What Is The Current Rate For Mileage Reimbursement Beginning on January 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 65 5 cents per mile driven for business

IRS mileage rates for 2023 For the 2023 tax years taxes filed in 2024 the IRS standard mileage rates are 65 5 cents per mile For 2023 the business standard mileage rate is 65 5 cents per mile a 3 cent increase from the 62 5 cent rate that applied during the second half of 2022 see our Checkpoint article The rate when an

What Is The Current Rate For Mileage Reimbursement

What Is The Current Rate For Mileage Reimbursement

https://hrwatchdog.calchamber.com/wp-content/uploads/EmployeeMileageReimburse.jpg

What Are The IRS Mileage Rate Amounts Updated For 2023

https://falconexpenses.com/blog/wp-content/uploads/2021/11/what-is-the-irs-mileage-rate.png

New IRS Standard Mileage Rates In 2022 MileageWise 2022

https://www.mileagewise.com/wp-content/uploads/2021/12/.irs-standard-mileage-rate-2022.jpeg

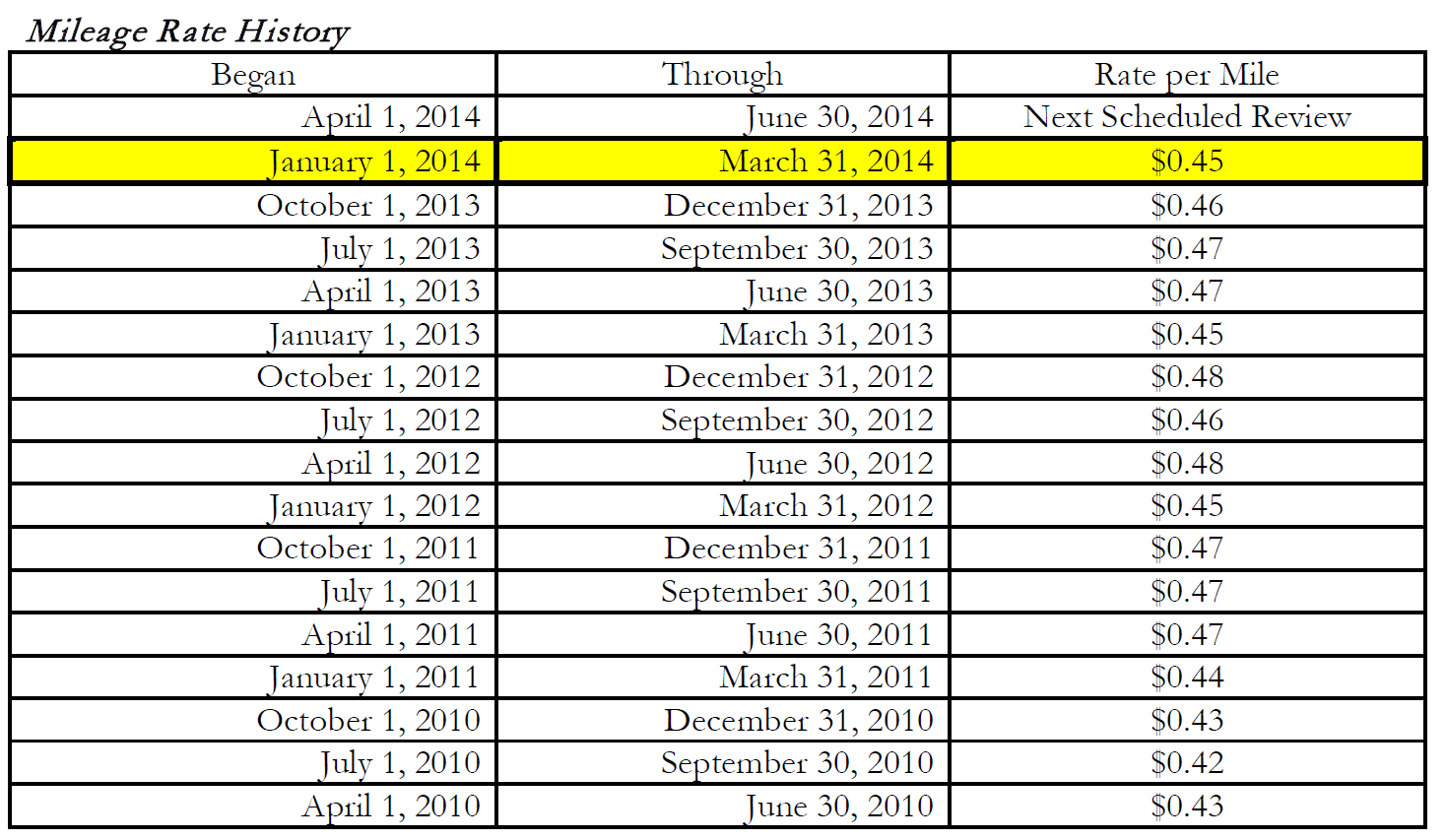

Effective July 1 through Dec 31 2022 the standard mileage rate for business travel will be 62 5 cents per mile up 4 cents from the 58 5 cents per mile rate The IRS has increased the standard mileage rates to 65 5 cents per miles for business purposes in 2023 up from 58 5 cents in early 2022 and 62 5 cents in the second half of 2022

Guidance on mileage reimbursement rates Each year the IRS sets a mileage reimbursement rate As of July 2022 the standard mileage rate is 0 625 per The IRS annually publishes three standard rates used to calculate deductions for mileage driven for business medical moving and charitable purposes The rates for 2022 are 58 5 cents mile for

