What Is Capital Gains Tax Allowance In Uk Capital gains tax is paid on the profits you make when you sell something if it exceeds your tax free allowance and losses from previous years Find out the CGT rates for

Income Tax and Capital Gains Tax are two entirely separate taxes with each having is own tax free element In 2023 to 2024 Income Tax has a personal allowance of What is the capital gains tax allowance Everyone is entitled to an allowance which is an amount of capital gains allowance they can make each year without incurring CGT It s 3 000 for the current tax year 2024 25

What Is Capital Gains Tax Allowance In Uk

What Is Capital Gains Tax Allowance In Uk

https://www.dginstitute.com.au/wp-content/uploads/2021/01/shutterstock_653550121-scaled.jpg

Long Term Vs Short Term Capital Gains Tax Ultimate Guide Ageras Free

https://assets-prod.ageras.com/assets/frontend/upload/resources/lt-capital-gains-tax-brackets.png

Capital Gains Are The Profits You Make From Selling Your Investments

https://www.businessinsider.in/photo/79520838/Master.jpg

This guide explains the essentials of Capital Gains Tax allowances in the UK for the 2024 25 tax year highlighting the 6 000 annual exemption and its importance in financial planning The Capital Gains Tax allowance is the amount of capital gain that is tax free In the 2019 2020 tax year this amount is 12 000

Capital gains tax CGT is payable on the sale of second homes and buy to let property Find out how much CGT you ll pay Capital gains tax on shares is charged at 18 or 24 The Capital Gains Tax CGT allowance is a tax free amount you can deduct from your total gains before calculating how much CGT you owe For the 2025 26 tax year the CGT allowance is 3 000 per individual

Download What Is Capital Gains Tax Allowance In Uk

More picture related to What Is Capital Gains Tax Allowance In Uk

The Different Tax Rates For Unearned Income Lietaer

https://imgtaer.lietaer.com/what_is_the_tax_rate_for_capital_gains_and_dividends.jpg

How To Calculate Capital Gain Tax On Shares In The UK Eqvista

https://eqvista.com/app/uploads/2022/01/When-Should-You-Pay-your-Capital-Gain-Tax-in-the-UK.png

Reaction Source Peanuts Calculator Capital Gains Outlaw Cheek Departure

https://www.investmentpropertycalculator.com.au/assets/images/free-land-capital-gains-tax-calculator.jpg

Capital Gains Tax CGT in the UK is levied on the profit made when selling an asset that has increased in value However not all gains are subject to this tax There are several exemptions and reliefs that can reduce In the tax year 2023 24 regulation for Capital Gains Tax CGT in the UK has shifted significantly The Annual Exemption Allowance AEA has had a notable reduction This allowance is the tax free threshold up to which

Capital Gains Tax allowance or annual exempt amount is the amount you can make in gains without paying any Capital Gains Tax For the tax year 2024 25 this allowance You ll get an annual tax free allowance known as the annual exempt amount AEA if you re liable to Capital Gains Tax every tax year unless you re non domiciled in the

A Guide To Short term Vs Long term Capital Gains Tax Rates TheStreet

https://www.thestreet.com/.image/t_share/MTk3MDQyNTMwNDMxMjgwNDQ3/screenshot-2023-04-05-at-11017-pm.png

How To Write A Capital Improvement Plan

https://i2.wp.com/www.transformproperty.co.in/blog/wp-content/uploads/2014/08/Capital-gains-tax-infographic.jpg

https://www.which.co.uk › money › tax › capital-gains...

Capital gains tax is paid on the profits you make when you sell something if it exceeds your tax free allowance and losses from previous years Find out the CGT rates for

https://community.hmrc.gov.uk › customerforums › cgt

Income Tax and Capital Gains Tax are two entirely separate taxes with each having is own tax free element In 2023 to 2024 Income Tax has a personal allowance of

