What Is The Difference Between 80ee And 80eea And 24b Explore deductions under Sections 24b 80EE and 80EEA of the Income Tax Act 1961 for interest on borrowed capital or housing loans Understand eligibility limits and implications

Section 80EE Dedution amounting to Rs 50 000 is allowed in addition to deduction under section 24 b The loan should be sanctioned between 1 st April 2016 31 st March 2017 The value for Three significant provisions that can make a substantial impact on an individual s tax liability are Section 24B 80EE and 80EEA In this article we will delve into the details of each of these sections

What Is The Difference Between 80ee And 80eea And 24b

What Is The Difference Between 80ee And 80eea And 24b

https://assets-news.housing.com/news/wp-content/uploads/2020/03/04181558/Section-80EEA-24b-80EE.jpg

Difference Between Section 80ee And 80eea For Home Loan

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/HL-image-Banner.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

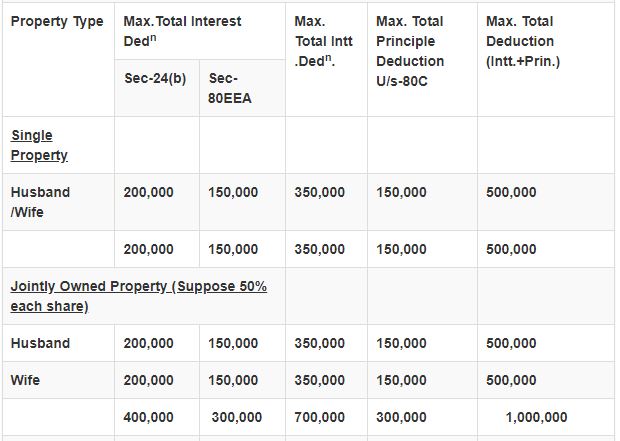

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto What is the difference between Section 80EE and Section 24 b of the Income Tax Act Under Section 24 b a deduction of Rs 2 lakh is allowed for self occupied property and

What is the difference between section 24 and 80EE and 80EEA According to Section 24 you can claim a deduction of up to Rs 2 00 000 on interest paid for a self Sections 24B 80C 80EE and 80EEA of the Income Tax Act offer deductions for interest paid on loans and principal repayment Understanding the eligibility criteria and conditions for each section is

Download What Is The Difference Between 80ee And 80eea And 24b

More picture related to What Is The Difference Between 80ee And 80eea And 24b

Who Is Eligible For 80EE And 80EEA The Deduction Under Th Flickr

https://live.staticflickr.com/65535/51928780532_67ab32f222_b.jpg

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

https://taxguru.in/wp-content/uploads/2022/01/Conditions-to-claim.jpg

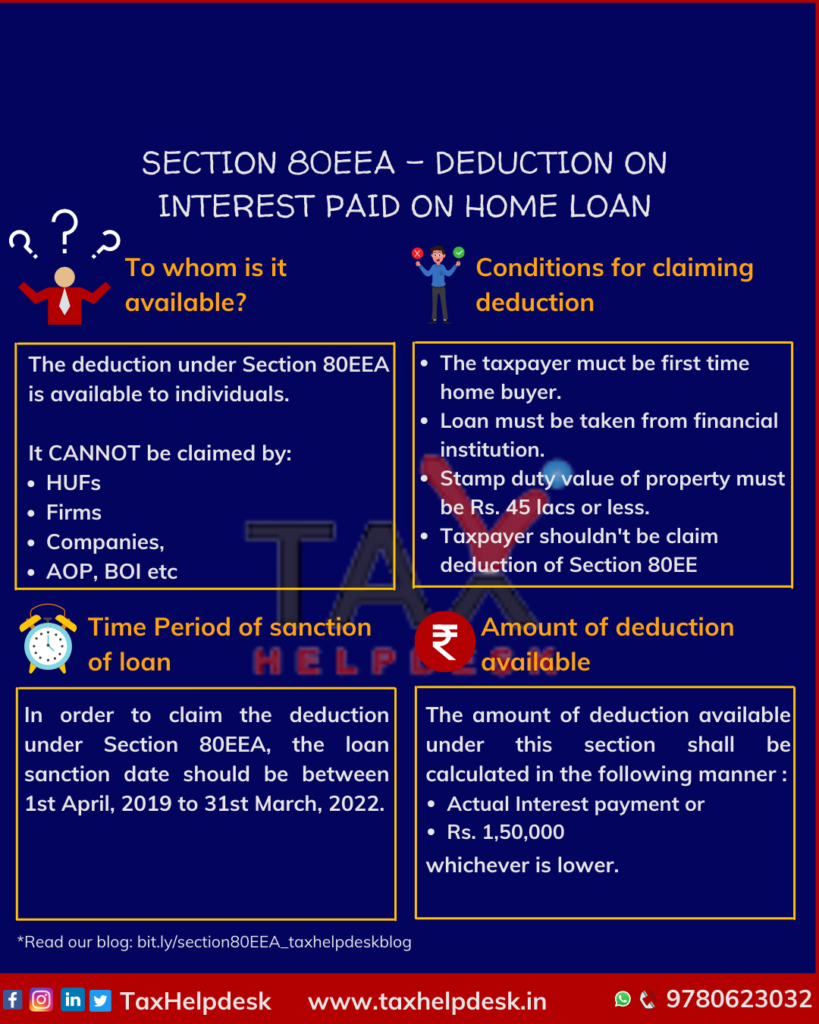

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Section-80EEA-Deduction-on-interest-paid-on-home-loan-819x1024.png

Difference between Section 80EE and Section 24 b Section 24 b allows a deduction of INR 2 lakh for interest on a home loan of a self occupied property In the 80EE deductions can be claimed till the home loan is fully repaid Also note that 80EE deduction is available only to individuals This means an HUF an AOP a company etc cannot claim 80EE

Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum deduction The main difference of Sections 80EE vs 80EEA lies in the eligibility criteria and the amount of deduction available Section 80EE provides a deduction of up to 50 000 for

DEDUCTION UNDER SECTION 80EE AND SECTION 80EEA incometaxact1961 YouTube

https://i.ytimg.com/vi/5vo7QwBpDOs/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgXChUMA8=&rs=AOn4CLBGb-KGapoLpxCpvJZH8DGRSYGrnA

Section 80EEA Features And Conditions

https://images.timesproperty.com/blog/2014/unnamed_85.png

https://taxguru.in/income-tax/tax-benefits...

Explore deductions under Sections 24b 80EE and 80EEA of the Income Tax Act 1961 for interest on borrowed capital or housing loans Understand eligibility limits and implications

https://taxguru.in/income-tax/deduction-i…

Section 80EE Dedution amounting to Rs 50 000 is allowed in addition to deduction under section 24 b The loan should be sanctioned between 1 st April 2016 31 st March 2017 The value for

Section 80EE And 80EEA Interest On Housing Loan Deduction

DEDUCTION UNDER SECTION 80EE AND SECTION 80EEA incometaxact1961 YouTube

80EEA Rs 1 50 Lakh

80EEA Deduction For Income Tax On Home Loans 2024

Income Tax Deduction L2 80G 80EE 80EEA 80EEB 80GG 80GGB 80GGC

What Is Section 80EE And Section 24 Bashamakh Co

What Is Section 80EE And Section 24 Bashamakh Co

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Income Tax Benefits On Home Loan

What Is The Difference Between 80ee And 80eea And 24b - Sections 24B 80C 80EE and 80EEA of the Income Tax Act offer deductions for interest paid on loans and principal repayment Understanding the eligibility criteria and conditions for each section is