What Is Property Tax In Texas What is a property tax Property tax is measured by the value of a taxpayer s property It is also called ad valorem tax a Latin phrase meaning according to value The tax consists of two parts a base amount against which the tax is imposed and a rate a percentage that determines the amount of tax due

The property tax system in Texas comprises three primary parts a county appraisal district an appraisal review board and the local taxing units themselves Under the guidance of the county s chief appraiser the appraisal Property taxes in Texas are the seventh highest in the U S as the average effective property tax rate in the Lone Star State is 1 60 Compare that to the national average which currently stands at 0 99 The typical Texas homeowner pays 3 797 annually in property taxes

What Is Property Tax In Texas

What Is Property Tax In Texas

https://www.hometaxsolutions.com/wp-content/uploads/2016/02/image00.png

What Is Property Tax In Texas Why Do We Have To Pay It

https://certsimpleusa.com/media/std_page/background/background_87.desktop.jpg

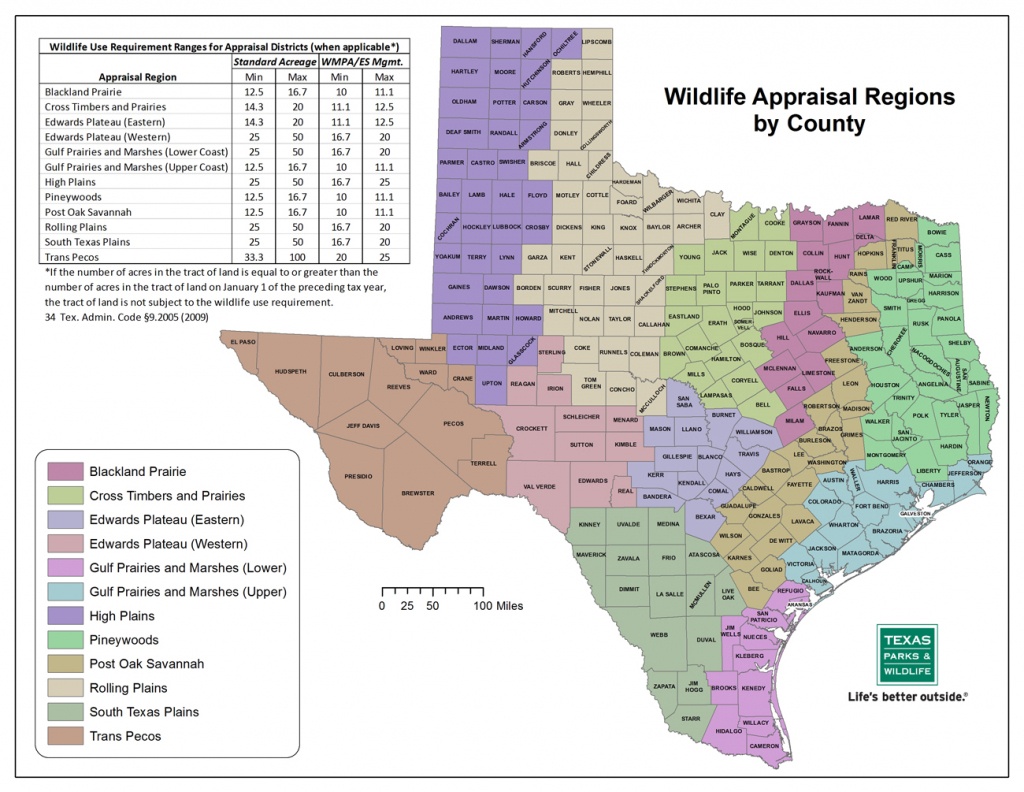

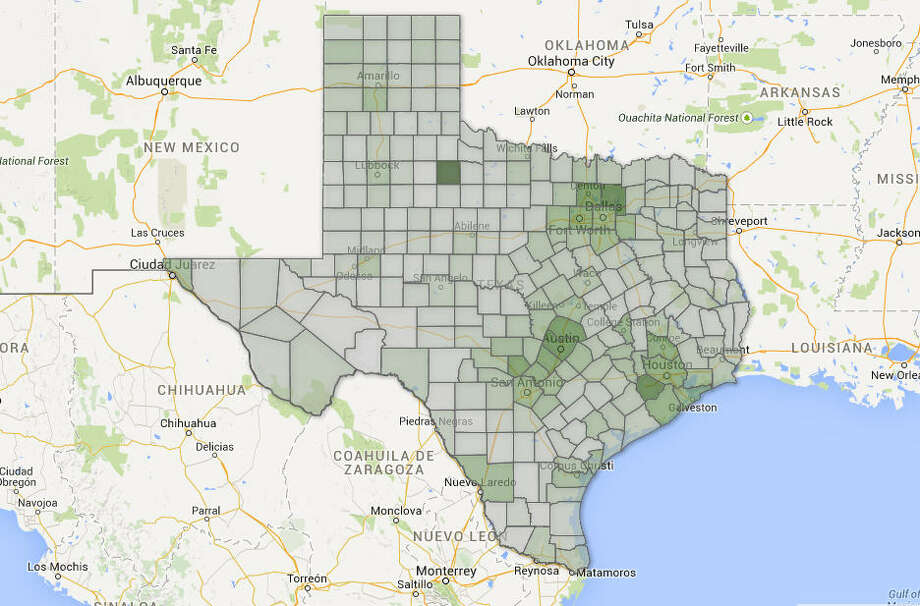

Texas Property Tax Map Printable Maps

https://printablemapaz.com/wp-content/uploads/2019/07/tpwd-agricultural-tax-appraisal-based-on-wildlife-management-texas-property-tax-map.jpg

Property taxes are local taxes imposed on real estate properties including residential properties commercial properties and vacant land According to the official website of the Comptroller of Texas property tax is determined by the value of the property that each individual owns Texas property tax refers to assessing both real property meaning land buildings or structures land improvements and growing improvements like vines or orchards and business personal property like tangible assets and business owned inventory used to

Explore this guide to discover which counties have the lowest property taxes in Texas where to buy near Texas biggest cities to save money and find ways homeowners can lower Texas property taxes even more A Texas is often considered a low tax state in that it has no state income tax but property taxes are not low in the Lone Star state In fact Texas had the ninth highest average

