What Income Is Taxable In New York State 2022 tax tables Select the return you file Form IT 201 Resident Income Tax Return for full year residents of New York State or Form IT 203 Nonresidents and

Find out how much you ll pay in New York state income taxes given your annual income Customize using your filing status deductions exemptions and more Income tax rates in New York State vary from 4 to 10 9 contingent on factors like taxable income adjusted gross income and filing status New York State offers a range of income tax rates including 4

What Income Is Taxable In New York State

What Income Is Taxable In New York State

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable.png

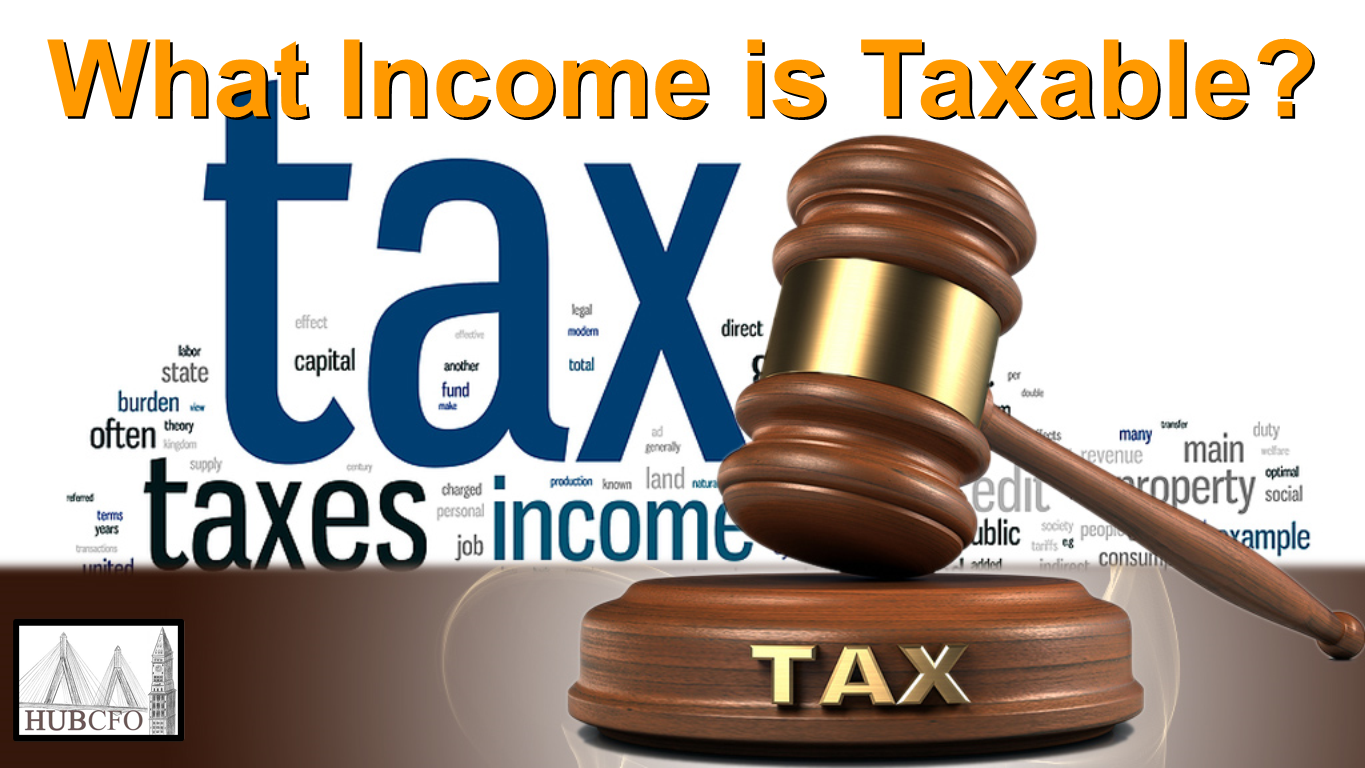

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

How To Calculate Taxable Income A Comprehensive Guide The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg

Information about tax rates and tax tables for New York State New York City Yonkers and the metropolitan commuter transportation mobility tax by year are provided New York s income tax rates range from 4 to 10 9 The top tax rate is one of the highest in the country though only taxpayers whose taxable income exceeds

Obtain the New York paycheck tax Because of your AGI your standard deduction is 16 050 Hence your taxable income becomes 58 950 The state income tax is 1 202 plus 5 85 of the amount over Income tax 4 percent to 10 9 percent New York has nine tax brackets ranging from 4 percent to 10 9 percent Residents of New York City and Yonkers also

Download What Income Is Taxable In New York State

More picture related to What Income Is Taxable In New York State

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

Least Tax Friendly States For Retirees

https://s.hdnux.com/photos/32/77/25/7075155/4/1200x0.jpg

What Is Pre Tax Commuter Benefit

http://www.remotefinancialplanner.com/wp-content/uploads/2017/02/word-image-3.png

The New York income tax has nine tax brackets with a maximum marginal income tax of 10 900 as of 2024 Detailed New York state income tax rates and brackets are New York has a graduated state individual income tax rate ranging from 4 00 percent to 10 90 percent New York tax on retirement benefits New York does not tax Social Security

New York State personal income tax differs from federal rules in a few ways such as exempting pension income and adding college tuition deductions New York s income tax ranges from 4 00 to 10 9 divided into multiple brackets based on income level and filing status There are tax recapture provisions for some taxpayers

Exploring NY s Top heavy PIT Base Empire Center For Public Policy

https://empirecenter.org/wp-content/uploads/2017/02/PIT-RDB-TAB1.png

What is taxable income Financial Wellness Starts Here

https://blog.navitmoney.com/wp-content/uploads/2020/07/what-is-taxable-income.png

https://www.tax.ny.gov/pit/file/tax-tables/2022.htm

2022 tax tables Select the return you file Form IT 201 Resident Income Tax Return for full year residents of New York State or Form IT 203 Nonresidents and

https://smartasset.com/taxes/new-york …

Find out how much you ll pay in New York state income taxes given your annual income Customize using your filing status deductions exemptions and more

Tax Calculator 2024 Irving Texas Irena Saloma

Exploring NY s Top heavy PIT Base Empire Center For Public Policy

What Is Taxable Income Explanation Importance Calculation Bizness

Is Shipping Taxable In New York TaxJar

Go Safety Compliance Centre Individual Income Filing Requirements

Calculate My Income Tax SuellenGiorgio

Calculate My Income Tax SuellenGiorgio

rny k Depresszi s Puncs Us Salary Tax Calculator Tumor Diktat ra

Income Tax Computation Format In Excel Fy 2023 24 Free Download Free

What Is Taxable Income With Examples TheStreet

What Income Is Taxable In New York State - Information about tax rates and tax tables for New York State New York City Yonkers and the metropolitan commuter transportation mobility tax by year are provided