What Is Low Income Rebate The 32 5 marginal tax rate will be lowered to 30 for a substantial bracket spanning from 45 000 to 200 000 Notably the 37 tax bracket will be abolished altogether Here s a breakdown Income up to 18 200 Nil tax payable Income between 18 201 and 45 000 Nil plus 19 of the excess over 18 200

Between 2018 19 and 2021 22 you may have been eligible to receive one or both of the low income tax offset if you earn up to 66 667 low and middle income tax offset if you earn up to 126 000 LMITO ended on 30 June 2022 The last year you can receive it is the 2021 22 income year The NSW Low Income Household Rebate helps eligible concession cardholders pay their electricity bills The rebate is 385 per embedded network on supply household per financial year If you re an embedded network on supply customer you can apply for the rebate here

What Is Low Income Rebate

What Is Low Income Rebate

https://9jabusinesshub.com/wp-content/uploads/2023/04/low-income.jpg

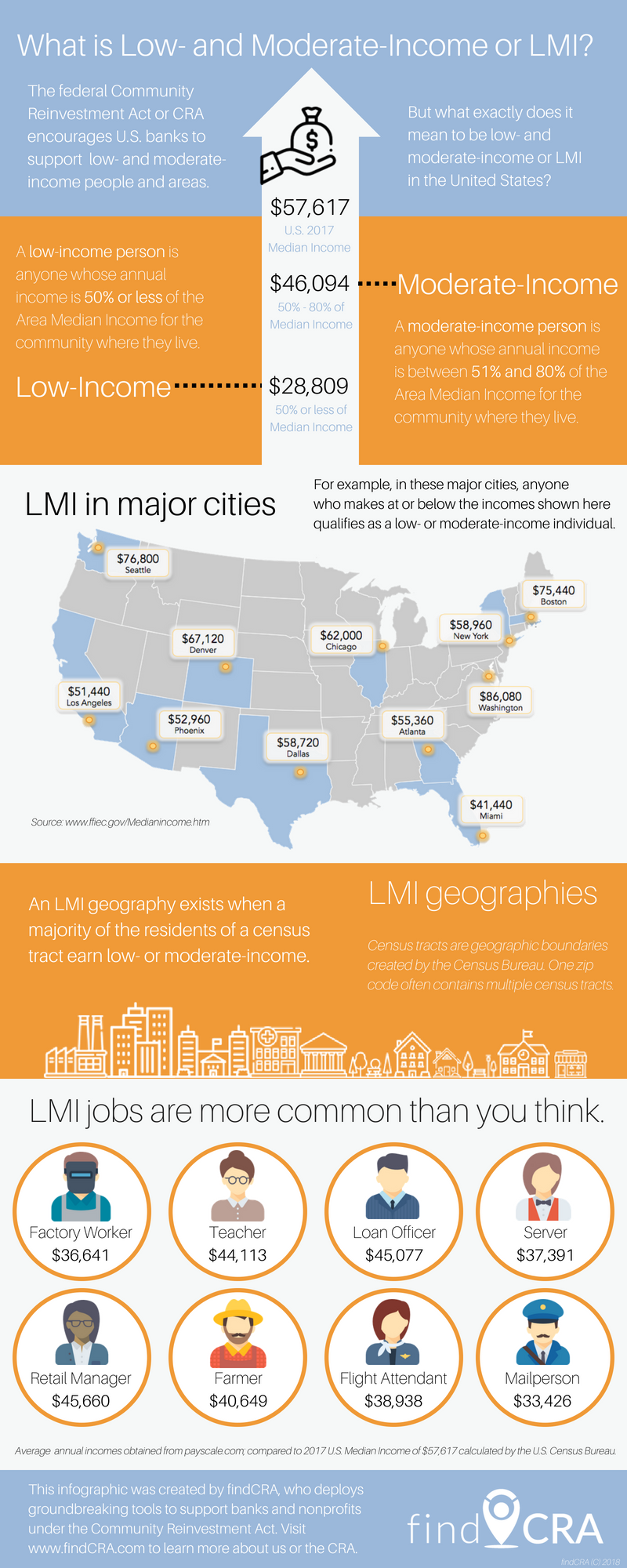

Ever Wondered What Is Low And Moderate Income Or LMI Here s Your

https://www.learncra.com/wp-content/uploads/2018/06/What-is-LMI.png

How Do Low Income Families Spend Their Money Econofact

https://econofact.org/wp-content/uploads/2021/11/Avg-Monthly-Expend-Final_V3.png

For 2022 23 full the Low Income Tax Offset is valued at 700 on low incomes up to 37 500 The offset is withdrawn at the rate of 5 of income above 37 500 up to 45 000 At an income of 45 000 the offset is reduced to 325 withdrawn at the rate of 1 5 of the income above 45 000 The NSW Low Income Household Rebate helps eligible concession cardholders pay their electricity bills The rebate is 350 per retail on market household per financial year If you re a retail on market customer you need to