Download What Is Property Tax In Texas

More picture related to What Is Property Tax In Texas

Biennial Property Tax Report Texas County Progress

https://countyprogress.com/wp-content/uploads/2019/01/Exhibit2.jpg

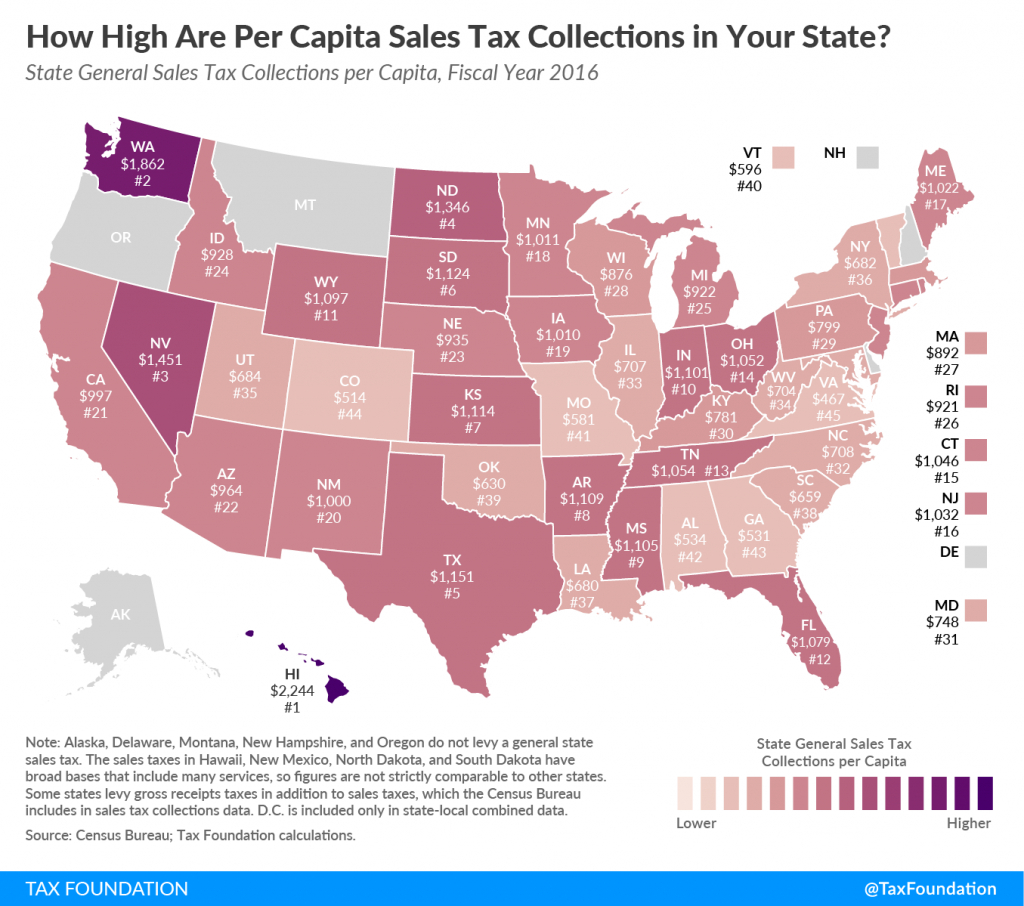

Sales Taxes Per Capita How Much Does Your State Collect Texas