Download What Is The Current Rate For Mileage Reimbursement

More picture related to What Is The Current Rate For Mileage Reimbursement

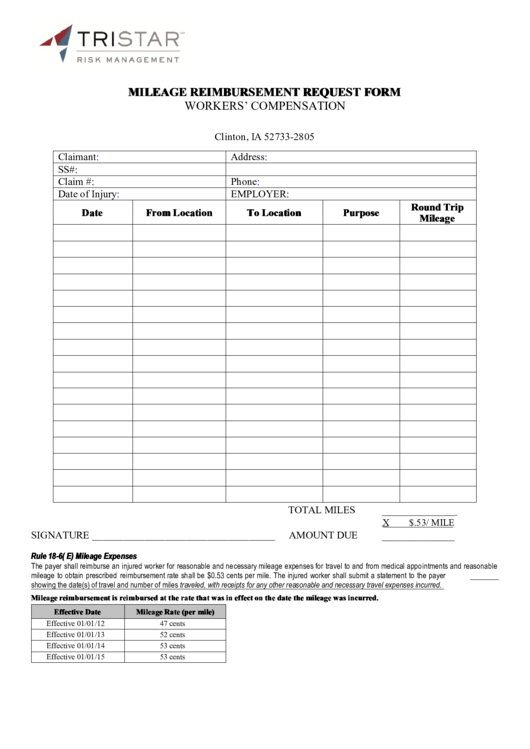

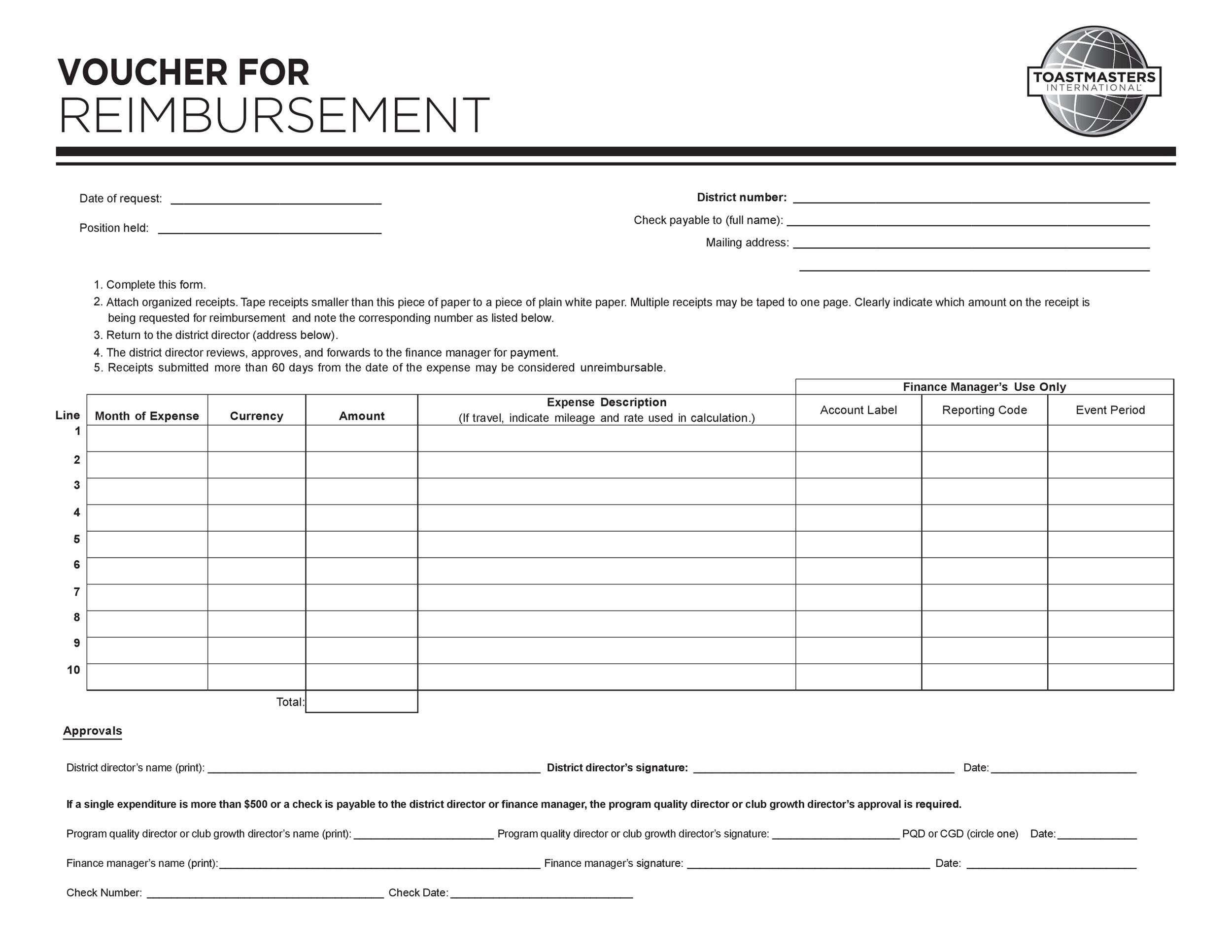

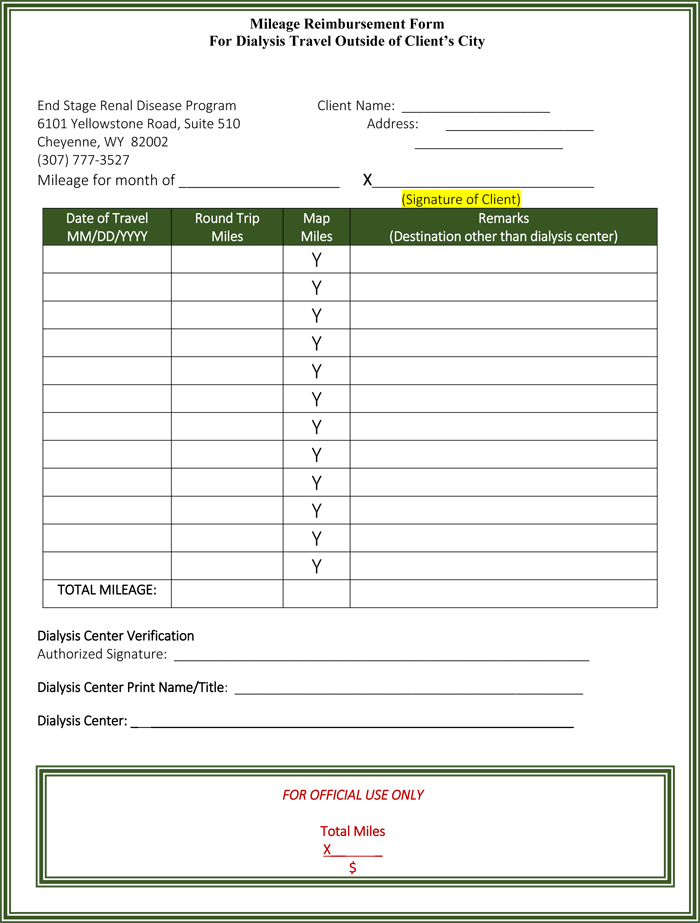

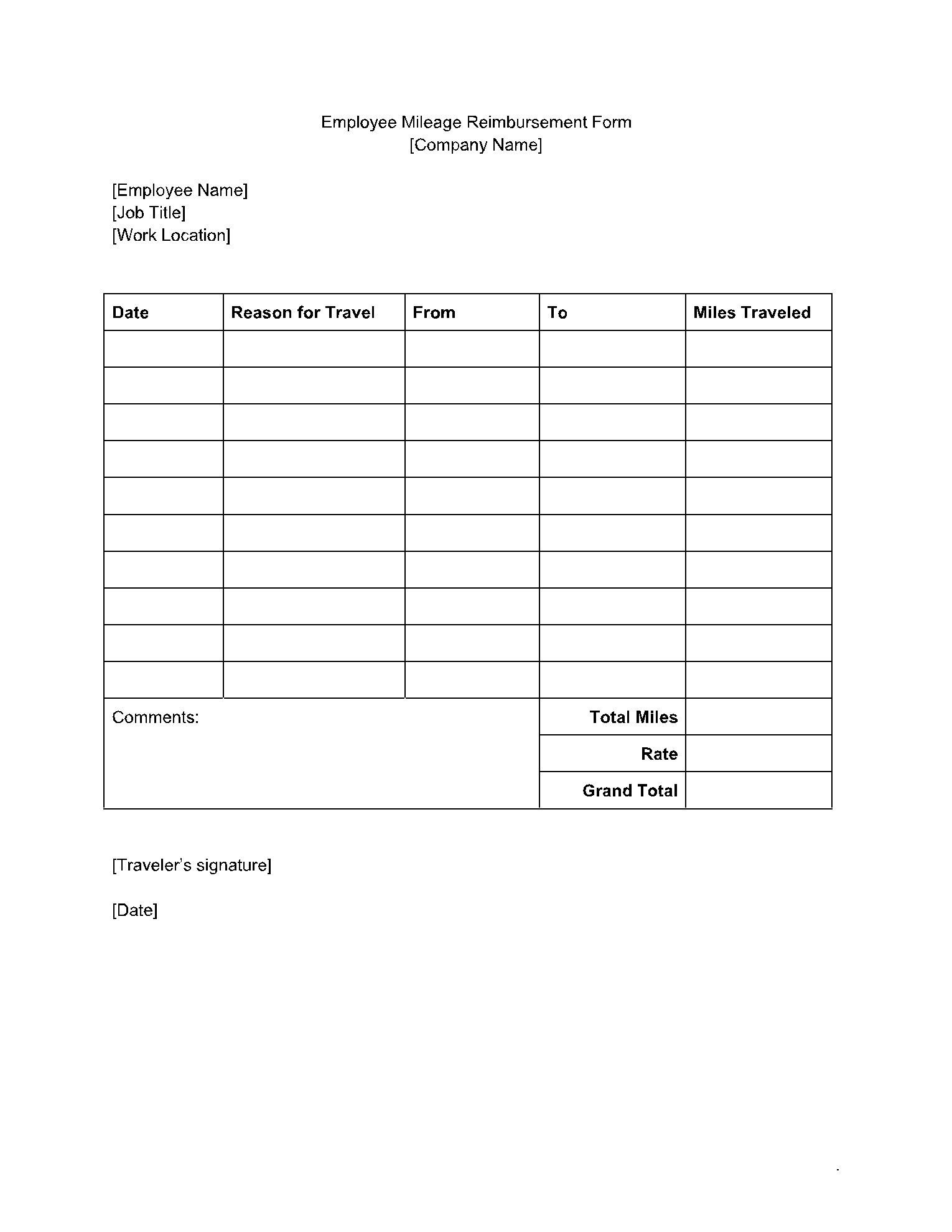

Fillable Mileage Reimbursement Form IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/fillable-mileage-reimbursement-request-form-printable-pdf.png