If you receive the NSW Low Income Household Rebate NSW Family Energy Rebate NSW Seniors Energy Rebates NSW Medical Energy Rebate or NSW Life Support Rebate in the 2023 24 financial year you will also automatically receive the bill What is the low income super tax offset If you earn up to 37 000 a year you may be eligible to receive a low income super tax offset LISTO payment of up to 500 You don t need to do anything to receive a LISTO payment

Download What Is Low Income Rebate

More picture related to What Is Low Income Rebate

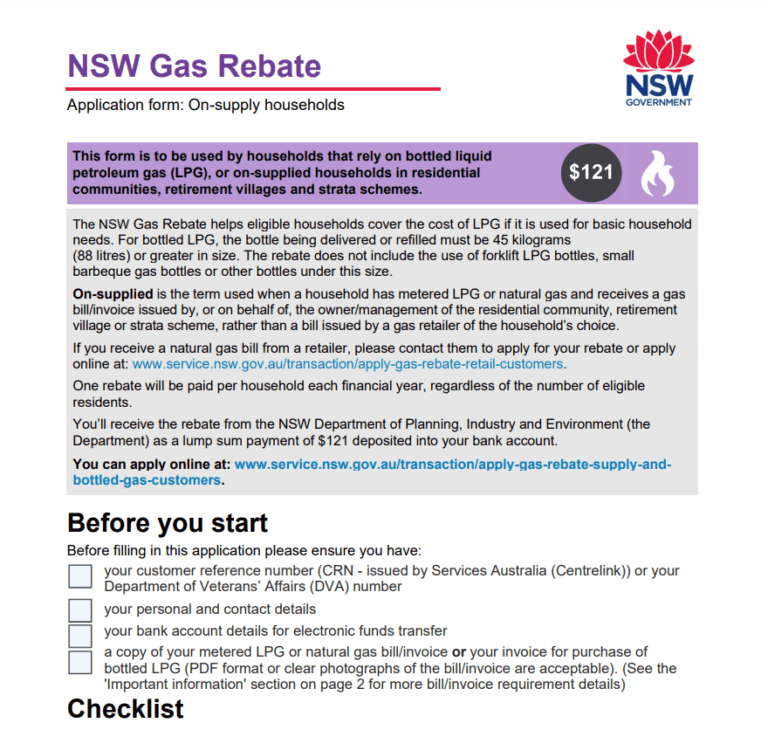

NSW Gas Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/NSW-Gas-Rebate-Form-768x730.png

What Is Low Income

https://www.askmoney.com/wp-content/uploads/sites/18/2021/09/2a6ce166adaabf4c5872fa47d9b8e7db.jpg?resize=300

Banks_Avenue_public_housing.jpg)

How To Apply For Low Income Apartments In Albany NY

https://global-uploads.webflow.com/5a585cd951b49400018c874a/5f2c373da932cb7f59b0de10_(1)Banks_Avenue_public_housing.jpg

Rebate income 2022 Work out your rebate income and if you re eligible for the seniors and pensioners tax offset at question T1 We work out what we call rebate income to determine whether you are eligible for the seniors and pensioners tax offset at T1 There are rebates for low income households families and seniors gas rebates medical and life support energy rebates These programs are available to eligible NSW residents

The 700 Low Income Tax Offset LITO combined with the tax free threshold of 18 200 effectively allows working Australians to earn up to 21 884 for the 2022 23 financial year before they need to pay any income tax or Medicare Levy Programs should identify opportunities to deliver free home energy upgrades to the lowest income households at no up front cost through combining rebates with other program funds and tax credits as well as options for low to no cost financing

Low Income Household Income Rebate Survey

https://surveymonkey-assets.s3.amazonaws.com/survey/510807941/12acbaee-5e2c-4012-bd9b-32618628d42b.png

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

https://www.kpgtaxation.com.au/blog/low-income-tax...

The 32 5 marginal tax rate will be lowered to 30 for a substantial bracket spanning from 45 000 to 200 000 Notably the 37 tax bracket will be abolished altogether Here s a breakdown Income up to 18 200 Nil tax payable Income between 18 201 and 45 000 Nil plus 19 of the excess over 18 200

https://www.ato.gov.au/forms-and-instructions/low...

Between 2018 19 and 2021 22 you may have been eligible to receive one or both of the low income tax offset if you earn up to 66 667 low and middle income tax offset if you earn up to 126 000 LMITO ended on 30 June 2022 The last year you can receive it is the 2021 22 income year

Illinois Tax Rebates 2022 Property Income Rebate Checks Being Sent To

Low Income Household Income Rebate Survey

What Is Income Tax Rebate Under Section 87A HDFC Life

How To Get Low Income Housing Fast Housing Waiting List Secrets YouTube

What Is Low Income

What Is Low Income Subsidy Or Medicare Extra Help

What Is Low Income Subsidy Or Medicare Extra Help

What Is Considered Low Income In New York State The Right Answer

Low Income Property Tax Rebate Nova Scotia Lowesrebate

50 Expert Tips Calculating Ideal Rent Income Ratio 2023 Guide

What Is Low Income Rebate - If you are a low or low and middle income earner you may be eligible to claim the low income tax offset and low and middle income tax offset LITMO You won t need to complete any section in your tax return as it