What Is Disability Tax Credit Form Applying for the DTC involves the person who has the impairment and a medical practitioner who can certify the effects of the impairment Find a medical practitioner to certify your impairment Possible medical practitioner fees When to apply You may apply for the DTC at any time during the year

RC4064 Disability Related Information Date modified 2024 01 23 Individuals with a severe and prolonged impairment in physical or mental functions can use this form to apply for the disability tax credit The disability tax credit DTC reduces taxes you owe but does not generate a refund You have to apply for the DTC with a medical practitioner s approval The DTC can be claimed for yourself or others who rely on you for daily assistance File your taxes with confidence Get your maximum refund guaranteed Start filing

What Is Disability Tax Credit Form

What Is Disability Tax Credit Form

https://disabilitycreditcanada.com/wp-content/uploads/2017_Disability_Tax_Credit_Guide.jpg

Disability Tax Credit Form Example Word Template

https://www.buysampleforms.com/wp-content/uploads/2023/03/disability-tax-credit-form-768x678.jpg?v=1678417263

The Disability Tax Credit Your Online Guide For 2023

https://www.resolutelegal.ca/wp-content/uploads/2022/11/the-disability-tax-credit2.jpg

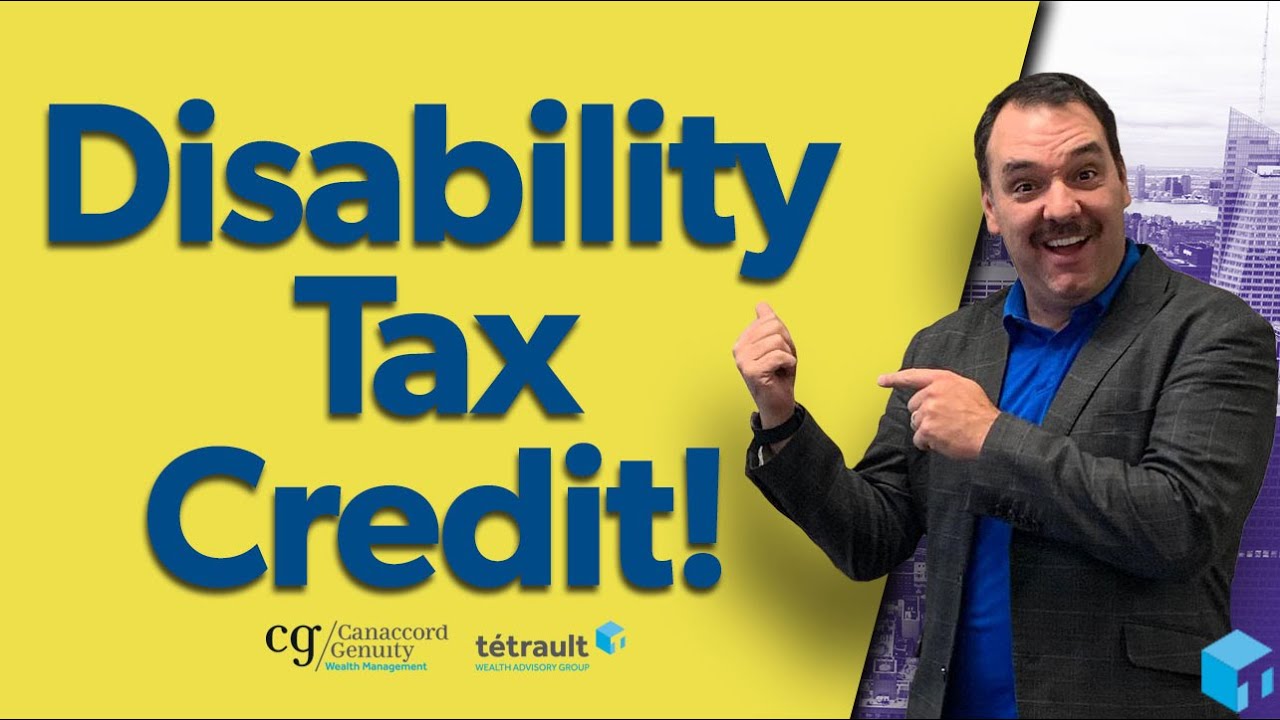

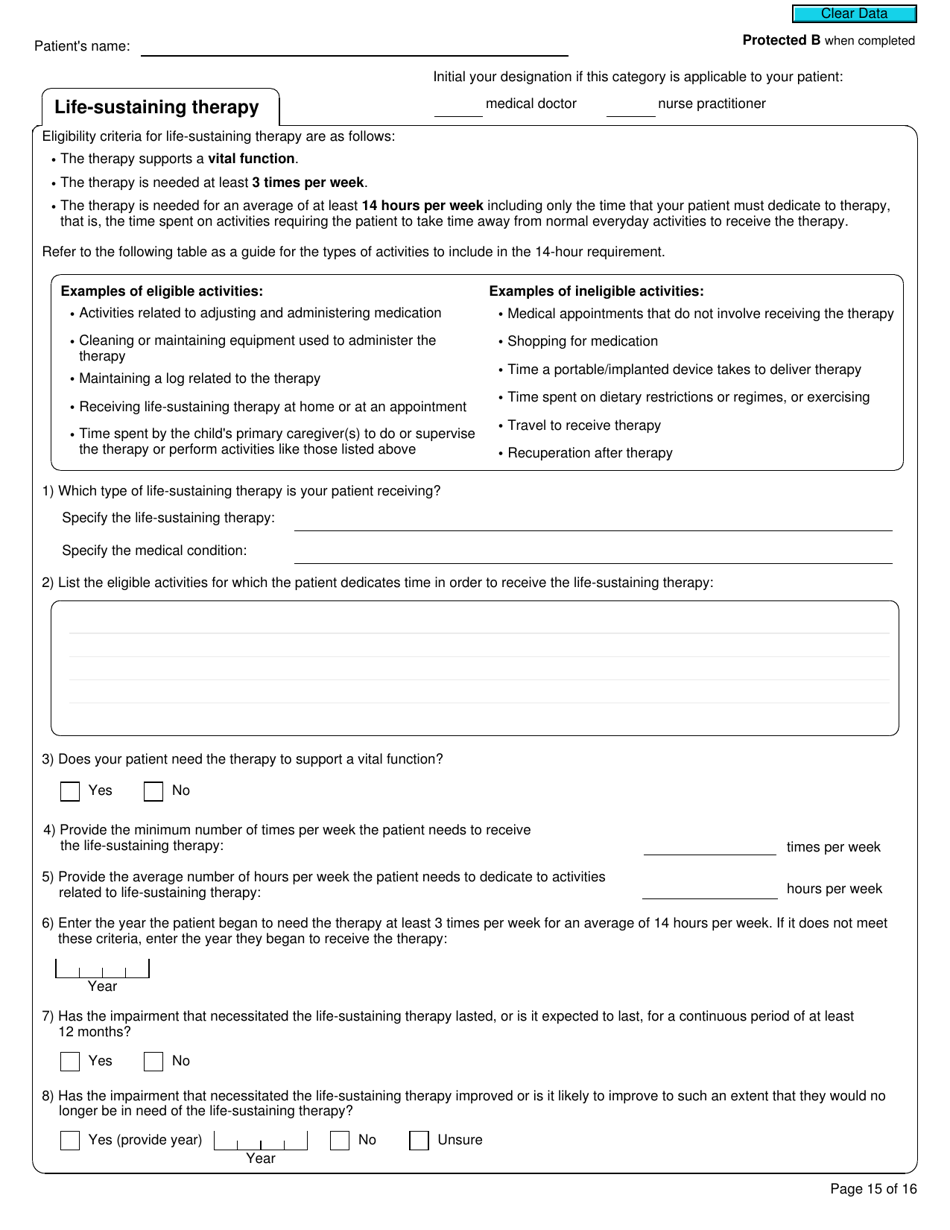

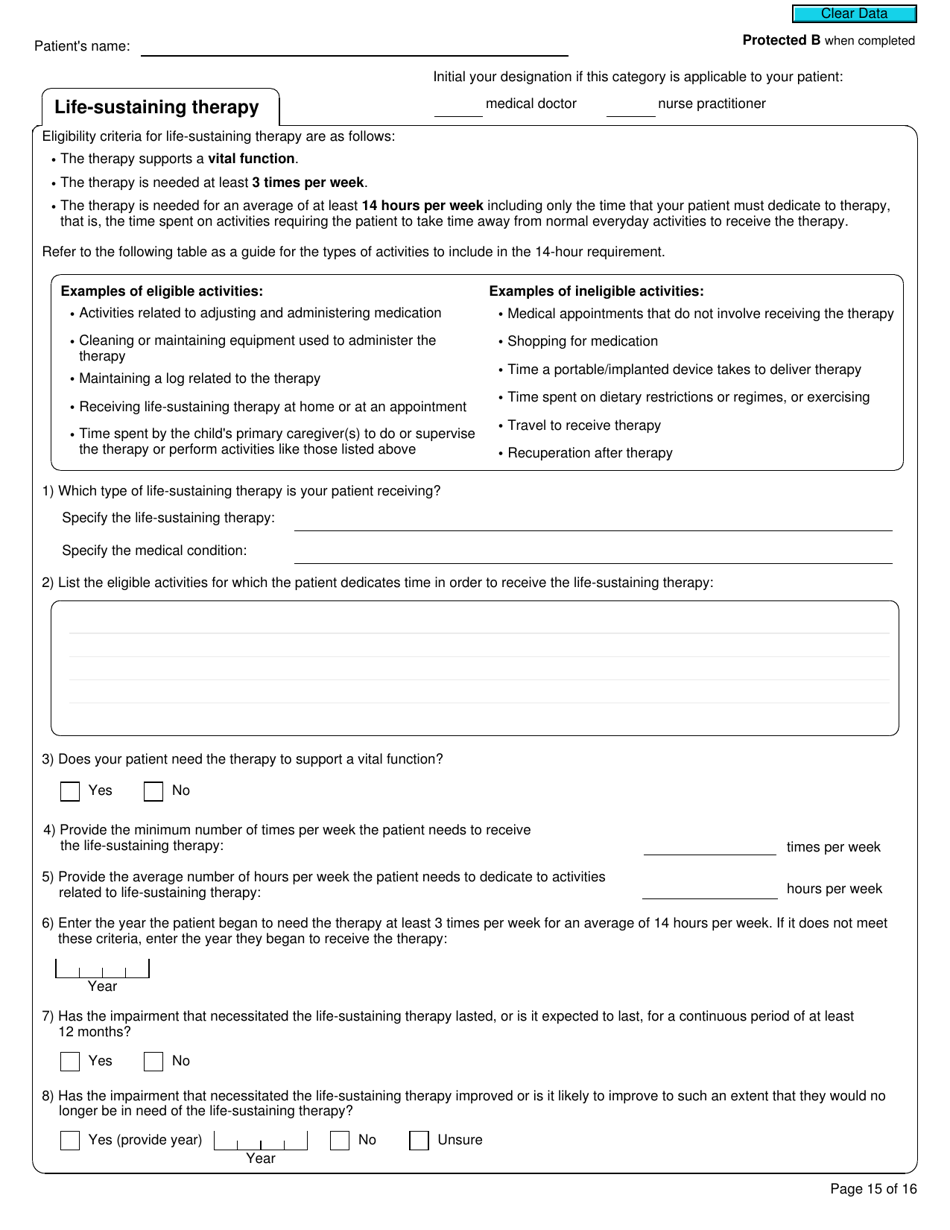

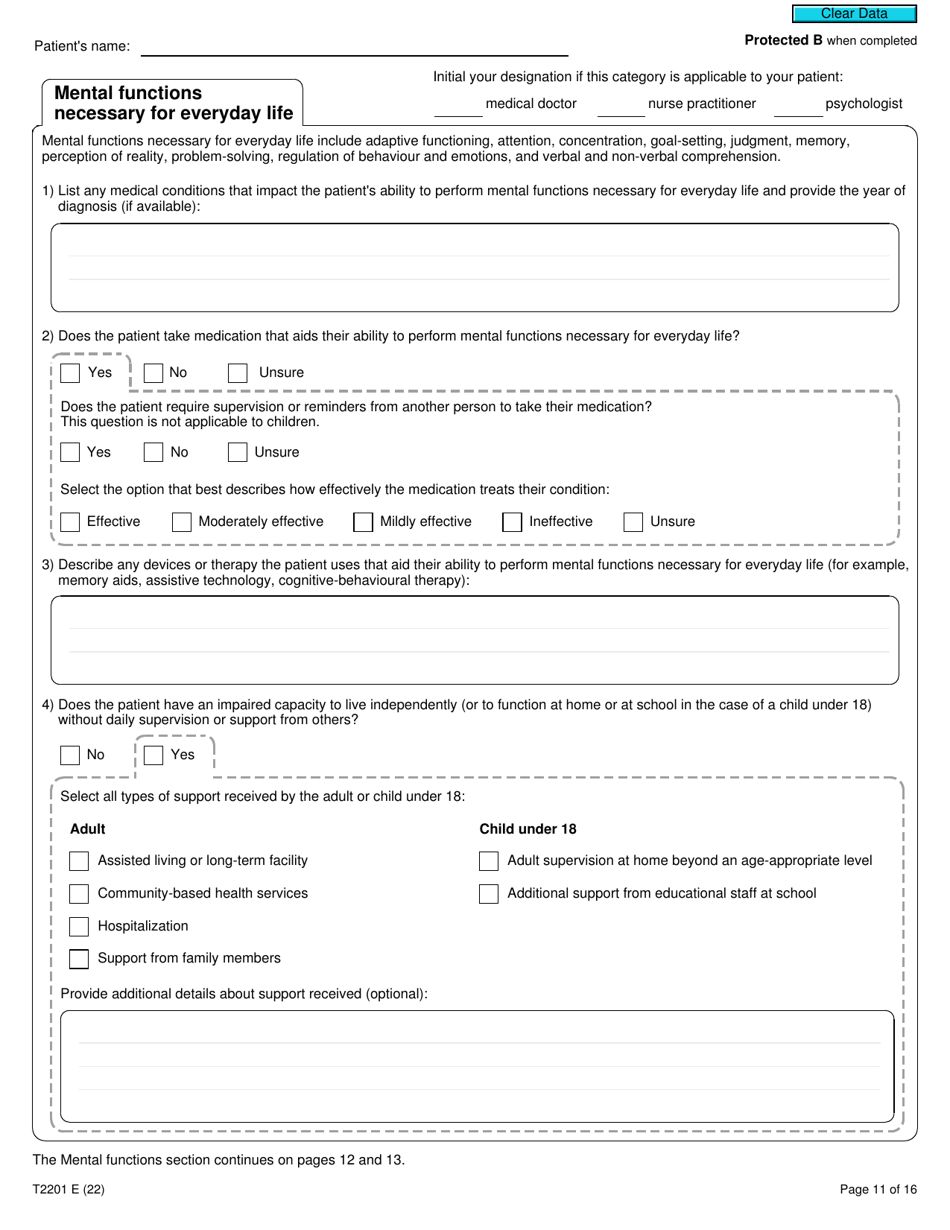

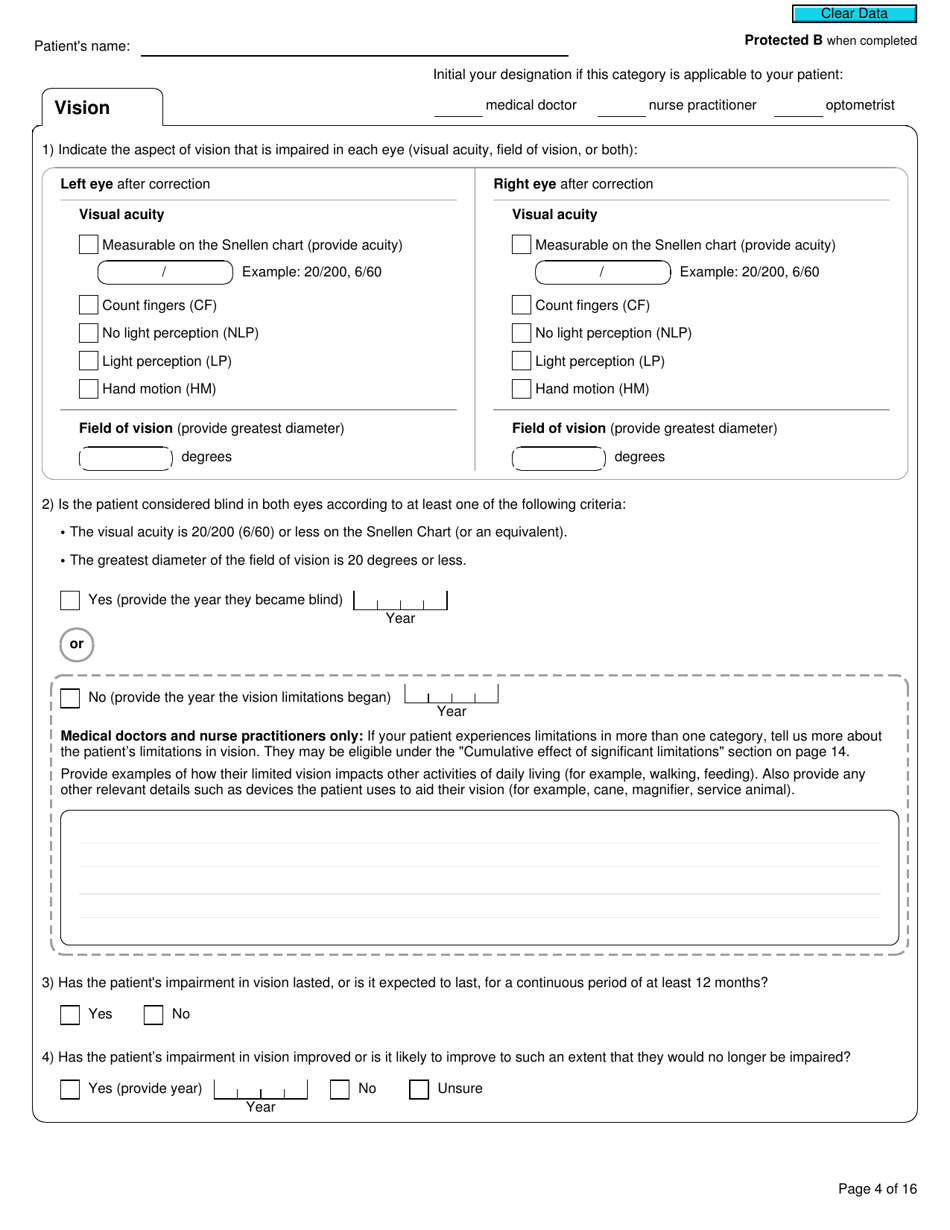

Form T2201 is the application you and your health professional must fill out to determine your eligibility for the DTC DTC eligibility An individual may be eligible if they have an impairment in physical or mental functions in one of the following categories The effects