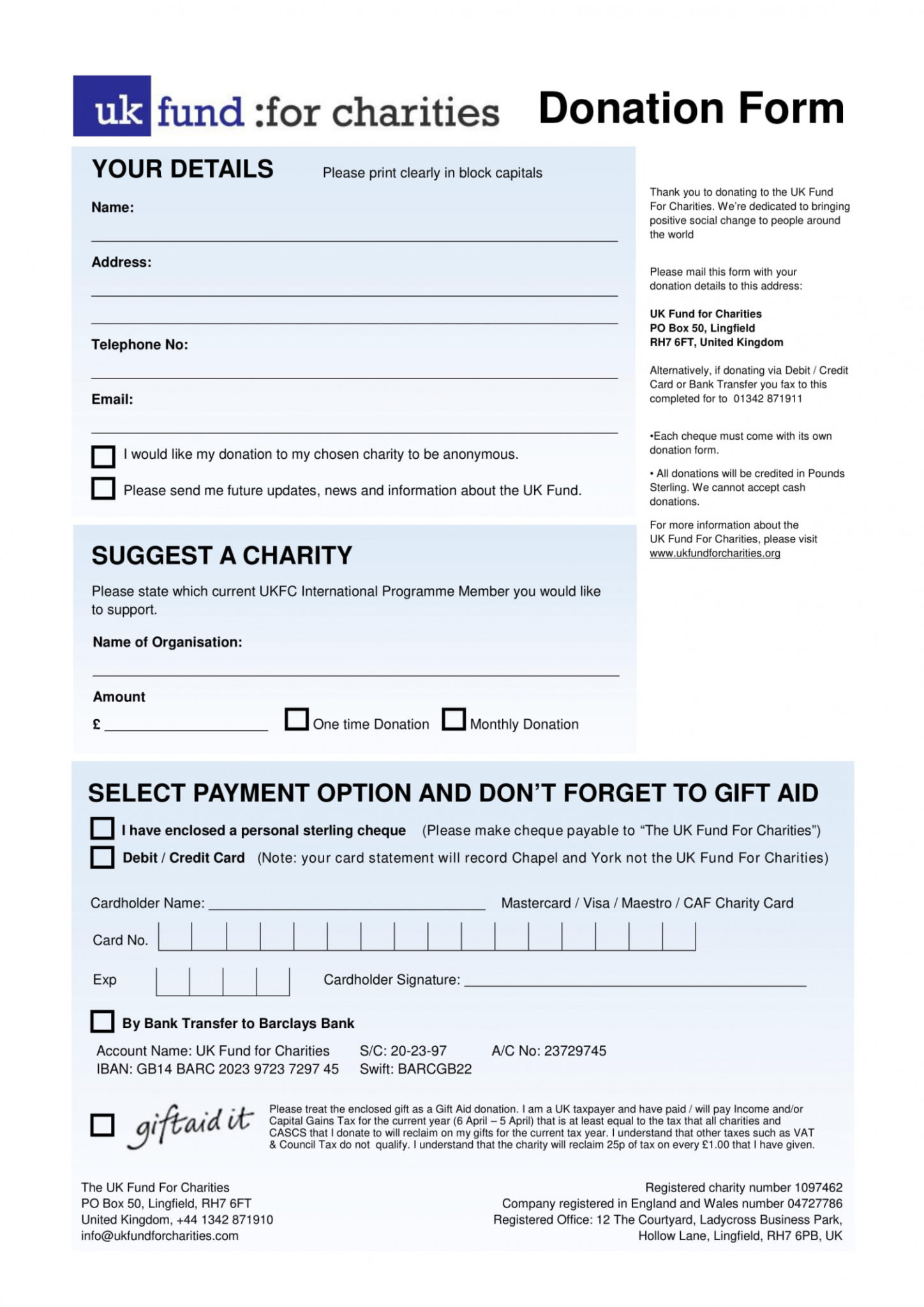

What Is A Donation Tax Credit Web The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t itemize Following special tax law changes made earlier this year cash donations of up to 300 made before December 31 2020 are now deductible when people file