IRS Issues Standard Mileage Rates For 2023 Business Use Increases 3

https://www.clevelandgroup.net/wp-content/uploads/2023/01/mileage-rate.jpg

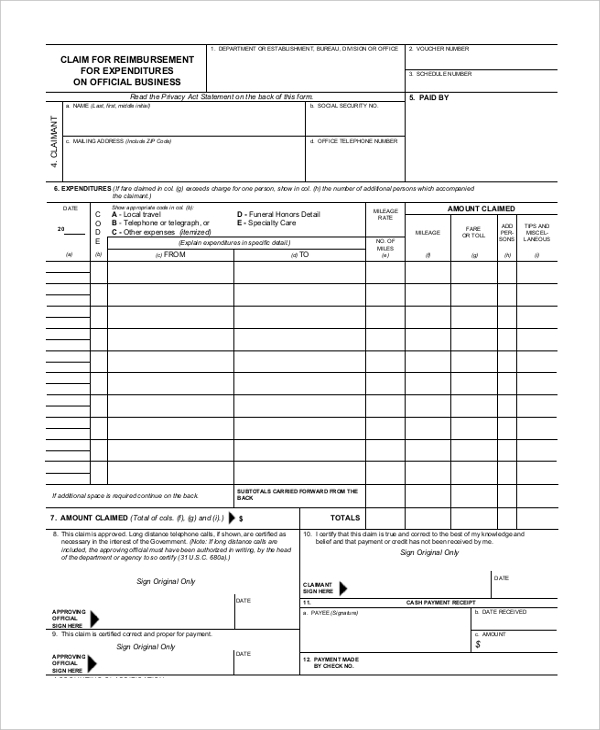

Federal Mileage Reimbursement IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/free-9-sample-mileage-reimbursement-forms-in-pdf-word.jpg

The 2023 mileage reimbursement rate for business was 65 5 cents per mile 22 cents for medical and moving miles and 14 cents for miles in the service of Mileage reimbursement is the amount a company pays an employee to cover the costs of driving a personal vehicle for business purposes Per the Internal

IRS Standard Mileage Rates from Jan 1 2023 65 5 cents per mile for business purposes 22 cents per mile for medical and moving purposes 14 cents per January 1 2024 0 65 Relocation Effective Applicability date Rate per mile Standard mileage rates for moving purposes January 1 2024 0 21 Airplane nautical miles

Reimbursement Form Template IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/47-reimbursement-form-templates-mileage-expense-vsp-1.jpg

Mileage Reimbursement A Complete Guide TravelPerk

https://www.travelperk.com/wp-content/uploads/The-complete-guide-to-corporate-mileage-reimbursement.png

https://www.irs.gov/newsroom/irs-issues-standard...

Beginning on January 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 65 5 cents per mile driven for business

https://www.nerdwallet.com/article/taxes/irs...

