Income Tax Rebate On Home Loan Stamp Duty Web 31 janv 2022 nbsp 0183 32 Under Section 24 of Income Tax Act 1961 a buyer can claim deduction up to a maximum of Rs 2 lakh for interest on the loan taken for acquisition construction of self occupied house property

Web 1 avr 2016 nbsp 0183 32 HM Revenue amp Customs Published 1 April 2016 Last updated 3 June 2020 See all updates Get emails about this page Documents Apply online sign in using Web 3 nov 2020 nbsp 0183 32 Stamp duty is paid for the registration of residential properties This tax is imposed on the transfer of ownership in real estate The exemption can be availed by the

Income Tax Rebate On Home Loan Stamp Duty

Income Tax Rebate On Home Loan Stamp Duty

https://www.financialexpress.com/wp-content/uploads/2022/01/home-loan.jpg

Best Home Loan Calculator In Malaysia With Legal Fees Stamp Duty

https://cdn.loanstreet.com.my/assets/og_images/en/home-loan-stamp-duty-calc-f374c1084832829fb98841b49a612234e73597b9275af23778c87c59e3b957d5.png

Blog

https://assetyogi.b-cdn.net/wp-content/uploads/2017/08/income-tax-rebate-on-home-loan-for-under-construction-property-1024x576.jpg

Web 28 mai 2020 nbsp 0183 32 Deduction on stamp duty and registration charges on property purchase could be claimed under Section 80C of the Income Web HOME INCOME TAX 80C 80 DEDUCTIONS TAX BENEFIT ON STAMP DUTY amp REGISTRATION CHARGES OF A PROPERTY Tax Benefit on Stamp Duty amp

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan Web 3 mars 2023 nbsp 0183 32 Income Tax Rebate on Home Loan for Stamp Duty and Registration Charges Apart from the rebate on principal repayment per Section 80C a reduction for custom duties and fees of registration can

Download Income Tax Rebate On Home Loan Stamp Duty

More picture related to Income Tax Rebate On Home Loan Stamp Duty

Stamp Duty Claims Claim Your Stamp Duty Rebate TODAY

https://getmytax.co.uk/wp-content/uploads/2023/01/Stamp-Duty-Land-Tax-Rebates.png

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://i.ytimg.com/vi/XkpSV0LrRSU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgSShAMA8=&rs=AOn4CLBKOFRJ5AEKmvS89fKVIw-BGAzxdw

Web 5 f 233 vr 2023 nbsp 0183 32 Deduction for stamp duty and registration charges Besides claiming the deduction for principal repayment a deduction for stamp duty and registration charges Web 15 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web Tax benefits on stamp duty You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA Web 1 f 233 vr 2022 nbsp 0183 32 Under Section 24 of Income Tax Act 1961 a buyer can claim deduction up to a maximum of Rs 2 lakh for interest on the loan taken for acquisition construction of self

Home Loan Calculator With Legal Fees Stamp Duty

https://cdn.loanstreet.com.my/assets/og_images/en/home-loan-stamp-duty-calc-c9dc9be375fa442ca3816bf58be86931.png

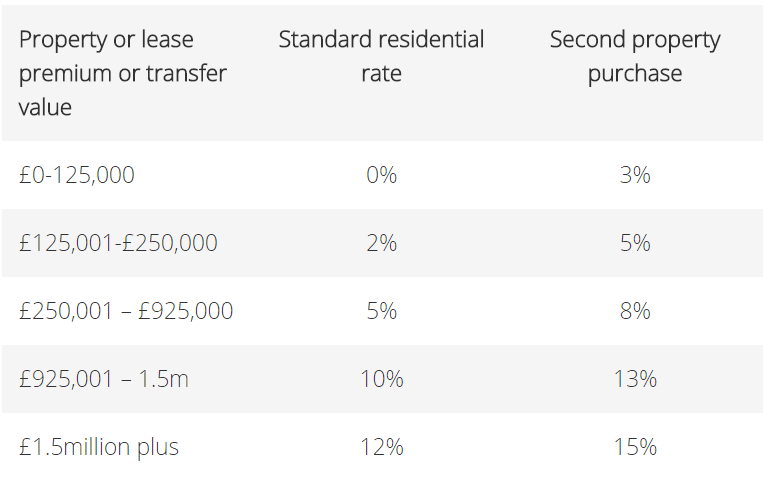

Stamp Duty For Second Homes Kempton Carr Croft

https://www.kemptoncarr.co.uk/wp-content/uploads/2018/03/Capture.png

https://www.financialexpress.com/budget/fro…

Web 31 janv 2022 nbsp 0183 32 Under Section 24 of Income Tax Act 1961 a buyer can claim deduction up to a maximum of Rs 2 lakh for interest on the loan taken for acquisition construction of self occupied house property

https://www.gov.uk/government/publications/stamp-duty-land-tax-apply...

Web 1 avr 2016 nbsp 0183 32 HM Revenue amp Customs Published 1 April 2016 Last updated 3 June 2020 See all updates Get emails about this page Documents Apply online sign in using

Individual Income Tax Rebate

Home Loan Calculator With Legal Fees Stamp Duty

DEDUCTION UNDER SECTION 80C TO 80U PDF

How To Calculate Tax Rebate On Home Loan Grizzbye

Property Tax Rebate Application Printable Pdf Download

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate Under Section 87A

Pay Upfront Mark Bouris On Stamp Duty Vs Annual Property Tax In NSW

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate On Home Loan Stamp Duty - Web 28 mai 2020 nbsp 0183 32 Deduction on stamp duty and registration charges on property purchase could be claimed under Section 80C of the Income