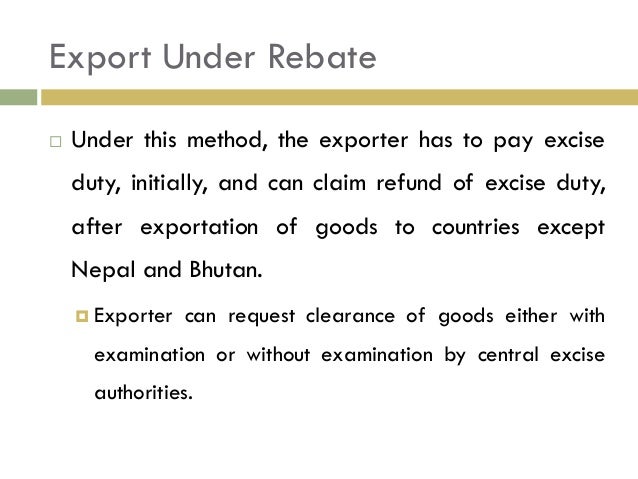

What Is Export Under Rebate Export tax rebates refer to refunds of the value added tax VAT and consumption tax CT actually paid by the exporting enterprises on exported goods during the production and circulation process

Types of export incentives include export subsidies direct payments low cost loans tax exemption on profits made from exports and government financed international advertising RoDTEP stands for Remission of Duties and Taxes on Export Products It is a new scheme applicable from 1 January 2021 It replaced the existing MEIS Merchandise Exports from India Scheme The scheme

What Is Export Under Rebate

What Is Export Under Rebate

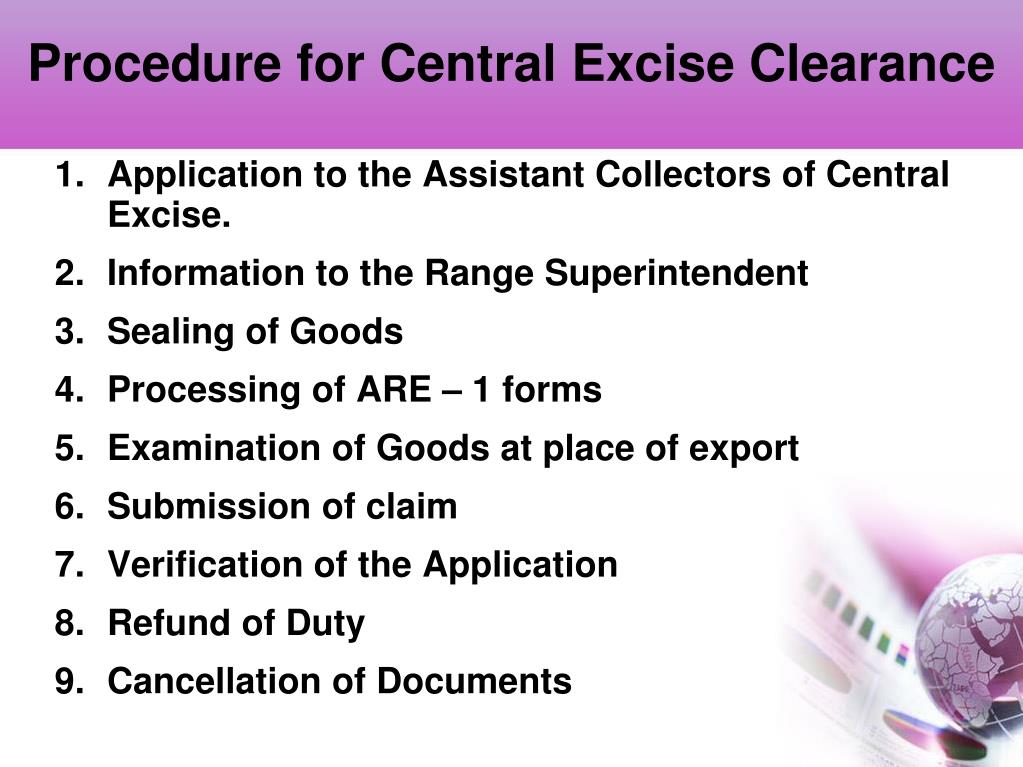

https://image2.slideserve.com/5205387/procedure-for-central-excise-clearance-l.jpg

PPT Export Documents Procedure PowerPoint Presentation Free

https://image2.slideserve.com/5205387/excise-duty-refund-l.jpg

Infographic

https://image.freepik.com/free-vector/import-and-export-infographic-hand-drawn_23-2149165167.jpg

Export Under Claim For Rebate New Central Excise Rule 18 corresponds to the earlier rule 12 of the Central Excise Rules 1944 The term refund in section 11B of the Central Excise Act 1944 Under the MEIS an incentive of 2 5 of the Free On Board FOB value of exports is provided to all exporters irrespective of their annual turnover However MEIS will

Rebate of duty paid on excisable goods exported or duty paid on the material used in the manufacture of such export goods may be claimed under Rule of 18 of Central Excise Rules 2002 Export of goods under Bond An exporter needs to file a shipping bill for the goods being exported to a place outside India Under this case the shipping bill so filed is treated as a deemed application for

Download What Is Export Under Rebate

More picture related to What Is Export Under Rebate

Retiring A Bill Of Exchange Under Rebate Journal Entries Finance

https://learn.financestrategists.com/wp-content/uploads/Bill-of-Exchange-Retired-Under-Rebate-Journal-Entries.jpg

Exporter Et Importer Signification Avantages Et Inconv nients

https://media.geeksforgeeks.org/wp-content/cdn-uploads/20220627181517/Export-import-poster-768x510.png

Stages Of Export Order

https://image.slidesharecdn.com/7-140413234036-phpapp02/95/stages-of-export-order-21-638.jpg?cb=1397432631

In June 2022 the European Parliament put forward amendments regarding the potential introduction of export rebates under the EU Emission Trading System ETS and Under GST regime the exporter has either of the two options Export under bond without payment of tax Export along with tax payment and claim refund later Brief on refund of IGST

This paper examines the effect of export value added tax VAT rebate policy on the margins of exports in terms of export value quantity and price Under Rule 12 rebate of Central Excise duty is admissible to the exporters of the goods in respect of duty paid on excisable goods and duty paid on material used in the manufacture of

Export Industry Optimistic About Future Engineering Post Leader In

https://enggpost.com/wp-content/uploads/2020/05/export.jpg

Export Worldwide Blog Export Marketing

https://blog.exportworldwide.com/hubfs/export_map.jpg?t=1530100788056

https://www.china-briefing.com › news › …

Export tax rebates refer to refunds of the value added tax VAT and consumption tax CT actually paid by the exporting enterprises on exported goods during the production and circulation process

https://www.investopedia.com › terms …

Types of export incentives include export subsidies direct payments low cost loans tax exemption on profits made from exports and government financed international advertising

What Is A Subsidy Definition And Meaning Market Business News

Export Industry Optimistic About Future Engineering Post Leader In

What Is Export Marketing Land Sea Air Shipping Services InterlogUSA

Suhas Kakade Senior Executive Siemens LinkedIn

How To Export Under GST

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

An Impetus To Export And Import Under GST

Income Tax Rebate Under Section 87A

GST Refund For Exporters IndiaFilings

What Is Export Under Rebate - Under the MEIS an incentive of 2 5 of the Free On Board FOB value of exports is provided to all exporters irrespective of their annual turnover However MEIS will