Energy Star Tax Credit Requirements Web 28 Aug 2023 nbsp 0183 32 Who Qualifies You may claim the residential clean energy credit for improvements to your main home whether you own or rent it Your main home is

Web 19 Dez 2023 nbsp 0183 32 To claim the Energy Efficient Home Improvement Credit for appliances that meet applicable ENERGY STAR requirements you must file Form 5695 Residential Web 16 Feb 2023 nbsp 0183 32 Please note not all ENERGY STAR certified products qualify for a tax credit ENERGY STAR certifies energy efficient products in over 75 categories which

Energy Star Tax Credit Requirements

Energy Star Tax Credit Requirements

https://www.whe.org/assets/images/491872633.jpg

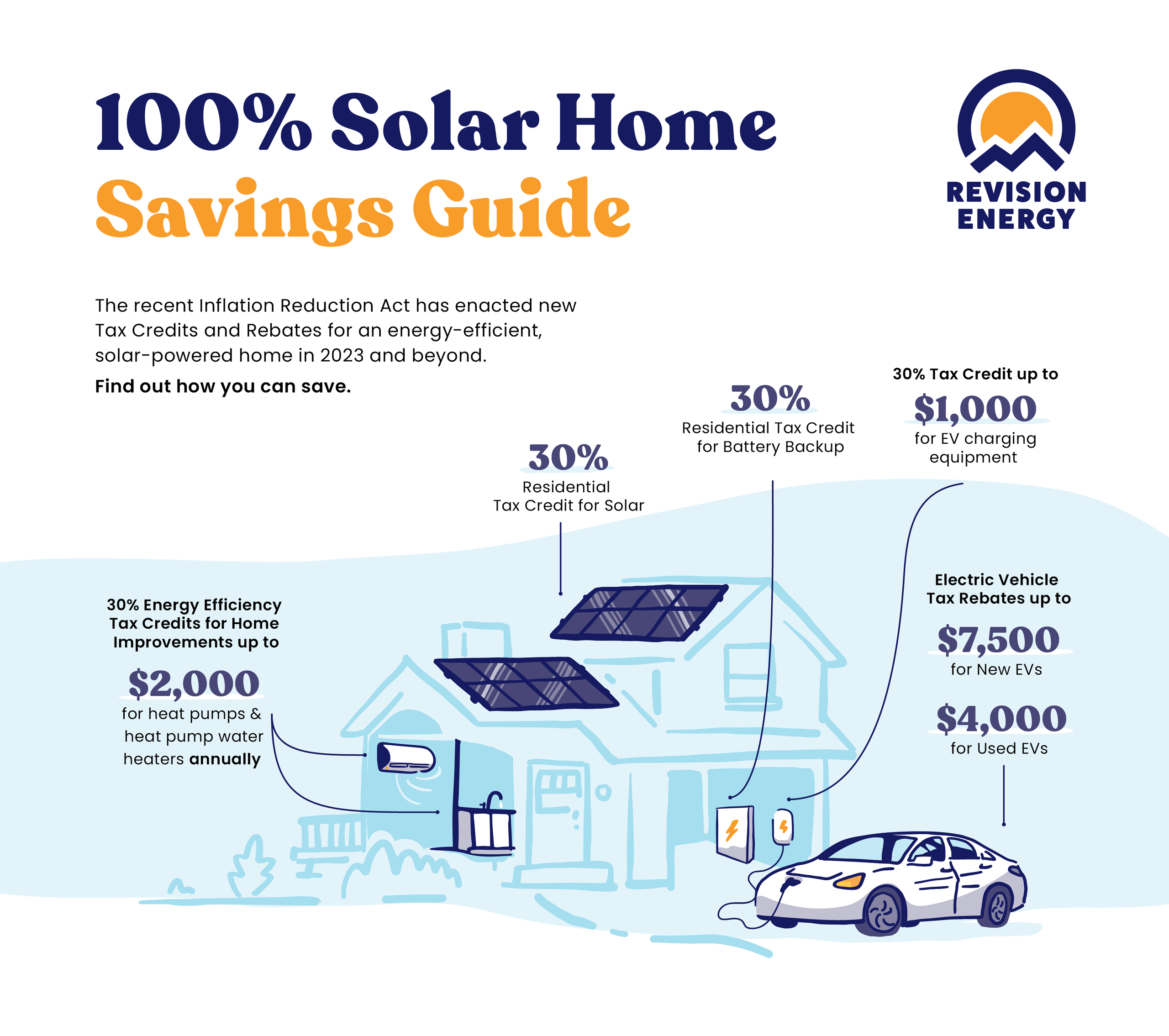

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

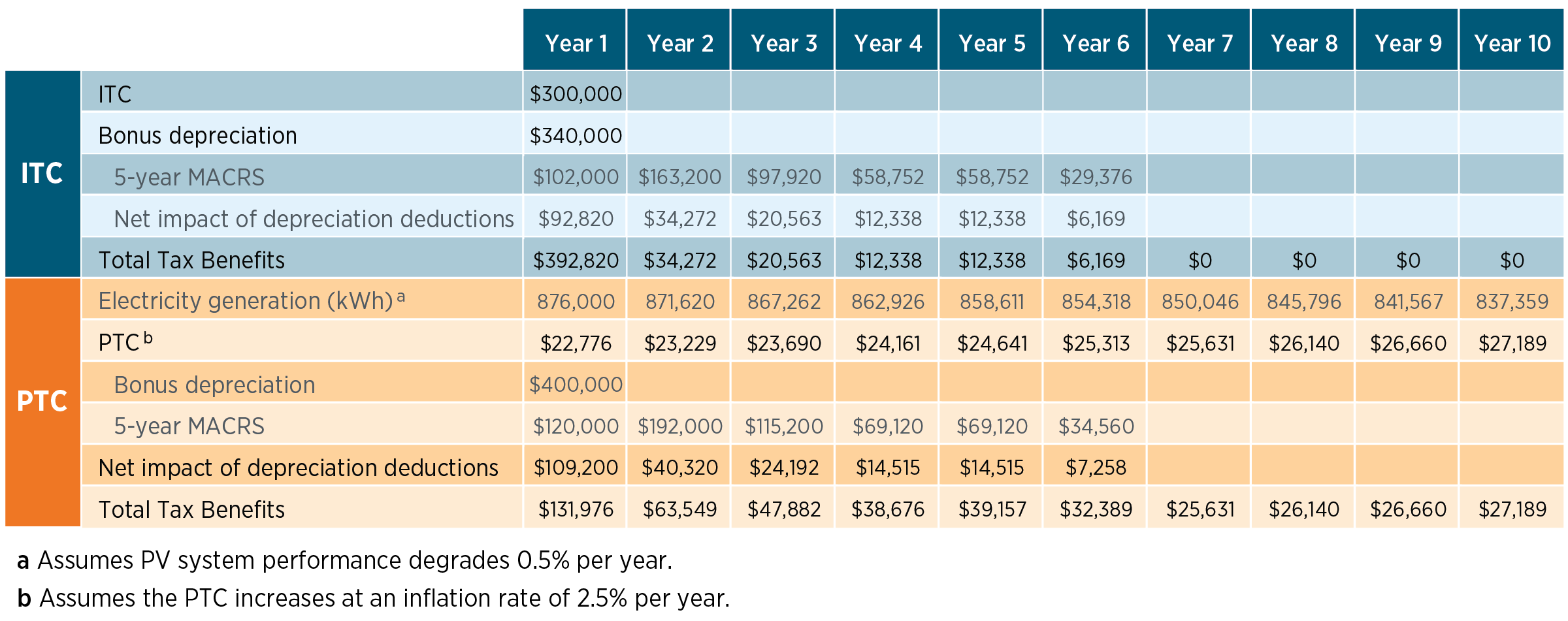

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Comparison-ITC-PTC-w-bonus-depreciation-Chart.png

Web 5 Dez 2023 nbsp 0183 32 A larger tax credit 2 500 is available when prevailing wage requirements are met A larger tax credit 2x ENERGY STAR levels is also available for homes that Web Program Requirements x EPA has updated the ENERGY STAR Tax Credits for Home Builders webpage based on new guidance for taxpayers on the 167 45L New Energy Efficient Home Credit issued by the IRS in

Web Vor 18 Stunden nbsp 0183 32 The literature provides conflicting guidance about the appropriate time matching requirement between electricity consumption by electrolysers and contracted Web 19 Okt 2023 nbsp 0183 32 Credit amounts The IRC Section 45L credit is based on meeting the 1 Energy Star program requirements 2 Zero Energy Ready Home program

