What Is Property Tax Exemption Texas The tax ceiling is the amount you pay in the year that you qualified for the age 65 or older or disabled person exemption The school district taxes on your residence homestead may go below but not above the ceiling amount

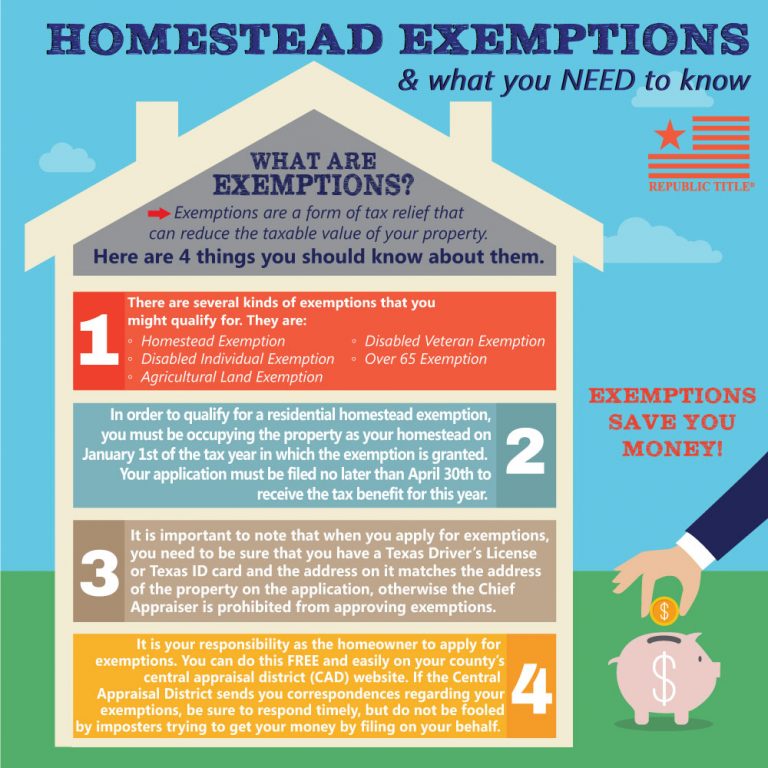

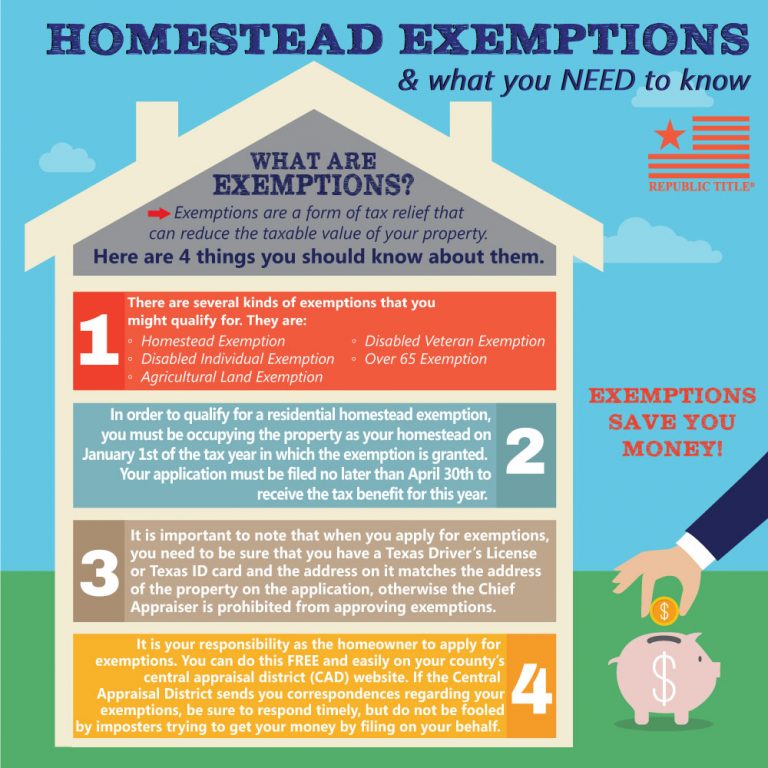

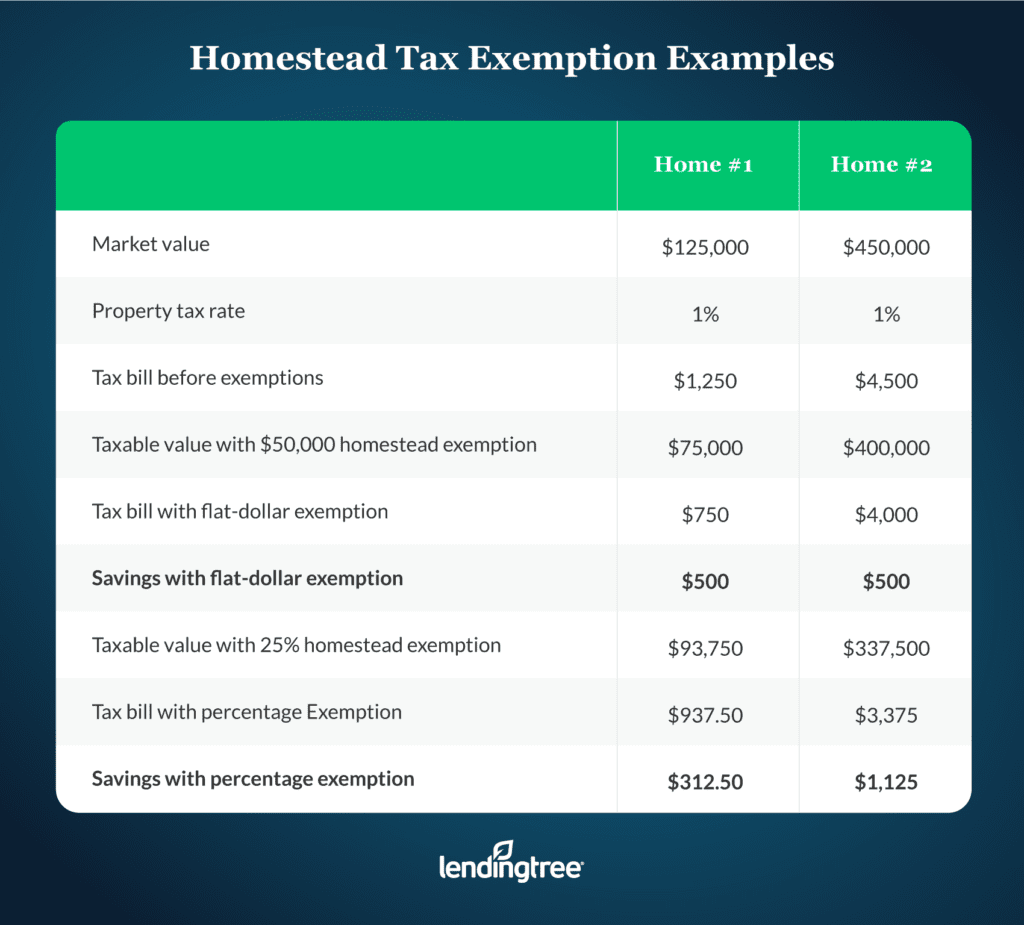

A general homestead exemption in Texas can save you money on property taxes by lowering the taxable value of your home by up to 100 000 for school taxes Senior homeowners disabled homeowners disabled veterans and military or first responder spouses can claim additional exemptions What Is A Property Tax Exemption Exemptions allow owners of real estate in Texas to save money on property taxes Exemptions work in two separate ways They can A exempt a portion of the value from taxation and B cap how property taxes can increase year over year