Web Vor 2 Tagen nbsp 0183 32 Key Takeaways For a charitable contribution to be deductible the recipient charity must be a qualified organization under federal tax law Charitable contributions must be claimed as itemized Web Vor 5 Tagen nbsp 0183 32 A charitable donation is a gift money or goods to a tax exempt organization that can reduce your taxable income Is charitable giving tax deductible In general you can deduct up to 60 of

What Is A Donation Tax Credit

What Is A Donation Tax Credit

https://i.pinimg.com/originals/88/49/6d/88496d91d13bcb909c03ec93216394a1.jpg

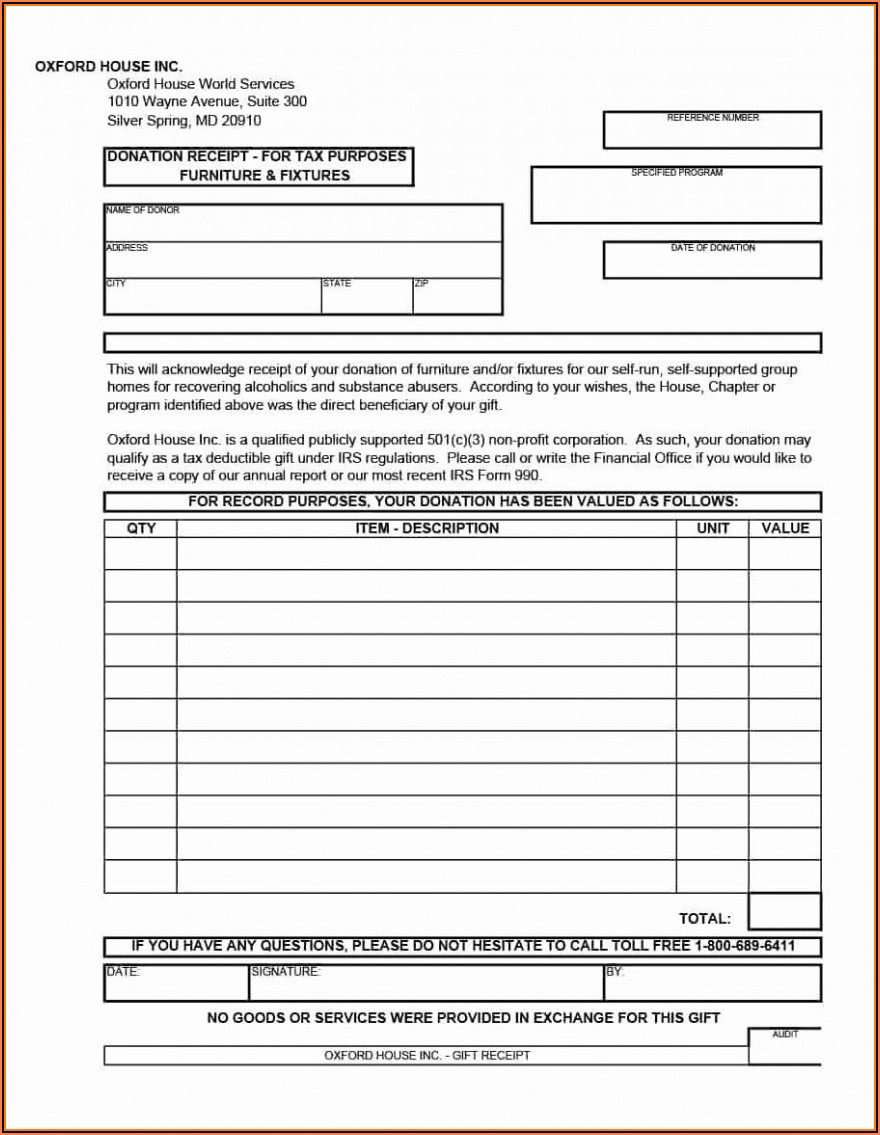

Tax Donation Form Template SampleTemplatess SampleTemplatess

https://www.sampletemplatess.com/wp-content/uploads/2017/11/Tax-Donation-Form-Template.jpg

Addictionary

https://www.addictionary.org/g/006-impressive-tax-exempt-donation-receipt-template-concept-1920_2486.jpg

