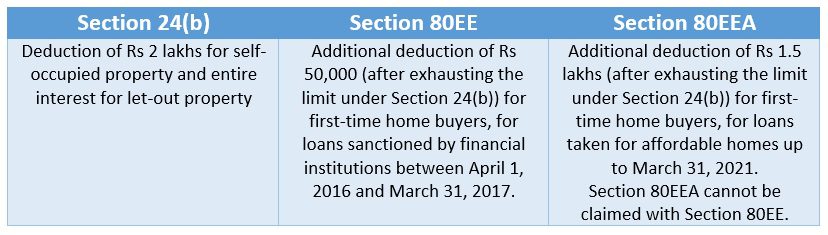

What Is 80ee Vs 80eea Vs 24b Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto

Section 80EE Dedution amounting to Rs 50 000 is allowed in addition to deduction under section 24 b The loan should be sanctioned between 1 st April 2016 Explore deductions under Sections 24b 80EE and 80EEA of the Income Tax Act 1961 for interest on borrowed capital or housing loans Understand eligibility

What Is 80ee Vs 80eea Vs 24b

What Is 80ee Vs 80eea Vs 24b

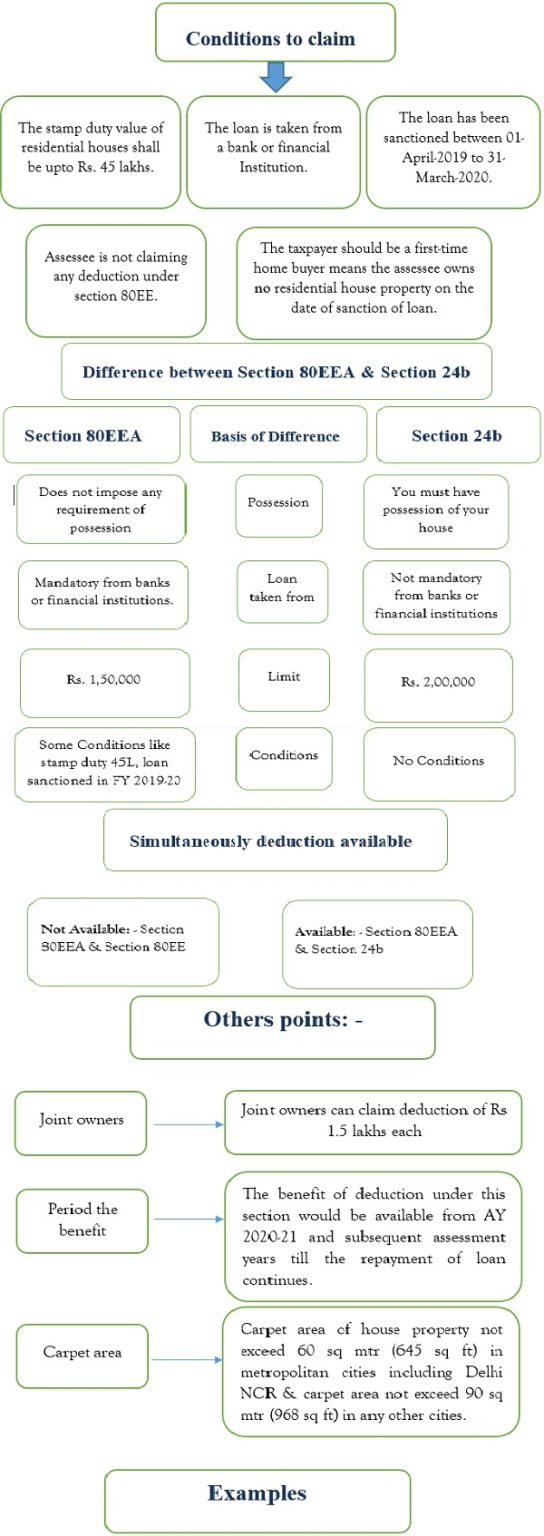

https://taxguru.in/wp-content/uploads/2022/01/Conditions-to-claim-544x1536.jpg

Section 80EE And 80EEA Interest On Housing Loan Deduction

https://i0.wp.com/saralpaypack.com/wp-content/uploads/2022/08/80ee-and-80eea.png?resize=750%2C221&quality=100&strip=all&ssl=1

Stamp Duty Exemption 2019 Warren Churchill

https://assets-news.housing.com/news/wp-content/uploads/2020/03/04181558/Section-80EEA-24b-80EE.jpg

Understand the difference between 80EE and 80EEA based on the deduction limit eligibility criteria applicability etc here in detail on Groww What is the difference between Section 80EE and Section 24 b of the Income Tax Act Under Section 24 b a deduction of Rs 2 lakh is allowed for self

Three significant provisions that can make a substantial impact on an individual s tax liability are Section 24B 80EE and 80EEA In this article we will delve Learn the differences between Section 80EE and 80EEA two tax saving sections for home loans Know how first time buyers can claim tax benefits under these

