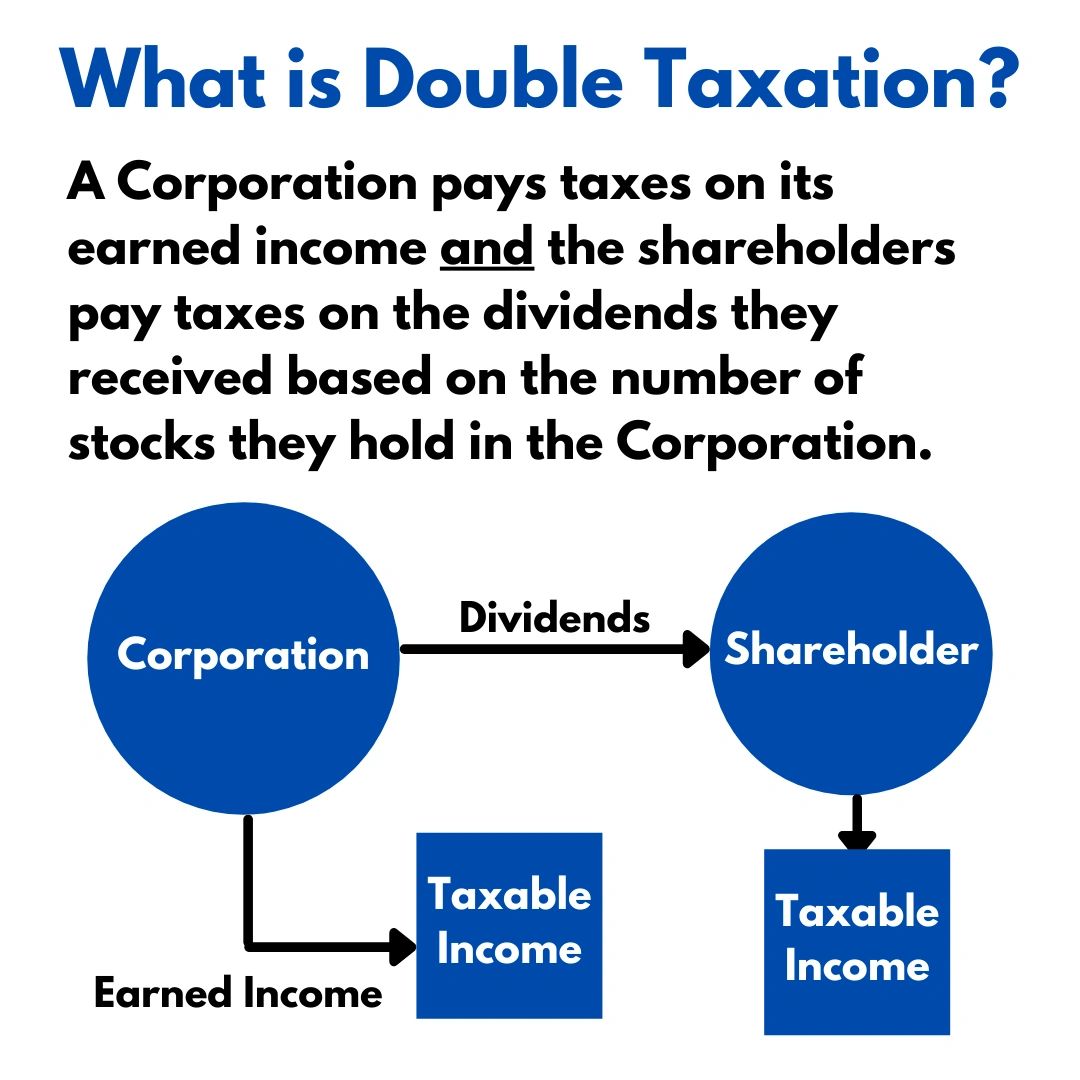

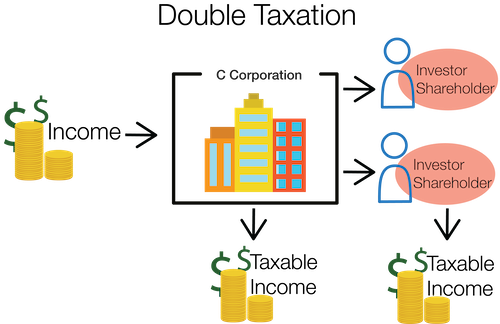

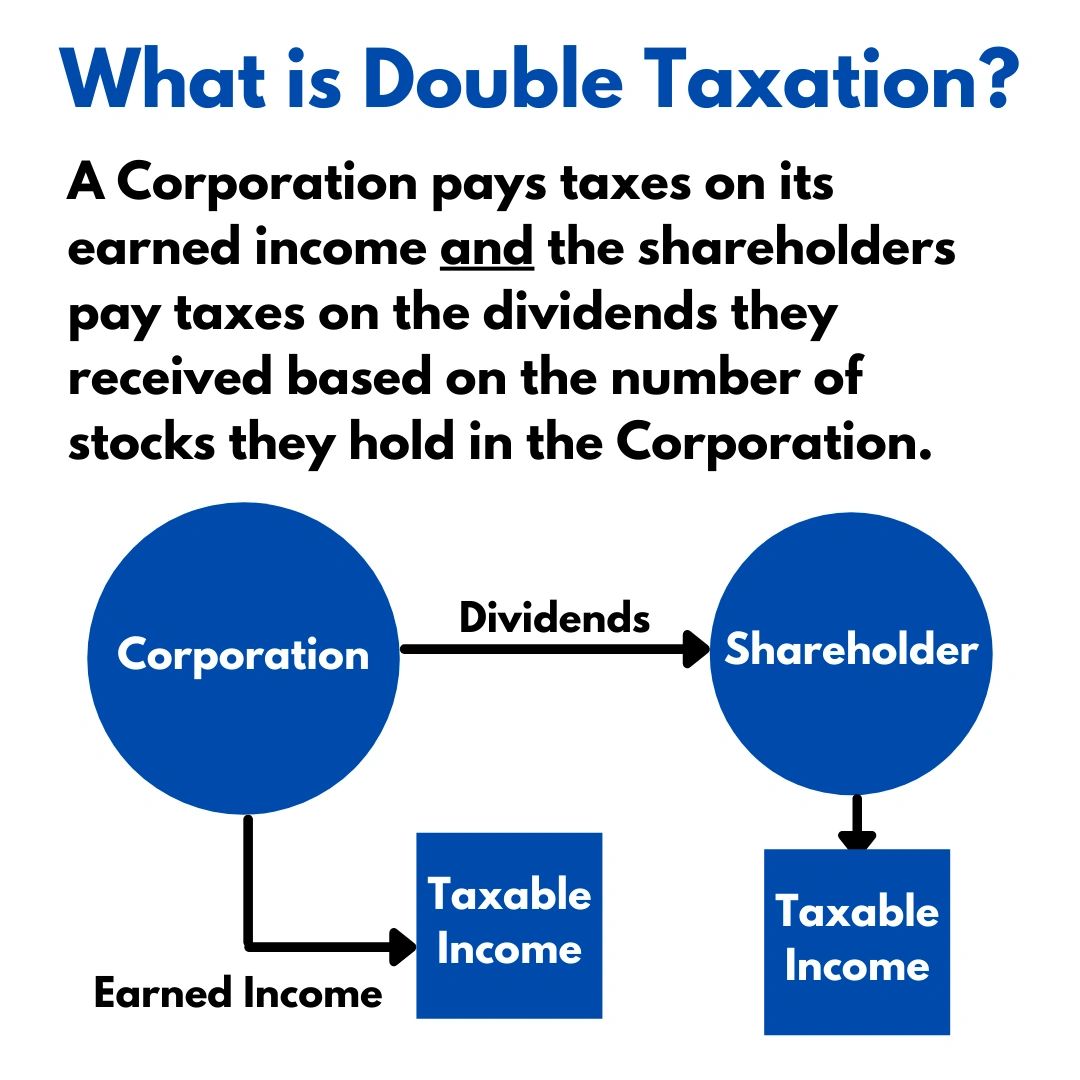

What Is Double Taxation Double taxation is the levying of tax by two or more jurisdictions on the same income in the case of income taxes asset in the case of capital taxes or financial transaction in the case of sales taxes

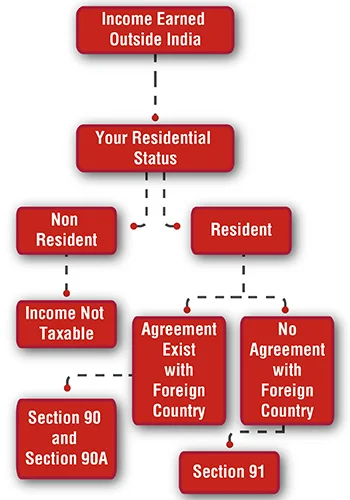

Double taxation occurs when income is taxed by two or more countries on the same profits This can happen when there is no agreement between the countries on how to tax cross border income or when the two countries have different tax systems Double taxation is a situation associated with how corporate and individual income is taxed and is therefore susceptible to being taxed twice

What Is Double Taxation

What Is Double Taxation

https://img1.wsimg.com/isteam/ip/8daf91c8-5755-4439-8eba-ba599096975d/Post 20.png

Double Tax Deduction

http://rimc.uum.edu.my/images/dtd1bi.JPG

Doble Imposici n Fiscal Todo Lo Que Debe Saber FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Double-Taxation-_Graphic-2.png

Double taxation in economics situation in which the same financial assets or earnings are subject to taxation at two different levels e g personal and corporate or in two different countries What is a DTA As the name suggests a double tax agreement is an agreement or a contract regarding double taxation or more correctly the avoidance of double taxation In the Malaysian context a DTA is usually signed by a cabinet minister or sometimes by the prime minister representing his country

