What Is Incorrect Recovery Rebate Credit You had a change in income If your income was lower in 2021 the IRS could have used an incorrect AGI to calculate your third stimulus payment meaning you might qualify for more than you received refer to the

News TAX IRS mostly correct on recovery rebate credits TIGTA says By Paul Bonner May 23 2022 TOPICS The IRS correctly calculated taxpayers eligibility Early filers who claimed the wrong amount of Recovery Rebate Credit You may have filed your 2020 return early and claimed additional Recovery Rebate Credit but later received your second

What Is Incorrect Recovery Rebate Credit

What Is Incorrect Recovery Rebate Credit

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

:max_bytes(150000):strip_icc()/GettyImages-162233497-56cb365f3df78cfb379b575a.jpg)

Recovery Rebate Credit What It Is How It Works FAQ

https://www.investopedia.com/thmb/hi0D3xSBspI8wFFXoV3cb7efock=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-162233497-56cb365f3df78cfb379b575a.jpg

How To Check The Status Of Your Tax Refund

https://www.taxdefensenetwork.com/wp-content/uploads/2021/06/tax-refund-2020-compressed.jpg

The recovery rebate tax credit and stimulus checks are joined at the hip In fact third stimulus checks including plus up payments were simply advance payments of the credit The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000

How taxpayers who are not required to file a tax return for 2021 may claim the recovery rebate credit Topic B Specific eligibility FAQs on claiming the recovery The Internal Revenue Service is correcting plenty of mistakes that are being made after people plug in the wrong number for the Recovery Rebate Credit on their

Download What Is Incorrect Recovery Rebate Credit

More picture related to What Is Incorrect Recovery Rebate Credit

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/the-recovery-rebate-credit-get-your-full-stimulus-check-payment-with-1.jpg

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/bravecto-online-rebate-2022-rebate2022-2.png

The IRS figures out the amount of the Recovery Rebate Credit similar to how they calculated your stimulus payment except your credit eligibility and the amount The May 17 2024 deadline is fast approaching for taxpayers who have not yet filed a 2020 tax return to claim a refund of withholdings estimated taxes or their

The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round What if the IRS adjusts my return for the RRC and it is incorrect If you did not receive the stimulus payment as the IRS has suggested you will disagree with the notice when you

What Does The Recovery Rebate Form Look Like Bears

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like-768x719.png

How To File Recovery Rebate Credit Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

https://blog.taxact.com/10-faqs-about-cl…

You had a change in income If your income was lower in 2021 the IRS could have used an incorrect AGI to calculate your third stimulus payment meaning you might qualify for more than you received refer to the

:max_bytes(150000):strip_icc()/GettyImages-162233497-56cb365f3df78cfb379b575a.jpg?w=186)

https://www.journalofaccountancy.com/news/2022/may/...

News TAX IRS mostly correct on recovery rebate credits TIGTA says By Paul Bonner May 23 2022 TOPICS The IRS correctly calculated taxpayers eligibility