Download Energy Star Tax Credit Requirements

More picture related to Energy Star Tax Credit Requirements

2020 ENERGY STAR Tax Credits For Windows SoftLite

https://www.soft-lite.com/wp-content/uploads/2022/10/Screen-Shot-2020-08-03-at-2.27.54-PM-1024x920.png

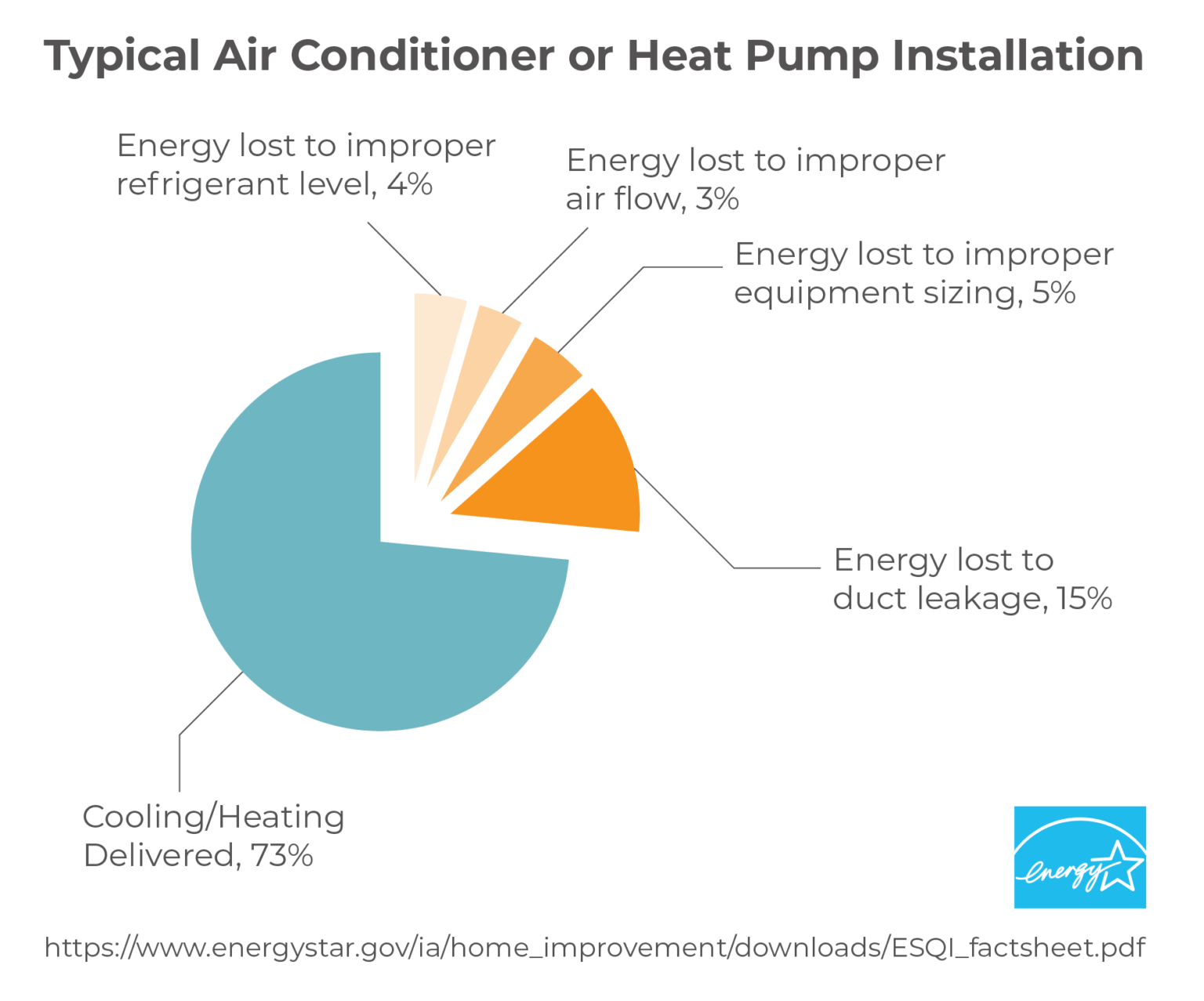

Energy Star Rating HVAC Efficiency Ratings Guide Modernize

https://modernize.com/wp-content/uploads/2021/07/hvac-energy-star_installation-graphic-01-1536x1277.png