IRS mileage rates for 2023 For the 2023 tax years taxes filed in 2024 the IRS standard mileage rates are 65 5 cents per mile

IRS Mileage Rate For 2023 What Can Businesses Expect For The Upcoming

Reimbursement Form Template IRS Mileage Rate 2021

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

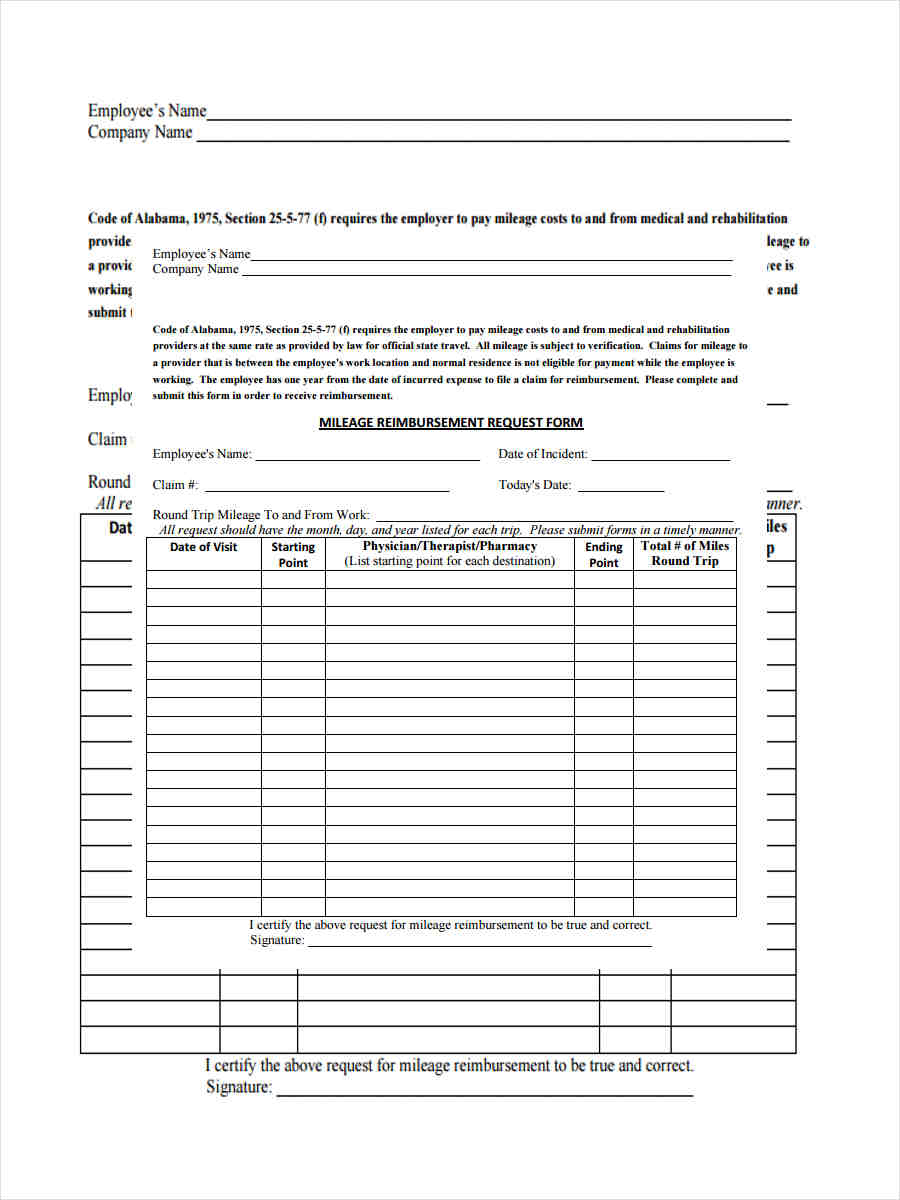