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

What Does The Recovery Rebate Form Look Like Bears

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

What Is The Recovery Rebate Credit And Do You Qualify The

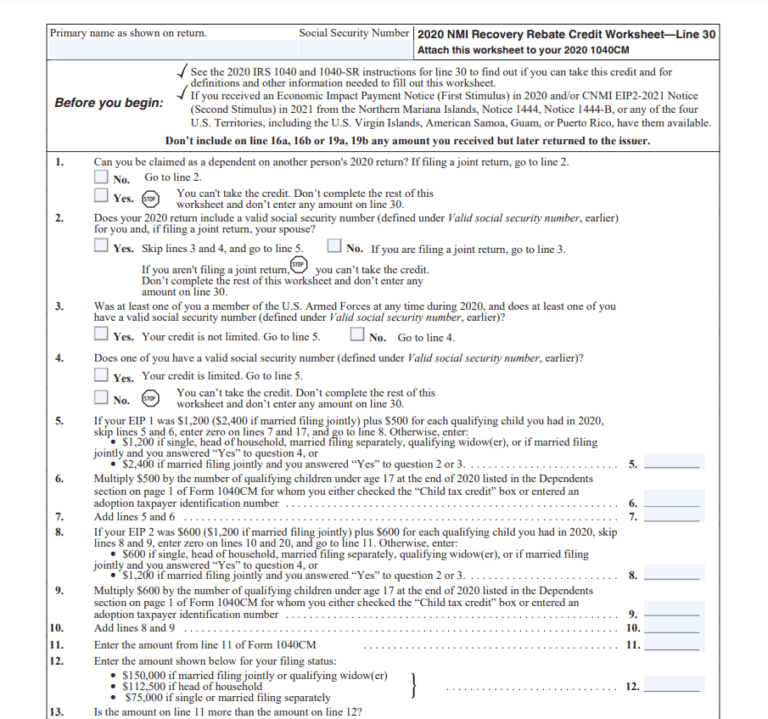

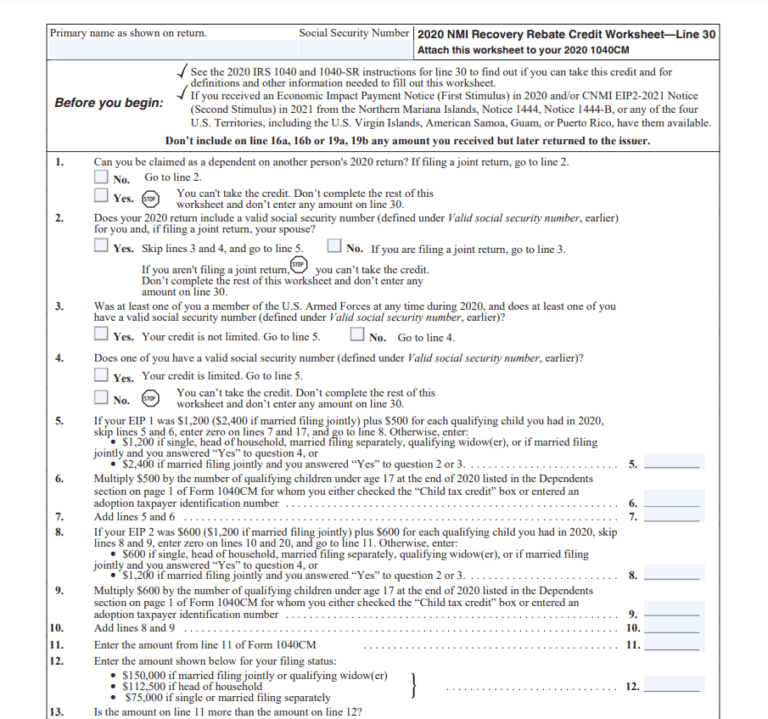

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

IRS Provides FAQs Regarding The Recovery Rebate Credit YouTube

IRS Provides FAQs Regarding The Recovery Rebate Credit YouTube

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

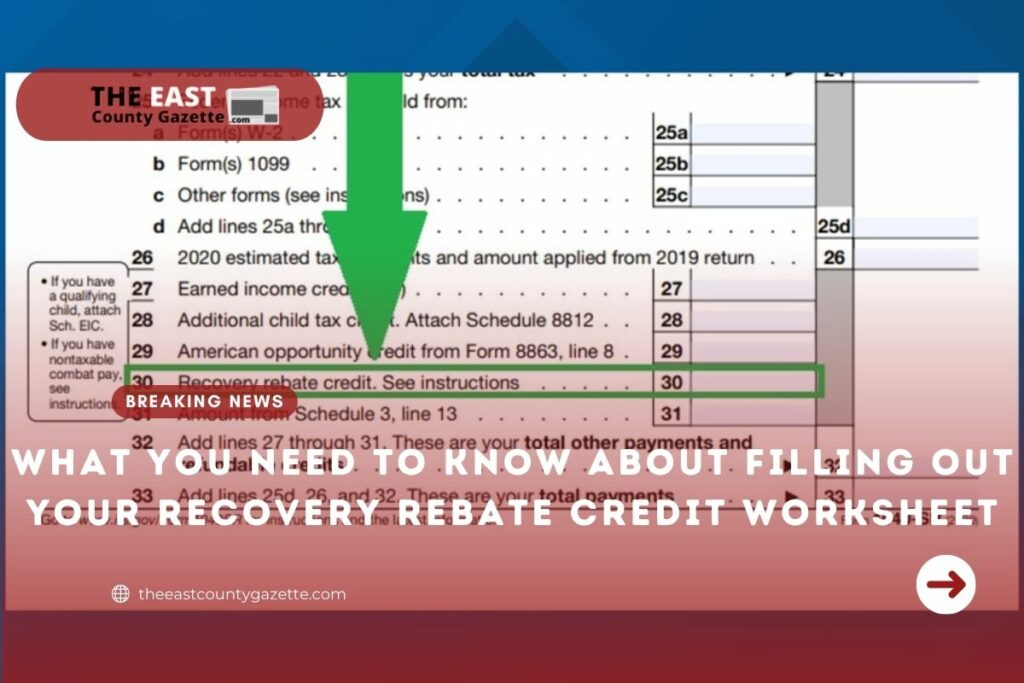

What You Need To Know About Filling Out Your Recovery Rebate Credit

Recovery Rebate Credit Form Printable Rebate Form

What Is Incorrect Recovery Rebate Credit - The recovery rebate credit can generate a tax refund whether or not you owe any taxes which means extra money in your pocket So it s worth filing a tax