Rebates And Energy Star Tax Credits Michigan C C Heat Air

https://candcheat.com/wp-content/uploads/DTE-HVAC-Rebates-MIchigan-1000x865.png

Web Vor 3 Tagen nbsp 0183 32 The Proposed Regulations provide much anticipated guidance regarding eligibility for and the requirements for claiming the two types of clean hydrogen federal Web 25 Dez 2023 nbsp 0183 32 As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 There are certain restrictions

Web The 45L tax credit is 5 000 for single family and manufactured homes eligible to participate in the EPA s ENERGY STAR Single Family New Homes Program or the ENERGY STAR Web Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up

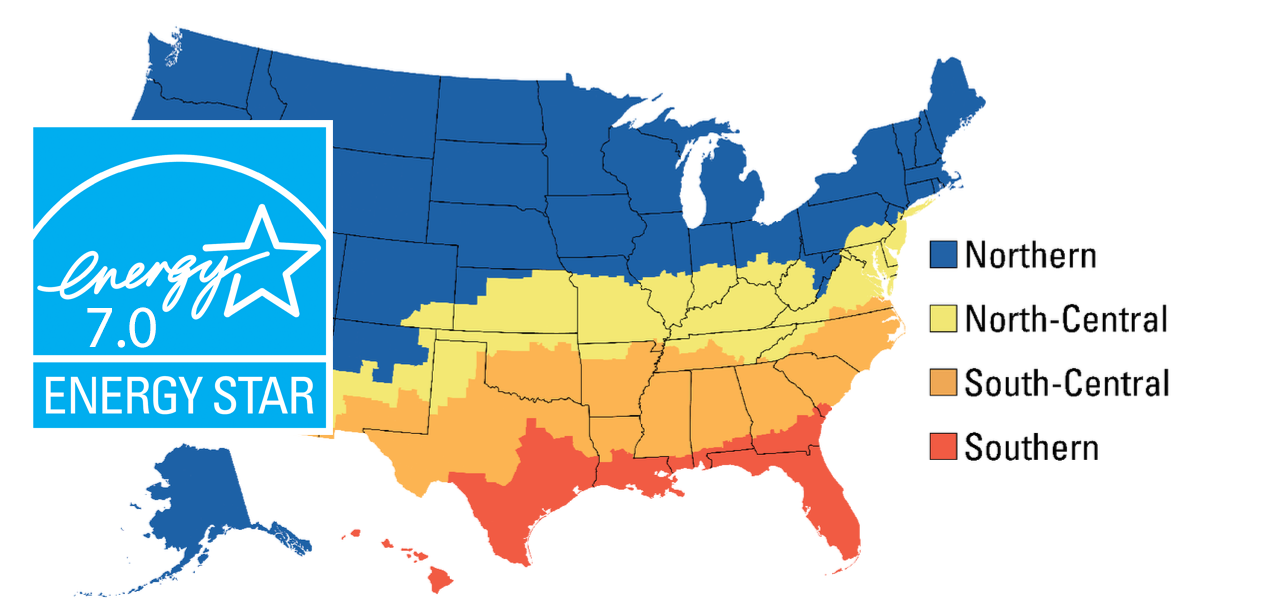

Energy Star Criteria For Windows Healthy Building Science

https://healthybuildingscience.com/wp-content/uploads/2013/06/Energy-Star-Criteria-for-windows.jpg

Rebates And Energy Star Tax Credits Michigan C C Heat Air

https://candcheat.com/wp-content/uploads/Federal-Energy-Star-Tax-Credits-for-Heating-Cooling--1000x699.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 Aug 2023 nbsp 0183 32 Who Qualifies You may claim the residential clean energy credit for improvements to your main home whether you own or rent it Your main home is

https://tax.thomsonreuters.com/blog/understanding-energy-efficient …

Web 19 Dez 2023 nbsp 0183 32 To claim the Energy Efficient Home Improvement Credit for appliances that meet applicable ENERGY STAR requirements you must file Form 5695 Residential

Maximize Your Savings With The Energy Star 7 0 Tax Credit For Windows

Energy Star Criteria For Windows Healthy Building Science

Residential Energy Tax Credit Use Eye On Housing

Building An Energy Efficient Spec House JLC Online

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Tax Credits For Energy Upgrades BuildingGreen

