What Is Considered Personal Mileage On A Company Vehicle The personal use of a company owned automobile is considered part of an employee s fully taxable wage income and proper documentation is vital If you cannot determine

So what s considered personal use of a company car PUCC includes Commuting to and from work Running a personal The ALV rule also known as the table value method uses a vehicle s annual lease value as the FMV of the total annual use of a company auto to determine the

What Is Considered Personal Mileage On A Company Vehicle

What Is Considered Personal Mileage On A Company Vehicle

https://kubrick.htvapps.com/htv-prod-media.s3.amazonaws.com/images/car-mileage-tips-1599571312.jpg?crop=1.00xw:0.846xh;0,0&resize=1200:*

High Mileage Vehicle Maintenance

https://wrench.com/blog/content/images/2019/10/high-mileage-car.jpg

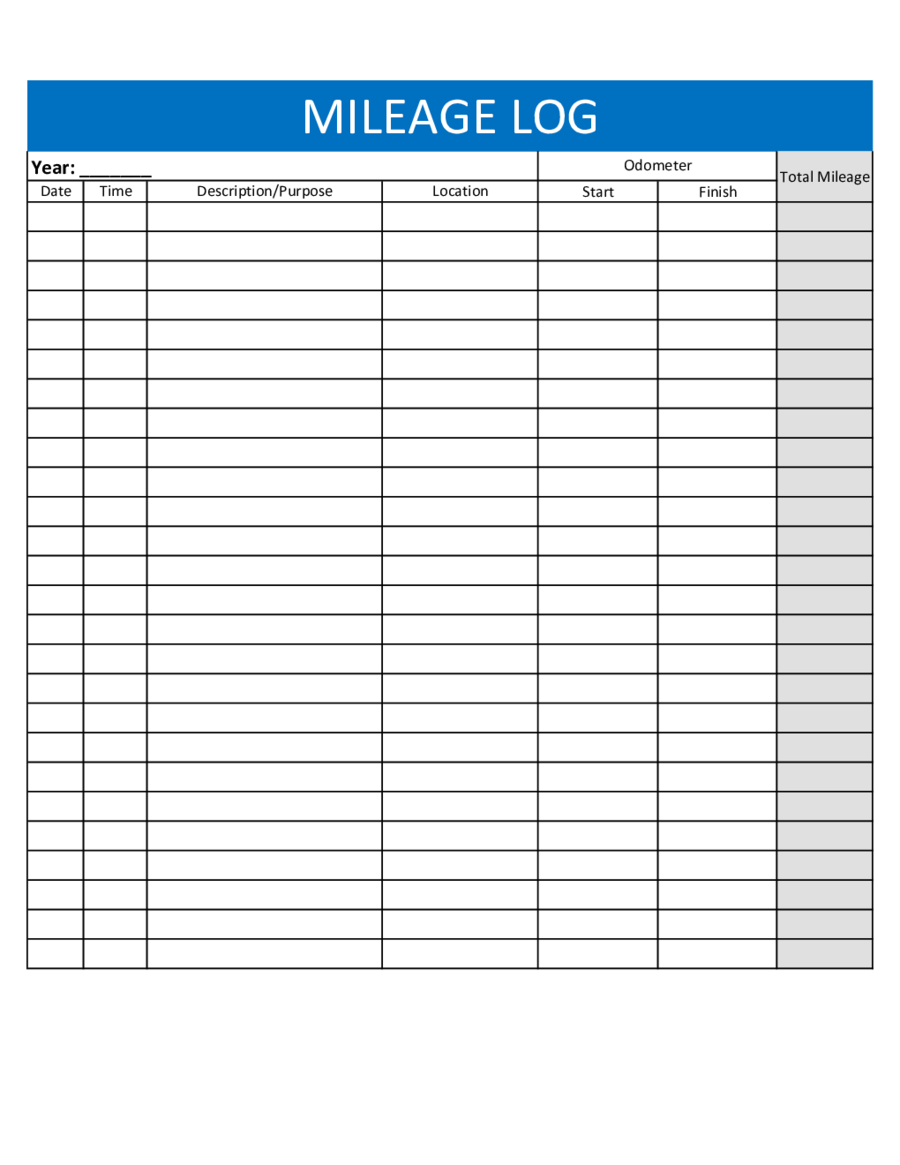

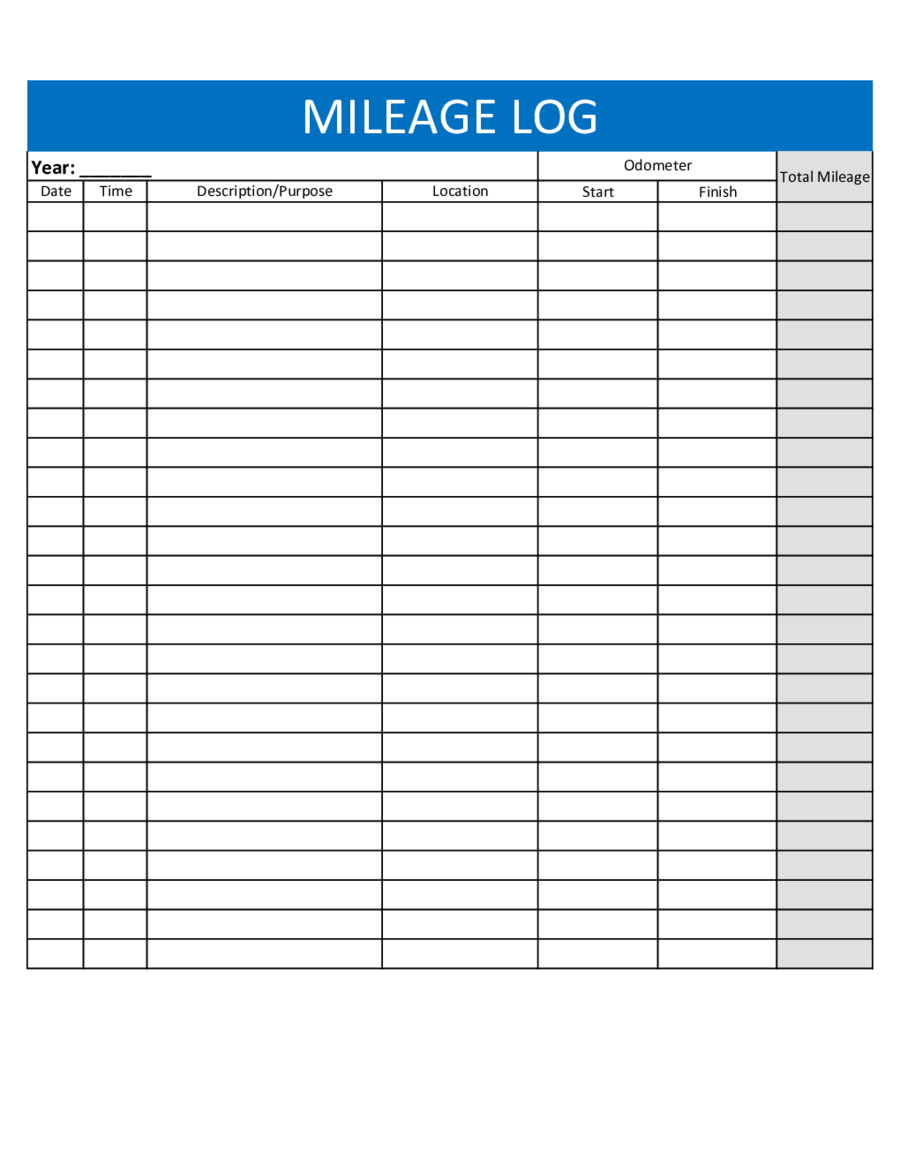

Vehicle Mileage Log Is Shown In This Image

https://i.pinimg.com/736x/06/c2/be/06c2be96a32077850c22fd9b77064426.jpg

On January 4 2021 the IRS issued Notice 2021 7 permitting employers who rely on the lease value method to retroactively apply the cents per mile method for Offering employees a company car for business driving may seem like a good investment However having your employees use a mileage tracking app with a company vehicle

Yes the IRS considers the personal use of a company vehicle a taxable noncash fringe benefit Businesses must calculate the value of this and include it on employee wages Personal miles include driving to from work grocery shopping during lunch or family outings in the company vehicle Whether or not a driver can use their company vehicle for personal use should be clearly

Download What Is Considered Personal Mileage On A Company Vehicle

More picture related to What Is Considered Personal Mileage On A Company Vehicle

Free Mileage Log Template For Taxes Track Business Miles

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110cac61f61527fef942bec_60d8292fc2f1e427c014c612_excel-mileage-log-spreadsheet-2018-01-23.png

