishings cleaning maintenance fees marketing home office deduction commissions and fees mortgage interest and insurance and other indirect expenses are just a few of the tax deductions that Airbnb hosts may be eligible for

What Expenses Can I Write Off For Airbnb

What Expenses Can I Write Off For Airbnb

https://i.pinimg.com/736x/9b/eb/16/9beb16c1bad30aa0dea779d8c5c50b3c.jpg

Business Tax Write Offs 2018 Edenwes

https://webtaxonline.ca/wp-content/uploads/2018/07/office-expenses-copy.jpg

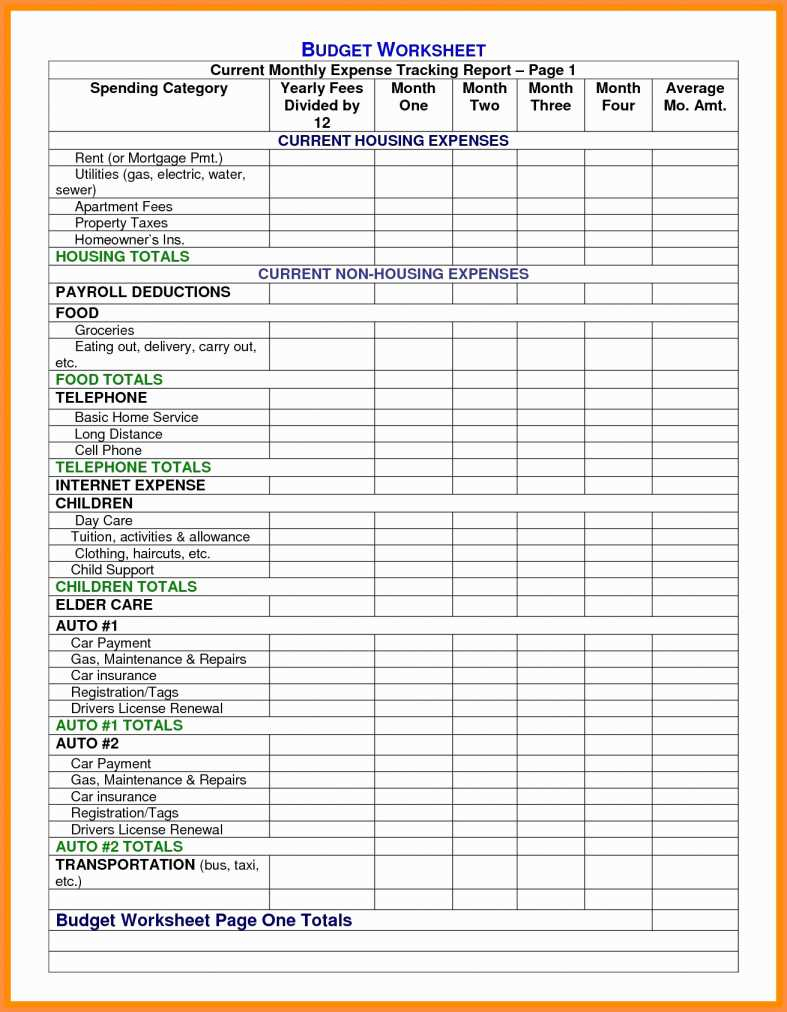

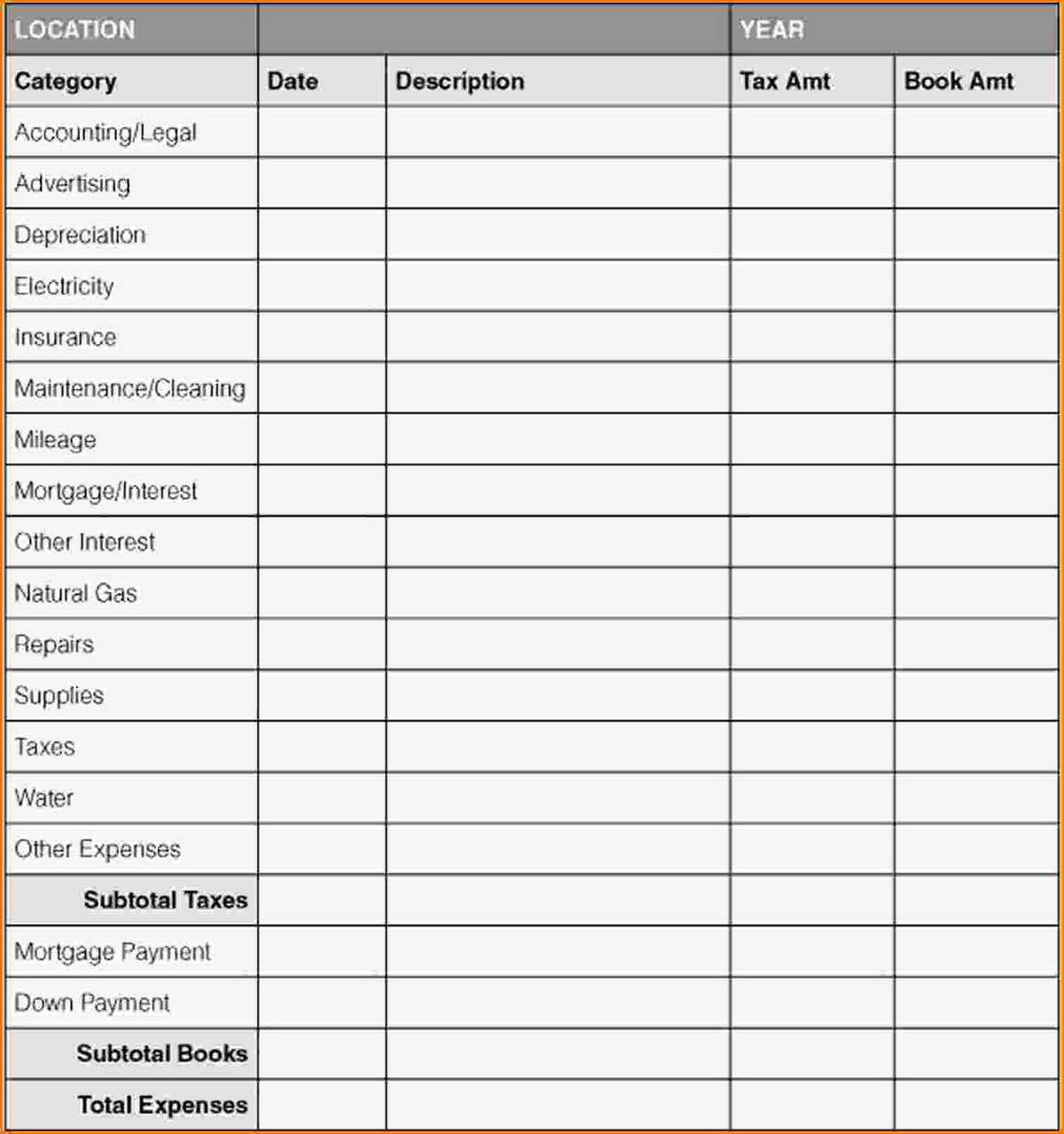

Tax Expenses Spreadsheet Within Tax Template For Expenses Return

https://db-excel.com/wp-content/uploads/2019/01/tax-expenses-spreadsheet-within-tax-template-for-expenses-return-taspreadsheet-awesome-rental.jpg

So here is the list of expenses that you can write off for your Airbnb 1 Advertising If you want to optimize your Airbnb you might consider outsourcing the promotion of your rental These expenses may include listing fees photography and other marketing initiatives to draw a huge number of guests 2 Auto and Travel Expenses Typical expenses that can be deducted from an individual s income in relation to short term lettings As a main rule all expenses relating to the rental period can be deducted from the rental income In cases where only a part of the apartment is rented out expenses are allocated and deducted

10 Airbnb Tax Write Offs You may be able to deduct certain expenses if you rent out your personal or additional residence for more than 15 days in a tax year We ve shared a list of potential short term rental tax deductions below 1 Depreciation You can recover some of the costs of your rental properties by taking a depreciation What expenses can I write off for an Airbnb You can write off deduct all ordinary and necessary expenses for your Airbnb business as long as you in business to make a profit not a hobby The amount you can write off depends on two factors

Download What Expenses Can I Write Off For Airbnb

More picture related to What Expenses Can I Write Off For Airbnb

What Can I Write Off If I Am 1099 Ethel Hernandez s Templates

https://i.pinimg.com/originals/f7/c5/0b/f7c50b365b0c710ababccbed71d1fde2.png

Can I Write Off business Expenses Without Having An LLC

https://assets.website-files.com/60ea39bf3d69eb332f567a61/62642fe5b78455e01627bdfe_email.jpeg

