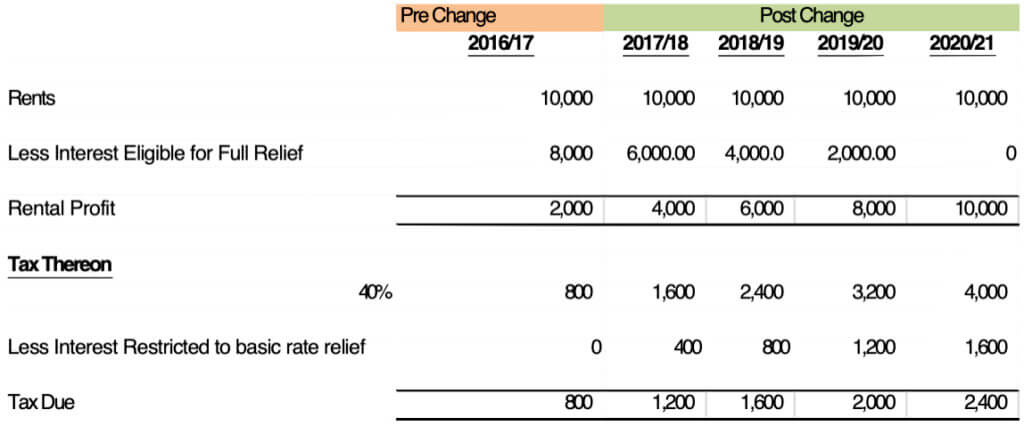

Tax Rebate On Mortgage Interest Web 22 juil 2021 nbsp 0183 32 If you are charging 163 10 000 in rent for your property and are being charged 163 9 000 in mortgage interest then you will be taxed on the full 163 10 000 income depending on your personal tax bracket After this

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Web 1 Tax rebate on mortgage interest payments and expenses The tax rebate on mortgage interest payments will drop for home owners with an income over EUR 69 398 Right

Tax Rebate On Mortgage Interest

Tax Rebate On Mortgage Interest

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

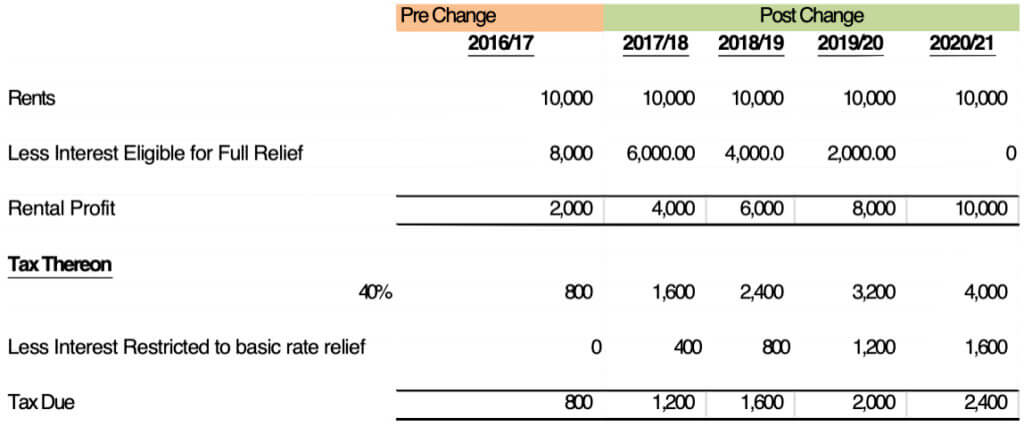

Tax Relief Of Mortgage Interest Sigma Chartered Accountants

https://www.sigmatax.co.uk/wp-content/uploads/2019/04/tax-relief-of-mortgage-interest-chart-1024x426.jpg

34 Mortgage Interest Deduction Taxes NairnMykenzi

https://itep.sfo2.digitaloceanspaces.com/fig2_mid.png

Web 19 janv 2023 nbsp 0183 32 The tax relief landlords get on a buy to let mortgage interest has now ended as of April 2020 Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you Web 18 juil 2023 nbsp 0183 32 About Tax Deductions for a Mortgage Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 July 18 2023 03 20 PM

Web Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes This Web Income tax rebate on home loan Tax deductions Tax deductions for a mortgage loan FY 2022 23 Repayment of a home loan s principal is tax deductible under Section 80C

Download Tax Rebate On Mortgage Interest

More picture related to Tax Rebate On Mortgage Interest

Fillable 1098 Mortgage Interest Form Form Resume Examples yKVBbovrVM

https://www.contrapositionmagazine.com/wp-content/uploads/2020/12/1098-mortgage-interest-tax-form.jpg

