What Interest Does The Irs Pay On Late Refunds The IRS has 45 days to pay a tax refund before interest payments to you kick in However if the IRS doesn t pay up within 45 days it generally starts calculating interest on your overpayment from one of

If you haven t received your refund within 45 days of the tax deadline the IRS pays interest on your outstanding funds at the If your tax refund is still in limbo there s good news Your balance may be accruing interest and the rate increases to 7 from 6 on Jan 1 according to the IRS As of Nov 18 there were

What Interest Does The Irs Pay On Late Refunds

What Interest Does The Irs Pay On Late Refunds

https://www.irsdebtforgiveness.net/img/7a94aa506820bfc42cb9faa4d165d9a0.jpg?26

IRS To Pay Interest On Late Tax Returns DSJ CPA

https://dsjcpa.com/wp-content/uploads/2022/06/IRS-to-pay-interest-on-late-returns-1152x768.jpg

5 500 CHECKS JUST APPROVED 4th Stimulus Package IRS Owes Interest

https://i.ytimg.com/vi/rvc3dDj3uHg/maxresdefault.jpg

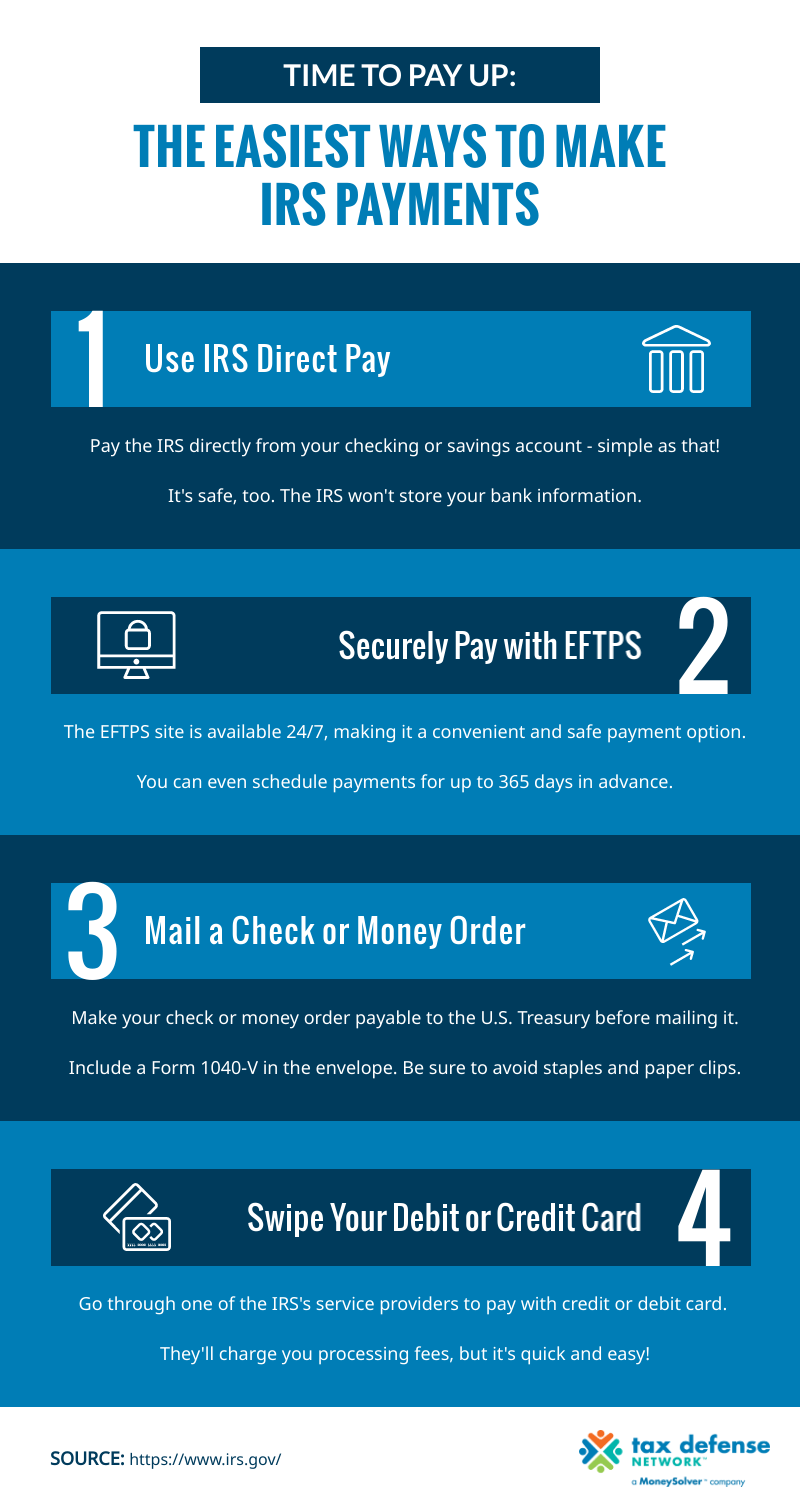

If you pay your taxes late the IRS can charge you interest on the unpaid balance and assess a penalty based on how late you are The exact amount you ll have to pay depends on a few If you re late submitting your tax payment you re required to pay the IRS interest and penalties on that sum even if you re only late by a matter of days

The IRS charges a penalty for various reasons including if you don t File your tax return on time Pay any tax you owe on time and in the right way Prepare an accurate return If you re still waiting for a tax refund you may receive 5 interest starting July 1 2022 according to the IRS Here s what else to know

Download What Interest Does The Irs Pay On Late Refunds

More picture related to What Interest Does The Irs Pay On Late Refunds

Does The IRS Pay Attention To Ongoing Compliance After Filing An OVDP

https://klasing-associates.com/wp-content/uploads/2020/09/Supreme-Court.jpg

Your Tax Return Is Still Being Processed Diversified Tax

https://diversifiedllctax.com/wp-content/uploads/2022/03/featured-image-for-blogs-1160x665105-1.jpg

IRS Payment Plan Interest Rate How Much Interest Does The IRS Charge

