What Expenses Covered By Hsa HSA contribution limits View contribution limits for 2024 and historical limits back to 2004 Includes contribution limits for both single and married people as well as catch up contribution amounts ages 55

An HSA is a tax exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur You must be an eligible individual to contribute to an HSA Health savings accounts HSAs allow you to use pretax dollars to pay for qualified medical expenses which lets you save money on everyday healthcare items Your HSA can help you cover qualified emergency dental vision and

What Expenses Covered By Hsa

What Expenses Covered By Hsa

https://images.contentful.com/6j8y907dne6i/4ASMR4GJB8EGJoXPtGWqLj/d6a2d0cf2f363b57abaa037e62026a55/Infographic_Money_Out_HORIZ.png

Health Expenses Covered By HSA Or FSA Qualified Medical Expense

https://blog.taxact.com/wp-content/uploads/9-Surprising-Health-Expenses-Covered-by-Your-HSA-or-FSA-1277242852_Blog.jpg

5 Things To Know About Health Savings Accounts ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

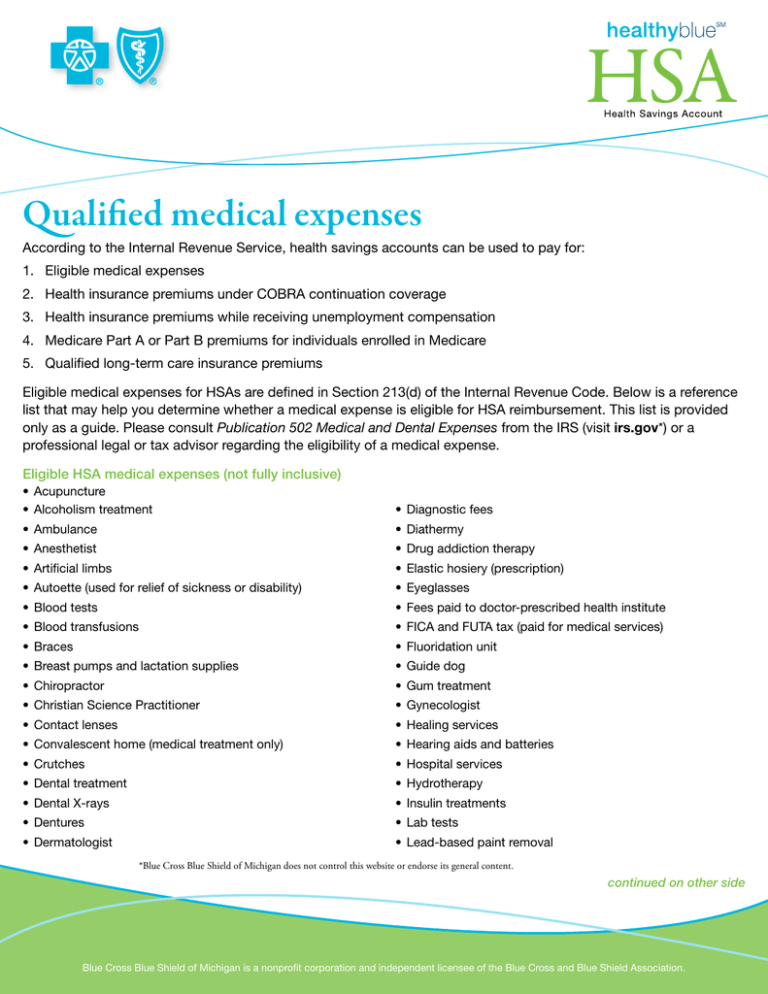

What expenses are eligible for an HSA The government only allows these tax advantages if you use your HSA money for qualified medical expenses These costs generally include payment to doctors From A to Z items and services deemed eligible for tax free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and more will be here complete with details and requirements

Generally you can t use your HSA to pay for expenses that don t meaningfully promote the proper function of the body or prevent or treat illness or disease Nutritional supplements and weight loss programs not prescribed by a physician are examples of expenses that would not be covered by your HSA You can use money from your HSA or health care FSA to pay for qualified medical expenses Here s what s eligible and ineligible

Download What Expenses Covered By Hsa

More picture related to What Expenses Covered By Hsa

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What s The Difference

https://www.investopedia.com/thmb/PE1dbX0Tuo1ohlHmjw_RcTUcvNw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg

Fsa Covered Expenses 2024 Mamie Rozanna

https://m.foolcdn.com/media/dubs/original_images/hsa-eligible-expenses-infographic.png

Health Savings Account Eligible Expenses

https://uploads-firstquotehealth.s3.us-west-2.amazonaws.com/articles/October2017/health_savings_account_expenses.jpg

Health savings accounts HSAs are tax advantaged accounts designed to pay for future healthcare costs Here s a list of HSA eligible expenses approved right now The following is a summary of common expenses claimed against Health Savings Accounts HSAs Health Reimbursement Arrangements HRAs Healthcare Flexible Spending Accounts HC FSAs and Dependent Care FSAs DC FSAs

Here are some of the expenses that can be covered with HSA funds For a full list see IRS Publication 502 Acupuncture Ambulance services Birth control Body scans Health Savings Account HSA eligible plan also called a High Deductible Health Plan HDHP and open an HSA a type of savings account that lets you set aside money on a pre tax basis to pay for qualified medical expenses like

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How Operating Expenses And Cost Of Goods Sold Differ

https://www.investopedia.com/thmb/PRGkjFMd-SG0-ebs4y1M2omqsHE=/1391x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg

HSA Qualified Medical Expenses

https://s2.studylib.net/store/data/012820623_1-1132dc89d22ae76677bae033049228ca-768x994.png

https://www.hsalist.org

HSA contribution limits View contribution limits for 2024 and historical limits back to 2004 Includes contribution limits for both single and married people as well as catch up contribution amounts ages 55

https://www.irs.gov/publications/p969

An HSA is a tax exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur You must be an eligible individual to contribute to an HSA

PDF Sample List Of Eligible Medical Expenses Covered By HSA Or

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How Operating Expenses And Cost Of Goods Sold Differ

FSA HSA Are Health Insurance Premiums An Eligible Expense All

Employee Expenses Covered By Exemption Thompson Taraz Rand

FAQs_featured.jpg)

Health Savings Account HSA FAQs

What Is A Health Savings Account HSA Jefferson Bank

What Is A Health Savings Account HSA Jefferson Bank

Business Expenses Template Excel Templates

FAQ About Health Savings Accounts HSA

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrangement HRA Vs Health Savings Account HSA

What Expenses Covered By Hsa - From A to Z items and services deemed eligible for tax free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and more will be here complete with details and requirements