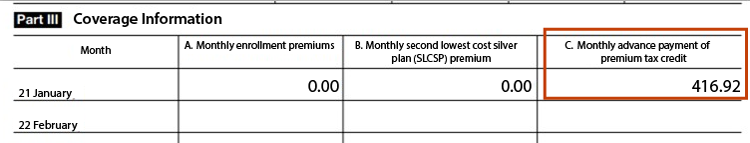

What Is Advanced Premium Tax Credit 1095 A The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased

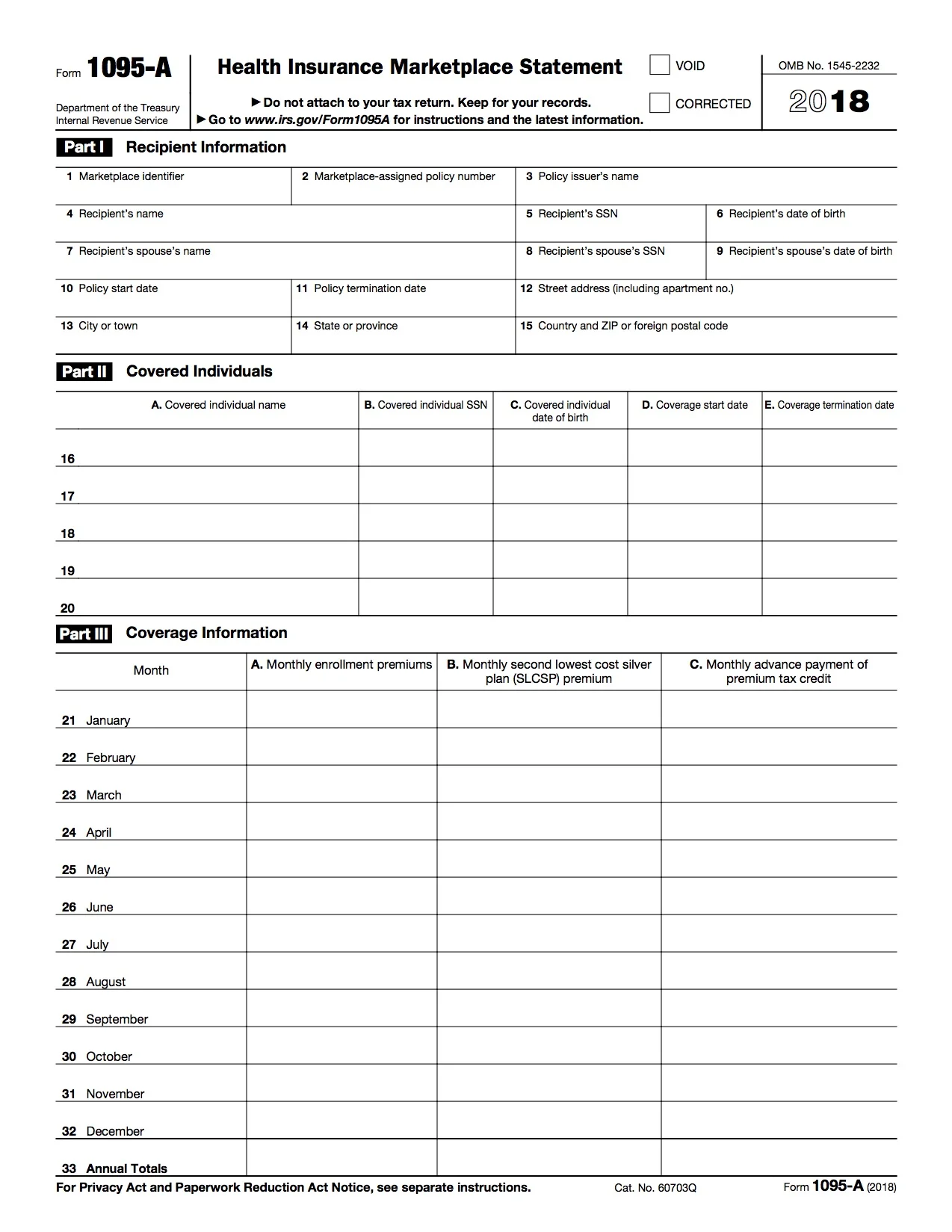

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves Form 1095 A gives you information about the amount of advanced premium tax credit APTC that was paid during the year to your health plan in order to reduce your monthly

What Is Advanced Premium Tax Credit 1095 A

What Is Advanced Premium Tax Credit 1095 A

https://w3ll.com/wp-content/uploads/2021/01/Understanding-the-Advanced-Premium-Tax-Creditwp.png

Advanced Premium Tax Credit And Form 1095 A In Georgia Georgia Health

https://ga-health-insurance.com/wp-content/uploads/2020/02/kelly-sikkema-SiOW0btU0zk-unsplash-683x1024.jpg