https://i.ytimg.com/vi/ASciRgqyxjk/maxresdefault.jpg

Key Points If you re still waiting on a tax refund you may be earning interest on your unpaid balance and the rate jumps to 6 on Oct 1 according to the IRS The IRS will start paying 5 percent in guaranteed interest to individuals with delayed tax returns beginning in July up a percentage point from the last interest rate hike that took effect in

If your refund is delayed more than 45 days the IRS will pay interest on the total Starting July 1 the interest payments will increase from 4 to 5 compounded Generally interest accrues on any unpaid tax from the due date of the return until the date of payment in full The interest rate is determined quarterly and is the federal short term

What Is The Interest Rate On Installment Agreements

https://polstontax.com/wp-content/uploads/2020/10/what-is-the-irs-interest-rate-for-installment-agreements.png

What Interest Rate Does The Irs Pay On Delayed Refunds Dollar Keg

https://dollarkeg.com/wp-content/uploads/2022/11/image-723.png

https://turbotax.intuit.com/tax-tips/tax-…

The IRS has 45 days to pay a tax refund before interest payments to you kick in However if the IRS doesn t pay up within 45 days it generally starts calculating interest on your overpayment from one of

https://www.nerdwallet.com/article/taxe…

If you haven t received your refund within 45 days of the tax deadline the IRS pays interest on your outstanding funds at the

Irs Refund Check Envelope Hot Sex Picture

What Is The Interest Rate On Installment Agreements

Irs Pay Taxes Kyle Favro

Does The IRS Pay Interest On Late Refunds 11alive

What Is IRS Form 1040 Overview And Instructions Bench Accounting

How To Understand A Letter From The IRS Philadelphia Legal Assistance

How To Understand A Letter From The IRS Philadelphia Legal Assistance

How Much Does The IRS Expect Me To Pay On My Back Taxes Calculating

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Avoid The Rush Track Tax Refunds Using Tool At IRS gov

What Interest Does The Irs Pay On Late Refunds - However this year the IRS will pay 5 interest compounded daily for refunds after April 15 and 3 interest compounded daily starting July 1