What Is Rebate On A Mortgage Loan

https://www.gcash.com/wp-content/uploads/2020/06/Loans-CIMB-Loans-Interest-Rebate_1200x628-1.jpg

FREE AFTER REBATE Tax Software Exp 2 28 14 Tax Software Free

https://i.pinimg.com/originals/24/5d/6b/245d6b42162db94f6bd6ed8c0340ea4f.jpg

Web 6 mars 2023 nbsp 0183 32 The credit amount ranges from 10 to 50 of mortgage interest paid during the year The exact percentage is listed on the MCC issued to you The credit is limited to 2 000 if the credit rate is Web How much is the tax refund on the mortgage interest deduction You will only receive a tax reduction if the deductible financing interest and fees exceed the amount added to

Web Il y a 1 jour nbsp 0183 32 My five year fixed rate deal is ending in 2024 and I m stressed about my next steps My mortgage will represent less than 50 of the value of the house at the next Web 7 avr 2023 nbsp 0183 32 Basic income information including amounts of your income An estimated total if applicable of the amounts paid for mortgage interest points and or mortgage

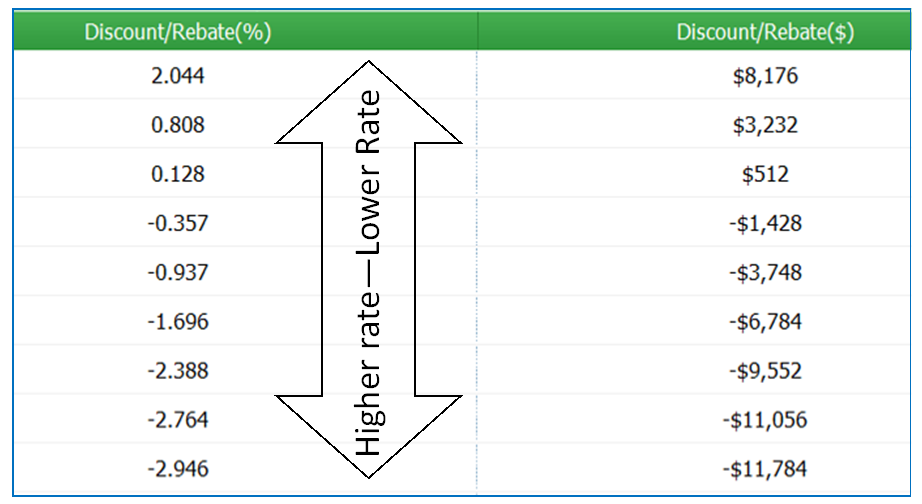

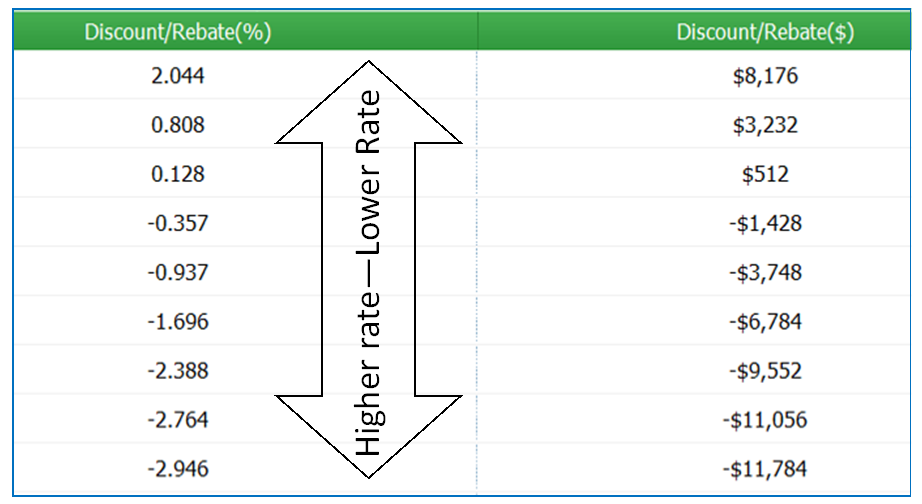

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

https://mortgageporter.com/images/old/6a00d834522f5769e2015390e201e9970b-pi.png

House Loan Interest Tax Deduction Home Sweet Home Insurance

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

https://www.income-tax.co.uk/mortgage-inter…

Web 22 juil 2021 nbsp 0183 32 If you are charging 163 10 000 in rent for your property and are being charged 163 9 000 in mortgage interest then you will be taxed on the full 163 10 000 income depending on your personal tax bracket After this