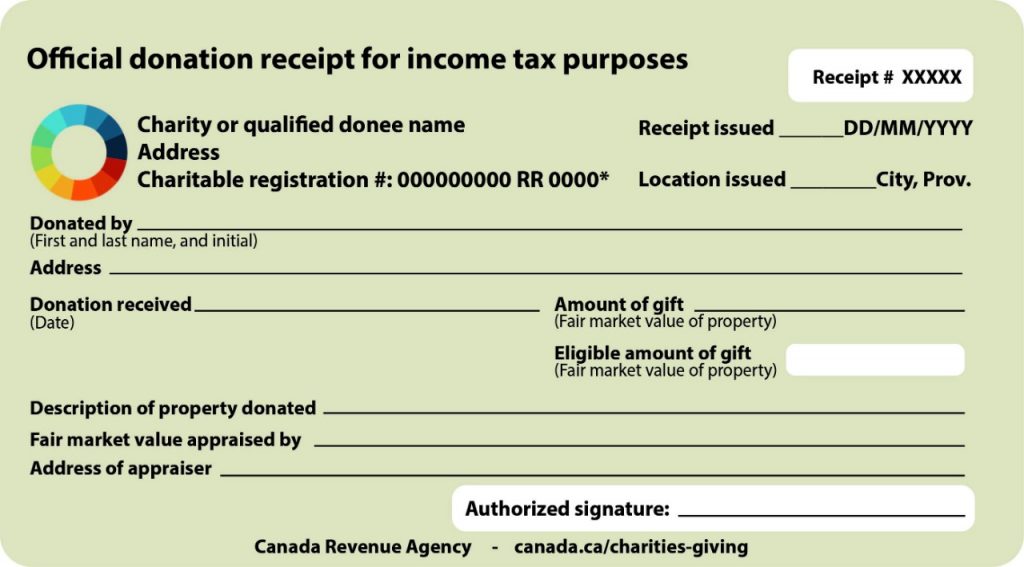

Web If you made a donation of publicly traded securities you may increase your tax saving by reducing your capital gains tax For a quick estimate of your charitable tax credit for the current tax year try out the Charitable donation tax credit calculator Web 18 Aug 2019 nbsp 0183 32 Donation Tax Credit Personal Tax Tax Credit When an individual donates personally they get a tax credit A tax credit means that it reduces your tax bill from CRA dollar for dollar However keep in mind that a donation results in a non refundable tax credit

Web 5 Dez 2023 nbsp 0183 32 This article generally explains the rules covering income tax deductions for charitable contributions by individuals You can find a more comprehensive discussion of these rules in Publication 526 Charitable Contributions PDF and Publication 561 Determining the Value of Donated Property PDF Web Federal charitable donation tax credit 30 15 on the first 200 145 29 on the remaining 500 175 30 145 is their total federal tax credit Provincial charitable donation tax credit 20 10 on the first 200 105 21 on the remaining 500 125 20 105 is their total provincial tax credit