Download What Is 80ee Vs 80eea Vs 24b

More picture related to What Is 80ee Vs 80eea Vs 24b

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

What Is Section 80EEA Income Tax India 2023 YouTube

https://i.ytimg.com/vi/DBgfsEEe8Qg/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGDAgZSgSMA8=&rs=AOn4CLCtpobPHFaDgMvyRM96R2UAJzxImw

Section 80EE Income Tax Deduction For Interest On Home Loan

https://life.futuregenerali.in/media/vyedfzjg/home-vs-tax.jpg

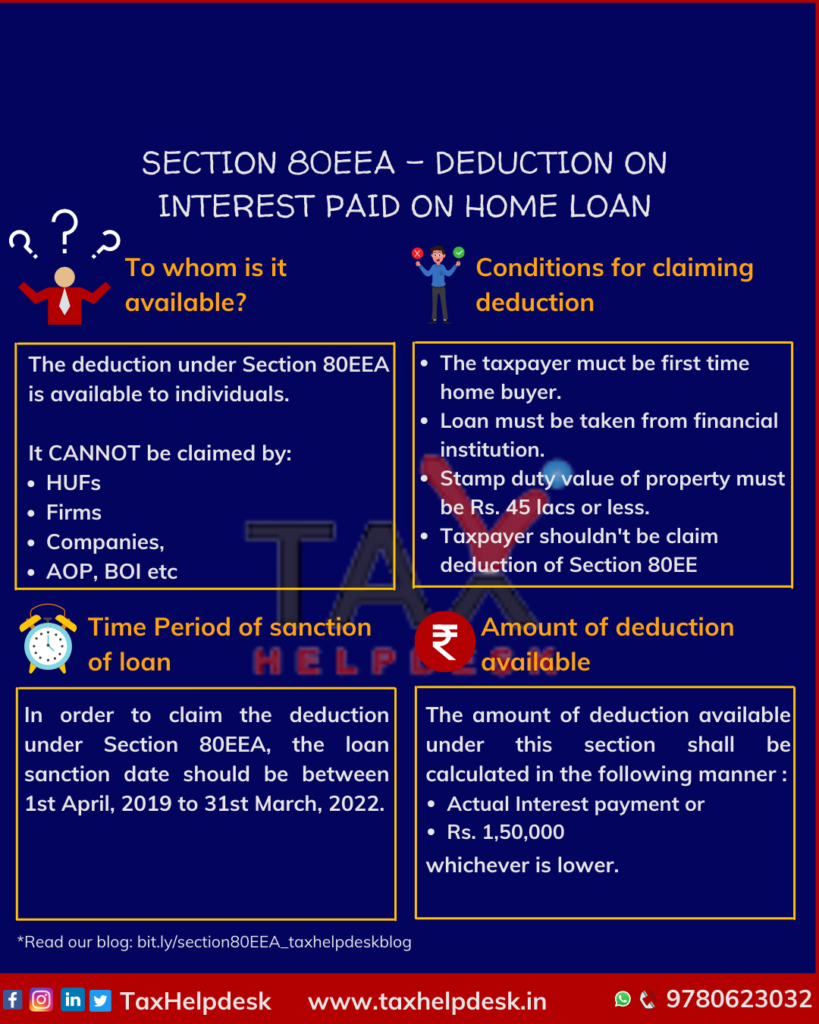

Difference between Section 80EEA and Section 24 Deduction under section 80EEA is available over and above deduction under section 24 Hence a first time home Section 80EEA Section 80EEA of the Income Tax Act 1961 came into effect from April 1 2020 It allows a deduction for interest on a loan taken for specific

What is 80EEA in income tax Section 80EEA provides extended tax deductions of up to Rs 1 50 000 for first time homebuyers in India An individual is permitted to claim this Under Section 80C you can claim up to 1 5 lakh on principal repayment while Section 24 b allows deductions of up to 2 lakh on interest payment along with an additional

Who Is Eligible For 80EE And 80EEA The Deduction Under Th Flickr

https://live.staticflickr.com/65535/51928780532_67ab32f222_b.jpg

Komyushou VS Yuri Covers ComicK

https://meo.comick.pictures/m2ywL.jpg

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto

https://taxguru.in/income-tax/deduction-interest...

Section 80EE Dedution amounting to Rs 50 000 is allowed in addition to deduction under section 24 b The loan should be sanctioned between 1 st April 2016

Deduction Under Sec 80 E 80EE 80EEA 80EEB YouTube

Who Is Eligible For 80EE And 80EEA The Deduction Under Th Flickr

Section 80EEA Claim Rs 1 50 Lakh IT Deduction Hurry Up Before 31 03 2022

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

What Is Section 80EE In The Income Tax Act Quora

Section 80EE And 80EEA Interest On Housing Loan Deduction

Section 80EE And 80EEA Interest On Housing Loan Deduction

Difference Between Section 80ee And 80eea For Home Loan

Home Loan Saving Study Of Tax Section 80EE 80EEA And 24B

Live Fill Section 80EEA 80EE In Income Tax Return Claim Deduction

What Is 80ee Vs 80eea Vs 24b - Understand the difference between 80EE and 80EEA based on the deduction limit eligibility criteria applicability etc here in detail on Groww