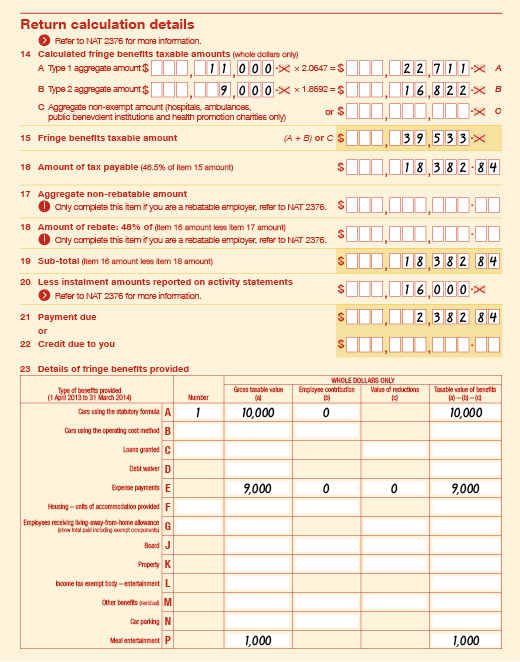

What Is Rebate Income Ato Rates and thresholds for seniors and pensioners tax offset To be entitled to the offset your rebate income must be less than the relevant cut out threshold in the table below You receive the maximum offset if your rebate income is less than the shading out threshold

The Seniors and Pensioners Tax Offset will vary depending on your taxable income and marital status In order to qualify for the SAPTO you must pass a rebate income threshold test Rebate income is the balance of the following items What is rebate income May 27 2021 Rebate income is made up of the total of all the following details from your tax return Taxable income if a loss then zero Reportable employer superannuation contributions total of RESC from your payment summary s

What Is Rebate Income Ato

What Is Rebate Income Ato

https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/knowledge-center/images/tax/section-87A.jpg

What Are Rebated Doors How To Fit Them Properly Doors More Guide

https://www.doorsonlineuk.co.uk/wp-content/uploads/2020/02/rebated-french-doors.jpg

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://i.pinimg.com/736x/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Your rebate income is the total of the following items Your taxable income if any Your taxable income is your assessable income less any deductions that you re eligible to claim Your reportable employer super contributions if any Rebate income is defined as taxable income disregarding any assessable First Home Super Saver released amount plus adjusted fringe benefits total reportable super contributions and total net investment losses

Tax offsets and rebates directly reduce the amount of tax payable on your taxable income and are applied after tax has been calculated and generally cannot be refunded or carried forward for use in future years Tax offsets are not the same as tax deductions The Seniors and Age Pension Tax Offset SAPTO provides valuable financial assistance to eligible Australian seniors and pensioners Understanding the eligibility criteria rebate income thresholds and offset reduction factors is crucial for maximizing this benefit

Download What Is Rebate Income Ato

More picture related to What Is Rebate Income Ato

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

A Guide To Rebates On Discounted Bills

https://khatabook-assets.s3.amazonaws.com/media/post/2023-07-28_163050.4600640000.webp

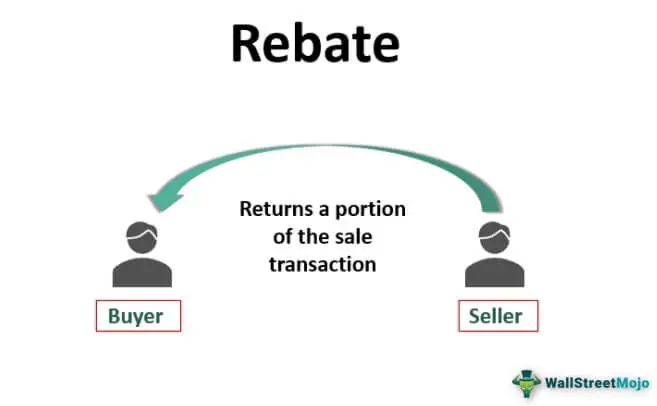

Rebate What Is It Example Vs Discount Types Regulations

https://www.wallstreetmojo.com/wp-content/uploads/2021/01/Rebate.jpg.webp

We work out what we call rebate income to determine whether you are eligible for the seniors and pensioners tax offset at T1 Your rebate income is the total amount of your taxable income excluding any assessable First home super saver released amount plus the following amounts if they apply to you What is your rebate income Your rebate income is the total of the following items Your taxable income if any Your taxable income is your assessable income less any deductions that you are eligible to claim Your reportable employer super contributions if any

Rebate income We work out what we call rebate income to determine whether you are eligible for the seniors and pensioners tax offset SAPTO If you want to work it out yourself use the calculator Income tests calculator The Private Health Insurance Rebate reduces the premium you pay for having private health insurance You can receive the rebate or refund as either a direct reduction of the cost of your private health insurance through the year and this is a reduction

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

https://www.ato.gov.au › individuals-and-families › ...

Rates and thresholds for seniors and pensioners tax offset To be entitled to the offset your rebate income must be less than the relevant cut out threshold in the table below You receive the maximum offset if your rebate income is less than the shading out threshold

https://www.money.com.au › tax › sapto

The Seniors and Pensioners Tax Offset will vary depending on your taxable income and marital status In order to qualify for the SAPTO you must pass a rebate income threshold test Rebate income is the balance of the following items

Rebates Vs Discounts What Are The Differences Enable

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

XM Rebates 12 45 USD Daily And Direct PipRebate

Government Solar Rebate QLD Everything You Need To Know

Ato Tax Declaration Form Printable Printable Forms Free Online

Ato Tax Declaration Form Printable Printable Forms Free Online

Expired 15 Rebate From P G Freebies 4 Mom

what Is Rebate Income Tunes

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

What Is Rebate Income Ato - Rebate income is defined as taxable income disregarding any assessable First Home Super Saver released amount plus adjusted fringe benefits total reportable super contributions and total net investment losses