2023 Mileage Reimbursement Form Printable Forms Free Online

Mileage Reimbursement Calculator Excel Excel Templates

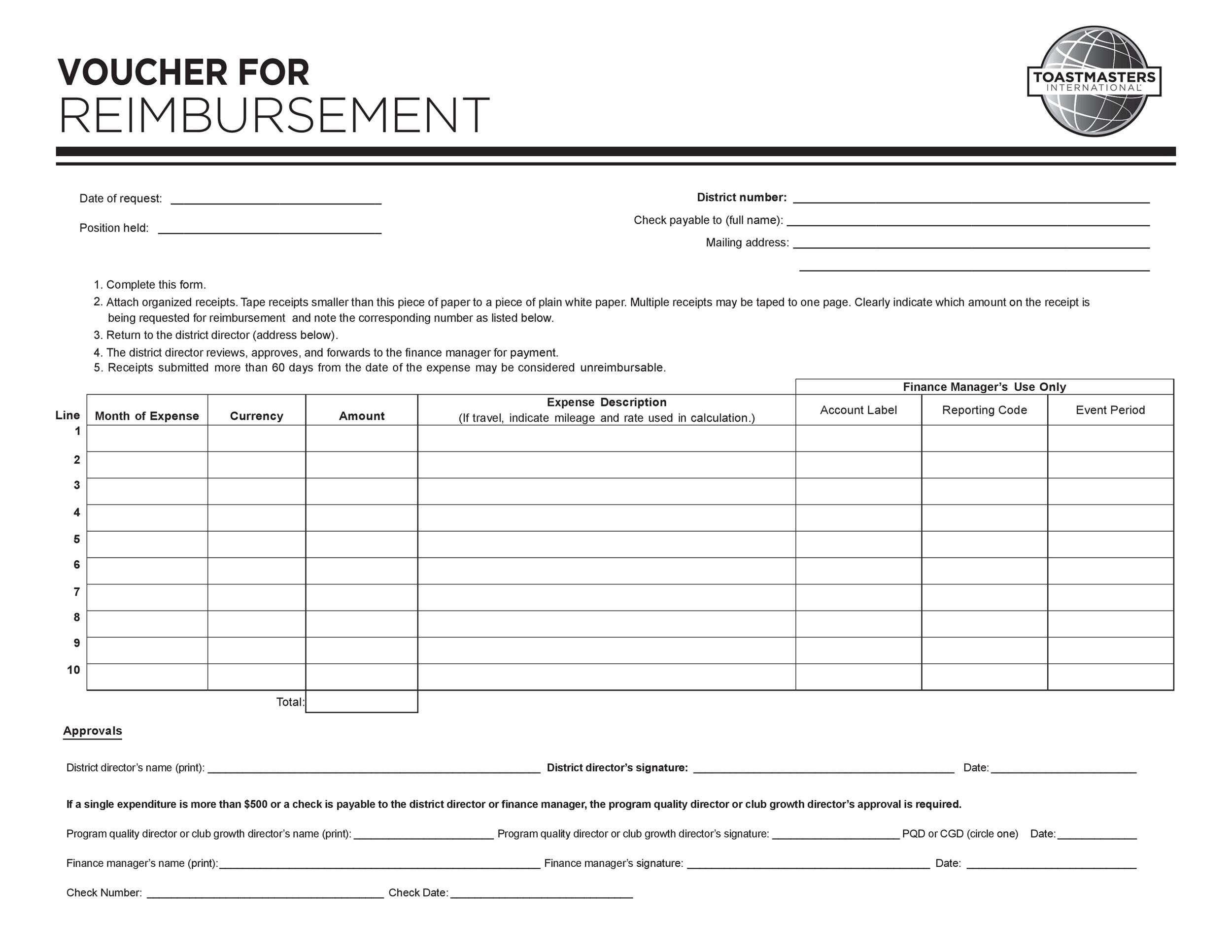

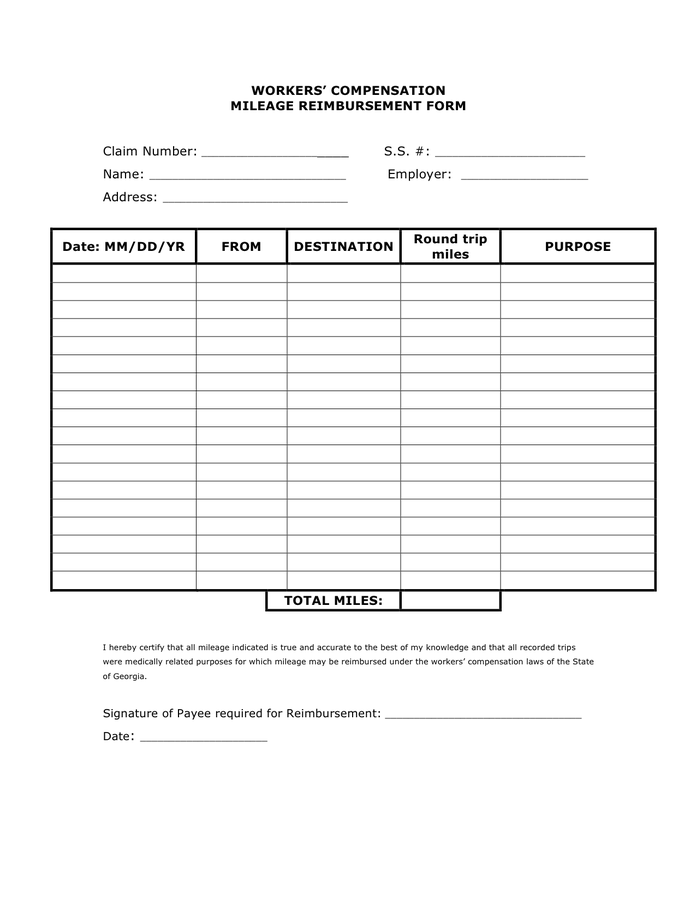

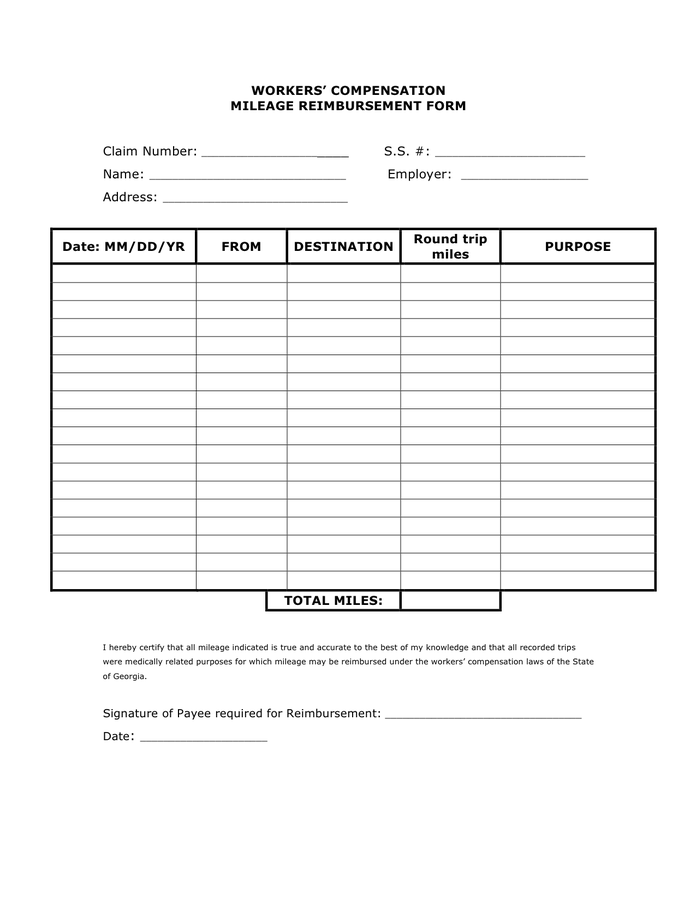

Workers Comp Mileage Reimbursement Form IRS Mileage Rate 2021

Workers Comp Mileage Reimbursement Form IRS Mileage Rate 2021

Example Mileage Reimbursement Form Printable Form Templates And Letter

Current Car Mileage Reimbursement Rate IRS Mileage Rate 2021

Mileage Reimbursement 2023 Form Printable Forms Free Online

What Is The Current Rate For Mileage Reimbursement - Rates and allowances for travel including mileage and fuel allowances From HM Revenue Customs Published 13 June 2013 Last updated 5 April 2023 See all updates Get