What Is Property Tax Exemption Texas

What Is Property Tax Exemption Texas

http://theshoppersweekly.com/wp-content/uploads/2018/04/tax-1.jpg

Homestead Exemption Mojgan JJ Panah

http://www.jjpanah.com/files/2018/12/Homestead-Exemption-Infographic-768x768.jpg

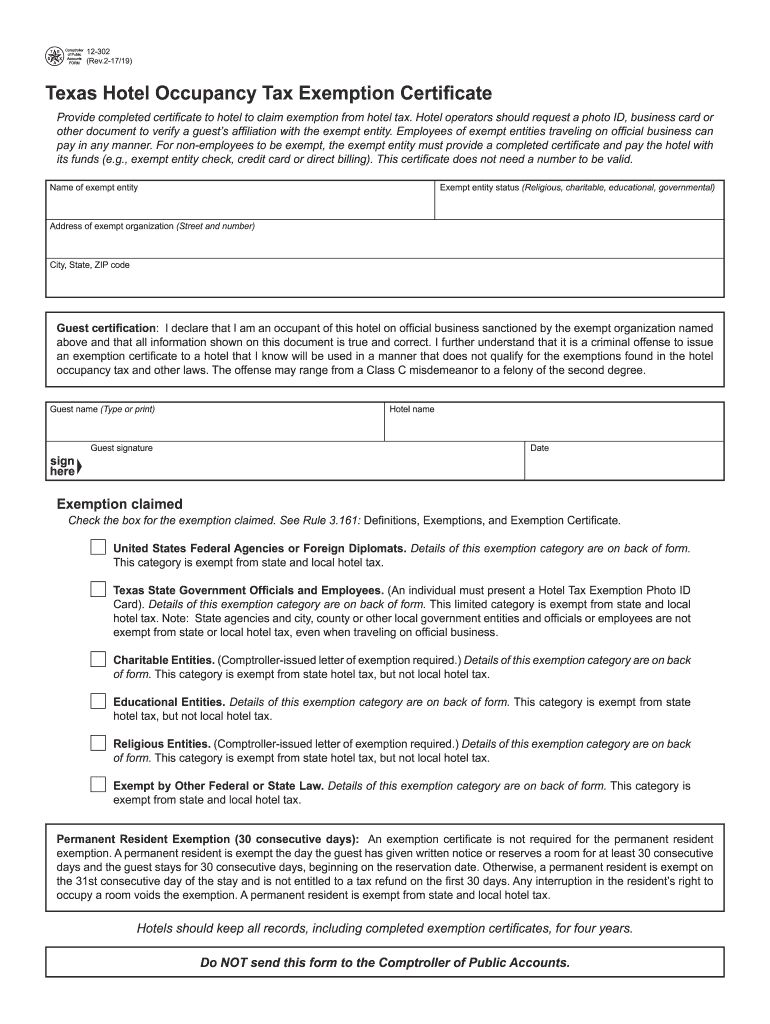

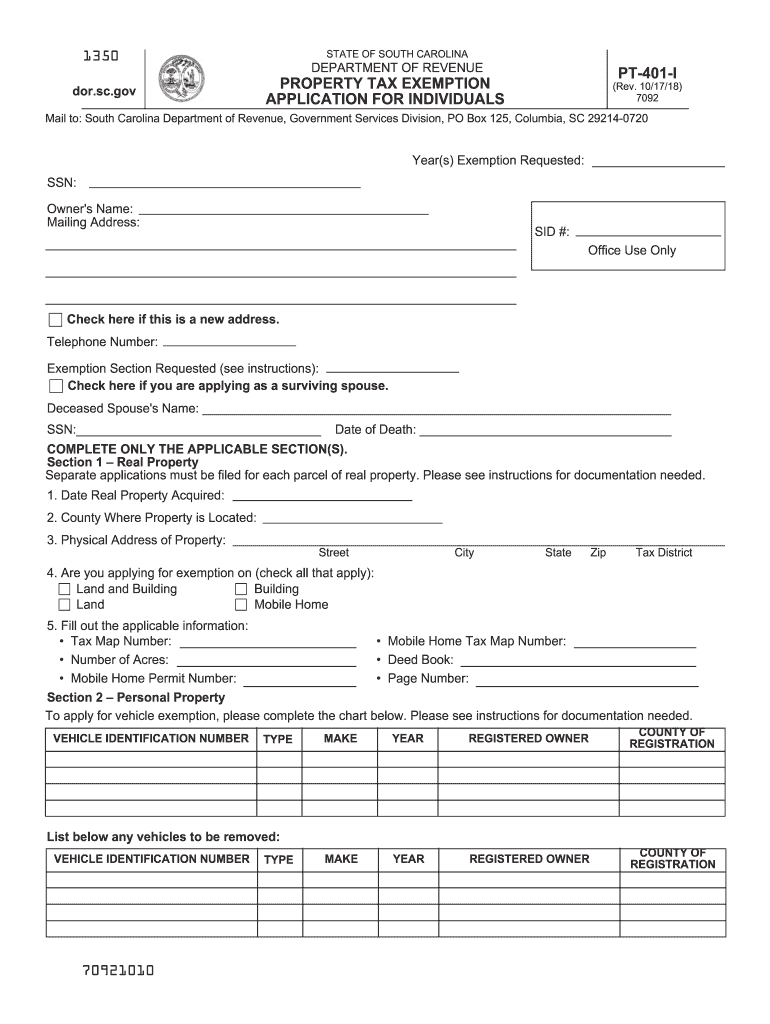

Taxact Online Fillable Tax Forms Printable Forms Free Online

https://www.signnow.com/preview/100/313/100313563/large.png

Homestead exemptions can help lower the property taxes on your home Here learn how to claim a homestead exemption You might be able to claim a homestead exemption based on whether you are 65 or older have a disability or are a veteran of the military Property taxes in Texas are the seventh highest in the U S as the average effective property tax rate in the Lone Star State is 1 60 Compare that to the national average which currently stands at 0 99 The typical Texas homeowner pays 3 797 annually in property taxes

As a Texas property owner you might qualify for a reduction in the taxable appraised value of your property thereby reducing the amount of your tax bill These deductions are referred to as property tax exemptions and in Texas they are the most common way property owners reduce their tax burden In Texas one of the few states that does not All real property and tangible personal property located in the state is taxable unless an exemption is required or permit ted by the Texas Constitution 1 Texas provides for a variety of exemptions from property tax for property and property owners that qualify for the exemption

Download What Is Property Tax Exemption Texas

More picture related to What Is Property Tax Exemption Texas

Property Tax Education Campaign Texas REALTORS

https://www.texasrealestate.com/wp-content/uploads/PropertyTaxExemption_Homestead.png