What Is A 1095 A Form And How Does It Work Debt

https://www.debt.com/wp-content/uploads/2019/02/Obamacare-IRS-tax-form-1095.jpg

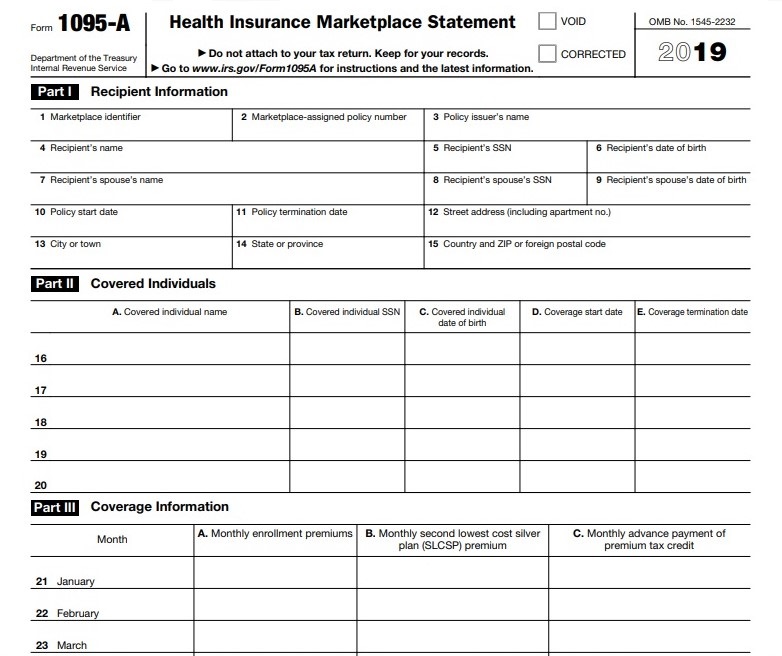

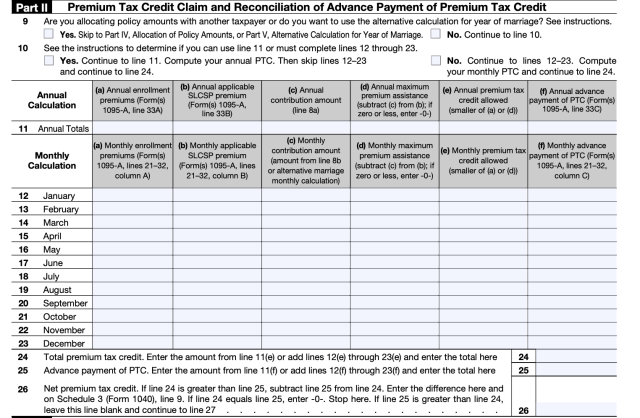

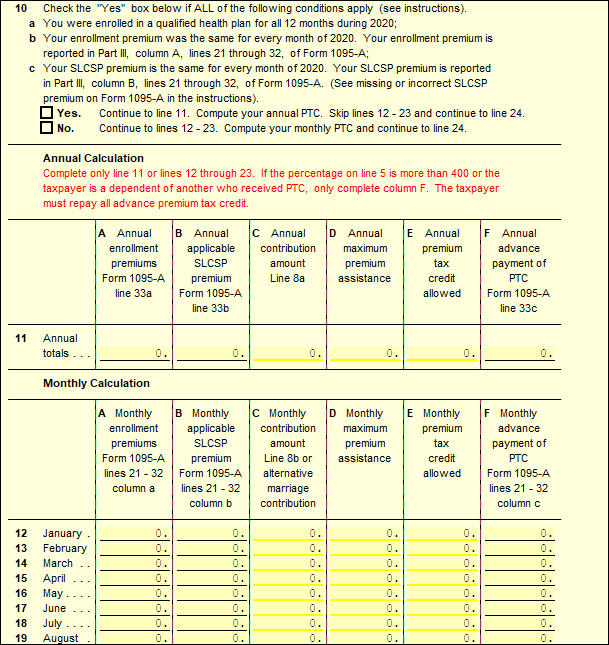

Use the information from Form 1095 A to complete Form 8962 to reconcile your advance payments of the premium tax credit with the premium tax credit you are allowed on your The advanced premium tax credit is a federal tax credit for individuals that reduces the amount they pay for monthly health insurance premiums when they buy

Your Form 1095 A provides information for you to either claim your tax credits as a lump sum or to reconcile the tax credits you received in advance each moth to help pay for If you bought health insurance through one of the Health Care Exchanges also known as Marketplaces you should receive a Form 1095 A that provides

Download What Is Advanced Premium Tax Credit 1095 A

More picture related to What Is Advanced Premium Tax Credit 1095 A

2021 Explanation Of Advanced Premium Tax Credits APTC YouTube

https://i.ytimg.com/vi/hk1IoRXLAwE/maxresdefault.jpg

1095 A Tax Form H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2015/01/1095-banner-featured-825x510.jpg

Premium Tax Credit PTC 965 Income Tax 2020 YouTube

https://i.ytimg.com/vi/vZ-LzT0wVuI/maxresdefault.jpg

Starting in February all Marketplace enrollees will receive Form 1095 A which will include information regarding your health insurance coverage such as your A tax credit you can take in advance to lower your monthly health insurance payment or premium When you apply for coverage in the Health Insurance Marketplace you