Tax Credits For Energy Upgrades BuildingGreen

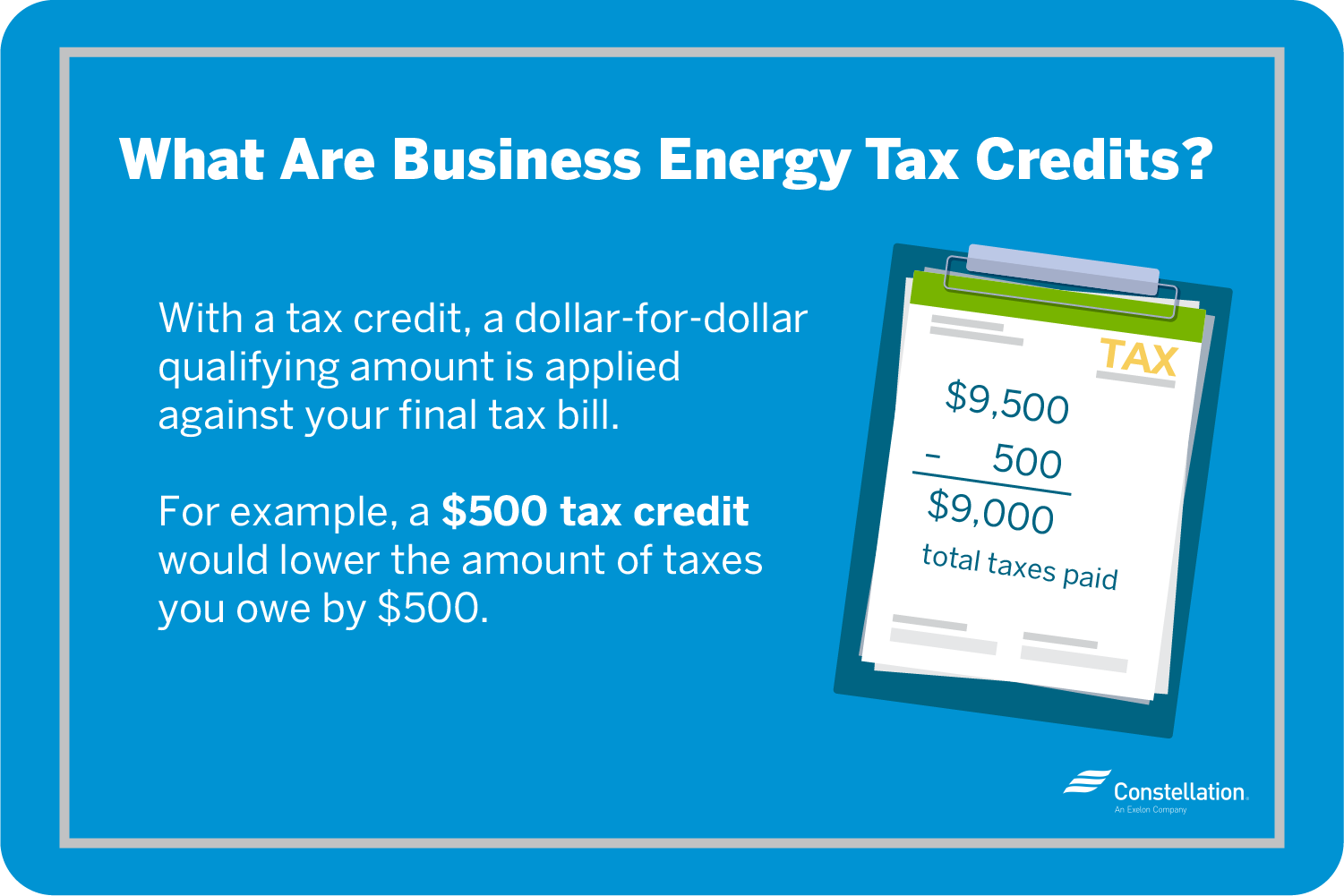

Finding Small Business Energy Tax Credits Constellation

ENERGY STAR Labels 101 What They Mean How To Read Them

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Energy Star Tax Credit Requirements - Web Provides a tax credit to homeowners equal to 30 of installation costs for ENERGY STAR 174 tier products until 2032 That percentage drops to 26 in 2033 and 22 in