Business Tax Expenses Worksheet

https://i.pinimg.com/originals/6f/eb/d5/6febd52815bdd63ebb68a598d20ee5d5.png

What expenses are deductible from my Airbnb income as a host of a stay Deductible items may include rent mortgage cleaning fees rental commissions insurance and other expenses How to Are Airbnb stays tax deductible It is not possible for us to provide charitable donation tax receipts for Airbnb stays at this time General info 1 A new deduction Instead of letting property owners deduct only 50 percent of your furniture and equipment the new tax law now allows owners to deduct 100 percent of expenses for personal

What expenses are deductible from my Airbnb income as a host of a stay Deductible items may include rent mortgage cleaning fees rental commissions insurance and other expenses How to Are Airbnb stays tax deductible It is not possible for us to provide charitable donation tax receipts for Airbnb stays at this time You can deduct all ordinary and necessary expenses to operate your rental business including guest service fees unless you use the 14 day rule In this case since the income doesn t have to be claimed the expenses cannot be claimed either 1 Learn about the 14 day rule

A Guide To Writing Off Airbnb Expenses Airbtics Airbnb Analytics

https://airbtics.com/wp-content/uploads/2023/07/A-Guide-to-Writing-Off-Airbnb-Expenses.png

Taxes You Can Write Off When You Work From Home INFOGRAPHIC

https://i.pinimg.com/originals/4f/81/0f/4f810f590598d2ffd04be627113bc257.jpg

https://www.keepertax.com/tax-write-offs/airbnb-hosts

Whether you re a new or seasoned rental property host there s a lot to be gained from meeting with fellow property hosts or rental owners to learn from their work experiences This counts as a business meal so you can write off the cost of the meal

https://www.hostfully.com/blog/airbnb-income-expenses-tax-deductions

There are a lot of tax deductible Airbnb expenses Why does it matter Well you can offset your Airbnb income with those tax deductions The plus side is that you re likely paying for those expenses already So claiming

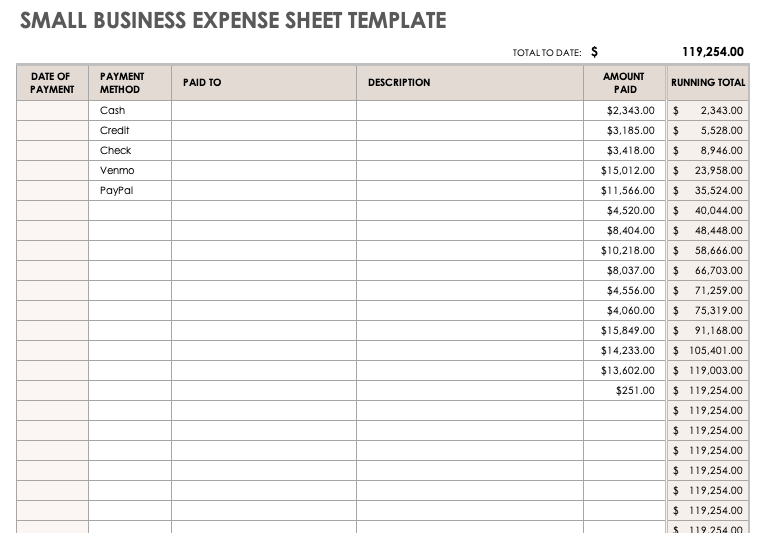

Small Business Printable Expense Report Template Printable Templates

A Guide To Writing Off Airbnb Expenses Airbtics Airbnb Analytics

Small Business Expense Spreadsheet In Free Business Expense Spreadsheet

The Ultimate List Of Self Employed Expenses You Can Claim

Image Result For Hair Salon Expenses Printable Business Tax

Pin On Daily Jewelry Making Tips

Pin On Daily Jewelry Making Tips

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

7 Insanely Awesome Write Offs That Solopreneurs Need To Know

The Ultimate List Of 31 Tax Deductions For Shop Owners Gusto

What Expenses Can I Write Off For Airbnb - Examples of the most common Airbnb tax deductible expenses are Service fees are charged by a property management company real estate agent vacation rental software solution and or an online travel agency OTA like Airbnb etc Cleaning supplies Fees paid for cleaning services Rental and property taxes Property insurance