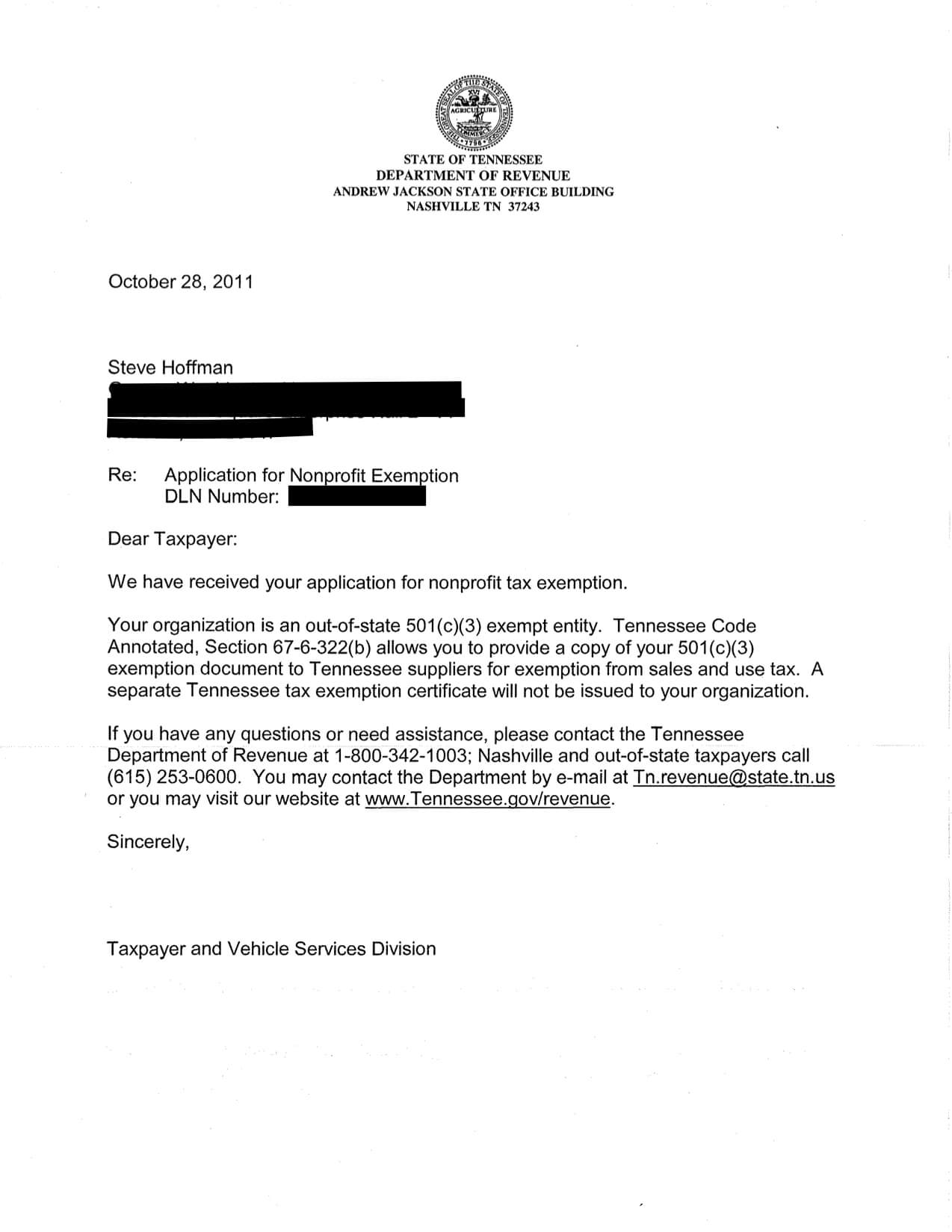

Tax Exempt Form Tn Fill And Sign Printable Template Online Bank2home

https://www.signnow.com/preview/1/649/1649273/large.png

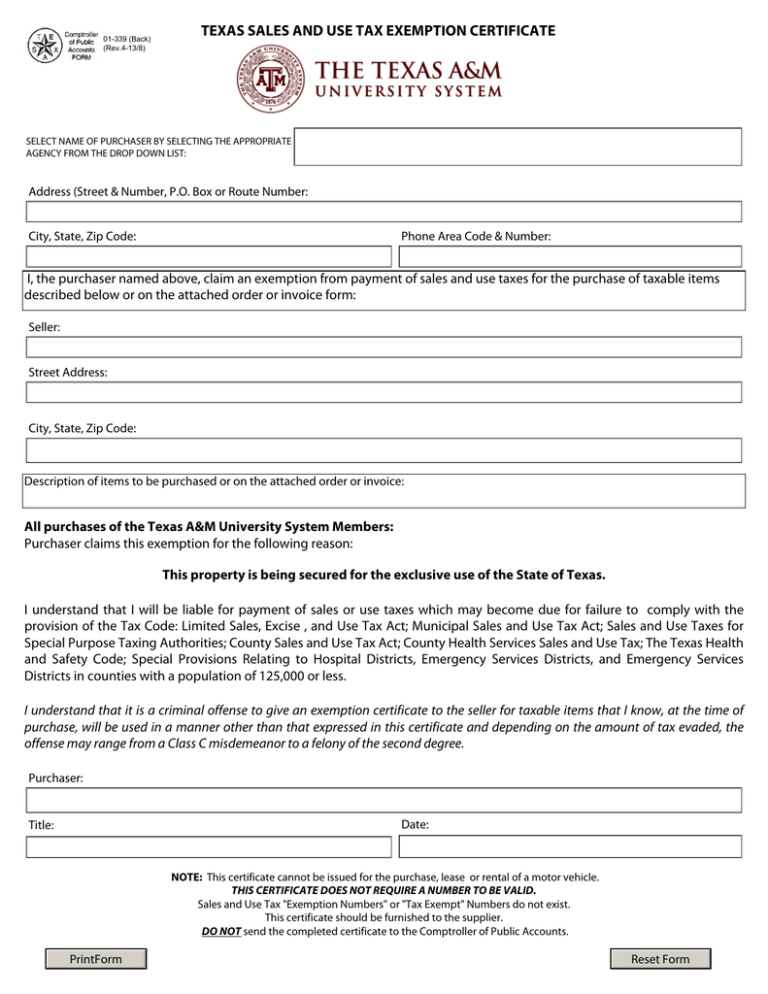

Texas Sales And Use Tax Exemption Certification Blank Form Regarding

https://www.thegreenerleithsocial.org/wp-content/uploads/2019/11/texas-sales-and-use-tax-exemption-certification-blank-form-regarding-resale-certificate-request-letter-template.png

A property tax exemption removes a certain percentage or amount in dollars of your property s appraised value from taxation If you re eligible for an exemption you will pay lower taxes since the tax rate will apply to a lower taxable value once the exemption is applied The Texas Homestead Exemption is a tax break that allows you to exclude up to 100 000 of your home s value from your property taxes Seniors or disabled homeowners are eligible for an additional 10 000 deduction

Per the Texas Property Tax Code all taxable property must be valued at 100 percent of market value as of January 1 each year This value is shown on your notice as Market Value If you bought a new home and moved in recently don t forget to fill out your homestead exemption form 50 114 Homestead exemption helps you save on your property tax

Property Tax Exemptions In Texas Texas Tax Protest Blog

http://static1.squarespace.com/static/60872c8d0b57fa2c92be4904/60872def59c9730432cde971/60b67e22befcb53aee3fd2d2/1623879270443/PROPTAXEXEMPTIONS.png?format=1500w