The advance premium tax credit is the portion of a taxpayer s premium tax credit paid directly to their health insurance company Learn what it could mean for you The purpose of Form 1095 A is to reconcile any advance premium tax credits you received during the year with the amount of credits you were eligible to

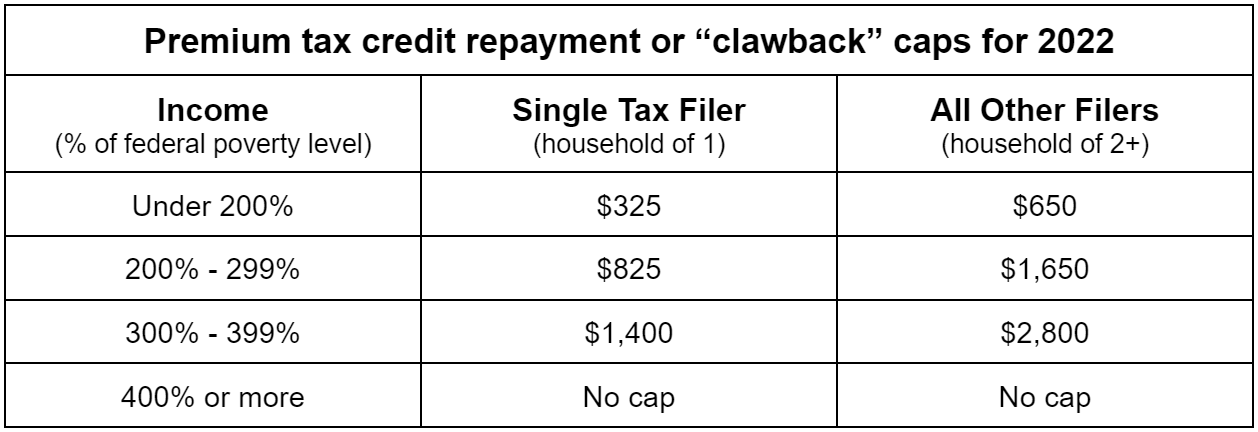

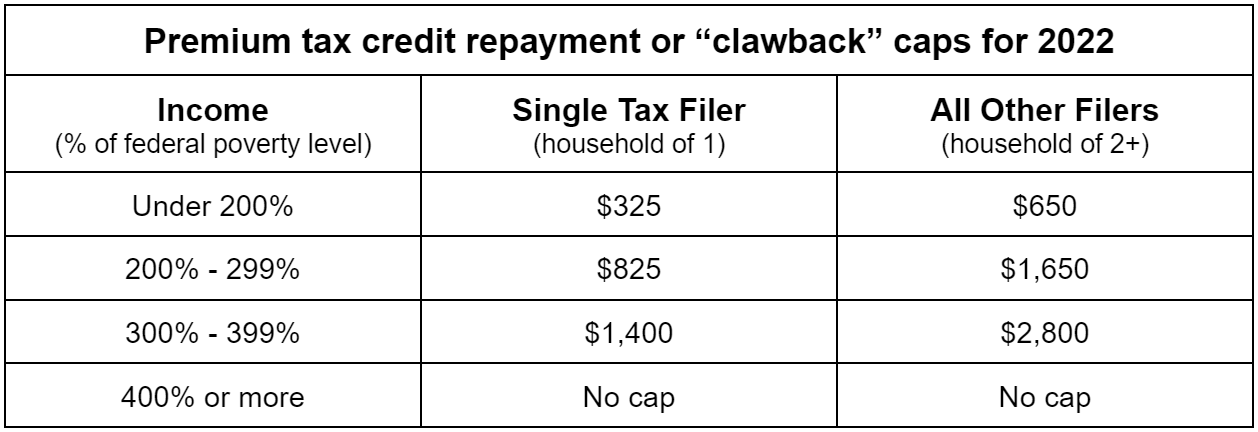

Who Gets The 1400 Tax Credit Leia Aqui Who Is Eligible For The 1400

https://uploads-ssl.webflow.com/5f8b3b580a028fb03a114a0c/635e8110482d4a62090ff7d0_premium tax credit repayment caps 2022.png

How Do I Find My 1095 A Tax Form

https://cdn.filestackcontent.com/If0HKNDDSXWgpF1WghxA

https://www.irs.gov/affordable-care-act/...

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased

https://www.nerdwallet.com/article/taxes/premium-tax-credit

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

The Premium Tax Credit And Form 1095 A

Who Gets The 1400 Tax Credit Leia Aqui Who Is Eligible For The 1400

How Do I Calculate My Premium Tax Credit

What Is A Tax Form 1095 A And How Do I Use It Stride Blog

How Does The Advanced Premium Tax Credit Work TaxAct

.jpg)

The Premium Tax Credit And Form 1095 A

.jpg)

The Premium Tax Credit And Form 1095 A

8962 Premium Tax Credit 1095 A UltimateTax Solution Center

A Guide To Forms 1095 1098 And Nonresident Tax Returns

IRS Form 1095 A FAQ MNsure

What Is Advanced Premium Tax Credit 1095 A - When the Health Insurance Marketplace pays advance payments of the premium tax credit on your behalf you must file Form 8962 to reconcile the advance