What Is The Energy Star Tax Credit Information updated 2 16 2023 Please note not all ENERGY STAR certified products qualify for a tax credit ENERGY STAR certifies energy efficient products in over 75 categories which meet strict energy efficiency specifications set by the U S EPA to save you energy and money and help protect the environment

About ENERGY STAR Federal Tax Credits For Energy Efficiency Windows Skylights Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

What Is The Energy Star Tax Credit

.jpg.aspx?width=1400&height=696)

What Is The Energy Star Tax Credit

https://www.banderaelectric.com/getattachment/ddbbe60d-5f83-4aec-852e-6e89d0bd01bd/05-2022-Blog-Images-(1).jpg.aspx?width=1400&height=696

All About Energy Star Adirondack Premier Properties

https://www.adkpp.com/wp-content/uploads/2021/09/EnergyStar-768x512.jpg

Coal Black Graber Roofing And Construction

https://graberroofingandconstruction.com/images/djmediatools/concealed_coal_black_0003.jpg

A1 The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Energy Star requirements Windows and skylights must meet Energy Star most efficient certification requirements Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount Energy Star Tax Credits are incentives provided by the U S government to encourage the adoption of energy efficient products and home improvements Energy Star program identifies products and technologies that meet strict energy efficiency standards ensuring they help consumers save on energy consumption and utility bills

Download What Is The Energy Star Tax Credit

More picture related to What Is The Energy Star Tax Credit

Virtual Career Fair Hosted By EPA s Office Of Water My Green

https://mygreenmontgomery.org/wp-content/uploads/2022/02/Feb-23-EPA-Virtual-Career-Fair-Panel-Save-the-Date.jpg

Is There A Tax Credit For A Whole House Generator

https://thisgenerator.com/wp-content/uploads/2021/09/Is-There-a-Tax-Credit-for-a-Whole-House-Generator.jpg

Standing Seam Metal Roofing And Panel Metal Construction News

https://www.metalconstructionnews.com/media/MCN-Images/_mediumImage/ENGLERT_NOV21_1.jpg

Understanding energy efficient tax credits Thomson Reuters Tax Accounting December 19 2023 6 minute read Overview of credits for heating and cooling water heating building products and more Jump to What is the Energy Efficient Home Improvement Credit What is ENERGY STAR How to claim energy Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to expand

The Energy Star Roof Tax Credit is a government backed initiative designed to incentivize homeowners to upgrade their roofs with Energy Star certified materials In this article we will explore the details of the Energy Star Roof Tax Credit its benefits and how homeowners can claim this tax credit when filing their taxes Table of Claiming energy tax credits for 2022 and 2023 4 min read Share Making energy efficient updates to your home is a great move for our environment But you might feel the pinch in your household budget The good news is that there are a couple of tax credits that can help out your pocketbook

ENERGY STAR Sales Tax Holiday Pedernales Electric Cooperative Inc

https://www.pec.coop/wp-content/uploads/2021/04/PEC-ENERGY-SAVINGS-2021.jpg

Charcoal Gray Graber Roofing And Construction

https://graberroofingandconstruction.com/media/djmediatools/cache/700x450-crop-90-images_djmediatools_concealed_charcoal_gray_0001.1.jpg

.jpg.aspx?width=1400&height=696?w=186)

https://www.energystar.gov/about/federal_tax...

Information updated 2 16 2023 Please note not all ENERGY STAR certified products qualify for a tax credit ENERGY STAR certifies energy efficient products in over 75 categories which meet strict energy efficiency specifications set by the U S EPA to save you energy and money and help protect the environment

https://www.energystar.gov/about/federal-tax...

About ENERGY STAR Federal Tax Credits For Energy Efficiency Windows Skylights Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695

Energy Star Tax Credit Energy Efficient Product HomeRite

ENERGY STAR Sales Tax Holiday Pedernales Electric Cooperative Inc

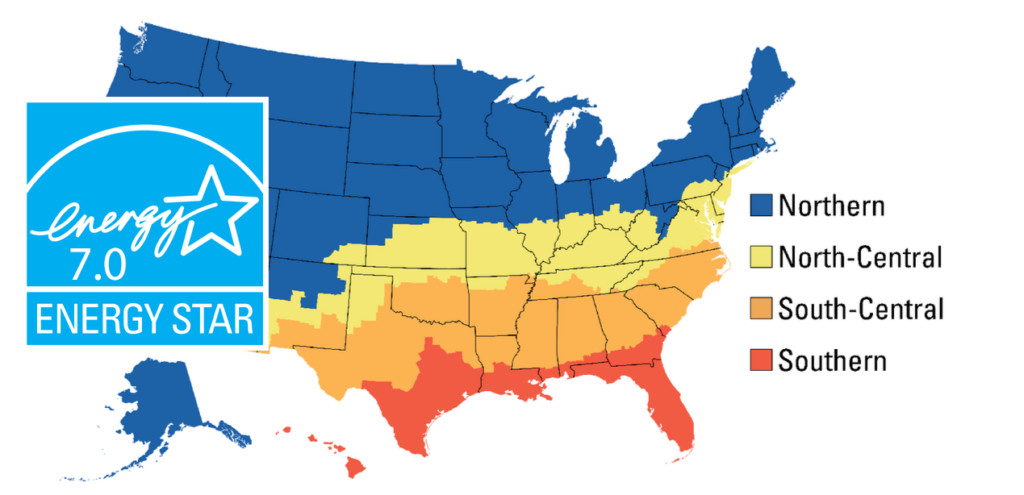

Maximize Your Savings With The Energy Star 7 0 Tax Credit For Windows

Colorado Heat Pump Air Conditioner Rebates Energy Star Tax Credit

Colorado Heat Pump Air Conditioner Rebates Energy Star Tax Credit

Free Water Heater Assistance Program For Low Income GrantsGeeks

Free Water Heater Assistance Program For Low Income GrantsGeeks

Taupe Graber Roofing And Construction

Preparing For The Future With All Electric VRF Technology Engineered

Nys Star Tax Rebate Checks 2022 StarRebate

What Is The Energy Star Tax Credit - A1 The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Energy Star requirements Windows and skylights must meet Energy Star most efficient certification requirements