of the impairment must meet specific criteria for each impairment Vision Unknown Applying for the disability tax credit What is the disability tax credit The disability tax credit DTC is a non refundable tax credit that helps people with physical or mental impairments or their supporting family member reduce the amount of income tax they may have to pay

You can download the T2201 Disability Tax Credit Form here It is available in print digital audio electronic text and large print versions In order for individuals with disabilities to gain access to the information required from the CRA you can place an order for an alternate format here How to fill out the T2201 Disability Tax Credit Form This is the Ultimate 2024 Disability Tax Credit Handbook Guide Your Go To Resource for the Latest Regulations on Applying Eligibility Form T2201 and Claiming the Credit Exciting news Our 2024 Disability Tax Credit DTC guide has just been refreshed for March 2024

Download What Is Disability Tax Credit Form

More picture related to What Is Disability Tax Credit Form

Disability Tax Credit Form PDF Visual Impairment Medical Diagnosis

https://imgv2-2-f.scribdassets.com/img/document/362855036/original/ad37d1f1c3/1703107768?v=1

What Is Disability Tax Credit And Who Is Eligible Empireone Credit

https://www.empireonecredit.ca/wp-content/uploads/2023/03/What-is-Disability-Tax-Credit-and-Who-is-Eligible-1-768x512.png

The Disability Tax Credit Infographic

https://aidecanada.ca/images/default-source/autism-funding-for-18/0002e9bd83f81fc14010b914cc375123bcbd.jpg?sfvrsn=e817d739_1

FREE ASSESSMENT April 23 2024 by dccinc If you or a family member in Canada has a physical or mental impairment you might be eligible for the Disability Tax Credit This could entitle you to receive retroactive tax credits of up to If a qualified person usually a medical doctor but see above certifies that you have a severe and prolonged mental or physical impairment which markedly restricts the ability to perform a basic activity of daily living then a disability amount may be claimed

The Disability Tax Credit is a non refundable federal tax credit intended to help people with disabilities or their caregivers reduce their income taxes owing It is not automatic the individual must submit a completed form T2201 for approval and must meet the eligibility criteria The first step in claiming your disability benefits is completing the Disability Tax Credit certificate CRA Form T2201 It s crucial to ensure each section of the form is correctly filled out a discrepancy can make your entire claim ineligible or not worth what it can be even if your disability or medical condition qualifies for the DTC