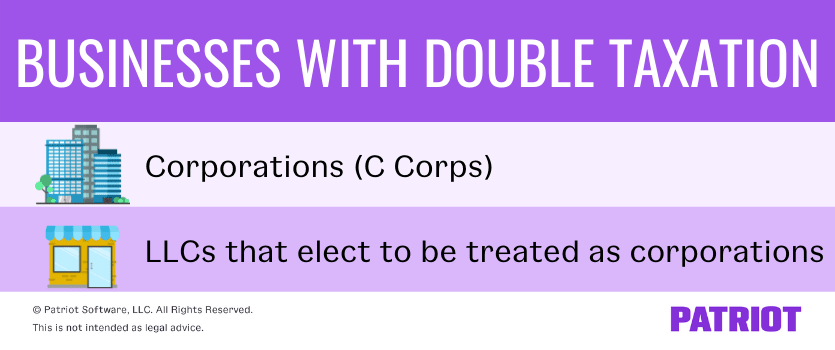

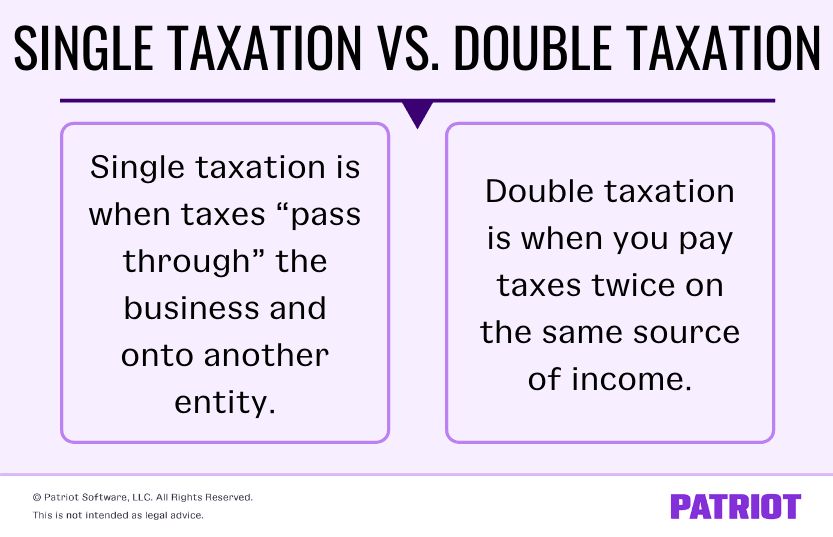

Double taxation is when a corporation or individual is taxed twice on the same income One way this happens is when a corporation pays corporate taxes on earnings or profits then pays dividends from those profits to shareholders who must pay personal taxes on that money Double taxation is when income or profits are taxed twice It is usually used in reference to when income taxes are paid twice This may happen when profit is taxed on the corporate level and then again as income on the personal level

Download What Is Double Taxation

More picture related to What Is Double Taxation

What Is Double Taxation How It Works Examples More

https://www.patriotsoftware.com/wp-content/uploads/2019/09/double-taxation-compressed.png

Single Taxation Vs Double Taxation Overview Pros Cons More

https://www.patriotsoftware.com/wp-content/uploads/2021/01/single-vs-double-taxation-1.png

How To Avoid Double Taxation In Your Small Business

https://m.foolcdn.com/media/affiliates/images/Double_Taxation-02-Double_Taxation_Flowchart.d.width-750.png

A tax treaty is a bilateral two party agreement made by two countries to resolve issues involving double taxation of passive and active income of each of their respective citizens Double taxation refers to the imposition of taxes on the same income assets or financial transaction at two different points of time Double taxation can be economic which refers to the taxing of shareholder dividends after taxation as corporate earnings

[desc-10] [desc-11]

What Is Double Taxation How It Works Examples More

https://www.patriotsoftware.com/wp-content/uploads/2019/12/double_taxation-01.jpg

Double Taxation PPT

https://cdn.slidesharecdn.com/ss_thumbnails/doubletaxation-201006091457-thumbnail.jpg?width=640&height=640&fit=bounds

https://en.wikipedia.org/wiki/Double_taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income in the case of income taxes asset in the case of capital taxes or financial transaction in the case of sales taxes

https://www.financestrategists.com/tax/double-taxation

Double taxation occurs when income is taxed by two or more countries on the same profits This can happen when there is no agreement between the countries on how to tax cross border income or when the two countries have different tax systems

What Is Double Taxation How It Works Examples More

What Is Double Taxation How It Works Examples More

Methods Of Avoiding The Double Taxation

What Is Double Taxation How It Works Examples More

What Is Double Taxation And How Can I Prevent It

What Is Double Taxation and How Can Expats Avoid It

What Is Double Taxation and How Can Expats Avoid It

Avoid Double Taxation In Canada Personal Tax Advisors

Principles Of Applying Double Taxation Agreements In Vietnam

State In One two Sentence s Each The Various Processes Involved In

What Is Double Taxation - Double taxation in economics situation in which the same financial assets or earnings are subject to taxation at two different levels e g personal and corporate or in two different countries