Printable Mileage Form Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/11/2021-mileage-log-fillable-printable-pdf-forms-handypdf-1.png

Mileage Report Template

https://www.ionos.co.uk/startupguide/fileadmin/StartupGuide/Vorlagen_KMU/Mileage_log_template_UK.PNG

Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys You re allowed to pay your employee a certain If an employee is required for bona fide non compensatory business reasons i e unsafe conditions to travel between home and work commute in a

What is considered work related mileage According to the IRS business mileage is any mileage driven between two places of work That means you can reimburse your employees for work related trips If you do not keep track of when you use the company car for personal use and business use it will all be considered personal use The easiest way to track your

Fuel Mileage Trip Calculator KuwatBobaker

https://i.pinimg.com/originals/16/15/51/161551b08e021585a6357db1346c7166.png

Printable Mileage Log Template In 2022 Mileage Log Printable Mileage

https://i.pinimg.com/736x/a2/21/dd/a221dd2079224ff2b3d7cb54c554ca72--view-source-logs.jpg

https://www.eidebailly.com/insights/articles/2018/...

The personal use of a company owned automobile is considered part of an employee s fully taxable wage income and proper documentation is vital If you cannot determine

https://www.patriotsoftware.com/blog/pa…

So what s considered personal use of a company car PUCC includes Commuting to and from work Running a personal

Free Mileage Tracker Printable Printable Templates

Fuel Mileage Trip Calculator KuwatBobaker

Free Printable Mileage Log Form Printable Blank World

24 Vehicle Lease Mileage Tracker Sample Excel Templates

How To Fix QuickBooks Error Codes

Mileage Claim Form Template

Mileage Claim Form Template

Travel Reimbursement Form Template Beautiful 13 Sample Mileage Log

10 Vehicle Mileage Log Templates For MS Excel Word Excel Templates

Printable Mileage Log Template Business

What Is Considered Personal Mileage On A Company Vehicle - Yes the IRS considers the personal use of a company vehicle a taxable noncash fringe benefit Businesses must calculate the value of this and include it on employee wages