Download What Is A Donation Tax Credit

More picture related to What Is A Donation Tax Credit

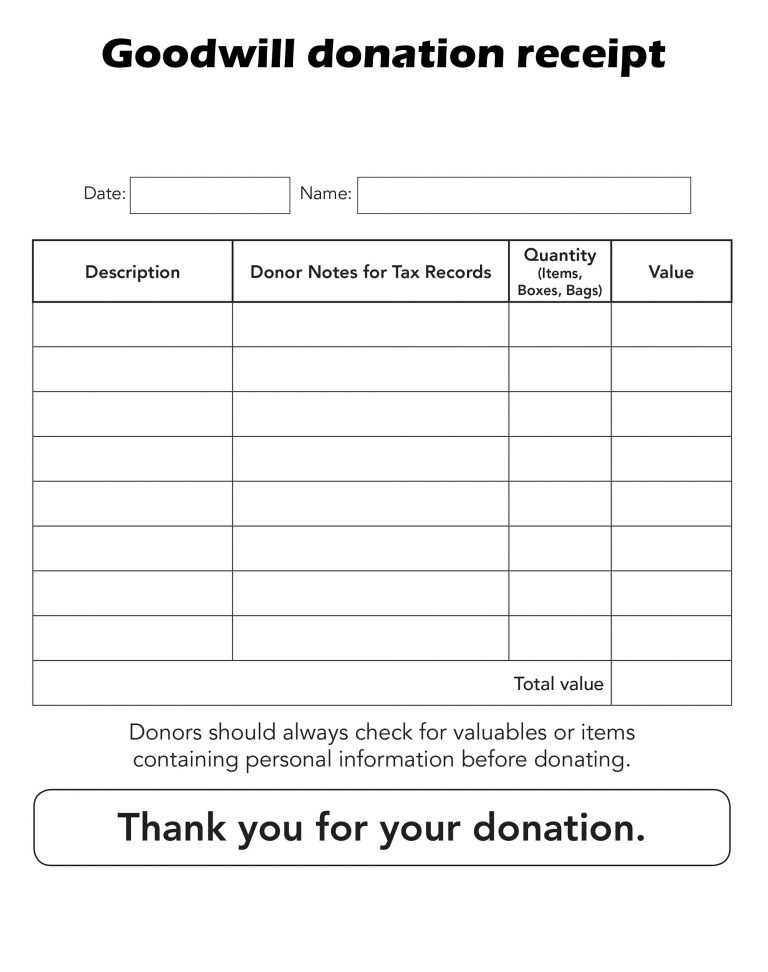

Goodwill Donation Worksheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/donation-spreadsheet-goodwill-free-spreadsheet-free.jpg

501 C 3 Form For Donations Form Resume Examples Bw9jkpnY7X

https://www.contrapositionmagazine.com/wp-content/uploads/2020/07/tax-deduction-form-for-donations.jpg

Printable Free 5 Charity Donation Forms In Pdf Ms Word Charitable

https://minasinternational.org/wp-content/uploads/2020/06/printable-free-5-charity-donation-forms-in-pdf-ms-word-charitable-donation-agreement-template-excel-1448x2048.jpg

Web 1 Dez 2022 nbsp 0183 32 Limits on the Charitable Contribution Tax Deduction Generally you can deduct contributions up to 60 of your adjusted gross income AGI depending on the nature and tax exempt status of the charity to which you re giving You can deduct contributions of appreciated assets up to 20 of your AGI For example if your AGI is Web Total of all other itemized federal tax deductions Important information about this tool The Charitable Giving Tax Savings Calculator demonstrates the tax savings power of your charitable giving Use our interactive tool to see how giving can help you save on taxes and how the bunching strategy may help you save even more

Web 2 Jan 2024 nbsp 0183 32 Tax benefits including tax credits tax deductions and tax exemptions can reduce your tax liability if you meet the various eligibility requirements Web 15 Dez 2022 nbsp 0183 32 A Guide to Tax Deductions for Charitable Contributions Here s how your philanthropic giving can lower your tax bill By Beth Braverman Dec 15 2022 at 1 29 p m Most Americans plan to make

Free Sample Printable Donation Receipt Template Form

https://bestlettertemplate.com/wp-content/uploads/2020/08/donation-receipt-Template-789x1024.jpg

Printable Free 10 Donation Receipt Examples Samples In Google Docs

https://i.pinimg.com/736x/a2/57/24/a25724789bd16e05b599eba52a6f3fee.jpg

https://www.irs.gov/credits-deductions/individuals/deducting-charitable...

Web The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t itemize Following special tax law changes made earlier this year cash donations of up to 300 made before December 31 2020 are now deductible when people file

https://www.investopedia.com/articles/personal-finance/041315/tips...

Web Vor 2 Tagen nbsp 0183 32 Key Takeaways For a charitable contribution to be deductible the recipient charity must be a qualified organization under federal tax law Charitable contributions must be claimed as itemized

FREE 10 Charity Donation Receipt Samples Templates In PDF

Free Sample Printable Donation Receipt Template Form

Exclusive Charitable Organization Donation Receipt Template Glamorous

CollSoft Payroll Support HelpDesk Tax Credit Certificate TCC

Nonprofit Thank You For Your Donation Letter Cover Letters Samples

TaxTips ca Donation Tax Credit

TaxTips ca Donation Tax Credit

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

Free Sample Printable Donation Receipt Template Form

Donation Letter for Taxes Best Letter Template

What Is A Donation Tax Credit - Web 5 Dez 2023 nbsp 0183 32 This article generally explains the rules covering income tax deductions for charitable contributions by individuals You can find a more comprehensive discussion of these rules in Publication 526 Charitable Contributions PDF and Publication 561 Determining the Value of Donated Property PDF