What Are Benefits Of Disability Tax Credit How To Claim It

https://www.xoatax.com/wp-content/uploads/disability-tax-credit-application-1.webp

Disability Tax Credit Certificate World OSCAR

https://worldoscar.org/wp-content/uploads/2022/01/disabilityTaxCreditCertificatePg1.png

https://www.canada.ca/.../disability-tax-credit/how-apply-dtc.html

Applying for the DTC involves the person who has the impairment and a medical practitioner who can certify the effects of the impairment Find a medical practitioner to certify your impairment Possible medical practitioner fees When to apply You may apply for the DTC at any time during the year

https://www.canada.ca/.../forms/t2201.html

RC4064 Disability Related Information Date modified 2024 01 23 Individuals with a severe and prolonged impairment in physical or mental functions can use this form to apply for the disability tax credit

Disability Tax Credit For Canadians YouTube

What Are Benefits Of Disability Tax Credit How To Claim It

The Disability Tax Credit Guide Updated March 2023

Revenue Canada Disability Tax Credit Form REVNEUS

2008 Form Canada T2201 E Fill Online Printable Fillable Blank

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

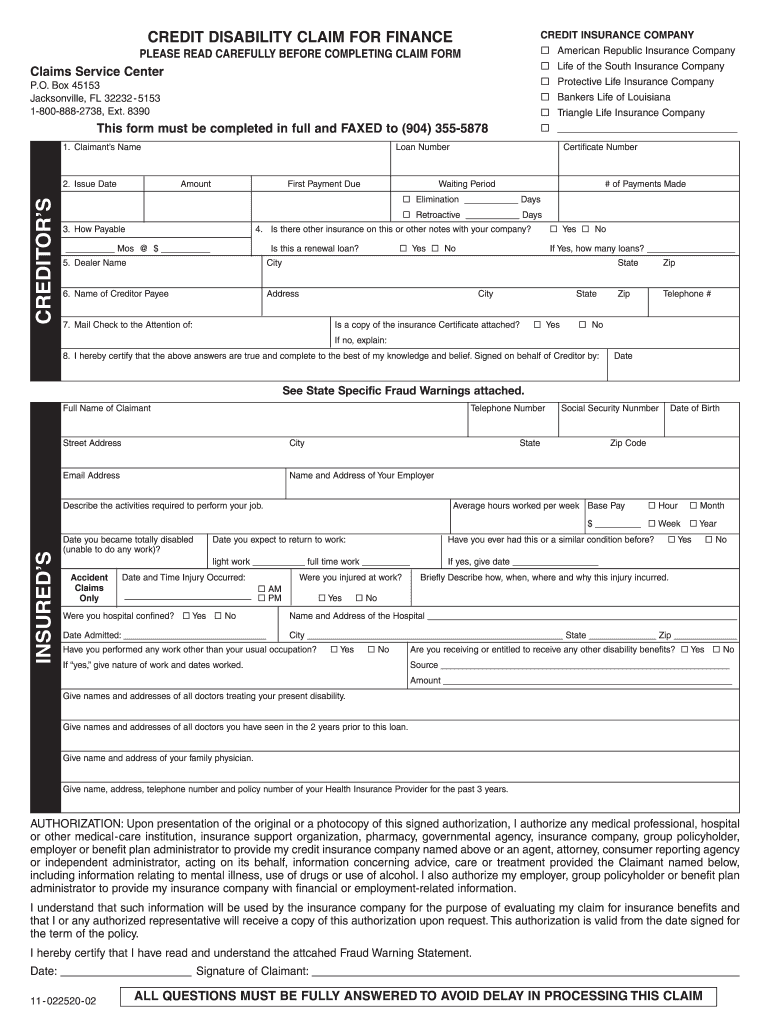

Credit Disability Form Fill Out Sign Online DocHub

What Is Disability Tax Credit Form - This is the Ultimate 2024 Disability Tax Credit Handbook Guide Your Go To Resource for the Latest Regulations on Applying Eligibility Form T2201 and Claiming the Credit Exciting news Our 2024 Disability Tax Credit DTC guide has just been refreshed for March 2024