https://printablemapjadi.com/wp-content/uploads/2019/07/sales-taxes-per-capita-how-much-does-your-state-collect-texas-property-tax-map.png

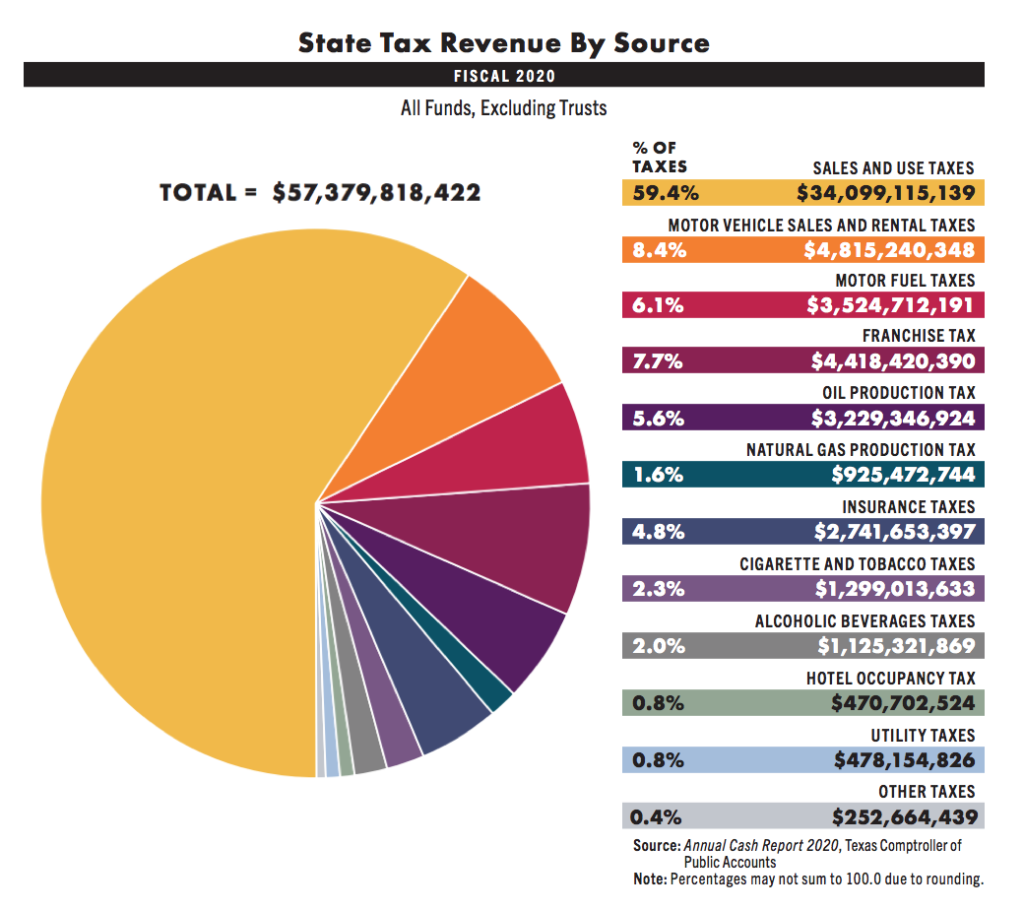

What Are The Tax Rates In Texas Texapedia

https://www.honestaustin.com/wp-content/uploads/2020/02/Texas-Tax-Revenue-by-Source-2020-1024x911.png