https://www.bankrate.com/mortgages/mortgage-tax-deduction-calculator

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

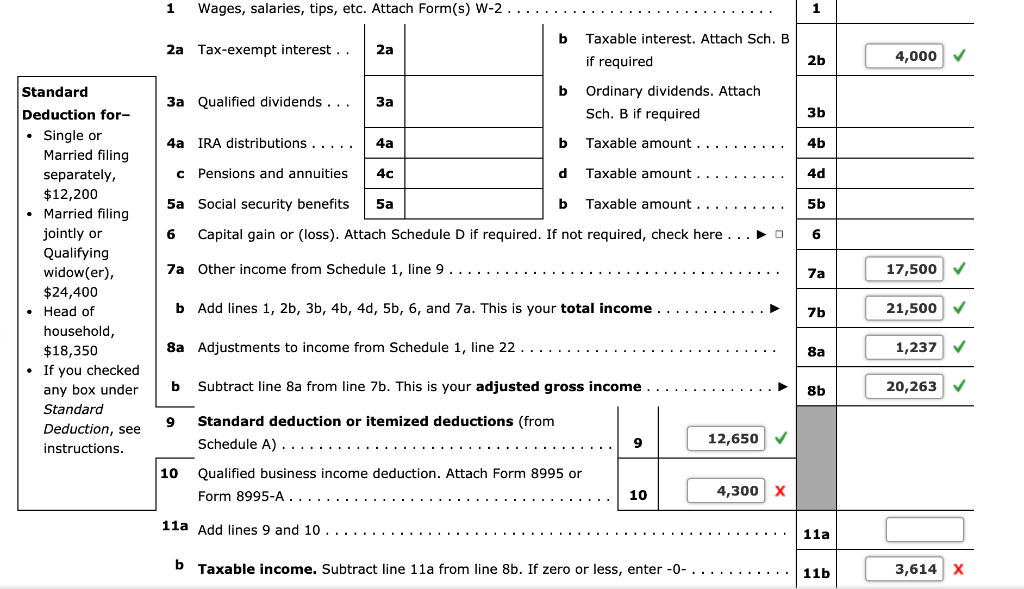

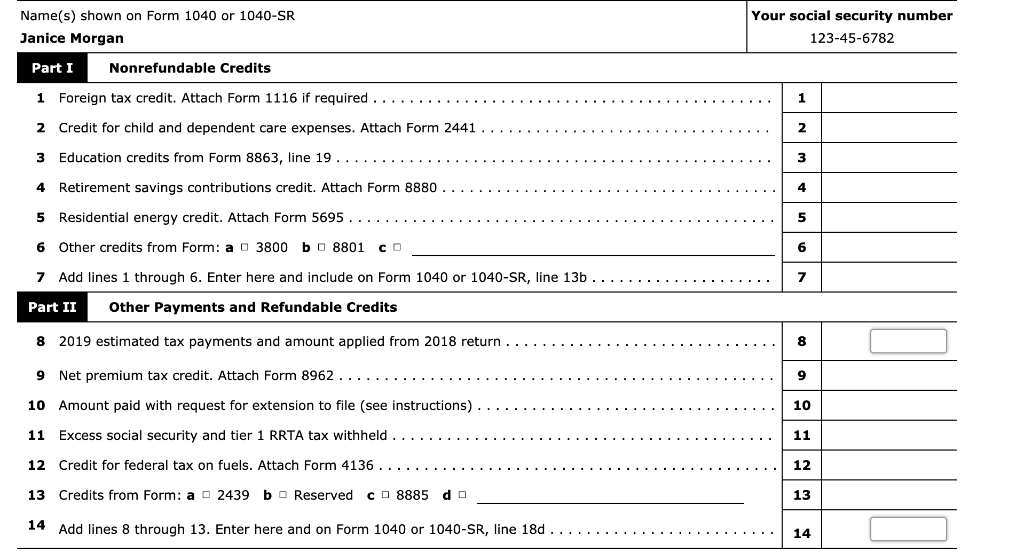

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

Tax Advantages Of Limited Partnerships

Form 11 Mortgage Interest Deduction Understand The Background Of Form

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

IVR Invesco Mortgage Capital Short Interest And Earnings Date Annual

IVR Invesco Mortgage Capital Short Interest And Earnings Date Annual

Solved Janice Morgan Age 24 Is Single And Has No Chegg

37 Standard Deduction Mortgage Interest EphraEmelyah

Estimate Home Mortgage Interest Deduction Oceandesignjewelry

Tax Rebate On Mortgage Interest - Web 18 juil 2023 nbsp 0183 32 About Tax Deductions for a Mortgage Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 July 18 2023 03 20 PM