How High Are Property Taxes In Your State

http://dailysignal.com/wp-content/uploads/property_taxes-01.png

https://comptroller.texas.gov/taxes/property-tax/...

The tax ceiling is the amount you pay in the year that you qualified for the age 65 or older or disabled person exemption The school district taxes on your residence homestead may go below but not above the ceiling amount

https://www.texasrealestatesource.com/blog/...

A general homestead exemption in Texas can save you money on property taxes by lowering the taxable value of your home by up to 100 000 for school taxes Senior homeowners disabled homeowners disabled veterans and military or first responder spouses can claim additional exemptions

Texas Exemption Certificate TUTORE ORG Master Of Documents

Property Tax Exemptions In Texas Texas Tax Protest Blog

2023 Sales Tax Exemption Form Texas ExemptForm

Homestead Exemption Form Fill Out Sign Online DocHub

Tax Exempt Form Texas Fill Out Sign Online DocHub

Bupa Tax Exemption Form How Much Savings Is My Texas Homestead

Bupa Tax Exemption Form How Much Savings Is My Texas Homestead

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

What Is A Homestead Exemption And How Does It Work LendingTree

What Is Property Tax Exemption Texas - Homestead exemptions can help lower the property taxes on your home Here learn how to claim a homestead exemption You might be able to claim a homestead exemption based on whether you are 65 or older have a disability or are a veteran of the military