Property tax in Texas is locally assessed and locally administered All real and tangible personal property in Texas is taxable in proportion to its appraised value unless the Texas Constitution authorizes an exemption Texas law provides a variety of property tax exemptions for qualifying property owners Local taxing units offer partial and Property Tax Assistance Texas has no state property tax The Comptroller s office does not collect property tax or set tax rates That s up to local taxing units which use tax revenue to provide local services including schools streets and

[desc-10] [desc-11]

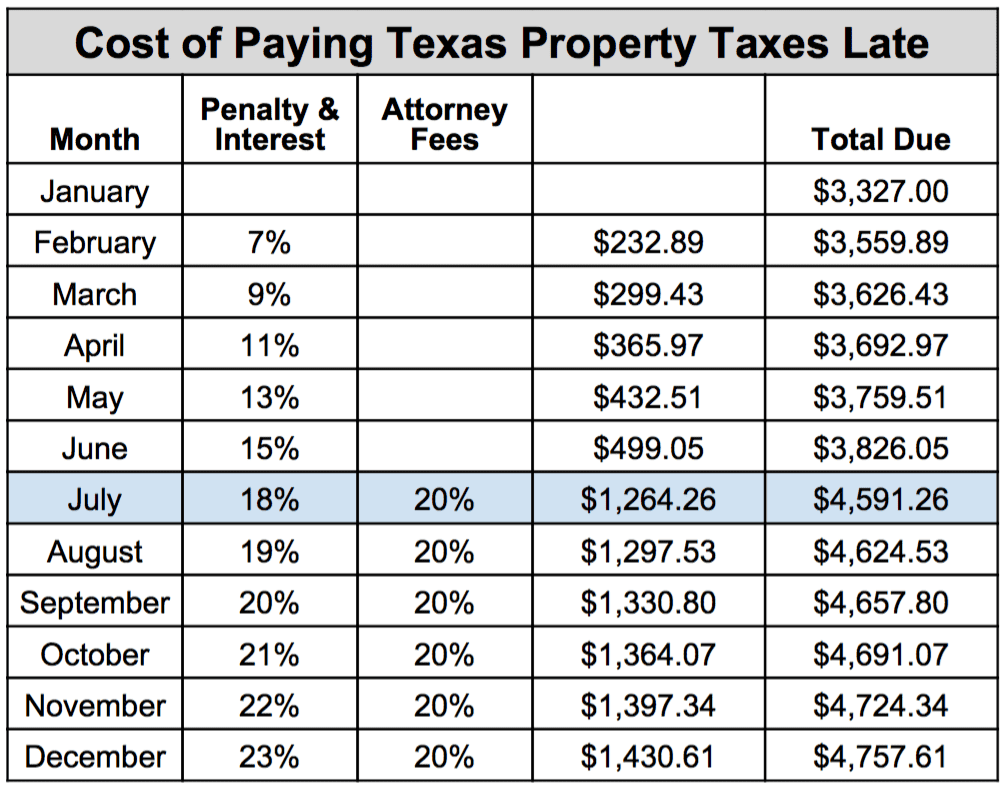

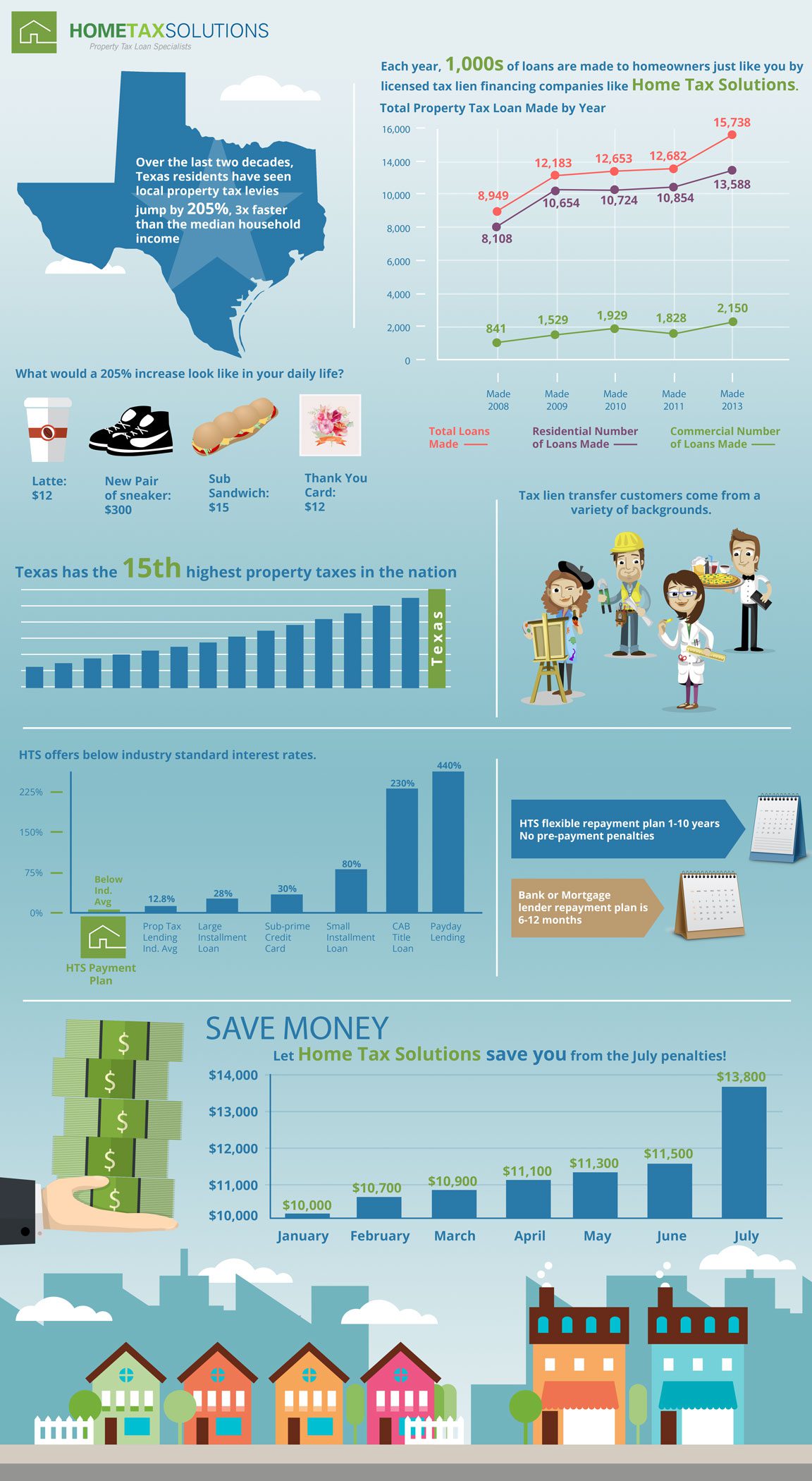

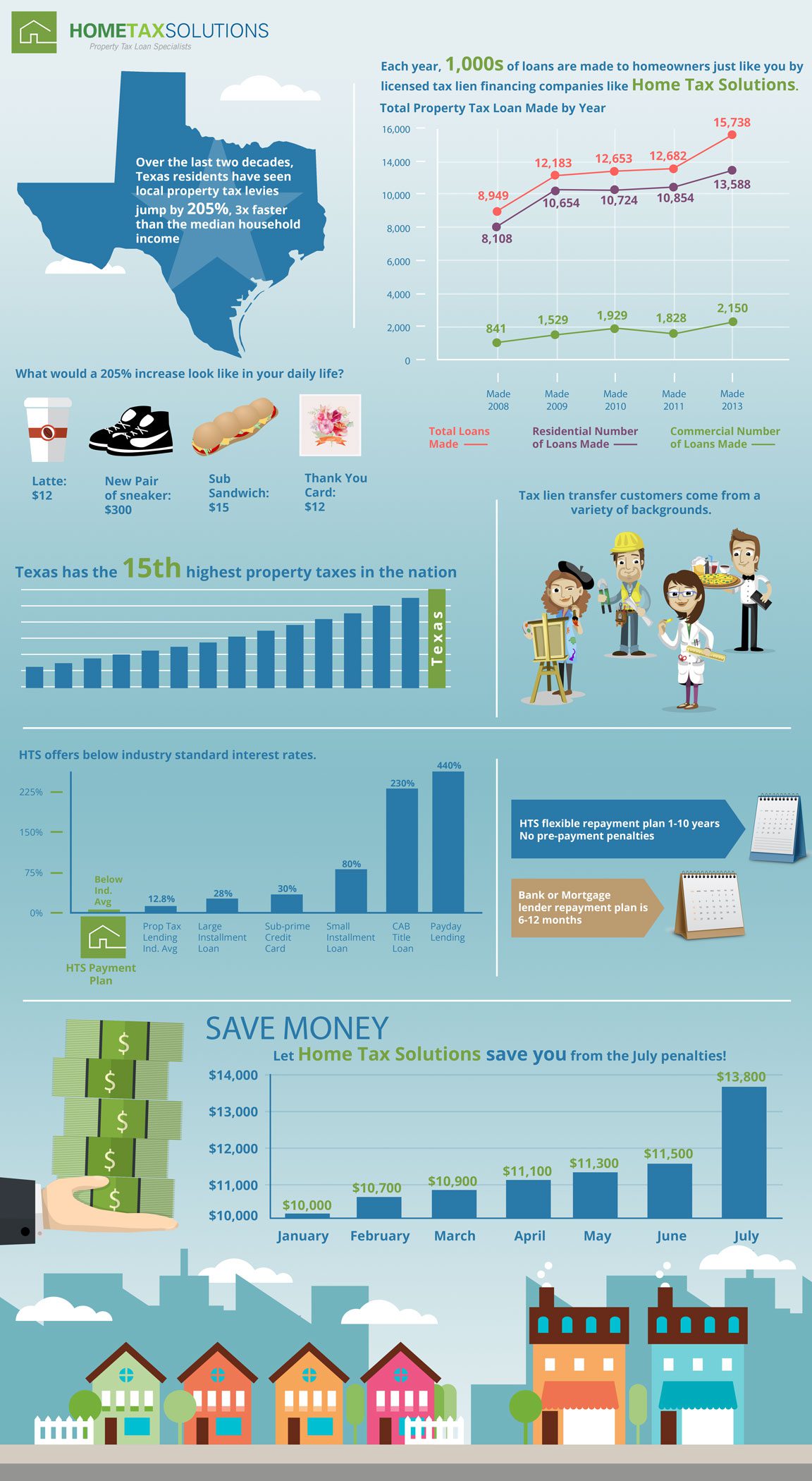

Understanding Delinquent Property Taxes Home Tax Solutions

https://www.hometaxsolutions.com/wp-content/uploads/2015/05/Texas-State-Property-Tax-Infographic.jpg

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

https://comptroller.texas.gov/taxes/property-tax/basics.php

What is a property tax Property tax is measured by the value of a taxpayer s property It is also called ad valorem tax a Latin phrase meaning according to value The tax consists of two parts a base amount against which the tax is imposed and a rate a percentage that determines the amount of tax due

https://www.texasrealestatesource.com/blog/texas-property-taxes

The property tax system in Texas comprises three primary parts a county appraisal district an appraisal review board and the local taxing units themselves Under the guidance of the county s chief appraiser the appraisal