Short Term And Long Term Capital Gains Tax Rates By Income

A Guide To Short term Vs Long term Capital Gains Tax Rates TheStreet

Manage Capital Gains Tax Tips Dana McGuffin CPA Accounting

Understanding The Capital Gains Tax A Case Study

Why You Won t Regret Buying Treasury Bonds Yielding 5

UK Tax Rates Landlords Tax Services Tax Info

UK Tax Rates Landlords Tax Services Tax Info

How Much Is Capital Gains Tax Times Money Mentor

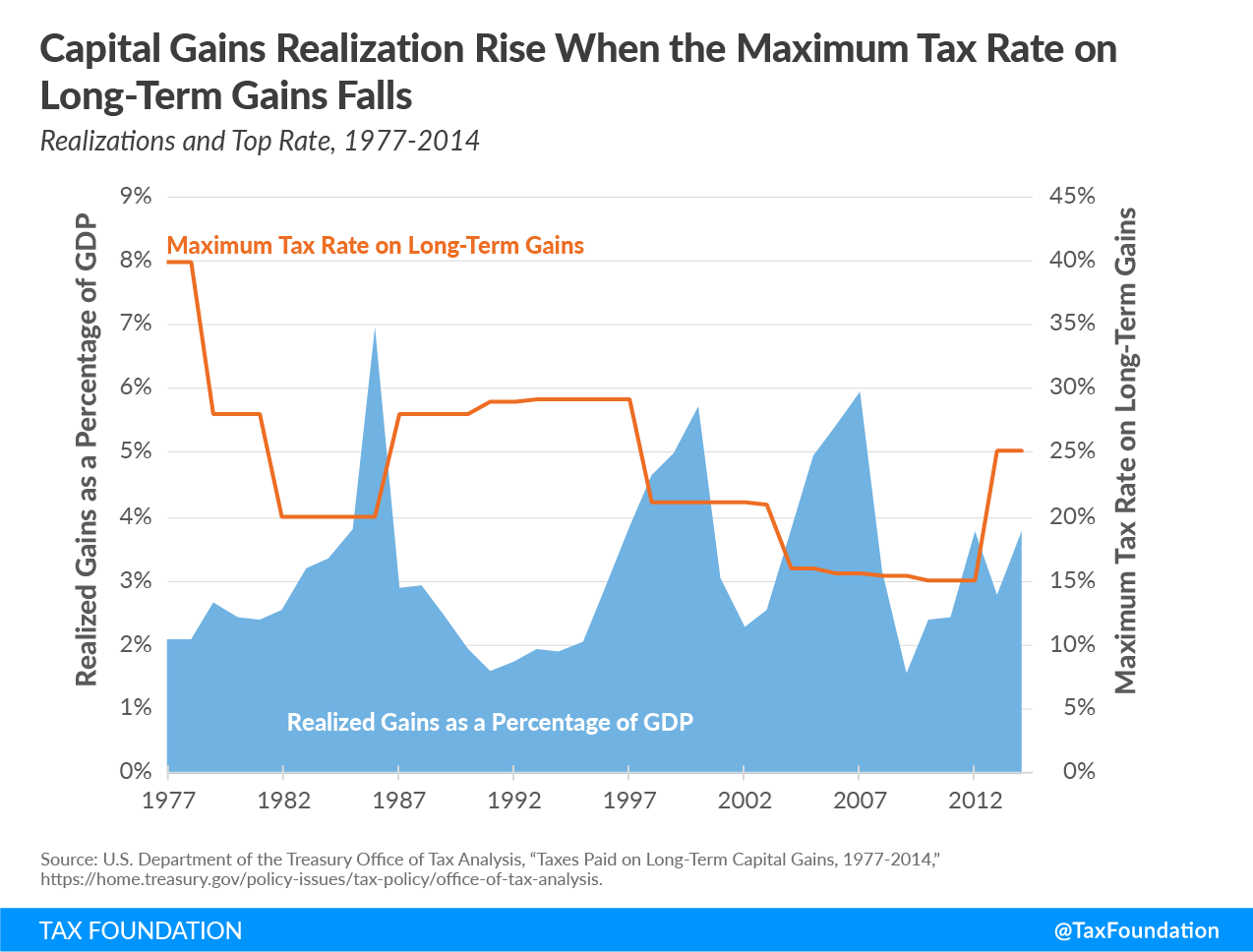

An Overview Of Capital Gains Taxes Tax Foundation

What Is Capital Gains Tax ZipMatch

What Is Capital Gains Tax Allowance In Uk - This guide explains the essentials of Capital Gains Tax allowances in the UK for the 2024 25 tax year highlighting the 6 000 annual exemption and its importance in financial planning