Cities With Lowest Property Taxes In Texas Property Walls

Understanding Delinquent Property Taxes Home Tax Solutions

How To Calculate Property Taxes

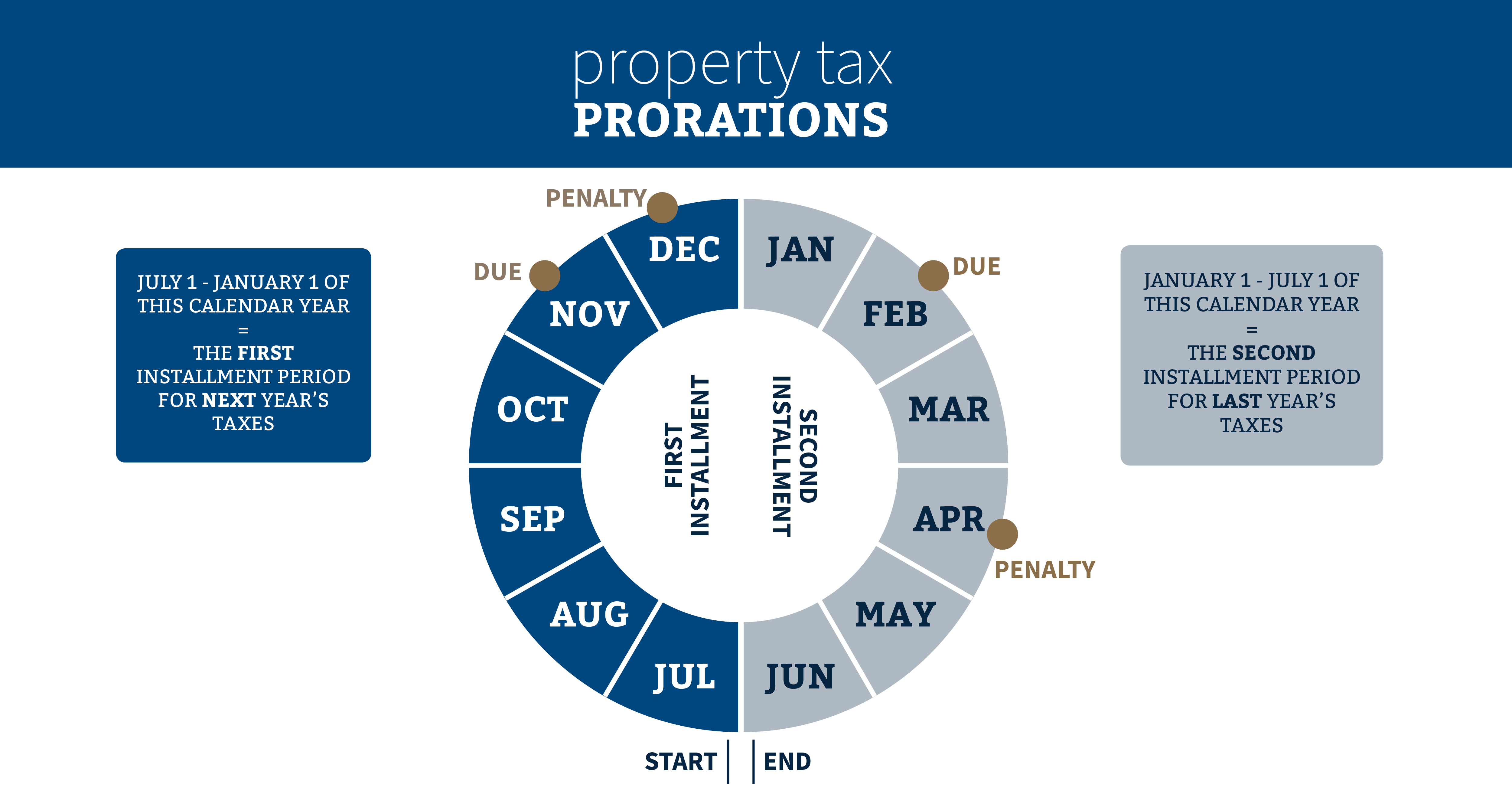

Property Tax Prorations Case Escrow

Title Tip The Property Tax Cycle Can Be A Vicious One

What Is Property Tax Property Tax What Is Property Tax Preparation

What Is Property Tax Property Tax What Is Property Tax Preparation

How Much Does Your State Collect In Property Taxes Per Capita

Understanding Your Property Tax Statement Cass County ND

5 Common Real Estate Tax Mistakes Property Tax Consultant Tips

What Is Property Tax In Texas - Explore this guide to discover which counties have the lowest property taxes in Texas where to buy near Texas biggest cities to save money and find ways homeowners can lower Texas property taxes even more